Daybreak: Venture Capital for the Next Generation

Building Daybreak & the State of the Union for Early-Stage Venture

Weekly writing about how technology shapes humanity and vice versa. If you haven’t subscribed, join 50,000 weekly readers by subscribing here:

Daybreak: Venture Capital for the Next Generation

As we get back into the swing of things post-Labor Day, I wanted to use this piece for two purposes: (1) for a career update, and (2) for a status check on early-stage venture capital.

The career update is something I’m excited to share: I’m launching my own venture capital firm, Daybreak (more on the name later), and this piece digs into why now is a unique moment in time for startup creation, Daybreak’s thesis on early-stage investing, and how Daybreak will evolve in the years ahead. This is something I’ve always wanted to do, and it feels energizing to build an institution that I hope modernizes the industry and serves the next generation of entrepreneurs.

In tandem, this piece acts as a “State of the Union” for early-stage venture, exploring why the next few years will be—in my mind—seminal years for startup creation.

The industry norm is to wait to talk about a fund until the fund closes; this is because firms can’t generally solicit investors or advertise for a fund under the regulations relied on by most firms. But there’s another path, Rule 506(c), that allows a fund manager to publicly talk about a fund in parallel with fundraising. I’ve always been a believer in building in public, and this path felt right to me. Part of Daybreak’s thesis is to bring venture capital into the next generation, and my view is that the tech and investing worlds need more transparency, not less.

I also believe that the best ideas are pressure-tested and debated, and I expect that tapping this community of 50,000+ will further refine my vision and ultimately allow me to build a more successful, innovative franchise.

With that, let’s jump into Daybreak and the current state of venture capital 👇

Why Now?

It’s a tough macroeconomic environment; venture capital got ahead of its skis the past few years, and the industry is now paying the price. So is it crazy to start a venture firm in this moment? I don’t think so.

The first person I talked to about Daybreak—before it had a name—was a mentor of mine, one of the general partners at Index. He said something that stuck with me: “Times of volatility are often also times of opportunity. Downturns have historically been the best moments for startup creation and for Seed investing. This is probably the best time in 15 years to launch an early-stage venture fund.”

When we zoom out, we see the confluence of a few forces: As a new generation comes of age, (1) massive behavior shifts are colliding with (2) exciting new technology platform shifts, all undergirded by (3) a talent unlock caused by the market downturn. These factors combine to make this a compelling moment for Daybreak. Let’s unpack each force in turn.

Behavior Shifts

Digital Native is as much about people as it is about technology. More specifically, it’s about how people shape technology, and how technology shapes people. (I often think of the Marshall McLuhan quote: “We shape our tools and thereafter they shape us.”) This interplay between tech and humanity becomes more complex and more interesting with the younger generation, the digital natives (hence the name!). I often say that the best part of being an early-stage venture investor is that it allows you to be an anthropologist of sorts—to study humans and to examine how tastes, preferences, and worldviews evolve over time.

We’re finally seeing the digital natives come of age: Gen Z is the largest generation in the world—two billion members comprising 30% of the world’s population—and the generation commands $360B in spending power, up from $143B just four years ago (36% compound annual growth rate).

As the digital natives come of age, they do so with radically new behaviors formed by growing up in a cyber-infused world. These are years-long trends: sustainability bleeding into e-commerce; increased loneliness and deteriorating mental health; a migration to more self-directed, flexible online work.

Each of these shifts creates an opening for startup creation. And these shifts are intersecting with large-scale changes in technology.

Technology Shifts

For the past ~15 years, two forces have powered the lion’s share of startup growth: (1) mobile, and (2) cloud. Mobile facilitated the rise of large consumer internet companies: Uber and Lyft, Instagram and Snap, Robinhood and Coinbase. Each was founded between 2009 and 2013.

Cloud, for its part, underpinned an explosion in software-as-a-service (SaaS) and enabled data to become the most prized resource in a business (“Data is the new oil” and all that). Emergent companies—again, each founded between 2009 and 2013—included Slack and Airtable, Stripe and Plaid, Snowflake and Databricks. The percentage of corporate data stored in the cloud doubled from 2015 to 2022.

Much of the hype surrounding new technologies and vaunted “platform shifts” derives from anxiety around mobile and cloud being…old. AWS launched in 2006; the iPhone came out in 2007. Neither mobile nor cloud are saturated, and there are plenty of opportunities left to seize, but neither is as ripe for greenfield business creation as it once was.

We’re now—finally—in the early innings of new technology epochs. Consider what’s happening in AI: the visualization below does a good job showing just how dramatically AI has improved over the past few years. AI now outperforms humans in image recognition, reading comprehension, language understanding, and code generation. April’s AI State of the Union examined how AI is augmenting human knowledge and human creativity.

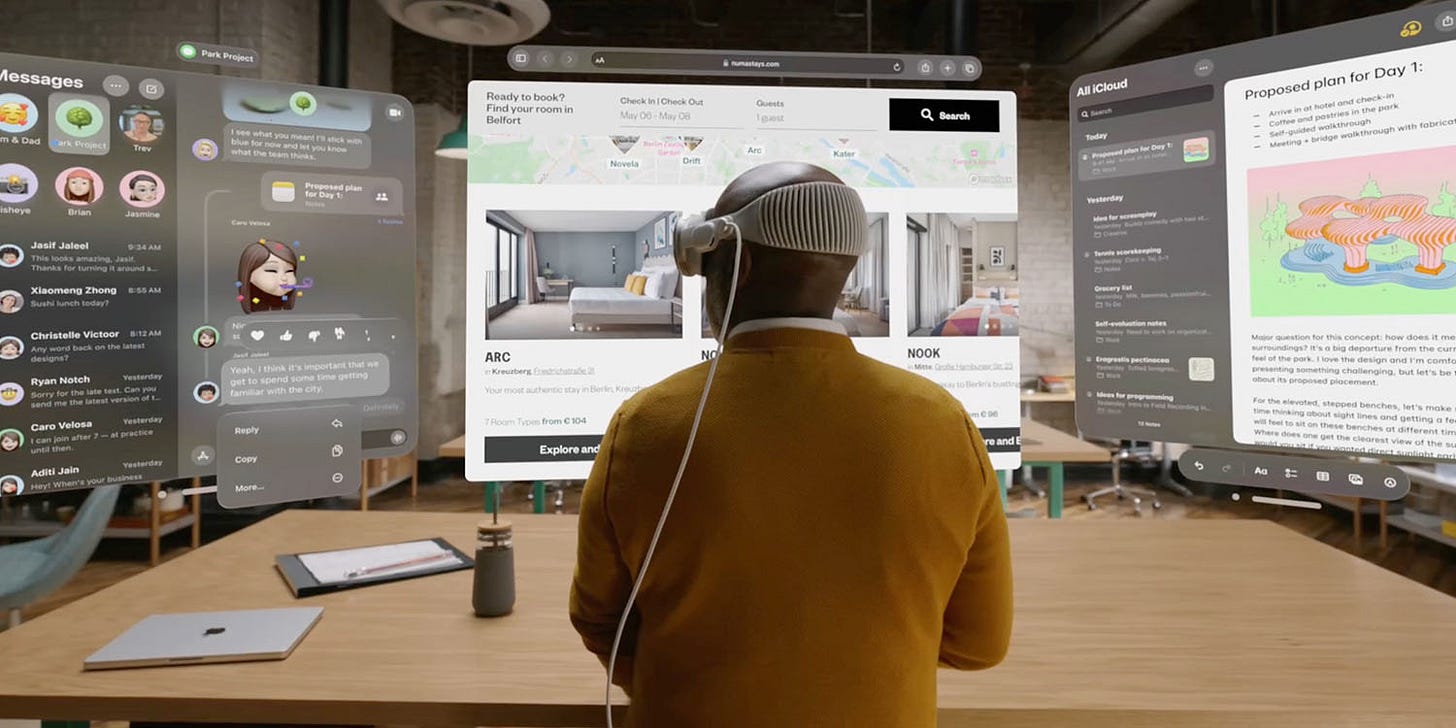

Mixed Reality hasn’t arrived in the mainstream quite yet, but Apple’s Vision Pro—due early next year—could be the device that underpins a robust application layer. Content and computing are moving 3D, and it’s a question of when not if digital experiences become fully immersive. (I like the Tim Sweeney quote: “I’ve never met a skeptic of VR who has tried it.”)

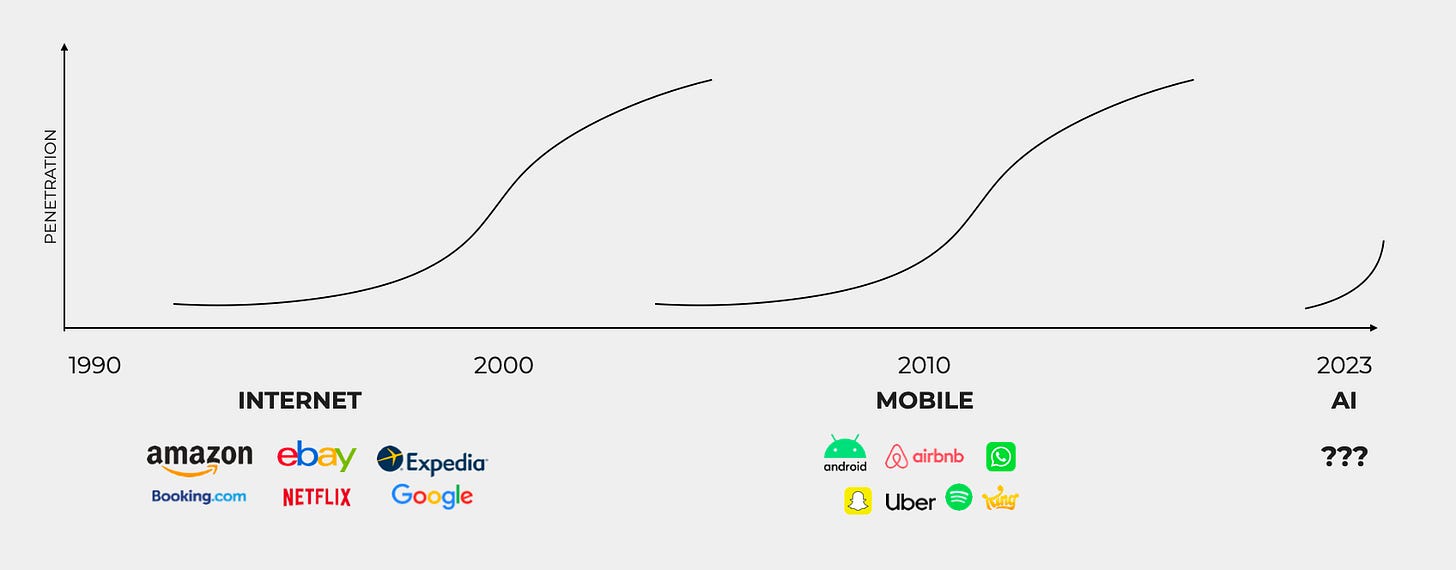

We’ve seen in past technology eras that iconic companies tend to be built in the early years of a big shift. We saw this play out with the internet, which gave birth to companies like Google, Amazon, and Expedia. We saw it again with mobile, which underpinned Uber, Snap, and Android. In 2023, we’re seeing it happen again with AI.

You could substitute “Mixed Reality” for “AI” in this visual and the same thesis holds—though maybe the year will be 2025 rather than 2023.

We have new technology applications emerging in a fast-changing market landscape. Only time will tell which generational companies are built on these shifts, but it’s an exciting time to be in early-stage startups.

Crucially, this is all happening during a market downturn. That sounds like a bad thing—but it actually creates a unique moment to innovate.

Talent Unlock

Over the past year, the tech sector has gone through a brutal correction. Low interest rates and COVID-era money printing powered a bubble in venture capital funding and startup valuations. Companies over-fundraised and over-hired, and now, as interest rates rise, they’re paying the price. (Rising interest rates will always punish tech stocks, as tech stocks are highly dependent on future cash flows discounted to the present.)

Elad Gil had an excellent piece on the startup reckoning, arguing that we’re about to see many startups shut down. As he puts it: “Multiples in the COVID era were the anomaly, not the 14 years prior. We are not going back to 2020-2021 valuation multiples (or anything close to it) until the next bubble.”

In 2021, it wasn’t uncommon to see startups raising at 50x or even 100x ARR (annual recurring revenue) multiples. Many companies will struggle to grow into those valuations. As Gil points out, a company that raised at 50X ARR will take 9 years growing 20% a year to just grow into its current valuation (assuming a 10X exit multiple). A company that raised at 100x ARR would take 6-7 years, growing 85% year-over-year, to grow into that last round price. That’s to say nothing of being a 2-3x step-up in valuation for the next fundraise.

In the coming quarters, many companies will have flat or down rounds; many others will shut down altogether.

This makes today a difficult moment for growth investing, but a compelling moment for early-stage investing. Talent is about to be unlocked, which will fuel a boom in startup creation. Looking back at the Great Recession, venture funding declined overall, but cohorts of iconic companies were born—again, all of the mobile and cloud companies mentioned above were founded in the five years of 2009, 2010, 2011, 2012, and 2013.

These next five years—2024, 2025, 2026, 2027, 2028—may be historic vintages for Seed. The talent unlock is coinciding with startup opportunities made possible by new behaviors and new technologies. The result is a surge in high-quality early-stage investment opportunities.

Daybreak’s Thesis

Daybreak was initially called “Tectonic.” Many of the things that interest me are tectonic shifts in behavior and technology—as alluded to above—and many of the companies I’ve partnered with build on, catalyze, and accelerate these shifts. But a mentor at Index (rightly) said that Tectonic was too austere and not very “me.” So I went back to the drawing board.

I chose the name Daybreak because it connotes early-stage—we’ll focus on Pre-Seed and Seed, and we’ll often be an entrepreneur’s first partner. Daybreak also connotes hope and optimism, and my view is that the next generation of iconic technology companies will make life tangibly better for people.

Capitalism—when well-designed and with proper guardrails—is a powerful tool for incentivizing innovation. The scalability of internet and software products, meanwhile, offers the perfect catalyst for turbocharging that innovation. In this summer’s “America Has A Problem. Startups Are Trying to Fix It” I wrote:

What captivates me about technology is how it can better ignite and amplify impact. Entrepreneurship is the engine behind everything: innovation is the purest distillation of potential energy. And if entrepreneurship is the spark, technology is the kerosene that uses zero marginal costs to grow the fire.

That piece dove into “impactful” areas like health, learning, and community that are ripe for technology reinvention. These areas all excite me.

I always hesitate to use the word “consumer,” because I think it can be limiting. It brings to mind consumer brands or consumer social, when investing in the consumer ecosystem is much broader. Shopify and Faire aren’t consumer-facing businesses, for instance, but they offer infrastructure for commerce; Figma and Notion are B2B, but they have viral bottom-up adoption; companies I’ve worked with like Flagship, Beam, and Persona are all B2B, but they build along important behavior shifts (respectively: the shift to more self-directed work; the shift to more mission-driven shopping; and the shift to more complex online identities). The reality is: every company has a buyer, whether it sells to consumers or to enterprises. I expect Daybreak to invest in both B2C and B2B companies, though always with an understanding of the next-generation consumer, and always with an eye toward companies with viral distribution channels and strong network effects.

My view is that an investor can be thesis-led, but must be founder-first. The best founders are living a year or two in the future. We can fall in love with our own projections of where the world is going, but exceptional entrepreneurs are always a step ahead; this job is about spotting that killer instinct and that x-factor—the steeliness and grit that allow someone to build a multi-billion-dollar business.

When you get it right, you get it really right. Investing in Snap’s Seed round for 15% ownership would yield a $3.6B stake at IPO with no dilution, $1.8B assuming 50% dilution. This job is about having conviction and being in early.

Venture is a power law business; one winner can return a fund many times over. Ideally you have two, three, four big winners. This is the business of not what can go wrong, but what can go right. This is a business built on optimism.

Daybreak will always be laser-focused on the early stages; we’ll always be thesis-led but founder-first; and, in working with our entrepreneurs, we’ll roll up our sleeves to unlock distribution.

Unlocking Distribution

There’s a famous line in the startup world, tracing back to Alex Rampell in 2015: “The battle between every startup and the incumbent comes down to whether the startup gets distribution before the incumbent gets innovation.”

The line relates to a Paul Graham quote I’ve shared before:

“A startup is a company designed to grow fast. Being newly founded does not in itself make a company a startup. Nor is it necessary for a startup to work on technology, or take venture funding, or have some sort of ‘exit.’ The only essential thing is growth. Everything else we associate with startups follows from growth.”

Startups are all about growth growth growth. Yet one sentence has been on my mind the past few months, and has offered a North Star for Daybreak:

There are a few reasons why growth has become uniquely difficult:

First, we’re in a rising CAC environment. Apple’s App Tracking Transparency changes severed the connection between companies and customers, throwing a wrench in customer acquisition costs. Every company is facing acquisition headwinds.

Second, Big Tech has never been bigger, wielding built-in distribution to fend off startups. That’s a formidable challenge—how does a productivity startup compete with Microsoft Office 365 or Google Workspace?—and entrepreneurs have to be especially agile and creative to disrupt Big Tech incumbents in 2023.

Finally, AI is reinventing customer discovery, in the process rewriting the distribution playbook. In AI’s Interface Revolution, we looked at how AI offers a new path of acquisition: in an old world, you might visit Airbnb.com, Booking.com, or Expedia.com to book a place to stay in Paris; what happens when you instead ask a chatbot, “Book me a room in Paris”? The AI interface obfuscates the traditional customer discovery journey.

This creates an Innovator’s Dilemma for incumbents: each has a valuable brand that it doesn’t want to devalue, and each has a reliable go-to-market that it doesn’t want to disrupt. This opens a door for savvy upstarts.

There’s a lot of smart money around, looking to invest in the same types of generational businesses. Savvy entrepreneurs expect (and should get!) more than just a check and some strategic advice. Some funds focus their value-add on hiring, others on tech and product, others on international expansion. When I thought honestly about what Daybreak could offer founders that would be both valuable and differentiated, distribution was the clear choice. In today’s world, distribution is everything.

I chose the word “distribution” because the word “growth” can imply something narrow or even premature in early-stage startups (scaling a paid channel, for instance). Distribution is broader: it’s designing your brand; it’s crafting your story; it’s figuring out your go-to-market; it’s building virality into your product.

Digital Native has been important for helping my companies unlock distribution in the past. This community of 50,000+ is a key source of early customers and early hires; it’s helped many of my companies find their first brands, their first engineers, their first pilot users. I expect media and content to continue to be core to the DNA of Daybreak, today with Digital Native and down the road with new channels we’ll launch.

Distribution also means working closely with entrepreneurs on everything from launching a TikTok channel, to designing referral loops, to implementing a community ambassador program. And critically, distribution means tapping the knowledge of an army of world-class distribution experts in the Daybreak Expert Network. There’s a lot of knowledge out there, largely inaccessible to founders. Our experts are folks who have led functions like growth, brand, marketing, and sales at companies like Instagram, Slack, Notion, and Figma.

(May’s How Notion Used Community to Scale to 20M+ Users focused on Ben Lang, Notion’s Head of Community; June’s How Duolingo Grew Its TikTok to 6.6M Followers focused on Zaria Parvez, Duolingo’s TikTok mastermind; both are examples of Distribution Experts in the Daybreak Network.) Daybreak will also partner with leading brand agencies (check out June’s How to Build Your Startup Brand with Red Antler), SEO/SEM agencies, and influencer agencies.

The goal: partnering with Daybreak means end-to-end support on every facet of distribution.

Daybreak in the Future 🌄

I’ve always been drawn to the artisanal side of venture—working closely with entrepreneurs at the earliest stages to get a business off the ground and hit escape velocity. I expect Daybreak will always skew toward the more artisanal, craftsman-like side of venture.

I don’t ever see us becoming a scaled asset manager, though we’ll grow our fund sizes. Today, Daybreak is just me; in five or 10 years, I hope we’re five or 10 people. We’ll probably never be 500 people, but rather a lean team focused on the art of early-stage venture capital.

We’ll emulate many of the places I’ve worked in my career: the analytical rigor and discipline of TPG; the impact focus of The Rise Fund and Stanford’s Knight-Hennessy program; perhaps most importantly, the founder-centricity of Index, focusing on the relationship side of early-stage startups. (If there’s one thing I’ve learned, it’s that early-stage is all about people.)

I started writing partly because I was inspired by venture capitalists like Fred Wilson at Union Square Ventures (avc.com) and Bill Gurley at Benchmark (abovethecrowd.com). One guiding question I’ve asked myself: What would USV and Benchmark look like if they were built in 2023?

Daybreak will have content in its DNA—Digital Native today, future initiatives in the future—which goes hand-in-hand with distribution. We’ll probably have a TikTok, similar to the TikTok we launched at Index (53K-strong now). We’ll have Discord channels for founders to share learnings and for future founders to meet and ideate. The Digital Native Discord—which now has 1,500 of us—is renamed Daybreak and will encompass the topics covered in Digital Native, as well as new forums for the broader Daybreak community. We’re launching this week with seven Community Managers to help engage the community.

Daybreak is a long journey, and we’re only at the very beginning. But I’m energized by the opportunity to build a venture firm for the next generation, and I’m excited to give this community a front-row seat to each step along the way.

As far as Digital Native goes, nothing will change—I’ll continue writing long-form pieces week in and week out. That said, I’ll weave in some new learnings from investing at the earliest stages, from running a venture capital fund, and from continuing as an anthropologist of sorts, studying how people and technology shape one another.

My new email is rex@daybreakventures.com 📬 See you next week!

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: