10 Charts That Capture How the World Is Changing

From AI Usage at Work to Disney IP, GLP-1s to Gen Z Worldviews

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 70,000+ weekly readers by subscribing here

10 Charts That Capture How the World Is Changing

It’s that time again: time for another entry in the “10 Charts” series.

I try to do these once a quarter, and we’re overdue: our last entry was back in mid-March (read it here). This is our 9th (!) entry, and you know the drill: I’m a visual learner and charts help me process information. Charts also happen to be an efficient way to show how the world’s changing, across a wide range of subjects.

This set’s agenda:

How Many People Use AI at Work?

How Does That Impact Employee Count?

America’s Protein Intake

AI Doctors

ChatGPT’s Growth

Original Content Is Struggling

Weight Loss and Market Cap Loss

Gen Z’s Bifurcation

Labor Spend Is the New Benchmark

Top 25 Biggest Companies (2015 vs. 2020 vs. 2025)

Let’s dive in.

1️⃣ How Many People Use AI at Work?

Gallup has a new poll out on AI usage at work. In the past two years, the percentage of U.S. employees who say they’ve used AI in their role “a few times a year or more” has doubled, from 21% to 40%.

If this strikes you as low, I agree; I can’t imagine going a day without using an AI product. The portion of daily AI users, for what it’s worth, roughly doubled in the last 12 months, from 4% to 8%. Here’s the data:

This may seem slow, but AI adoption is quite a bit faster than prior tech waves like internet and mobile. Naturally, white-collar workers are leading the charge here: 27% report frequent AI use, compared to 9% of blue-collar workers.

Here’s a chart from Coatue’s excellent new markets report, which will feature heavily in this “10 Charts” edition:

Still under half of U.S. businesses pay for AI subscriptions, but we’re up dramatically in the last quarter. My guess is that the Gallup data above will show another doubling in the next two years.

2️⃣ How Does That Impact Employee Count?

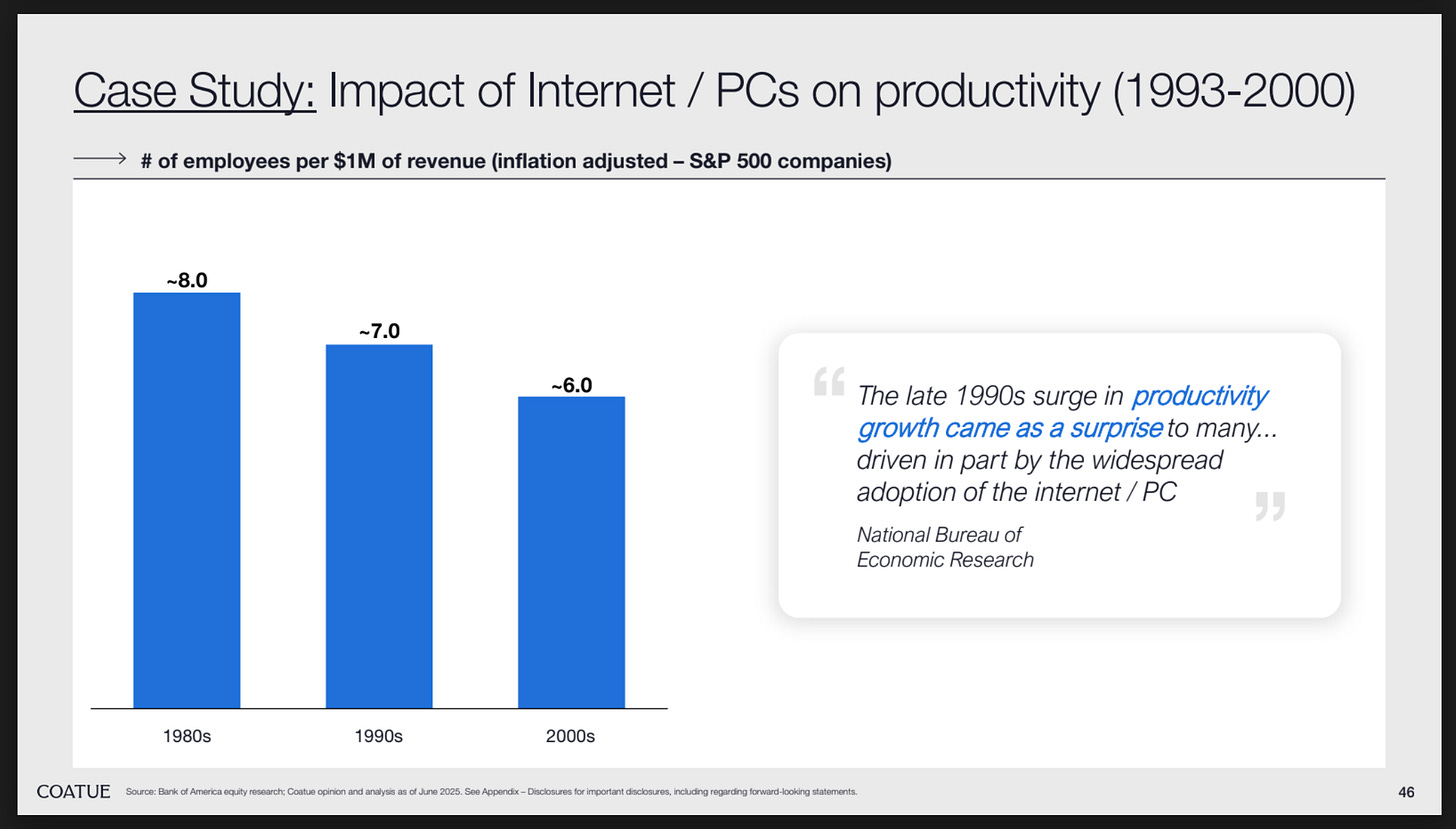

We’ve written before about how AI supercharges productivity, meaning companies can do more with less. This was true before AI: here’s a Coatue slide showing the decrease in # of employees per $1M of revenue over time, through the internet and PC eras:

A prior version of “10 Charts” underscored this by looking at the revenue / employee among leading AI companies like OpenAI ($1.5M / employee), Cursor ($3.3M), and Midjourney ($4.1M). But it’s not just startups that are showing impressive efficiency. AppLovin, a woefully under-appreciated business that boasts a $113B market cap, has doubled revenue / employee in recent years, surpassing $1B in revenue while trimming its headcount by 20%.

3️⃣ America’s Protein Intake

Let’s take a break from AI for a moment.

If AI is the defining technology trend of our time, health and wellness may be the defining behavior trend. Americans care more than ever about their health, and they’re willing to use their money to back it up.

Lately, we’ve seen a resurgence of CPG brands. Gruns, a gummy alternative to “greens” brands like AG1, is already worth $500M and reportedly doing over $100M in sales. It was only founded in 2023.

Or take David, which has exploded onto the scene. If you thought protein bars were a tired category, think again. David is the new brainchild of Peter Rahal, the founder of RXBAR (which sold to Kellogg for $600M). Rahal claims David is “the most effective portable protein on the planet,” and the company has already raised at $725M a year into existence. Naturally, David derives its name from Michelangelo’s sculpture.

David’s success gets at a broader trend: Americans are crazy about protein.

Here’s a chart from the 2024 IFIC health report, showing that 71% of Americans are trying to eat more protein:

“Protein” has become synonymous with “healthy.” The New Yorker put out a recent piece called The Quest to Build a Perfect Protein Bar, and The Atlantic just published The Protein Madness Is Just Getting Started. We have protein water, Kardashian-branded protein popcorn, protein pasta sauce, and even protein pale ales.

This doesn’t mean protein necessarily means healthy: Justin Mares, one of my favorite founders and writers in the health category, did an interesting take-down of David on Twitter:

What are contenders for the next protein-level trend?

I think fiber will take off; gut health is all the rage. And I also think creatine will be huge, with more studies showing creatine’s mental benefits in addition to the more widely-known benefits for gym rats. Just as Gruns innovated on format (thesis: AG1 powders are messy and inconvenient), brands like Create pack creatine into more accessible formats.

AI is monopolizing attention, but the success of companies like Gruns and David is a good reminder: there’s a whole world of innovation happening outside AI, too. We’re always going to have atoms to go alongside our bits.

A lot of the non-AI innovation will center around consumers’ willingness to spend on stuff that makes them look better and feel better.

4️⃣ AI Doctors

Justin, who wrote that tweet about David, also shared some interesting data on AI in medicine. OpenAI’s new healthbench release massively outperforms doctors who don’t use the models. The model, on its own, also slightly outperforms doctors who have access to the model (!). Here’s the data:

This is obviously game-changing in medicine. It won’t be long until it will be malpractice for a physician to not use AI to augment their work.

5️⃣ ChatGPT’s Growth

Let’s do a little check-in on ChatGPT’s growth. If you thought ChatGPT would continue its steep slope (already a higher slope than previous consumer applications), you were wrong. It has inflected even more:

Totally bonkers. The 4o model led ChatGPT to rapidly double its user base earlier this year. ChatGPT, which is still less than three years old, now dwarfs Twitter.

A side note on social: The Wrap’s new “The State of Social Media” report shows that Facebook and Instagram still lead in users (2.1B and 1.5B monthly actives, respectively). TikTok comes in next, with 1.2B users, but may soon beat out rivals in revenue: TikTok is on track for about $40 per user this year, which is mighty impressive. Snap and Pinterest, which never really cracked monetization, earn $1.51 and $1.91 per user, respectively.

ChatGPT, of course, is a consumer subscription business. It’s average revenue per user is probably quite healthy: more than 10M people pay for ChatGPT. I pay $20 / month ($280 a year) for ChatGPT—a nice 7x multiple on TikTok’s ARPU.

Surprisingly, “time spent” on ChatGPT is approaching social companies:

The fact that ChatGPT has higher daily engagement than Snap signals that it’s more than a Google replacement: it has created a new chat-centric category, a category equally important for answering basic queries (“Who won the big Grammys this year?”) as it is for less objective interactions (“How do I talk to my mom about her divorce?”). It is both search and social.

6️⃣ Original Content Is Struggling

Pixar’s Elio came out last weekend, and it was Pixar’s lowest-opening movie ever (excluding COVID releases). Not great.

This is a shame, since critics and audiences seem to love Elio: the film, which tells the story of a boy who gets beamed up to hang out with aliens, boasts an 84% positive critic score and 91% positive audience score on Rotten Tomatoes.

Elio’s performance stands in stark contrast to Pixar’s other most-recent film, Inside Out 2, which came out on the exact same weekend a year ago. Inside Out 2 went on to become the highest-grossing animated movie of all time with a $1.7B gross. (It has since lost that crown to China’s Ne Zha 2, signaling China’s investment in homegrown movies—and signaling America’s waning soft power in the East.)

The most interesting takeaway here: original content can’t compete with IP in today’s world of fragmented media.

I’m very interested in how IP and AI intersect. Companies tried to sue Netflix and YouTube into oblivion, instead of leaning into the obvious (that streaming was inevitable). Today, Disney is spearheading a lawsuit against Midjourney and has roped in Universal. Bloomberg’s Screentime had a good analysis of how Disney’s top lawyer, Horacio Gutierrez, is really the driver behind the lawsuit.

Why is Disney doing this? Well, because Midjourney lets me do this:

ChatGPT, by the way, refuses to incorporate IP into my image generations. It’ll be interested to see how this ends. I imagine with a lot more $$ for owners of coveted IP (read: Disney). Or as one TikTok comment put it, in response to an AI-generated trailer:

I doubt that, but Hollywood is in for some big changes. As content explodes, IP becomes one of the best signals for what will break through and earn real money.

7️⃣ Weight Loss and Market Cap Loss

Who is having a worse week than Pixar? Hims, which suffered a ~25% drop in one day. That drop erased about ~$4B of market value.

This came after Novo Nordisk, the maker of Ozempic and Wegovy, announced it would end its partnership with Hims.

Novo had been allowing Hims to sell copycat versions of the weight-loss drugs during a shortage. But Hims has been offering compounded versions and marketing them as “personalized,” which Novo wasn’t too pleased with. Compounded versions are supposed to be sold if a patient requires a modification, but that can be used as a loophole for jacking up prices and “mass compounding” (compounded drugs offer higher margins than generic versions).

Hims has been a poster-child for (1) consumer subscription companies, (2) DTC healthcare, and (3) the GLP-1 craze. But this drop underscores the risks of hitching a company’s wagon to a new hero product, particularly when the company doesn’t have control over the manufacturing and supply chain of that product.

8️⃣ Gen Z’s Political Polarization

Much has been made about how young voters shifted right in 2024—wayyy more than in previous elections:

But I liked Jean Twenge’s piece in The Atlantic this week, which argued that this was a one-off event rather than an ideological realignment. From Twenge:

Given that young voters have not become more likely to identify as conservative or hold broadly conservative political opinions, Gen Z might not be the disaster for Democrats that Shor and others are predicting. The 2024 election might have been an anomalous event in which young people’s deep dissatisfaction with the economy, especially the inflation that hit their just-starting-out budgets, drove them to want change.

Another distinct possibility is that, going forward, Gen Z will vote for whichever party is not currently in office.

Both are plausible, and I think more likely than a permanent red shift. I particularly agree with the second possibility, that we’ll see Gen Z perennially voting for the party not in power.

9️⃣ Labor Spend Is the New Benchmark

One way to think about the market size for AI companies: look at the labor spend.

Some of my companies have actually asked for the P&L for their customers—and then used that to inform product roadmap, automating some of the most human-intensive, manual, expensive work.

In the U.S., there are 1M doctors, 1M lawyers, and 2M software developers. There are 71M knowledge workers overall, averaging $85K in salary. That’s $6 trillion of spend. How much of this spend can AI applications capture?

🔟 Top 25 Biggest Companies (2015 vs. 2020 vs. 2025)

MANGO is new FAANG.

Let’s end with this slide from Coatue’s report, which shows the biggest tech companies in 2015, 2020, and 2025:

Typically, one-fourth to one-third of top 25 companies turn over every five years. From 2020 to 2025, we saw 16% turnover—slightly below average.

Is Big Tech solidifying itself at the top? Or maybe the days of FAANG MANGO are done? The big names are down 1% for the year, ceding some AI ground to fast-risers like Constellation, Palantir, and Broadcom. Check out this chart:

All of this is to say: we’ll probably have ~20% of names drop out of the top 25 by 2030, and we’ll have a slew of new names enter. Some new entrants might be today’s most-valuable private companies: OpenAI, Bytedance, and so on.

Or maybe the real trend to bet on is that half of the would-be top 25 will instead remain private, riding endless streams of private capital.

We’ll do another “10 Charts” piece in another few months. See you next week! 👋

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: