Flagship and the Future of Creator Commerce

How Flagship is Building the Infrastructure for Discovery-Driven Shopping

This is a weekly newsletter exploring the collision of technology and humanity. To receive Digital Native in your inbox each week, subscribe here:

Flagship and the Future of Creator Commerce

When I think of 20th-century retail, I think of Nordstrom and Macy’s and Kohl’s. Want a new sweater? Check out Macy’s. Need a TV? Head to Best Buy. Gardening supplies? Home Depot is your best bet. Retailers aggregated brands to make things easier on consumers. Shopping malls then aggregated retailers to create the ultimate hubs of commerce.

In the 21st century, e-commerce has ballooned to a $6 trillion global market. But online shopping is primarily search-driven: you go to Amazon and search for paper towels. When a Prime member visits Amazon.com, they end up buying something 74% of the time. E-commerce is built around utility. No one, meanwhile, has really figured out discovery-driven commerce online—a way of recreating the browsing, serendipity-fueled experience of 20th-century shopping.

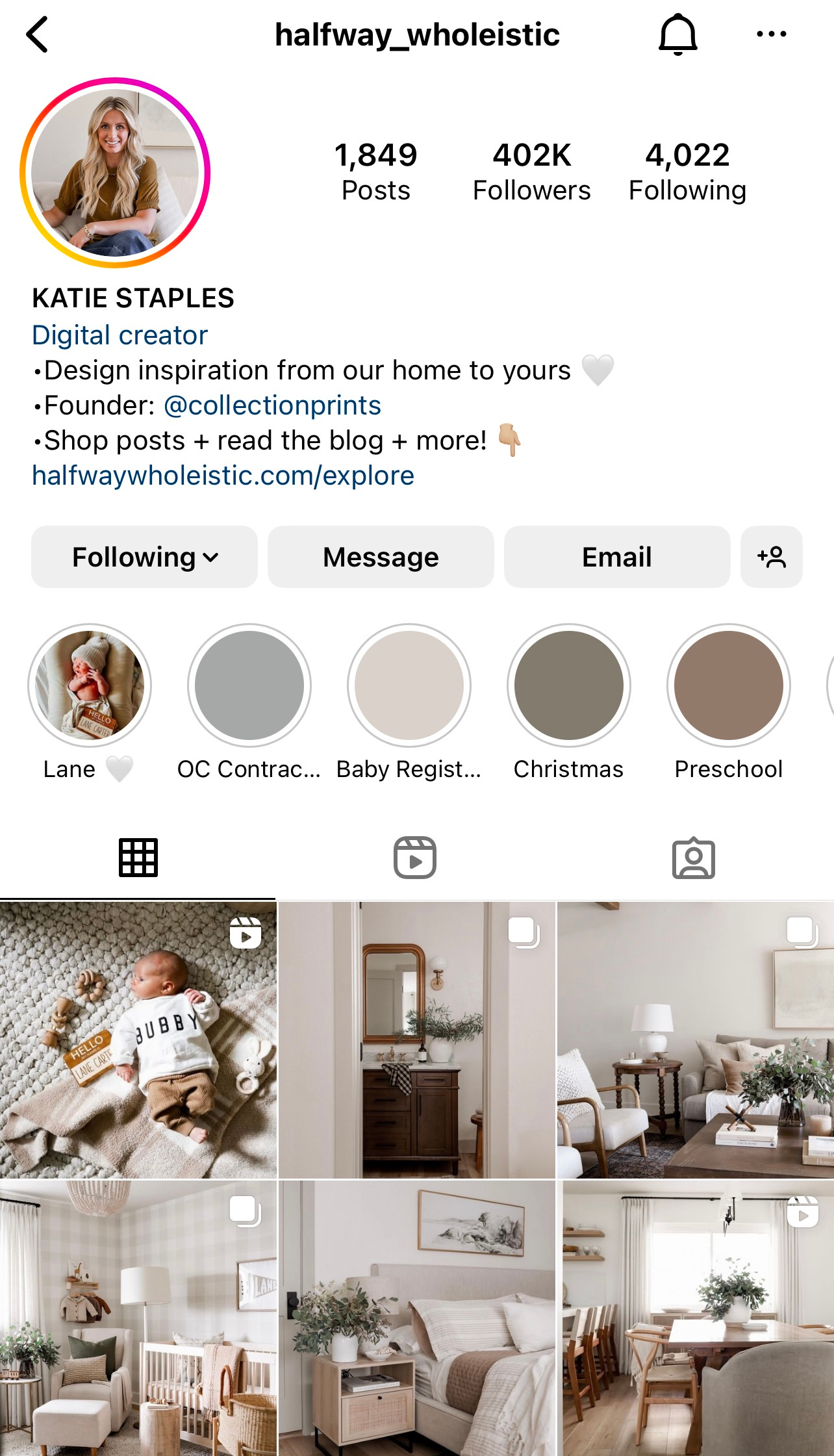

What are the 21st-century versions of Nordstrom and Macy’s and Kohl’s? In my view, people. Creators are the new retailers, aggregating brands through their social channels to offer curated recommendations. I recently furnished my apartment in New York. In the 1990s, I may have made a trip to Crate & Barrel to browse furniture. But in the 2020s, I instead follow home decor creators like Katie Staples on Instagram, browse their posts, and shop their links.

Yet there’s no infrastructure for this new form of creator commerce. Instead, we rely on a labyrinth of affiliate links, discount codes, and #sponsored hashtags. Incentives are misaligned, and neither brands nor creators come away happy.

This is where Flagship comes in, a new company launching this week.

At Index, we’re fortunate to be co-leading Flagship’s Seed round alongside Sequoia. In this piece, I’ll dig into Flagship’s product and the “why now” from both the brand side and the creator side. I’ve written many times about rising CACs for brands and the evolution of influencer marketing. Flagship builds on many of these same tailwinds, ushering in a new era of discovery-driven shopping and digitally-native small business creation. Anyone can launch and manage their own boutique.

In this piece, I’ll cover:

Overview: Flagship Boutiques & Creator Commerce

The Brand Side: How to Combat CAC Headwinds

The Creator Side: How to Maximize Your Influence

The Opportunity

The goal here: examine why no one has solved social commerce in the West, and explore why this might be the right moment to reinvent how we shop.

Let’s dive in.

Overview: Flagship Boutiques & Creator Commerce

What do retailers do? They aggregate brands and facilitate discovery. Last century, they did so using geography. Sears was convenient because the department store brought together thousands of products under one roof. I could buy a washing machine, a pair of shoes, and a set of Legos all in one shopping trip.

The best retailers also have an element of trust: Costco, for instance, has such limited selection (4,000 SKUs vs. 120,000 at Walmart) and such a carefully-preserved reputation for quality and price that I know what I’m buying is good stuff.

Online, we turn to people to aggregate brands, facilitate discovery, and provide trust. Most of this happens on social platforms like Instagram, TikTok, and Pinterest. People are arbiters of taste, and most of us have a few creators that we follow for product recommendations.

You can think of Flagship as the infrastructure powering creator-curated stores. Here’s how Flagship describes itself on its website:

Turn your community into a thriving business with a Flagship boutique.

Focus on what you do best: curating for your audience. We do the rest—for free.

Under the hood, Flagship is a marketplace between brands and creator merchants. Creators curate brands they love in their own online store. When people shop their boutique, the creator earns a percentage of every sale (Flagship also takes a share).

Here’s a sample store, Wrel Living from Alicia Lund and Samantha Wennerstrom:

The team behind Flagship—Youssef, Khalil, and Juhana—previously built creator and commerce products at Instagram, YouTube, and Yelp. They understand the interplay between creators and brands deeply, and they’ve seen firsthand how broken the system is. When we met the three of them last year, they shared this graphic of Flagship’s business model:

The elegance here is that everyone wins. Brands love Flagship because it solves their CAC problem, offering a new channel for customers to discover their products. Creators love Flagship because they get to be merchants while not worrying about the hassles of inventory and fulfillment, and because they earn income in a more self-directed, transparent, entrepreneurial way. Shoppers love Flagship because they get to discover new products from people they trust, all delivered in a frictionless checkout experience.

Let’s dig into the brand and creator sides of the marketplace in more detail, starting with brands.

The Brand Side: How to Combat CAC Headwinds

During the 2010s boom in direct-to-consumer brands, a popular saying became “CAC is the new rent.” Rather than acquiring customers with geography (“Oh, what’s that new store over there? Let me check it out!”), DTC brands relied on direct response ads.

Direct response advertising is a type of digital advertising designed to elicit an immediate response, such as clicking on a sponsored link. Take an example: say I search Google for Ruggable rugs. The first result is an ad placement for Rugs USA, a direct competitor to Ruggable in the “washable rugs” category.

This is an example of Search Engine Marketing (SEM), where Rugs USA is paying Google for clicks. To secure the coveted top result, advertisers had to bid on keywords; the auction’s winner was Rugs USA, which got the top slot. Ruggable, for what it’s worth, comes up second in my search. Other ads for Rugs.com and BoutiqueRugs.com follow, before the first organic search result in the fifth slot.

Most estimates have direct response comprising about 80% of all digital ad dollars spent online. Facebook, Instagram, Snap, YouTube, and now TikTok have followed a predictable migration from brand advertising to direct response. Direct response powered the direct-to-consumer brand explosion of the past decade.

But brands are now facing rising customer acquisition costs. Part of this is simple supply and demand: even digital real estate is finite, and there’s only so much space on Google, Meta, and Amazon. Those three companies form a triopoly in online advertising, vacuuming up 65% of the U.S. market (26.4% for Google, 24.1% for Meta, and 14.6% for Amazon). Things are getting crowded.

Apple’s App Tracking Transparency (ATT) changes, meanwhile, dealt another blow. ATT is Apple’s opt-in privacy framework that requires all iOS apps to ask users for permission to share their data. Spoiler alert: many people do not opt in. Meta estimates that it will lose $10 billion in ad sales revenue (about 8% of its annual revenue) because of ATT. When the company announced that, the stock plummeted 26%—$230 billion of market cap wiped out in one day.

Public DTC brands have seen their stocks crater over the past year. Here are the performances over the past 12 months for Warby Parker, Allbirds, BarkBox, Honest Company, and Stitch Fix:

The old playbook—spin up Facebook Ads Manager, sprinkle in some SEO and SEM—doesn’t cut it anymore. (Some brands, for what it’s worth, have gone back to old-fashioned rent for customer discovery: Warby Parker and The Honest Company now get 50%+ of revenue from physical retail locations.)

So brands find themselves in a uniquely vulnerable moment. How can they efficiently and scalably acquire new customers?

Flagship steps in as the solution. Flagship enables creators to be the next-generation sales channels for brands, in a transparent and privacy-forward way. Brands care about a few things:

They only want to pay when they’ve acquired a new customer and done so profitably;

They want to control who can sell / promote their brand and where; and

They want the ability to measure what’s working and know what’s worth doubling down on.

Flagship gives them all three. Brands select which creators can sell their products, and agree to a revenue split. Then they only pay when the creator drives sales.

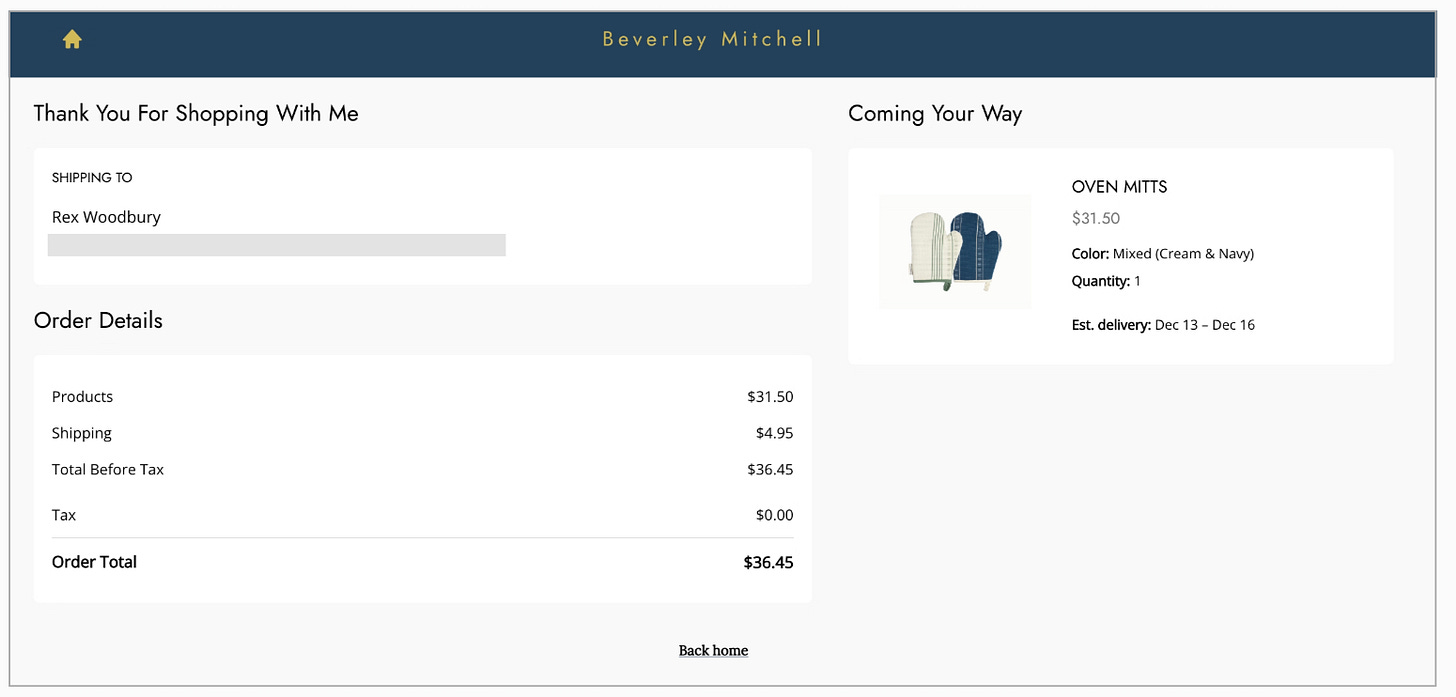

Here’s a pair of oven mitts I bought through Beverly Mitchell’s Flagship boutique.

Beverly doesn’t worry about managing inventory or fulfilling my order. The brand that makes the oven mitts, Caraway Home, receives the order in the same way that it would receive an order coming through its own website.

Caraway’s CAC is effectively the cut of sales that Beverly and Flagship take (it’s $0 if no one buys their product), while Beverly drives meaningful discovery to a new audience for the brand.

If you’re a brand and want to explore Flagship as a new channel, you can get in touch with them here 📬

The Creator Side: How to Maximize Your Influence

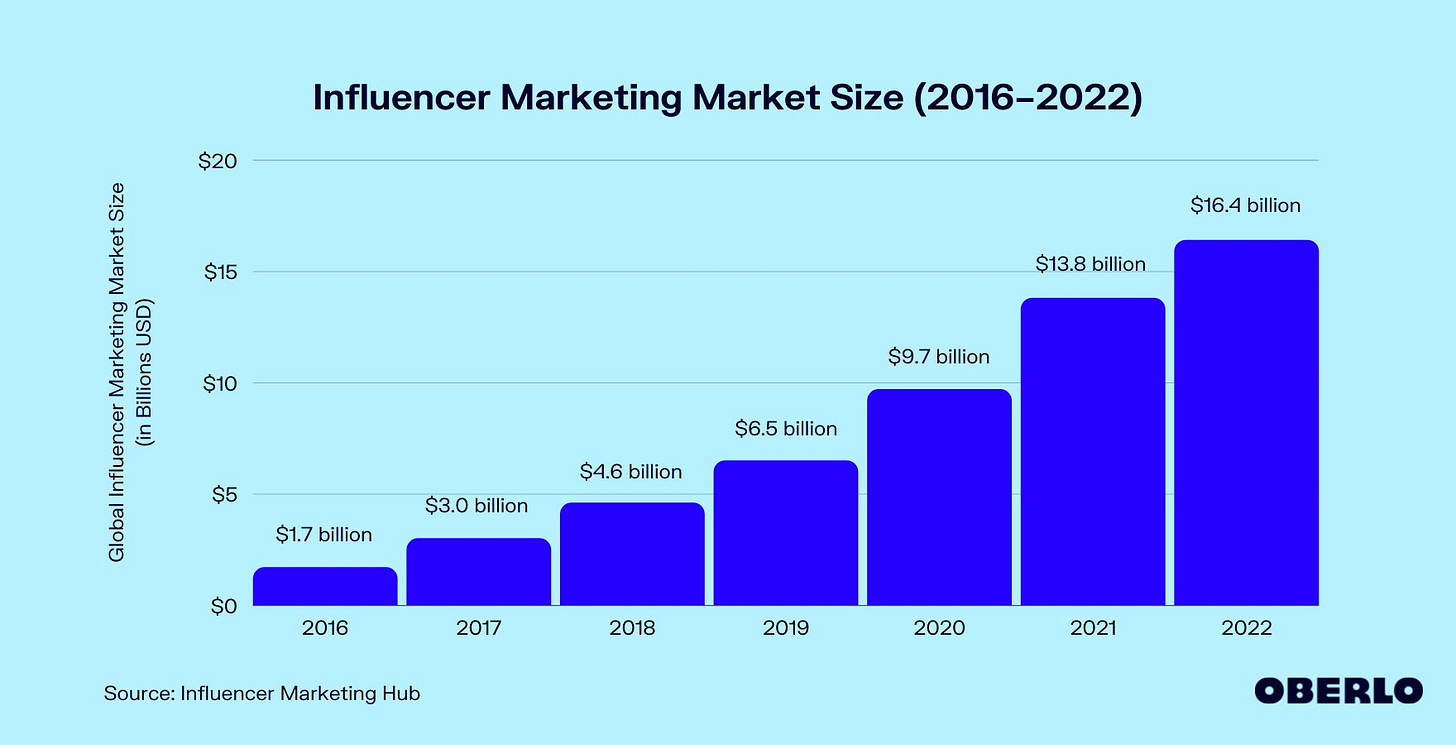

With direct response deteriorating, many brands have turned to an up-and-coming channel: influencer. The influencer marketing industry has swelled from $1.7 billion in 2016 to $16.4 billion in 2022 (a 46% CAGR).

But influencer marketing is broken. As I wrote in last May’s Influencer Marketing 2.0, most influencer campaigns rely on hefty upfront payments and use hacks like discount codes to track attribution. ROI is often poor, and measurement is even worse. The channel is difficult to scale efficiently.

From the creator perspective, influencer deals are clunky, unreliable, and tough to manage. Many are one-off. What’s more, in this macro environment, many sponsorships are drying up altogether.

Creators lack a sustainable business model around their work, and as a result, their income is volatile and capped. Yet these creators have influence: one estimate is that 80% of people have bought something after seeing a creator post about it. Many times, completed purchases aren’t properly attributed.

Creators need more authentic ways to capitalize on their influence, and that’s Flagship’s role. Flagship lets creators launch their own online storefront, becoming merchants of their own digital boutique. Think of the cute mom-and-pop shops on Main Street that aggregate eclectic products; Flagship boutiques are the online equivalent, in a scalable and low-entry-cost way (no lease required). If you’re good at curating things and can cultivate a community who trusts you, you’ve got a promising business on your hands.

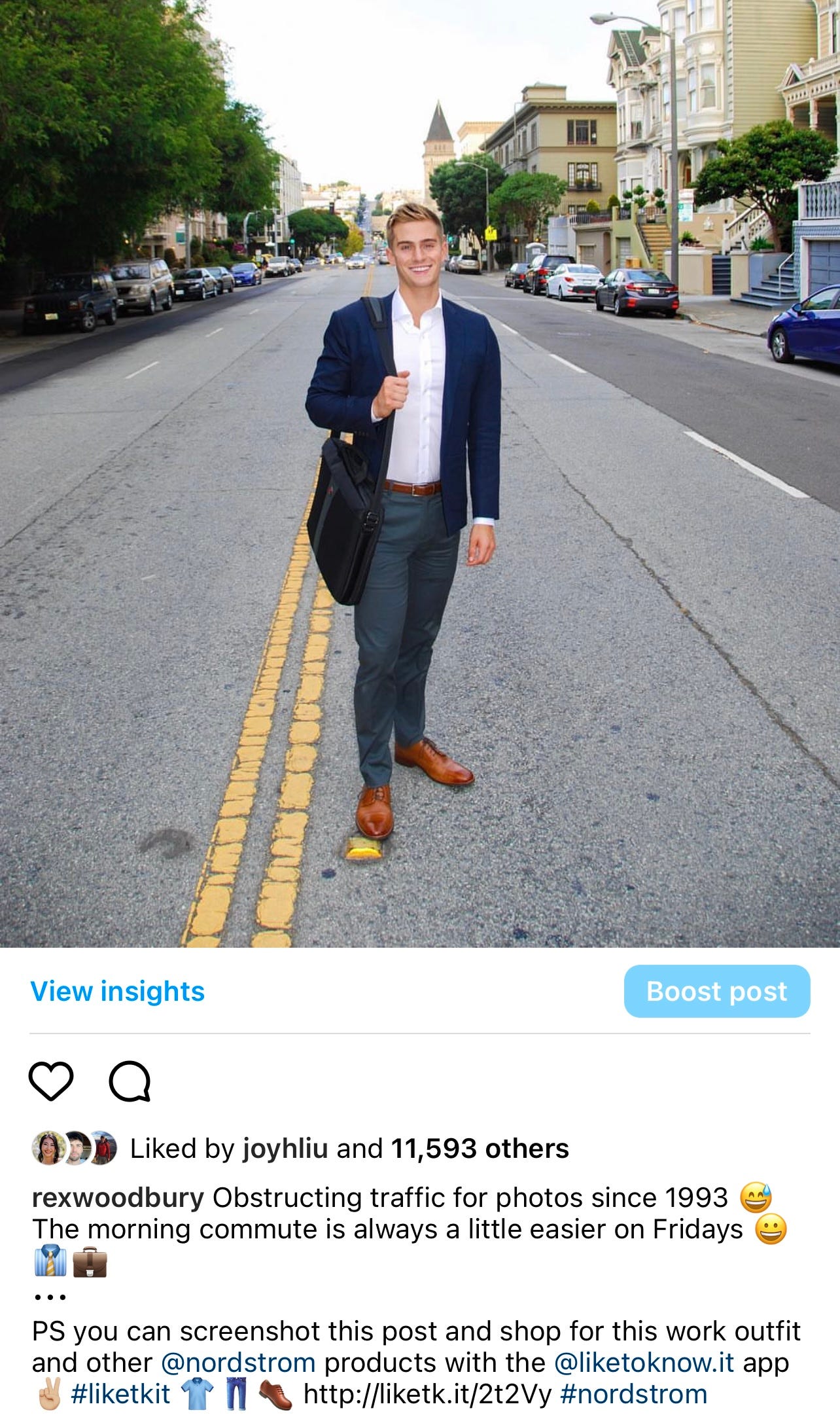

In this way, Flagship reinvents affiliate commerce. In a past life, I posted sponsored content for LTK, formerly known as LIKEtoKNOW.it. This was the early days of the “influencer economy,” and LTK was best known for letting you screenshot Instagram posts and then shop your screenshots within the LTK app. Here’s a cringeworthy image of a younger me promoting LTK and Nordstrom—and for some reason standing in the middle of the street while doing so 🤔

LTK has built a big business on affiliate—150K influencers, 5K retailers, 1M brands, and north of $3B in GMV as of 2021. Most of the action now takes place in the LTK app, where users can follow creators and shop their content.

But this is just scratching the surface of the opportunity in social commerce, for a number of reasons:

Affiliate remains opaque—creators don’t know what % of sales they’re getting, and brands don’t always know how much they’re giving up. Creators also don’t have visibility into who is buying or their “business metrics.”

Existing players focus on a subset of commerce; LTK, for instance, is 95%+ female creators selling apparel.

Consumers still experience friction (e.g., downloading a standalone app) rather than having a natural shopping experience while on social platforms.

Building on that point, inventory often isn’t synced, links are broken, or the checkout experience happens elsewhere.

Creators can’t themselves be business owners.

It’s telling that I felt embarrassed to share the sponsored photo above—#spon and #ad have become memes, making “influencer” a bad word. Having your own storefront though, full of handpicked products from brands you love, is a much more organic and empowering thing. I’d be excited to launch a boutique, showcasing my beloved espresso maker, my favorite sweaters, some of the furniture I adore. If people browse my shop and discover products they too love, great—they benefit from finding something they love, and I benefit from making new income in a low-friction, organic way.

If you’re a creator interested in launching your own boutique, you can get in touch with Flagship here 📬

The Opportunity

When people in the tech community talk about social commerce, they often point to China. There, we see companies emerge that meld social and commerce from the start. Pinduoduo is the most prominent example.

In the West, my view has always been that social comes first and commerce can then be layered on. Yes, Whatnot has been able to build a big business in livestream shopping, but many of the startups that have approached social and commerce simultaneously have struggled to get meaningful traction. The big social platforms are so big and so dominant that it’s difficult to wrestle attention away from them.

But leaning into the big social platforms creates a compelling opportunity for commerce. People are already discovering products on social networks and content platforms; there just hasn’t been the right infrastructure to align incentives and make the shopping experience seamless. That’s Flagship’s goal.

The best Flagship boutiques blend commerce with the creator’s personality and life—you can see that in Heather’s store Daughters and Things, featuring photos of her kids:

Flagship’s vision is to make creators the next-generation retailers. A home decor creator might be the next West Elm. A sports enthusiast might be the next Dick’s Sporting Goods. A beauty aficionado might be the next Sephora.

E-commerce is a massive market growing quickly:

“Social commerce” is a small fraction of that, but should have a much larger share.

People are also becoming more entrepreneurial. Americans submitted 5.4 million new business applications in 2021, an all-time high. Part of this is a pandemic boost, as COVID forced us to rethink the kinds of careers that we can and should have. But part of this is also a generational shift. As I wrote in last week’s Conversations with Gen Z, Gen Z is a uniquely entrepreneurial generation: 62% of Gen Zs say that they want to start their own business. Younger people value the flexibility, autonomy, and economic upside of having their own thing.

That’s the opportunity that Youssef, Khalil, and Juhana are going after with Flagship. Flagship should underpin a new economy of entrepreneurs—merchants who manage, run, and grow their own boutiques.

Final Thoughts

At its simplest, commerce is defined as the exchange of goods and services for some form of currency. One of the earliest recorded forms of commerce was cattle trade, around 10,000 B.C. Cattle had a fixed value and were exchanged for goods and services 🐮 The Latin word for money, pecunia, comes from pecus, which is the Latin word for cattle.

We’ve come a long way from trading cows. Commerce is now a $26 trillion global market (e-commerce, as shown above, is about 20% of that). But there’s still plenty of room for innovation.

This is a unique moment in time:

Rising CACs are pressuring brands to look for new ways to find customers.

The current state of influencer marketing—a channel already used by 93% of brands—is ultimately untenable. Brands need more scalable, efficient solutions.

Creators, on the other side of things, need more sustainable ways to earn a living. They have influence (80% of people trust them to recommend products), but they haven’t been able to effectively capitalize on that influence.

And people want to be entrepreneurs. Some of the biggest companies enable new ecosystems of business creation (YouTube, Amazon, Shopify), and there’s an opportunity to do the same in creator commerce.

One more tailwind: a fundamental shift of influence and trust towards individuals. Americans have lost trust for institutions like the U.S. government and The New York Times; more recently, Americans have lost trust in big corporations.

We instead place our faith and admiration in individuals, with the internet enabling an economy of niche influencers determined by ever-refined, algorithmically-sculpted tastes and preferences. My colleague Damir frames this well: “In the West, consumers have a relationship with creators moreso than with brands. We want to wear the shoes that Jordan wore and have the bag that Kim carries.” Power is shifting to the people. We—and all of Index—see Flagship as the infrastructure for this new paradigm.

Millions of people are tastemakers, curators, and creators; millions of people have nurtured vibrant communities. Flagship gives them a new way to launch their own store and earn a living from that influence.

Get in touch with Flagship:

If you’re a brand or creator, you can get in touch with the Flagship team here 📬

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week:

![How Many New Businesses Start Each Year? [Updated Dec 2022] How Many New Businesses Start Each Year? [Updated Dec 2022]](https://substackcdn.com/image/fetch/$s_!1tNk!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fb530373f-5fb4-48d9-904e-df1a5fcec77a_1760x900.jpeg)