Index Perspectives: From Figma to Gaming to the Market Downturn

Reflecting on the Art of Venture in this Market

This is a weekly newsletter about how tech and culture intersect. To receive Digital Native in your inbox each week, subscribe here:

Hey Everyone 👋 ,

This week, the Index team is gathering in New York to spend time together as a team and to formally launch our NYC office. I’m going to take a break from a long-form original piece this week, and instead share five recent pieces from my colleagues—each is interesting and worth reading for unique reasons.

Below are the five pieces and a short commentary on each.

See you next week!

Rex

🎨 The Story of Figma

In September, Adobe announced that it had agreed to acquire Figma in a ~$20 billion transaction, the largest acquisition of a private tech business in history. My partner Danny Rimer met Dylan Field when Dylan was a 19-year-old intern at Flipboard, and later had the foresight to lead Dylan’s and Evan’s Seed round for Figma in 2013. Index is fortunate to be Figma’s largest shareholder.

Figma wasn’t obvious, and the product took years to built. In this piece, Danny writes about what he saw in Dylan and Evan, and the trends that Figma built on. One excerpt:

There are a few big trends that Figma has both contributed to and benefitted from. The first is the generational significance of design-thinking. In the 19th century, the most significant marker of authority was spoken eloquence: your skills in oratory were how you found an audience. In the 20th century, as literacy rates increased, arguably that power migrated to the written word. Now, in the 21st century, as we dwell in an increasingly digital realm, the best proxy for public credibility is intuitive, responsive design. Thanks to the app-ification of everyday life, we’ve developed an extraordinary civilizational sophistication in appreciating good design – and a marked intolerance for the bad.

The piece is worth reading in full, and here’s a great video interview between Danny and Dylan.

💡 How Startups Should Handle the Downturn

Many of today’s great entrepreneurs, operators, and investors have never experienced a downturn. We’ve been in a ~14-year bull market, and the 2022 crisis is only the third crisis of the Internet Era after the Dotcom Bubble and the Great Recession.

In this piece, my colleague Mike Volpi shares advice for how startups should handle the downturn. He writes:

Runway falls into one of three categories: a) two years or more; b) between one and two years; c) a year or less. The corresponding strategy for each would be: a) “stay aggressive,” b) “ruthlessly prioritize,” and lastly, c) “time to trim.”

Mike goes into more depth on how to manage effectively in this environment.

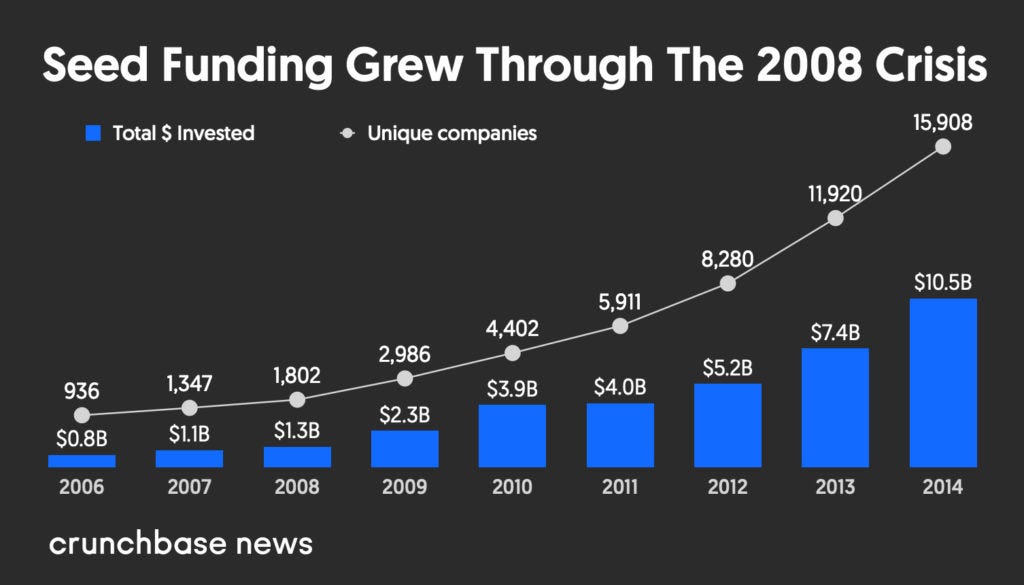

One note worth making: downturns often lead to a lot of startup creation. Seed funding actually increased throughout the financial crisis—

And as I wrote two weeks ago in The TikTokization of Everything, many iconic companies were built in the 2009 to 2013 period: on the consumer side, Instagram and Snap, Uber and Lyft, Robinhood and Coinbase; on the enterprise side, Slack and Figma, Stripe and Plaid, Snowflake and Databricks. The list goes on. The 2022 to 2025 period could be a seminal few years for seed investing and business creation.

🎮 10 Learnings from the Index Gaming Summit

With over three billion players globally, gaming is now the largest category in entertainment. The industry is set to be worth over $400 billion by 2028. I always like how this graphic from Visual Capitalist captures the sector’s swell over time:

Over the summer, we hosted the Index Gaming Summit—you can watch the footage here, including interviews with my colleagues Stephane, Damir, and Sofia, and with portfolio companies such as Roblox, Discord, Dream Games, Backbone, and Rec Room. The piece linked above summarizes 10 key takeaways, including:

The lines between social and gaming continue to blur.

Game developers are now in the business of hospitality. Jenova Chen of thatgamecompany calls users “guests” of a digital theme park, saying: “It’s a hospitality business really. You want players to have the best experience so they will come back with friends.”

Gaming is eating the world. As Rec Room’s Nick Fajt puts it: “What you see is gaming eating large parts of the consumer web: fashion, dating, events, concerts. These things are now moving into the gaming world in a way that was unthinkable 20 years ago.”

🐂 Vertical Software Wins in Bull & Bear Markets

In last week’s piece on B2B marketplaces, I wrote about adjacencies to vertical SaaS. Both pull an analog sector into the 21st century, digitizing workflows and payments. At Index, we’re lucky to be investors in vertical SaaS companies like ServiceTitan (home services), Shopmonkey (mechanics), Boulevard (salons and spas), Seso (agriculture), Built (construction), and Tekion (auto dealerships).

In this piece, my colleagues Nina and Paris write about why vertical software can thrive in both a bull market and a bear market. No matter the market conditions, for instance, every business has to adapt to the “Amazon effect”—customers have come to expect an Amazon-like ease of use for all facets of their life, whether booking a doctor appointment, fixing a car, or signing a child in for school.

Nina and Paris share the playbook for building an iconic vertical SaaS company, and a market map of private companies to watch:

⚡️ Harnessing Lightning in a Bottle

This is a profile of Danny written by Katie Prescott for The Times. What I like about it is how it captures the art of venture investing. As Danny puts it—

The best founders are “monomaniacal” and devote their lives to the mission of growing their business. “Our job is spotting someone trying to spark lightning in a bottle working out of their garage and we have to figure out whether they’re the right people to do this, that they have been placed on this Earth to go after this global ambition.” The relationship [Index] has with its founders is about support and “cold showers”, honest and difficult conversations.

Venture capitalists are, in many ways, glorified recruiters—

The investment decisions that Index makes are as much about context and contacts as business ideas. Rimer compares venture capitalists to “glorified recruiters” because “we are trying to find the most talented founders and then surround them with the best talent. We’re not the best operators, but we know the best operators and we know the personalities of the founders that we’re trying to help.”

And my favorite part:

Who, or what, is your mentor?

I was lucky enough to marry her. Need I remind you that spotting talent is key to my job?

I’ll be back next week with the usual long-form piece!

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: