Enterprise Software Is Dead. Long Live Enterprise Software.

Examining Trends in B2B SaaS and the Startups Building On Them

This is a weekly newsletter exploring the collision of technology and humanity. To receive Digital Native in your inbox each week, subscribe here:

Enterprise Software Is Dead. Long Live Enterprise Software.

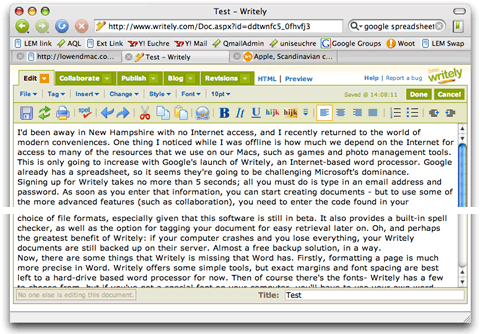

In August 2005, a startup called Writely released a web-based word processor. People loved it: all of a sudden, you could write and edit content all within your browser. You could even convert your documents into PDFs (!).

Seven months later, in March 2006, Google acquired Writely, and later that year Google introduced a refurbished Writely into the world. Its name: Google Docs.

Four years later, Google Docs got a major facelift with another Google acquisition. In March 2010, Google bought DocVerse, a startup that allowed multiple users to collaborate on Microsoft Word documents. DocVerse’s technology, as you may have guessed, was then used to power Google Docs’s real-time collaboration. A year later, Google Docs hit another important milestone: it became used by students at Catalina Foothills High School to surreptitiously gossip in class. One of those students: yours truly.

Google Docs, of course, has moved far beyond chatty high school students. Last year, Google revealed that Google Workspace—the company’s compilation of collaboration and productivity software products, formerly known as G Suite—had hit 2 billion monthly active users. This likely puts Google on par with the 800-pound gorilla in work software, Microsoft, at least in terms of users. (Excel alone has an estimated 1.2 billion MAUs). Microsoft, though, remains far ahead when it comes to paying users: Google in 2019 announced that 5 million businesses pay for Workspace, while Microsoft has said that over 200 million businesses pay for its Office 365 suite.

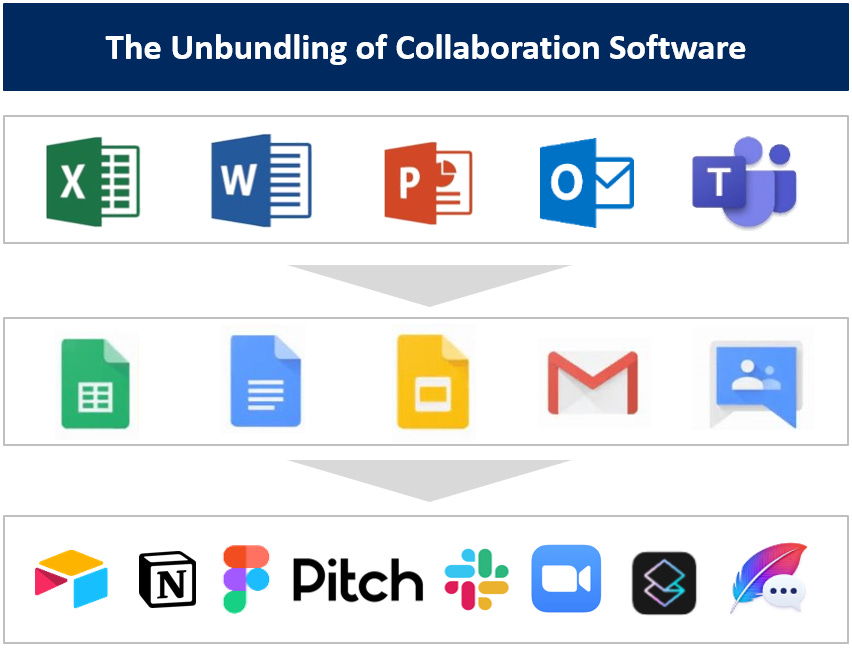

One of my first Digital Native pieces focused on the unbundling of collaboration software. It included this graphic:

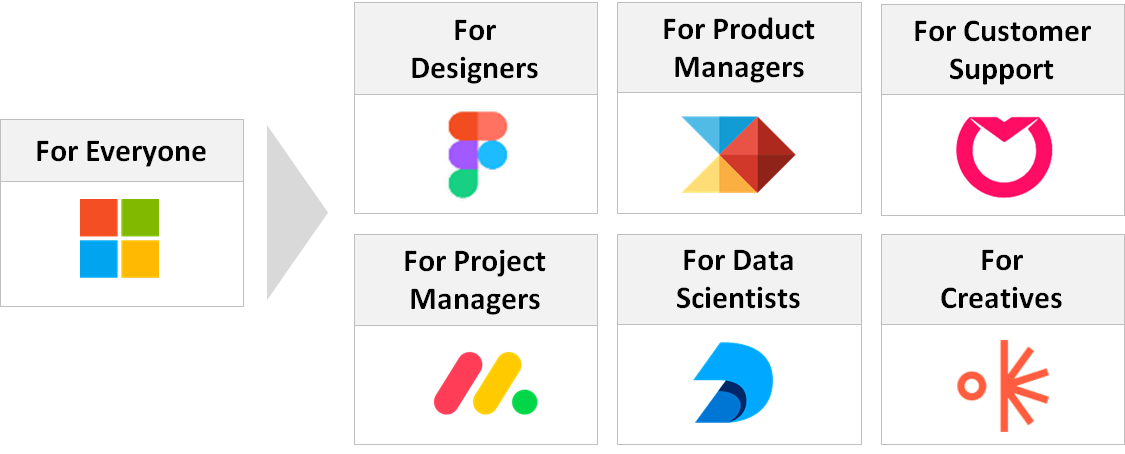

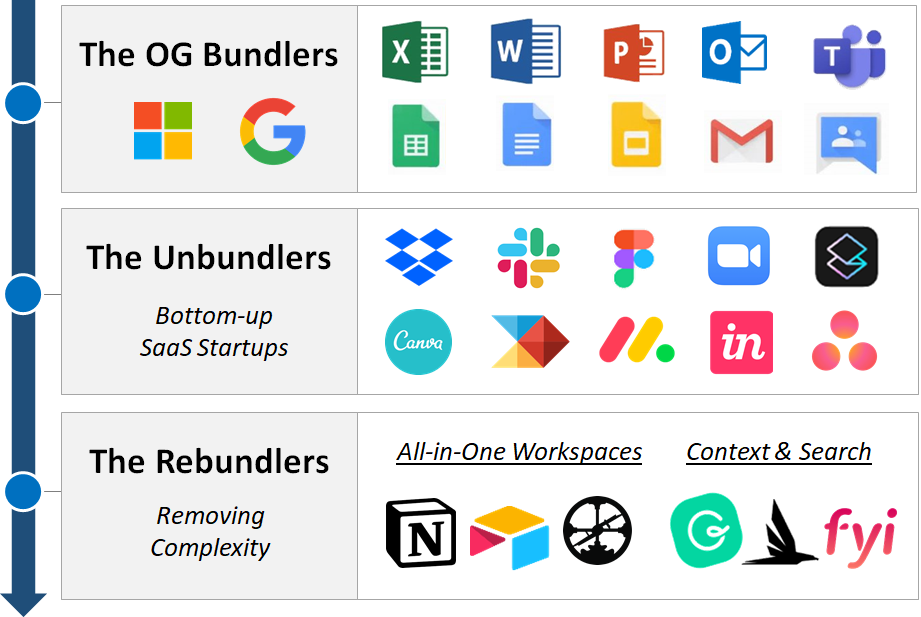

First, Google disrupted Microsoft by layering on real-time collaboration. Then, both Google and Microsoft found themselves flat-footed, too monolithic and slow-moving to ward off further disruption. As cloud computing made real-time collaboration tablestakes, startups turned to superior design and bottom-up go-to-market motions to eat away at the two incumbents.

This trend became known as “the consumerization of the enterprise”—work tools were becoming as elegant and user-friendly as consumer apps. Furthermore, many tools were tailored to a specific user within an organization, making them superior to broad catch-all tools like PowerPoint, Word, and Outlook.

Disruption in productivity and collaboration software was one of the leading startup trends throughout the 2010s. The VC buzzword for the movement (there always is one!) was the conveniently-vague “future of work.” Slack, which is credited with first popularizing product-led growth, was the biggest success of all, first with its 2019 IPO and later with its $27.7B sale to Salesforce.

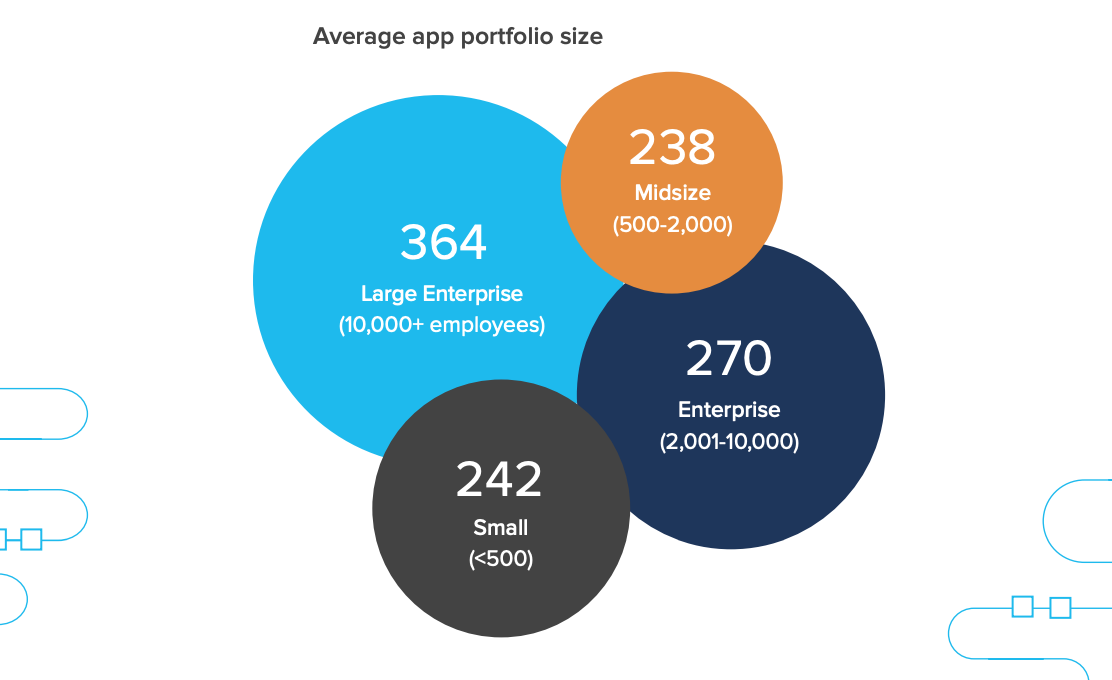

The downside to this movement has been an explosion in SaaS apps that’s become untenable for organizations to manage. Productiv’s 2021 State of SaaS Sprawl report found that the average company uses 254 distinct SaaS apps, which swells to 350+ in large enterprises. Many categories like Security & Compliance, Project Management, and Spreadsheets & Presentations each reliably have 5+ distinct tools within an org.

The worst part: Productiv found that average app engagement was just 45%, meaning that less than half of app licenses in a company’s portfolio are being used on a regular basis.

This isn’t a new phenomenon. A few years ago, I argued that we’d see a “rebundling” of SaaS tools because the proliferation was becoming unruly. But in that piece, I quoted a 2018 Okta report that the average company had 80 installed work apps, an increase from 50 apps in 2015. The Productiv data clearly paints a more extreme picture. (This is likely partly due to different data sources, and partly due to remote work-driven bloat in a company’s cloud tech stack.)

We have, to some extent, seen a rebundling. This has come in two predominant forms. First, there are companies building all-in-one offerings to replace disparate tools; Rippling is an example here, aggregating a company’s admin function (payroll, benefits, expenses, IT, etc). Then there are companies stitching together the diaspora of tools; Merge.dev is an example here, offering one unified API for integrations across HR, payroll, accounting, and so on.

But over the past few years, we’ve also seen a general cooling of the “future of work” category. After all, how many more SaaS tools do we need when the average company already uses 250+?

This cooling, though, is an overreaction. I’m reminded of the quote from the famed football coach Lou Houltz: “Nothing is ever as good as it seems, and nothing is ever as bad as it seems.” The ~2017-2020 excitement around productivity software was probably a tad overheated; at the same time, today’s hush is far too muted.

This isn’t to say nothing is happening in the space. Retool is on fire; Miro has quietly built a massive business; and Figma, of course, just entered into an agreement to be acquired by Adobe for $20B.

But there’s less buzz around the innovation taking place in earlier-stage companies, and that’s not for a lack of interesting startups. Last year, I wrote a piece titled Consumer Social Is Dead. Long Live Consumer Social. The focus was on areas for innovation in consumer social, a category that also seems past its prime. This week, I’m applying a similar lens to enterprise software (with a primary focus on productivity and collaboration SaaS). I’ll look at five segments I find compelling:

Knowledge Management

Employee Management

Identity

Observability & Monitoring

AI-Powered

Within each, I’ll look at three specific startups to offer tangible examples of what’s happening in the market and where the remaining opportunities might lie.

Let’s dive in.

Knowledge Management

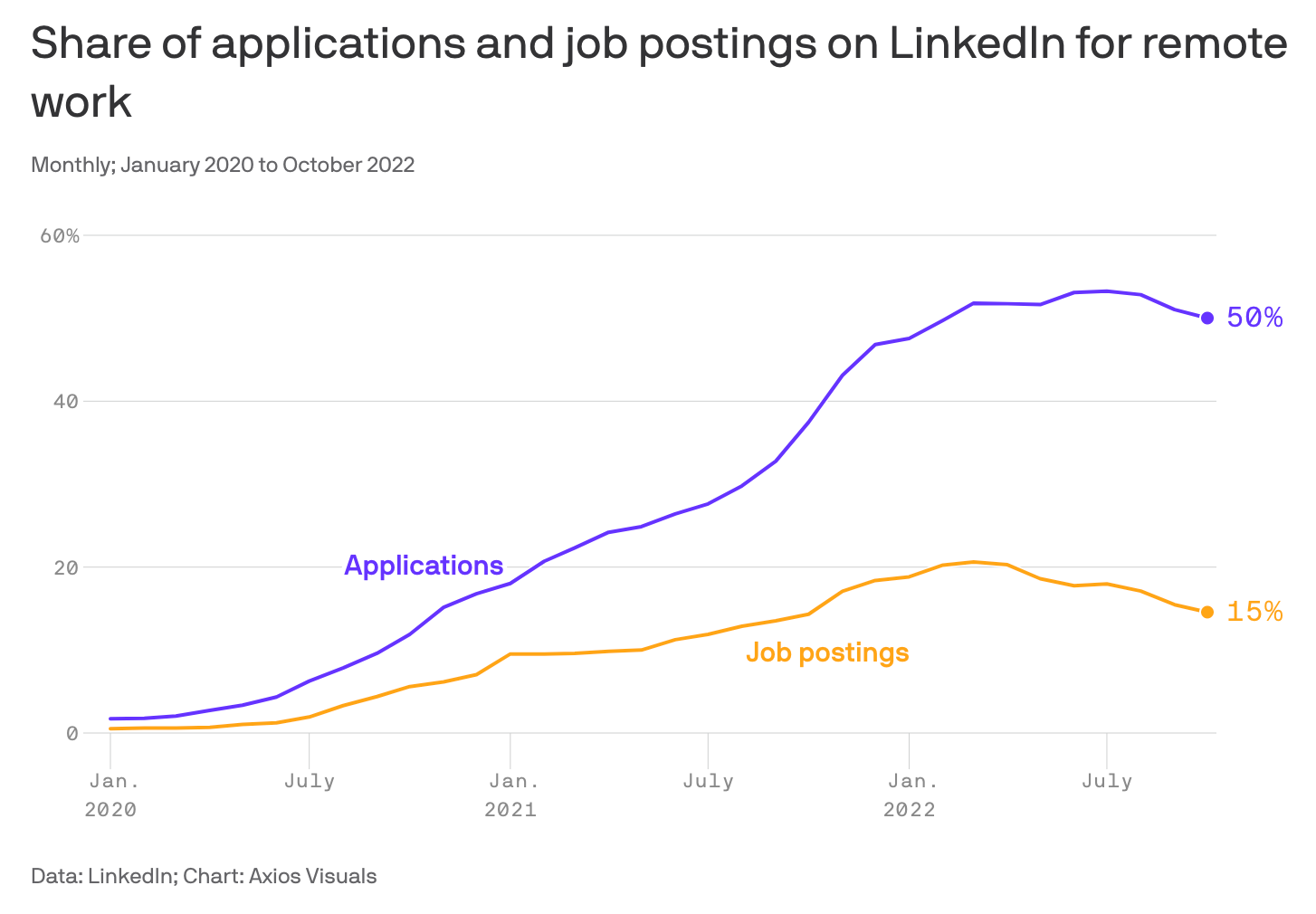

Demand for remote work is outpacing supply: while 50% of LinkedIn job applications request remote work, just 15% of job postings offer remote work.

Part of this dislocation stems from the fact that in this macro environment, power has shifted back to the employer. But this is long-term unsustainable: workers want flexible work, and sooner or later, employers will relent. (Over 50% of workers say they refuse to return to full-time office work, and finding a replacement worker can cost a company from 50% to 250% of an employee’s salary.) The share of remote, hybrid, and distributed teams will grow throughout the 2020s.

More remote and distributed teams means more emphasis on knowledge management within organizations. People need to know what’s going on and where to find important information—especially when they’re working from home, often in far-flung corners of the globe. We’ve already seen later-stage SaaS companies make headway here: Notion has become the central nervous system for many orgs; Slack channels offer a source of truth—you can scroll up and digest years of context; Guru is a company wiki with a strong focus on remote teams.

But we’re also seeing younger startups (Seed- & Series A-stage) tackle knowledge management. Three examples:

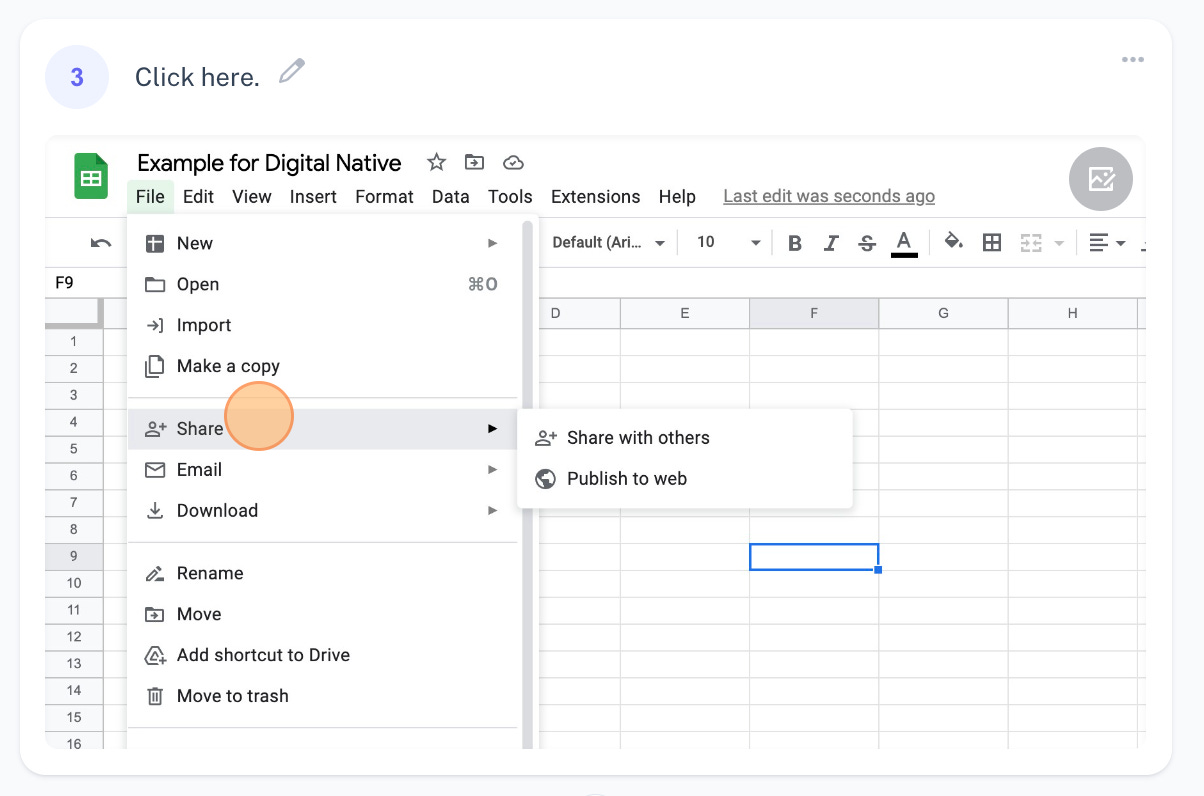

Scribe (Series A-stage) offers software for making how-to guides. Let’s say I want to explain to someone how to share a Google Sheet. I first install the Scribe Chrome extension and turn it on. Then I go through my workflow, and Scribe spits out a step-by-step guide of what I did. For instance, here’s Step 3:

Scribe’s product is intuitive and, like the best productivity software, a massive time-saver: no more screenshots and manual annotation. What’s also striking is the breadth of use cases and functions within which Scribe is popping up: customer support, employee onboarding, IT, learning and development. The best SaaS tools can “jump” from team to team inside of a company, and Scribe is proving to be a valuable tool across an org. A hub of Scribe how-to guides is a no-brainer for any org prioritizing knowledge management.

Another startup picking up steam: Fireflies.ai. Fireflies (also Series A-stage) lets you record, transcribe, search, and analyze voice conversations. Out of the few dozen Zoom meetings I take each week (I cringe just typing that), I typically encounter someone using Fireflies on three or four.

A final example within knowledge management: Rewind.ai (Seed-stage), a new company from Dan Siroker, the co-founder of Optimizely. Siroker describes the idea for Rewind stemming from the question, “What if we could use technology to augment our memory the same way a hearing aid can augment our hearing?” Rewind began with a concept similar to Fireflies (and to make matters even more confusing, that first iteration was called Scribe). But Rewind now offers a more robust product that it calls “The Search Engine For Your Life.”

Essentially, the product lets you sift through…anything from your online life. If you can’t remember where you saw/heard/read a piece of information, you can search with Rewind. Rewind digests audio from your Zoom meetings (compressing gigabytes of data into more manageable megabytes), vacuums up your Slack history, sorts through your notes and blogs and messages. It aggregates all your personal “knowledge” and lets you quickly search for what you need.

Employee Management

The employee lifecycle is being reinvented for our modern age of work. Every facet—attracting talent, onboarding employees, keeping your people happy, managing the headaches of a growing workforce—has been infiltrated by software and data.

Rippling, founded in 2016, is arguably the most well-known private tech company here, and its unfurling of product after product has been impressive to watch. But there are newer companies building along the employee lifecycle in interesting ways.

Remote.com was founded in 2019, catching the COVID tailwinds perfectly: Remote enables companies to hire global teams, abstracting away complexity like payroll, benefits, and taxes. The company has now swelled to over 2,500 employees.

Cocoon, meanwhile, simplifies employee leave. Unless you’ve gone through the leave process, it’s difficult to see it as the massive painpoint that it is. But applying for leave, such as maternity leave or paternity leave, typically requires hours and hours of paperwork to adhere to company, government, and insurance laws. It’s a nightmare.

My partner Mark led Index’s Seed and Series A investments in Cocoon right as he was finishing up his paternity leave. One of my other colleagues had recently spent over 25 hours on the phone with California’s Employment Development Department during the initial part of her maternity leave, trying to navigate a clerical error that threatened her job. The painpoint was clear. With Cocoon, what was once an hours-long headache becomes an automated process that takes under 10 minutes end-to-end.

A final example of employee management: Pave is an all-in-one hub for compensation.

What’s compelling about Pave is that the company digests data from many companies, and then leverages that data to help you make more effective compensation decisions. This offers a unique data moat for the business, as every additional customer improves Pave’s product.

Identity

Online identity is becoming more complex, dynamic, and multi-faceted. Managing identity is a massive headache for organizations.

Last summer, I wrote a piece about Persona, a company I’m fortunate to work with at Index. From that piece, a few examples of why online identity matters:

If I’m Airbnb, I have thousands of hosts on my platform. Guests will be staying in these people’s homes, and I need to make sure every host is who she says she is. Likewise for the other side of the marketplace, guests. How do I weed out bad actors, and how do I prevent fraud? Airbnb is a platform built on trust, and trust is inextricably tied to identity.

Or if I’m Uber, how do I ensure that the person picking up passengers is the same person I approved in our system, and not some stranger using their car?

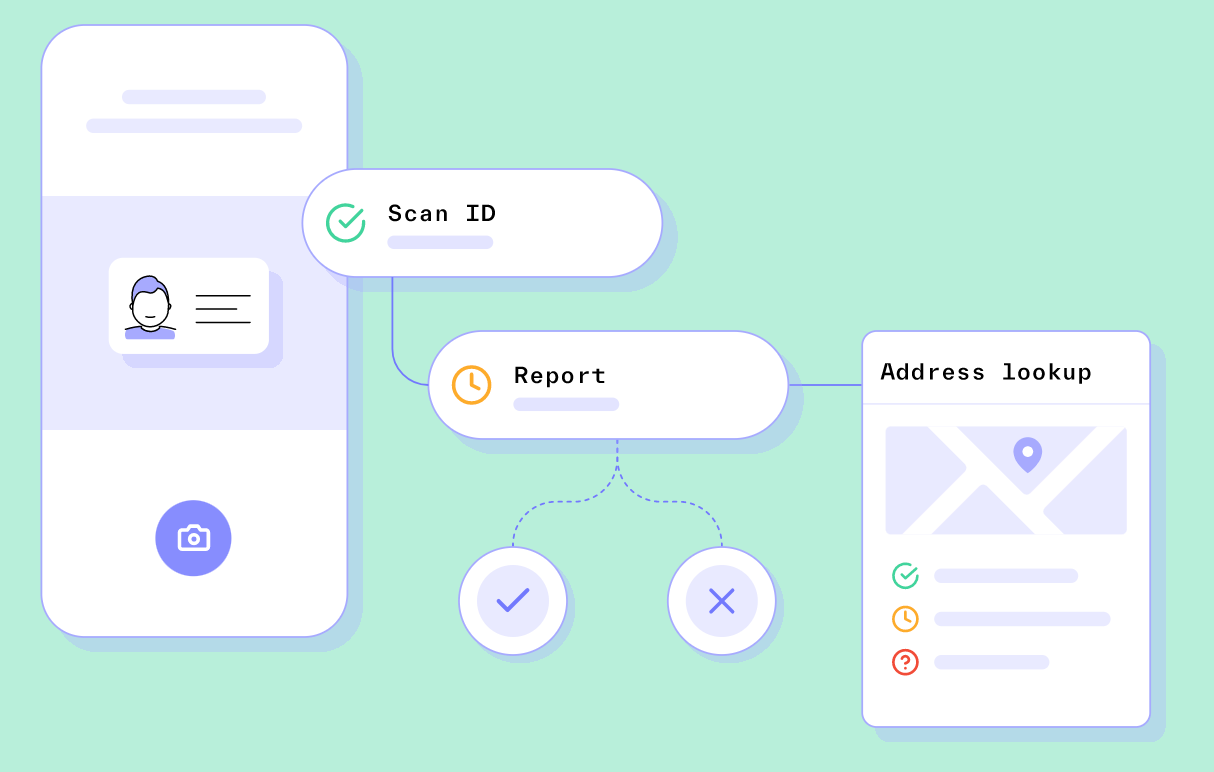

Over the weekend, I went to order dinner on DoorDash and I added a bottle of wine to my cart. DoorDash needed to verify that I’m over 21 and can legally purchase alcohol—you can see here the user flow I went through:

Identity underpins every interaction and every transaction on the internet, yet the infrastructure of identity was built for an analog world. Social security numbers. Physical addresses. Security questions. In 2022, aren’t there better ways to verify your identity than trying to remember the make and model of your first car?

We live in a world in which 6.9 billion people own a smartphone with biometric superpowers and a camera that can record 3D face scans. There are more secure ways to manage identity, and that’s where Persona comes in—an intuitive, customizable solution for collecting, verifying, and managing user identities throughout a customer lifecycle.

Identity has come a long way in the past few years. In February, Okta completed its $6.5B acquisition of Auth0 (though the acquisition was all-stock, and Okta stock has been clobbered over the past year alongside the broader tech market). And new entrants are popping up. Stytch wants to kill the password with a more flexible auth product. Earlier, we talked about the “SaaS sprawl”—the explosion of a company’s cloud tech stack. Lumos is an internal App Store for companies that allows them to manage access requests and access management; in other words, you can make sure the right people have access to the right tools.

Observability and Monitoring

One major trend in enterprise SaaS: more insight into what’s going on inside a business. Datadog, for instance, has built a massive business by allowing IT and DevOps teams to better monitor infrastructure and cloud services. PagerDuty, also now a public company, specializes in SaaS incident response for IT. But there’s still plenty of innovation happening.

Incident.io, for example, takes a broader approach to incident management, pulling in folks from across different functions—beyond engineering, where most existing players focus—to 1) better fix an incident (for example, a product outage) and 2) better learn from it.

Avenue, meanwhile, focuses on observability for operations teams. Avenue’s co-founders are ex-Uber and ex-Amazon; you’d be hard-pressed to find more operations-intensive companies. Customers like Blank Street (coffee chain) and Snackpass (food takeout) use Avenue to track and respond to what’s happening—warehouse stockouts, drops in order volume, snags in supply chains.

And Trackstar applies a similar playbook to DTC brands—24/7 monitoring for the e-commerce stack, another convoluted, fast-changing, and often opaque world.

The trend-line in all companies is toward more transparency: data is power, and workers are becoming more equipped to understand what’s going on, how to fix it, and how to prevent it from happening next time.

AI Superpowers

Okay, this one is cheating. AI-powered tools aren’t themselves a category, but rather a new vector cutting across functions and verticals. (Some of the products already mentioned could fit here as well—just look at the domains for Rewind.ai and Fireflies.ai.) We’re only going to see more and more tools incorporate AI, and you won’t have to be a technical expert to use AI or even to build with AI. I like how Nat Friedman framed the opportunity in a conversation with Daniel Gross and Ben Thompson:

When people hear about getting involved in AI and large language models, they assume a lot of specialized knowledge is needed. In order to work with these things I have to know deep learning and gosh, I probably have to know calculus or at least linear algebra, and I’m just sort of not into that sort of thing. Do I need to know how to program CUDA kernels for Nvidia hardware? It’s intimidating.

And what I think they’re missing is that I think this is a fallacy, and I think the fallacy is sort of saying, gosh, to make paint you have to be a chemist. And so if I want to be a painter, I have to learn chemistry. And the reality is you can be a great painter and not know anything about making paint. And I think you can build great products with large models without knowing exactly how they’re made.

I love that analogy. More tools will spring up with AI, and it’ll become easier to build work tools that harness AI. Over the next few years, productivity software might experience something of a resurgence as a result. We’re already seeing examples: Gong giving B2B salespeople better intelligence; Descript giving you video and audio editing superpowers; the stunning Runway demos I wrote about last week.

Three other examples:

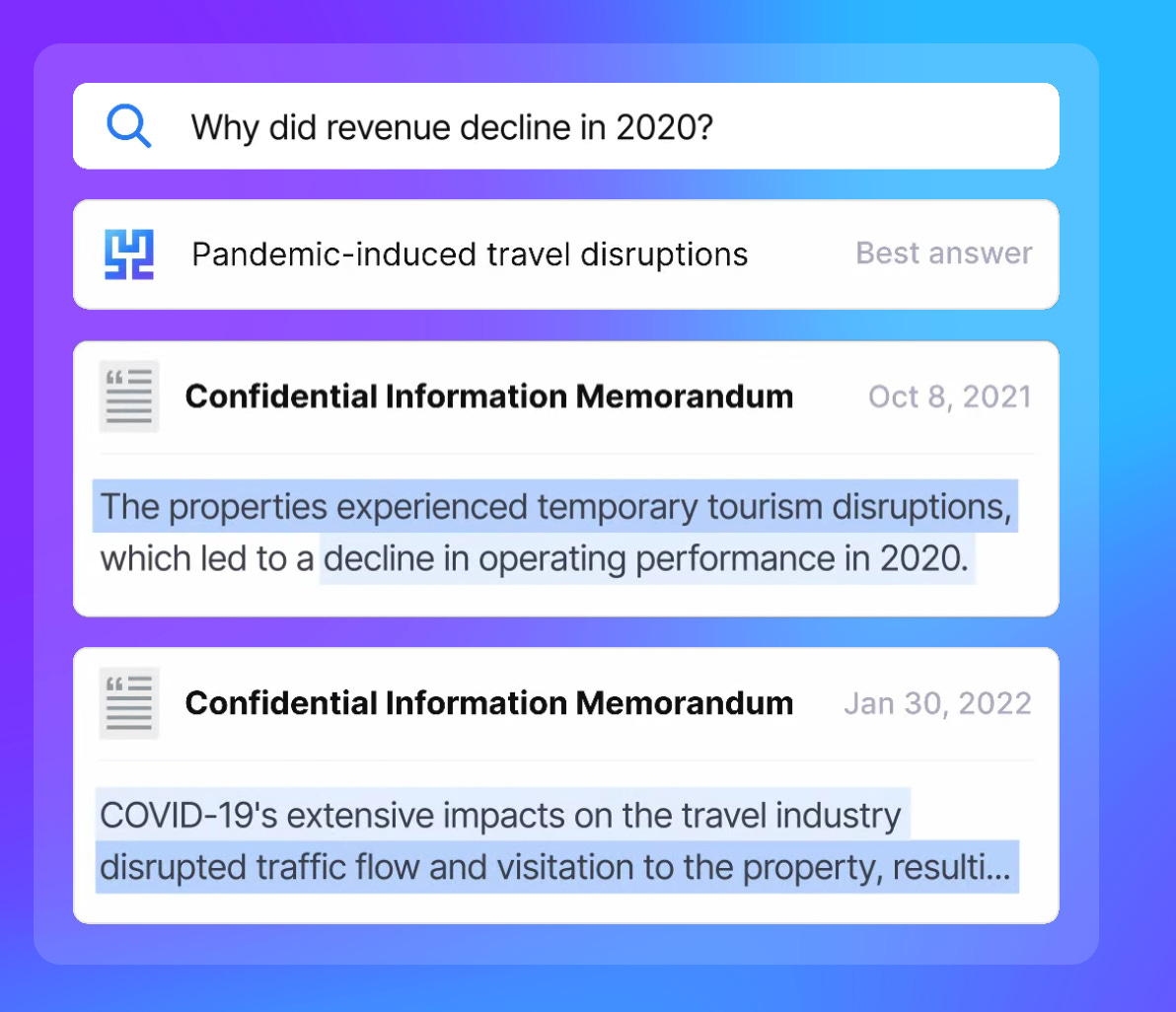

Hebbia offers neural search for the enterprise. Imagine you’re trying to dig through an SEC filing to figure out reasons revenue is down. Using Ctrl + F, this could take hours. With Hebbia, you just ask the question:

You can begin to imagine how much time this will save for any knowledge worker.

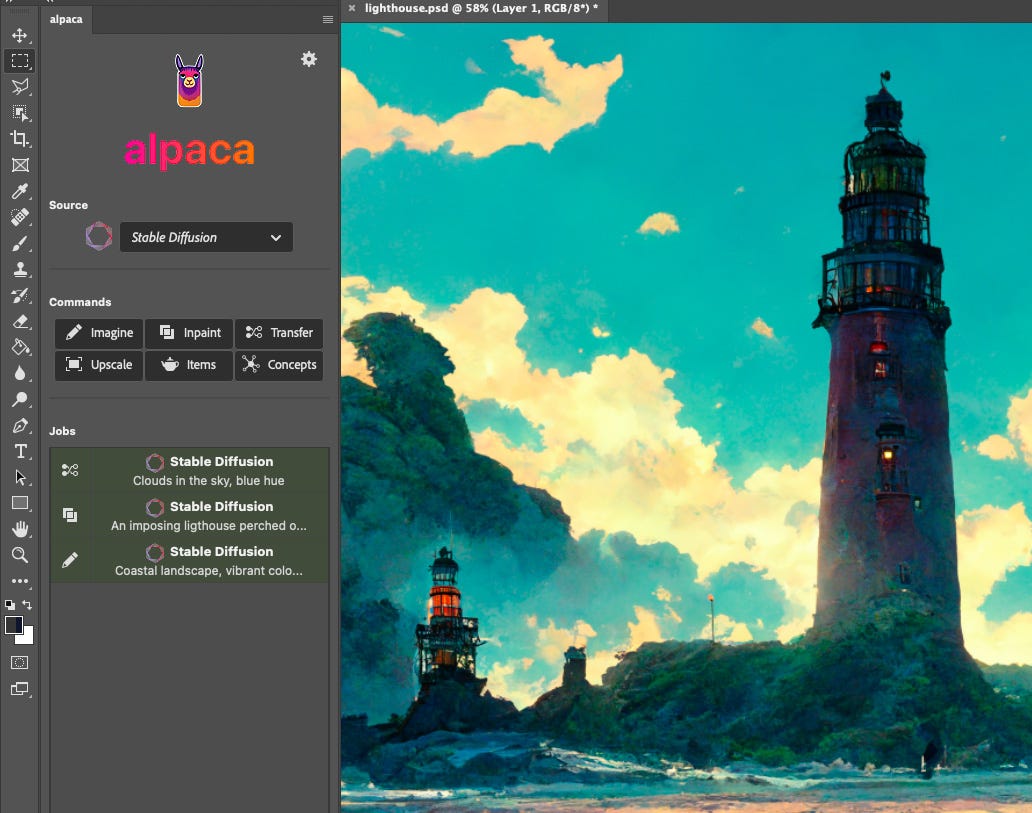

Alpaca, meanwhile, is a plug-in for Photoshop that “combines Stable Diffusion’s AI with human skill.” This article has a nice overview, and this tweet from co-founder Will Buchwalter gives you a sense of how it works.

In the screenshot here, you can see that a user can write a prompt like “An imposing lighthouse” to generate an image, and then manually interact with that image to fine-tune it. This is exactly what the best AI productivity tools will do: augment human skill.

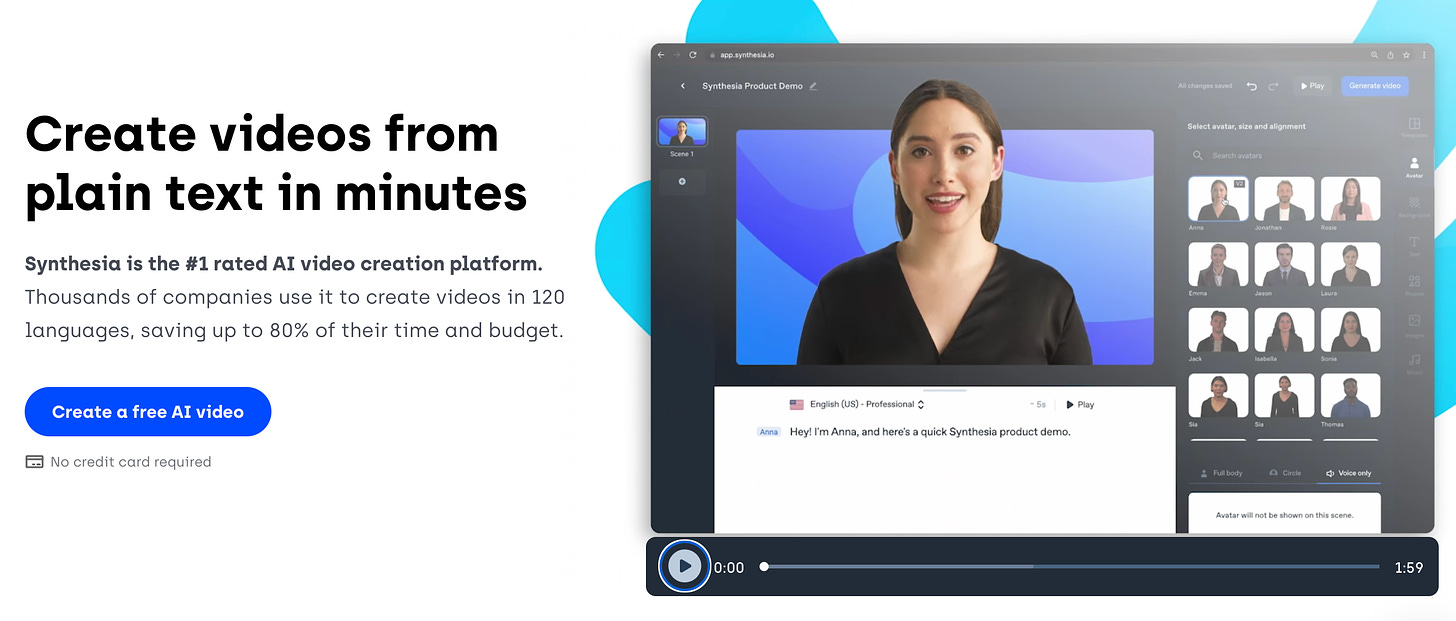

A final example is the London-based Synthesia, an AI video avatar platform.

Instead of hiring someone for an expensive training, how-to, or marketing video, you can input text into Synthesia and output a video of an avatar (who looks convincingly human) reading your script in one of in 120 languages. It’s pretty incredible; you can play around with the product by doing a free demo on the website.

Final Thoughts: Full Circle with Microsoft and OpenAI

Microsoft is still the Goliath in productivity software, and we started this piece by talking about how Microsoft had been disrupted first by Google, and then by a wave of product-led growth startups. AI is the next wave of disruption, but this time Microsoft is well-positioned: Satya Nadella was prescient to invest $1B into OpenAI back in 2019, and now Microsoft is reportedly in talks to invest another $10B (and to earn 75% of OpenAI profits until it recoups its investment).

I expect Microsoft to try to outright buy OpenAI sooner or later, though that may be difficult with the ongoing antitrust battle to acquire Activision Blizzard. But it makes sense that Microsoft wants to double down on OpenAI: Microsoft is the productivity company, and AI is the next era of productivity.

Last week, The Information reported that Microsoft is exploring integrating ChatGPT into Word, PowerPoint, Excel, etc. The result will hopefully be more successful than Clippy, the much-memed virtual assistant Microsoft introduced way back in 1997.

It will also be interesting to see how Google responds to all this. Google’s most important business, Search, where it owns ~90% market share, is already being threatened by Microsoft building ChatGPT into Bing. (Bing, believe it or not, still spits out $9B in annual revenue—about the same as Snap + Twitter combined.) Google, which is rumored to have an even better language model than OpenAI, is sure to move aggressively to protect both Search and Workspace.

Except, maybe not. The innovator’s dilemma tells us that big incumbents often don’t make the near-term painful but long-term optimal move. Ben Thompson drew a parallel this week between Google today and Kodak in the 90s. Kodak actually invented the digital camera, but then did nothing about it—all their profits came from selling film, and digital cameras are a one-time sale with no recurring film revenue. Why mess with your profit engine? In the end it didn’t matter (smartphones came along to wipe out both film and digital cameras), but it proved a point about incumbents being hesitant to cannibalize themselves in the name of long-term survival. We’ll see what road Google chooses.

The bottom line is: enterprise SaaS may not be as “hot” a space as it once was, but there’s still innovation happening. Work is changing rapidly, with the rise of remote, distributed teams; with leaps forward in AI; with both the continued digitization of work and the continued consumerization of the enterprise. You get the picture.

It’s only fitting to let ChatGPT write the last paragraph here 😊

Disclaimer: Some of the companies mentioned here are Index portfolio companies. These include Hebbia, Pave, Cocoon, Persona, Incident, and Remote. You can see a full list of our investments on our website here.

Sources & Additional Reading

Ben Thompson’s interview with Daniel Gross and Nat Friedman, as well as AI and the Big Five

Some of my favorite reads / listens on the consumerization of enterprise: The Commoditization of Enterprise (James Pember), Mapping Workplace Collaboration Startups (Merci Victoria Grace), Seed to Scale (Sarah Cannon)

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: