How People in the Philippines Are Making Money in the Metaverse

Yield Guild Games & Why Everyone Is Now An Investor

This is a weekly newsletter about how people and technology intersect. To receive this newsletter in your inbox each week, subscribe here:

The Settlers of the Metaverse

During the pandemic last spring, unemployment in the Philippines hit 40%. For reference, U.S. unemployment peaked at around 25% during the Great Depression. As it became harder for many Filipinos to put food on the table, thousands turned to blockchain-based online games as a way to make money.

It started with Axie Infinity, a popular blockchain-based game full of digital cartoonish creatures called Axies. Axie Infinity is what’s called a “play-to-earn” game: if you win battles with your Axie, you earn an in-game resource called Small Love Potion. You can exchange Small Love Potion, or SLP, for the cryptocurrency ETH and eventually convert it into real-world dollars.

This concept—earning money by playing online games with cartoon creatures—may seem silly, but it can be a real source of income.

Howard is a Filipino who lives in Cabanatuan City, about 68 miles north of Manila. When the pandemic hit, he was forced to stay home and found himself out of work. Howard started playing Axie and earning about $300 per month. For reference, minimum wage in the Philippines is about $170 per month.

There are now over 100 people in Howard’s local community earning a living playing Axie, including a 66-year-old grandmother.

Play-to-earn games have been life-changing for members of the community. One 75-year-old man plays from 4am to 10pm and says, “This is my only entertainment.” His wife adds, “We’re praying to the Lord that Axie doesn’t go away. It’s how we pay for our medicine.” During the pandemic, playing Axie became a viable source of income in many developing countries: players in the Philippines comprise about 30% of global Axie players; Indonesia comes in second with 15% global share.

What’s fascinating about play-to-earn games is how they foreshadow future labor structures—structures that will become more common in an increasingly-digital, borderless economy.

A problem with Axie Infinity is that it can be cost-prohibitive to get started. An Axie costs about $100 today, and you need three Axies to play the game—that’s $300 in upfront cost, or over a month’s wages for many Filipinos. Yield Guild Games (YGG) emerged to solve this problem.

Here’s roughly how YGG works:

YGG buys up game assets across various online games, including Axies. Then YGG leases those assets to players so that players can start playing the game and making money. Many players find out about YGG through community managers, who recruit new players and take a share of earnings. The economics break down like this:

Players get to keep 70% of the money they make in the game.

Community managers keep 20%.

Yield Guild takes 10%.

Howard, the player mentioned above, was recruited by a community manager and is happy with the arrangement. Hearing him speak about it, it sounds like any good job: “My bosses in Axie University aren’t as strict as other bosses. They help me build my confidence and teach me leadership.”

In its December launch announcement, YGG described its “scholarship” model:

Currently, we are in the alpha stage of our automated “scholarship program”, leasing out Axies to players who want to get started playing Axie Infinity. YGG recruits existing members of the community as our “scholarship managers”, who recruit and train our Axie “scholars” or players that are leasing Axies from the guild. Each manager recruits players from their respective sub-communities, trains them in how to win games in Axie Infinity, and starts them on the road of earning SLP for their families.

Yield Guild Games is a decentralized autonomous organization, or DAO—essentially a community-owned organization built on a shared set of blockchain-enforced rules. (For an overview of DAOs, check out Linda Xie’s piece here.) YGG’s vision is to allow anyone to earn income through play-to-earn games across the metaverse.

YGG’s founder, Gabby Dizon, emphasizes that players and community managers aren’t employees of the Guild—they’re entrepreneurs. YGG scholars have now earned six million Small Love Potion, two million in April alone. YGG’s Discord server has 11,780 members.

More recently, YGG has added more blockchain-based games. The Guild owns virtual real estate in The Sandbox and in League of Kingdoms, leasing that land to players. The latest addition is Star Atlas, a space exploration strategy game. Star Atlas’ co-founder says: “Yield Guild Games will provide access to burgeoning gaming communities based in the Philippines and throughout Asia, while Star Atlas will build the metaverse in which Yield Guild Games guild members earn yield.”

Gabby Dizon likens his organization to “settling the metaverse.” Just as settlers explored the American frontier in the 1700s and Singapore in the 1950s, gamers are settling digital worlds.

Play-to-earn games started because games need player liquidity—games aren’t fun if no one else is playing, so the ability to earn income lures enough players to kickstart things. But over time, players take on new jobs. YGG is seeing people get paid to be digital fashion designers for avatars or architects for virtual buildings. Robust digital economies are forming.

What excites Dizon is the opportunity for labor to be as free flowing as capital. Since the world began to globalize, capital has moved easily across borders. This has enriched the investor class—the wealthy elites who own equity. But salaried workers lower on the totem pole haven’t shared in the growing pie.

With an open metaverse, labor is borderless: workers can make money from anywhere—all they need is a smartphone and an internet connection. Play-to-earn games reward players who have time and who have skill, rather than players who have money. This creates a more equal and meritocratic digital economy.

Dizon says, “The fact that we can offer the ability to think like an investor to anyone in the world is so empowering. It’s a different mentality. This is accessible to anyone.”

Everyone Is An Investor

The first era of the web about was about how we interact with information. Google “won” this era. The second era was about how we interact with each other, giving us Facebook. Web3 is about how we interact with value.

This era will redefine how we create and capture economics online. An early proof-point of the shift to Web3 ethos is everyone becoming an investor.

We see this clearly in recent events. Robinhood added over 1 million accounts during the GameStop mania. The r/WallStreetBets subreddit that ignited that mania has over 10 million members. Elon Musk loyalists have driven Dogecoin—a literal meme currency—up 26,000% in the last six months. And 21 million U.S. adults—about 14% of the population—own cryptocurrencies like Bitcoin or Ethereum. It’s easier than ever (and more desired than ever) to be an investor.

New platforms make being an investor accessible. We see this in Yield Guild Games, which turns gamers into investors, and we see it in other blockchain-related startups.

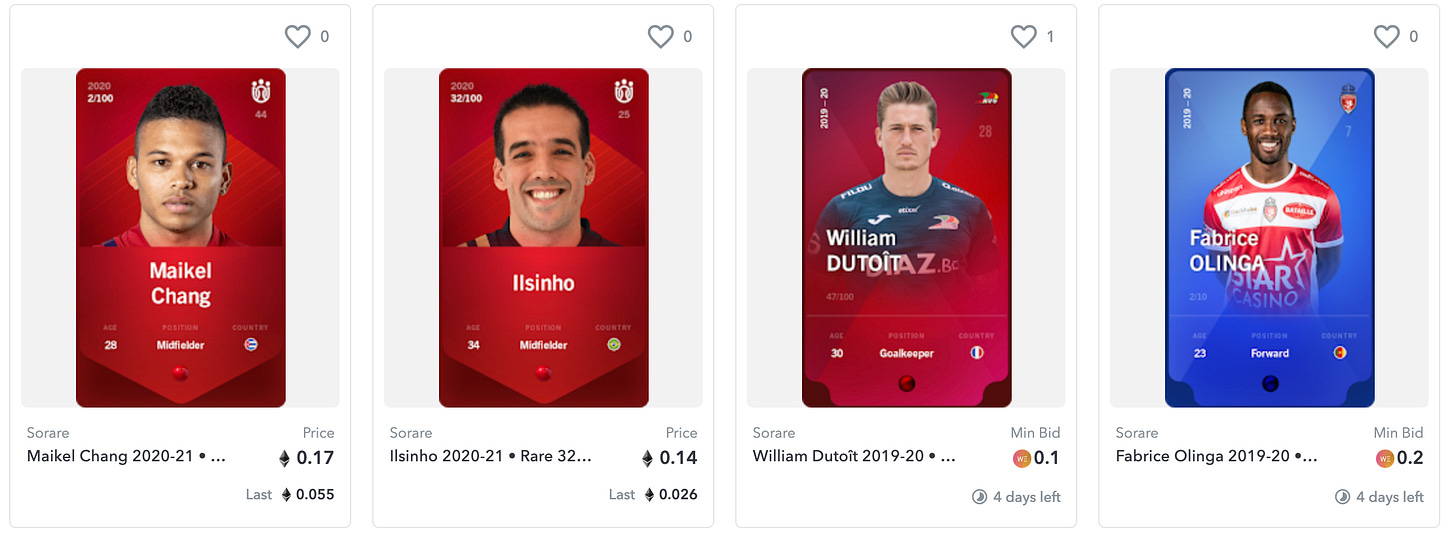

Sorare is a fantasy football (soccer) game built on non-fungible tokens (NFTs). NFTs offer provable scarcity so that there are only a set number of player cards. Sorare offers three tiers: Rare (100 per season), Super Rare (10 per season), and Unique (1 per season).

Sorare players buy cards to perform well in the game, but they also buy cards as an investment: cards can be resold on marketplaces like OpenSea for a profit.

If playing FIFA means just playing a game, playing Sorare means playing a game and being an investor.

Another example is Mirror, a decentralized crypto-based publishing platform that’s reinventing writing. Mirror lets people support writers financially and earn equity upside from that support. For example, one author recently raised $88K to write a novel. She’s using that money to take time off her job to write the book; people who supported her by buying the $NOVEL token will share in the profits of her book.

In her words:

Usually, novelists go to great lengths to fund their own novel-writing process by working other gigs, selling commercial writing, or – in significantly fewer cases – getting an advance from a publishing company. All of these methods have drawbacks, in the forms of limited time or limited creative freedom for the author. On top of that, the process of creating these works of art goes on behind a veil of secrecy, away from the community that will ultimately enjoy the final product. As an author and publisher, I’d like to change all that. This crowdfund will take us one step closer to a better future for writers and readers everywhere.

Top $NOVEL token holders get perks like early access to her manuscript and 1-on-1 sessions for writing tips. This economic model is built for creators.

What if you could not only subscribe to my Digital Native blog, but invest in it? You could support me—maybe I’d use the money to take a month off of work to write a long-form piece—and then you’d share in future income if I ever earn money from this blog. As Jarrod Dicker puts it, why subscribe when you can invest?

Mirror also allows cited works to earn income in perpetuity. If you write a really good piece, you’ll get paid every time someone cites you. This concept could revolutionize writing’s economics. Think of academics who rely on number of citations—what if those citations each held economic value, in addition to intellectual or social value?

Across all forms of creation and consumption, people are thinking like investors and reaping economic upsides as a result. This isn’t limited to crypto. Every aspect of life is being “financialized”. Kalshi, for example, is a platform that lets you bet on real-life events. Will Biden win the election? Will jobless claims reported this week be over 900,000? Will Nomadland win Best Picture? Any specialized knowledge or insight can be capitalized on economically.

The defining shift of our generation is the shift to creating and capturing value. This shift is both technological and cultural, each building on and reinforcing the other. What used to be purely exchanges of cultural capital are now also exchanges of economic value.

Final Thoughts

With new technologies—first, the internet and now, blockchain—there’s no reason that economic classes should be stratified into the investing class and the salaried class. Everyone is an investor. Anyone can trade stocks on Robinhood, buy and sell Axies on OpenSea, or claim an economic stake in someone’s work on Mirror.

We’ll invest in assets, both physical and digital, and even in people. Last fall, I wrote Creator IPOs, asking why I couldn’t own a share of Taylor Swift’s economics in return for being an early fan. This reality isn’t far off. Creative Juice, one of our investments at Index, lets creators invest in other creators through Juice Funds and earn a share of future earnings. Platforms like Roll, Rally, and Coinvise let people issue their own tokens.

This is leading to fascinating examples of investing in people. Reuben Bramanathan tokenized his time: 1 $CSNL token equaled 1 hour of Reuben’s time and was freely tradable. If you thought Reuben’s time would become more valuable as he became more successful, you could buy his token and resell it for a profit later. Alex Masmej created $ALEX token last year, raising $20K to fund his move from Paris to San Francisco. $ALEX holders will take 15% of Alex’s income for the next three years, capped at $100K. People who hold high numbers of $ALEX get access to Alex’s newsletter and can chat with him on Telegram.

In 10 years, instead of “following” people on Instagram or “subscribing” to people on YouTube, we’ll buy that person’s token. We’ll become economically invested in their success. Instead of social capital changing hands, real money will be exchanged.

And our actions and careers will be tied to equity upside. Why shouldn’t Uber’s drivers own more equity in the company? What if for every Uber ride, a driver got 1/1,000th of a share? This is what Fairmint is enabling—turning stakeholders into investors. Future companies and organizations and people will be “owned” by the community. The pie will grow and be split more equitably.

At this moment, people in the Philippines are earning 2x minimum wage by playing an online game. They’re an unlikely place to look to glimpse the future, but they embody a new digital economy—one that’s borderless and one in which labor flows as freely as capital. They think like investors and they share in the upside. They’re vanguards of the future of work, proof of what happens when technology unlocks access and reinvents outdated economic systems.

Sources & Additional Reading

Yield Guild Games Lets Players Earn From NFT Games | Venture Beat

The Token Economy | Shermin Voshmgir

The NFT Game That Makes Cents for Filipinos During COVID | Leah Callon-Butler, CoinDesk

NFT Gaming in the Philippines | This is a great 20-minute film, also by Leah Callon-Butler, that takes you into the world of Axies, Yield Guild, and the Philippines

Thanks for reading! Subscribe here to receive this newsletter in your inbox each week: