It's Still 1995

It Might Feel Like You're Late to the Party, But the Party Is Just Getting Started

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 70,000+ weekly readers by subscribing here:

It’s Still 1995

It might feel like AI is deep into its adoption cycle, but we’re still very, very early.

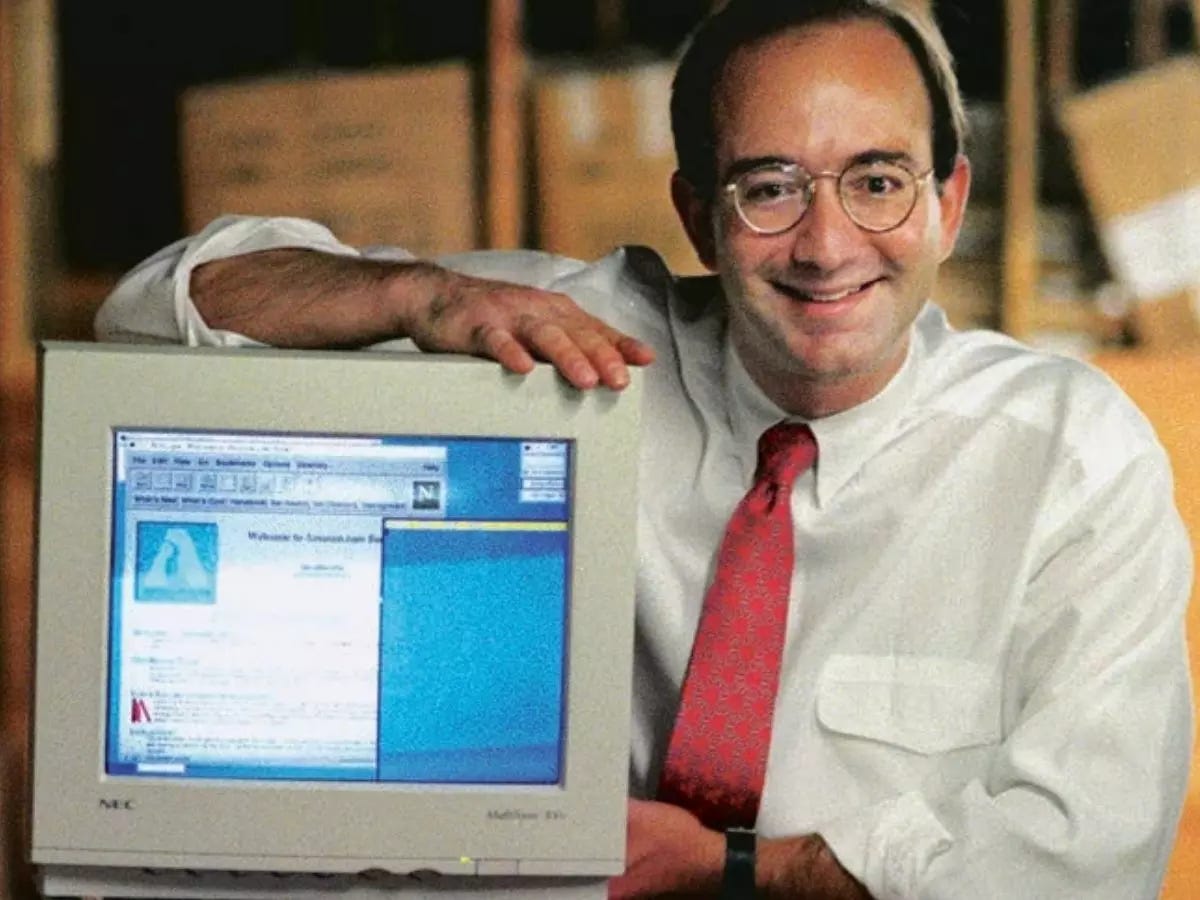

To use an internet analogy, it’s still 1995. That means that Jeff Bezos (metaphorically) still looks like this:

In 2014, the tech journalist Kevin Kelly wrote a piece called It’s Not Too Late. His core argument: “Right now, today, in 2014 is the best time to start something on the internet. There has never been a better time in the whole history of the world to invent something.”

In that piece, Kelly waxes poetic about how nice it would’ve been to be in tech back in 1985. Back then, he points out, you could buy virtually any domain. As late as 1994, a WIRED writer noticed that mcdonalds.com was unclaimed. The writer registered it, then went to McDonalds corporate—but they didn’t see the value in it. Oops. Around the same time, Kelly himself noticed abc.com was unregistered, so he delivered a presentation to ABC executives about why they should buy it. They declined.

Of course, corporate America is a lot savvier in 2025. Many companies were caught flat-footed by the internet, mobile, or cloud. Some by all three. They don’t plan to repeat their mistakes, and they’re diving headfirst into AI.

But when you zoom out, there’s still a lot of opportunity to seize. In that 2014 piece, Kelly wrote: “Looking back now it seems as if waves of settlers have since bulldozed and developed every possible venue, leaving only the most difficult and gnarly specks for today’s newcomers.” Since Kelly wrote those words, we’ve seen companies created that range from Revolut to Ramp, Anduril to Anthropic. And, of course, a company called OpenAI.

You could repeat Kelly’s words today: it does feel like settlers have bulldozed and developed every possible venue. We’re swimming in agents. Insert Oprah voice: “You get an agent, you get an agent, you get an agent!” There’s a lot of noise in tech right now. But ChatGPT only launched three years ago. We’re probably only in the first inning of a long and lucrative super-cycle. Maybe we’re top of the second.

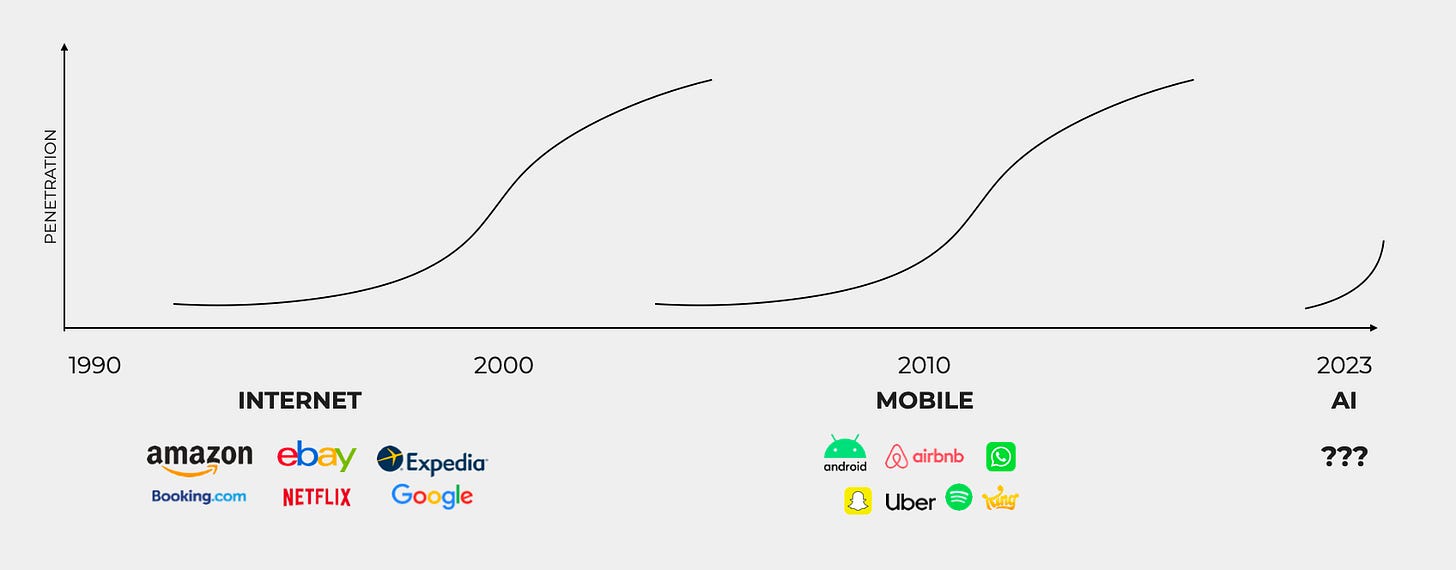

Here’s a visual from our Daybreak Fund I fundraising deck, showing why now is such a compelling moment:

The app layer is early, and 2025, 2026, and 2027 should be key vintages for applied AI. (Comparing to mobile: the period of 2009 to 2013 birthed companies like Uber, Lyft, Instagram, Snap, Robinhood, and Coinbase.)

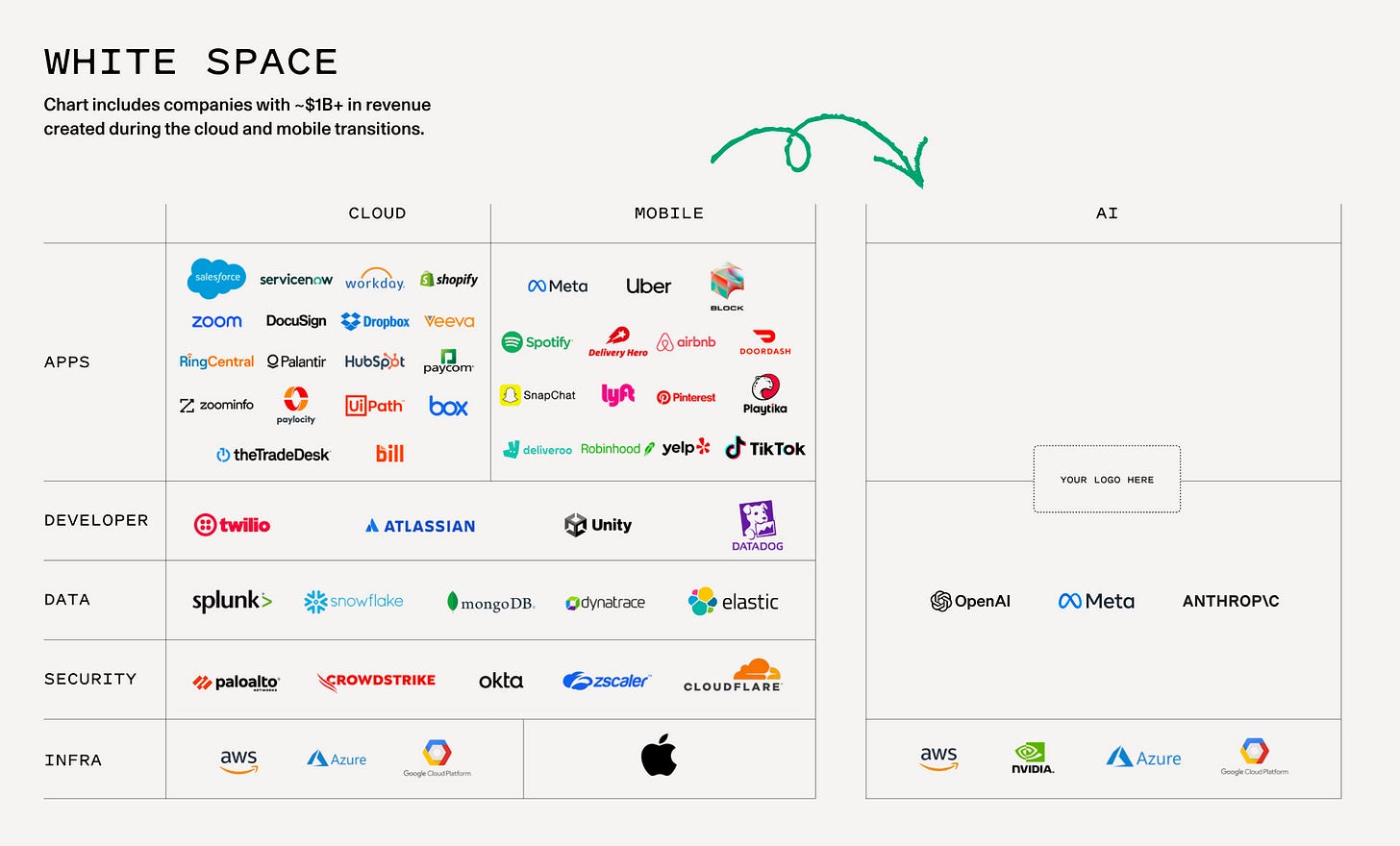

Sequoia did a good analysis that showed that each major tech shift tends to produce ~20 companies doing $1B+ in revenue. The cloud transition gave us roughly 20 companies doing $1B+; the mobile transition gave us another 20. So what will be the 20 companies borne from the AI revolution that do $1B+ in revenue?

The new entrants to the $1B+ revenue club will probably sit at the app layer. My favorite quote from Sonya’s and Pat’s great piece:

Imagine you want to start a business in AI. What layer of the stack do you target? Do you want to compete on infra? Good luck beating NVIDIA and the hyperscalers. Do you want to compete on the model? Good luck beating OpenAI and Mark Zuckerberg. Do you want to compete on apps? Good luck beating corporate IT and global systems integrators. Oh. Wait. That actually sounds pretty doable!

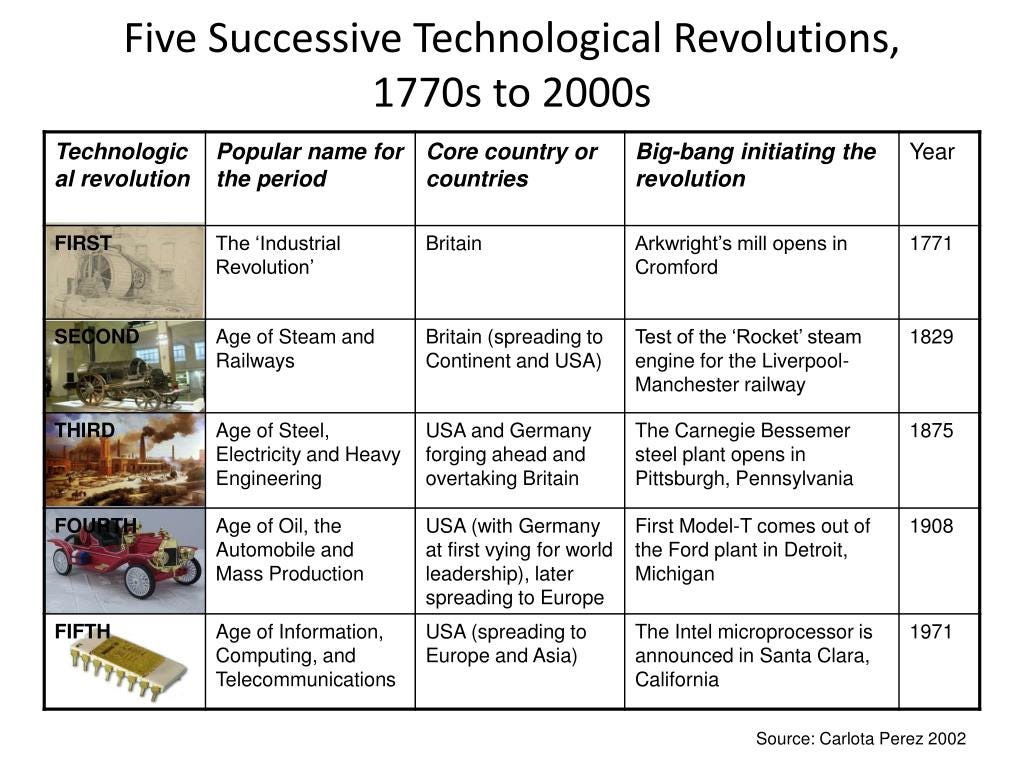

As one final datapoint: a couple years back we wrote a Digital Native piece called The Mobile Revolution vs. The AI Revolution, which referenced Carlota Perez’s research breaking technology revolutions into ~50-year cycles. Five examples:

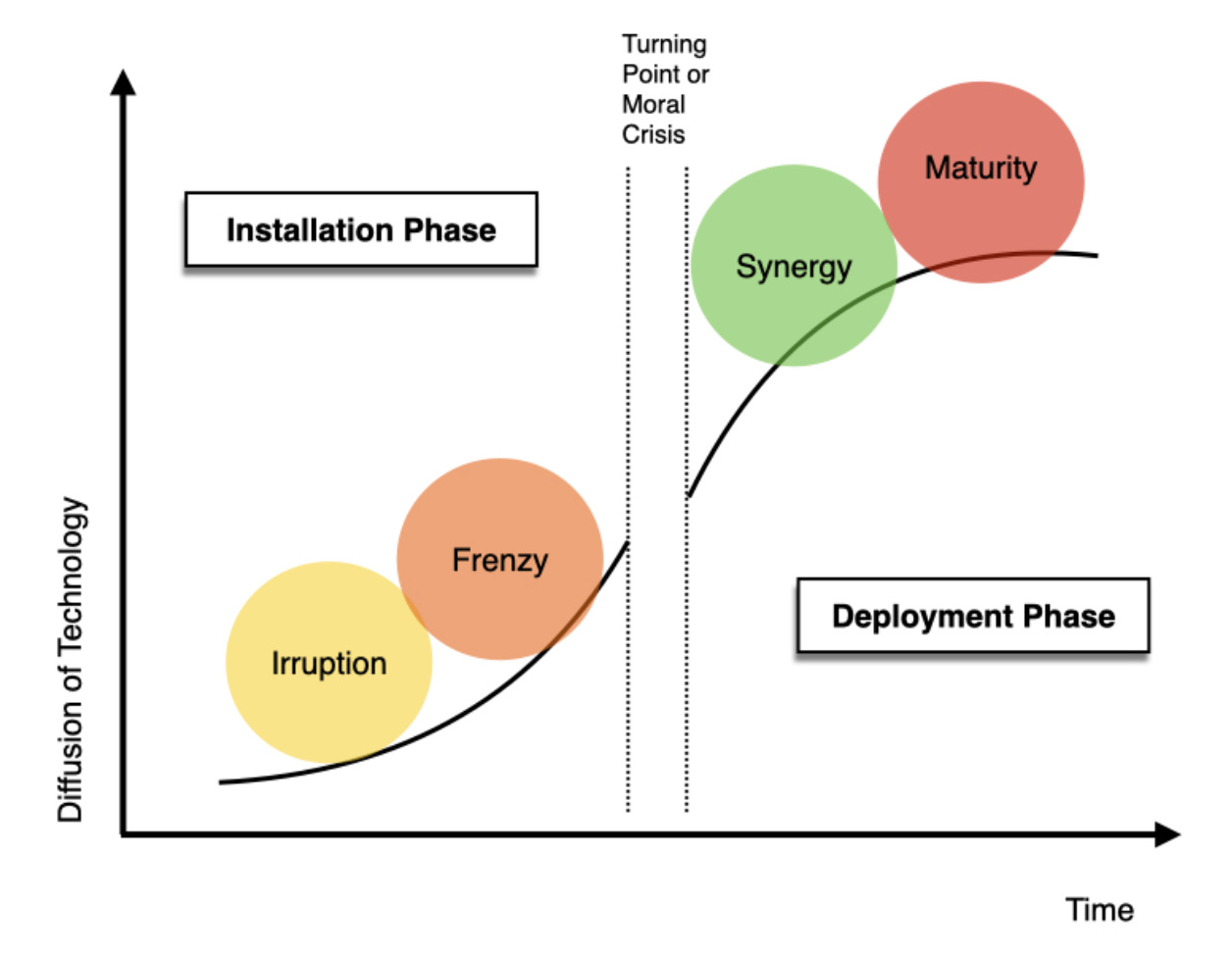

The first phase of each cycle, the Irruption Phase, typically lasts a decade. We’re probably still the Irruption Phase, though it feels like the Frenzy Phase:

I talk to a lot of people who want to get into tech. They see AI happening—the technology shift of our generation—and they want to be part of it. I recently posted a call on LinkedIn for bankers and consultants who are interested in startup roles, and it produced 748 responses! Some of our Daybreak companies are already hiring folks from the list. There’s clearly a Great Migration into tech happening, just as we saw in the dotcom boom, in mobile, and in cloud.

A lot of AI companies want high-slope talent eager to build. It might feel like you’re late to the party, but the party is still just getting started.

If you’re interested in joining a startup, here’s a Google Form to fill out—just input some details on your experience and what kind of company / role you’re looking for. I’ll share this with a handful of excellent founders.

Change Takes Time…

What are some analogies that illustrate how early we are? Five examples:

Example #1: Online Shopping

If you go back to the late 90s, with Amazon and Ebay beginning to dominate online commerce, you’d think that by 2025 we’d almost exclusively shop online. But e-commerce penetration is only 20%! A quarter-century after Amazon’s IPO, we still do four-fifths of our shopping offline.

Example #2: Cloud

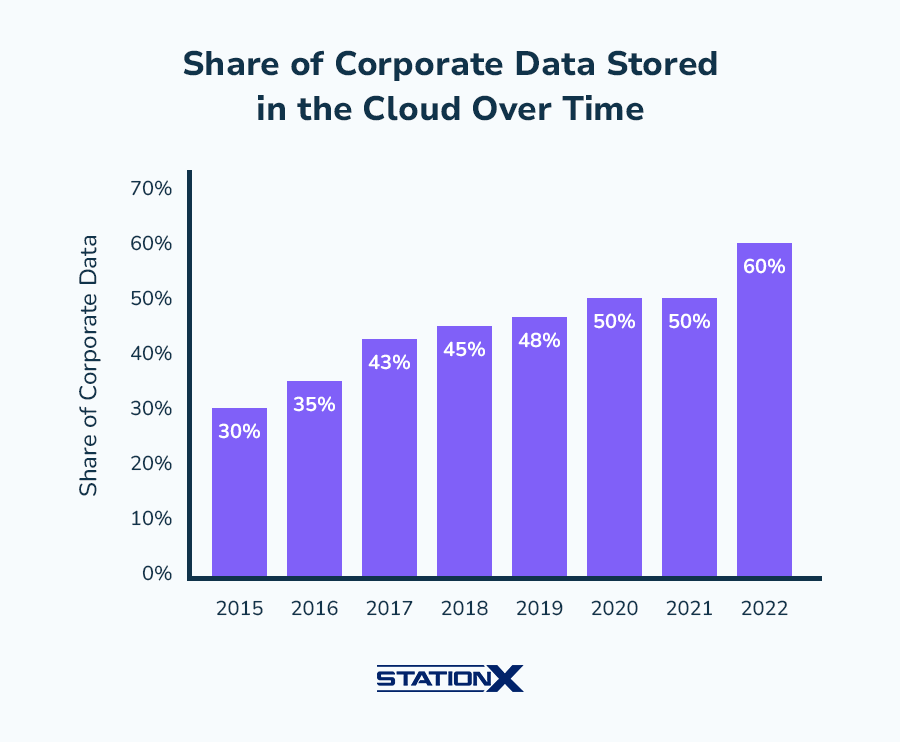

To take another example, only ~60% of corporate data is stored in the cloud:

Living and working in Silicon Valley, this sounds ludicrous: what kind of company wouldn’t store it’s data in the cloud?! It’s 2025, for crying out loud. But the answer to “what kind of company” is…40% of them.

Example #3: Cord-Cutting

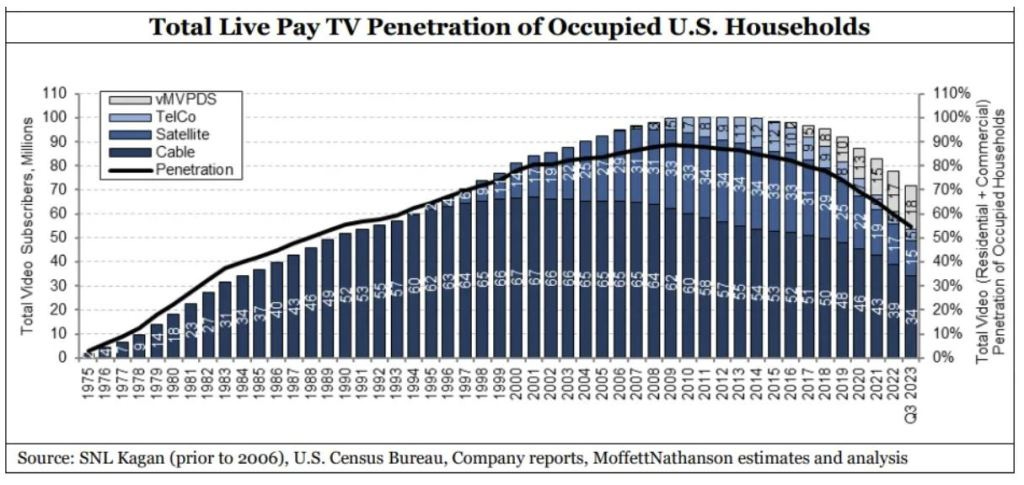

Or take cord-cutting. Streaming has steadily grown, sure, but ~50% of households still have cable—over a decade after the first Netflix original, House of Cards, hit our screens.

Example #4: Mobile Payments

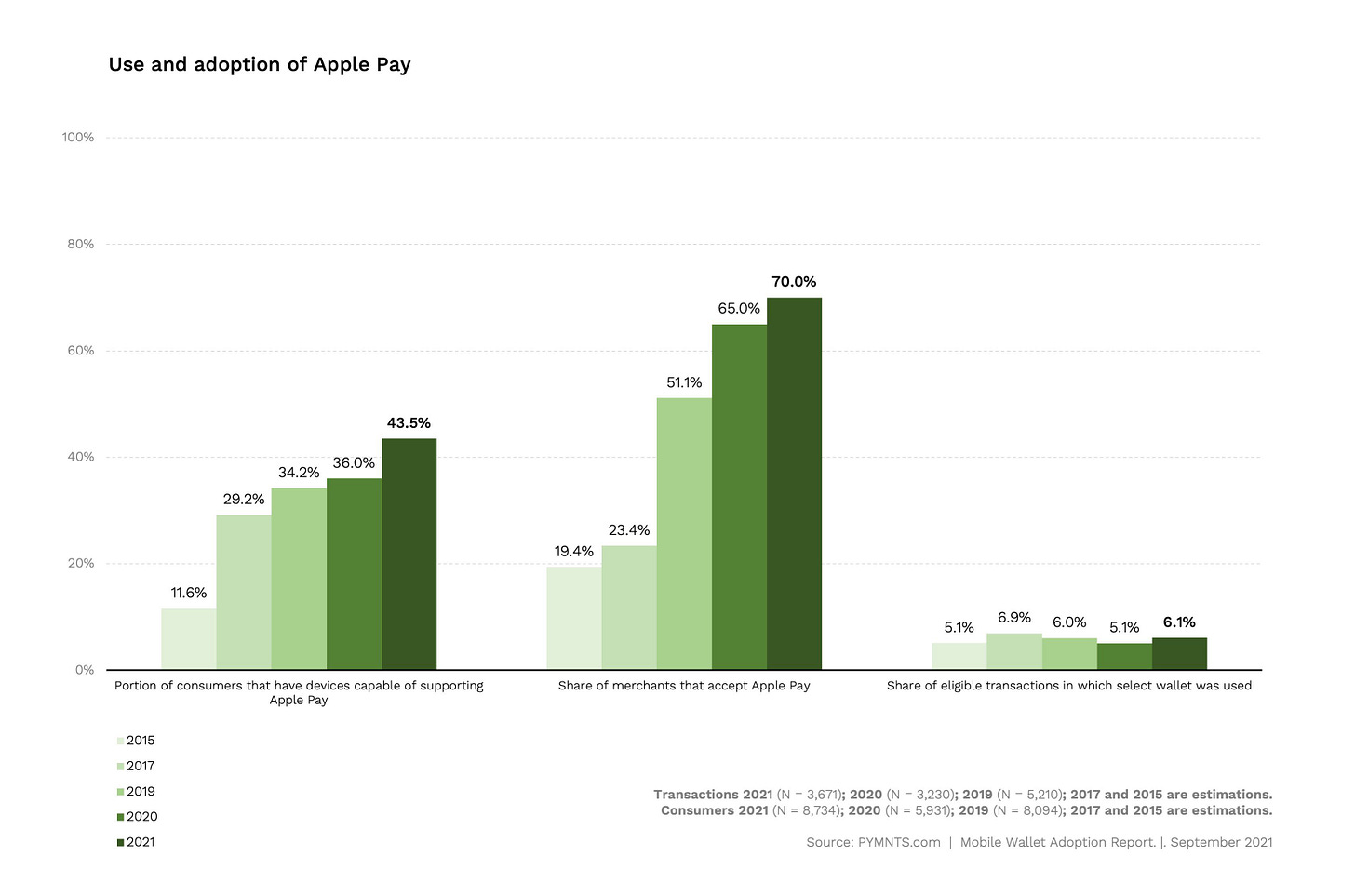

If you’re like me, you can’t remember life before Apple Pay. I don’t think I’ve seen my physical credit card in months. (Should probably look into that…) Yet only ~6% of eligible transactions use Apple Pay, over a decade after Apple Pay’s 2014 launch. In total, mobile payments hover around 15-20%.

Example #5: EVs

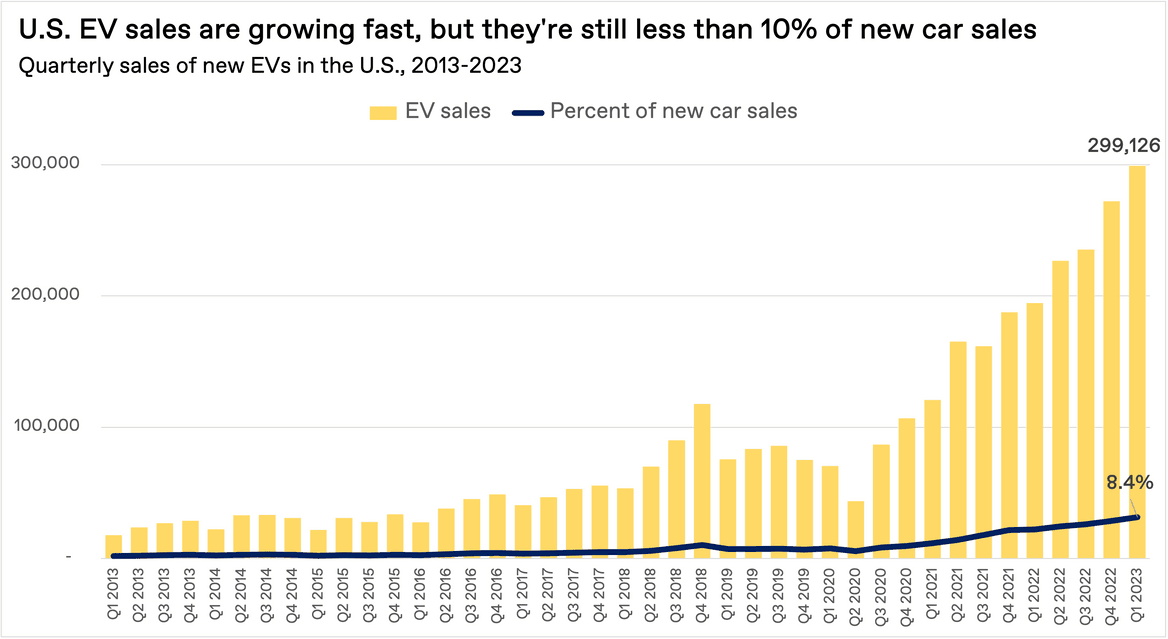

As a final example: electric vehicles only represent ~10% of new U.S. car sales:

The point is: change takes time. Adoption of new technologies takes a lot longer than you’d think. When it feels too late, it rarely is.

…But Change Can Also Be Fast

The five examples above show that change takes longer than we think. I stand by that: in 20 years, we’ll probably see similar charts of “agent penetration” still sitting at ~20%. But it’s also important to recognize how fast things are moving. This is important for two reasons:

Beware of cognitive biases.

Do things that don’t work today, but will soon.

To tackle the first, a dangerous bias in venture capital looks something like this:

“I passed on this company at $100M three months ago. Now they’re back in market at $500M? That’s insane! No way I’m paying that.”

The issue here is that human brains are wired for linear growth, not exponential growth. Exponential growth is so rare that we can’t wrap our minds around it. The $500M feels expensive because we’re anchoring on the $100M three months back. But we should be anchoring on the future: if the company is growing 50% month-over-month, that $500M might look cheap pretty soon.

To return to the Amazon and Bezos example: when Kevin Kelly wrote that 2014 article, Amazon stock was ~$14.90, about 199x the IPO price (when accounting for stock splits that have happened). Damn, seems like you missed the boat—right? Wrong. Amazon is up another 15x since then; $1,000 invested in 2014 would get you $15,000 today.

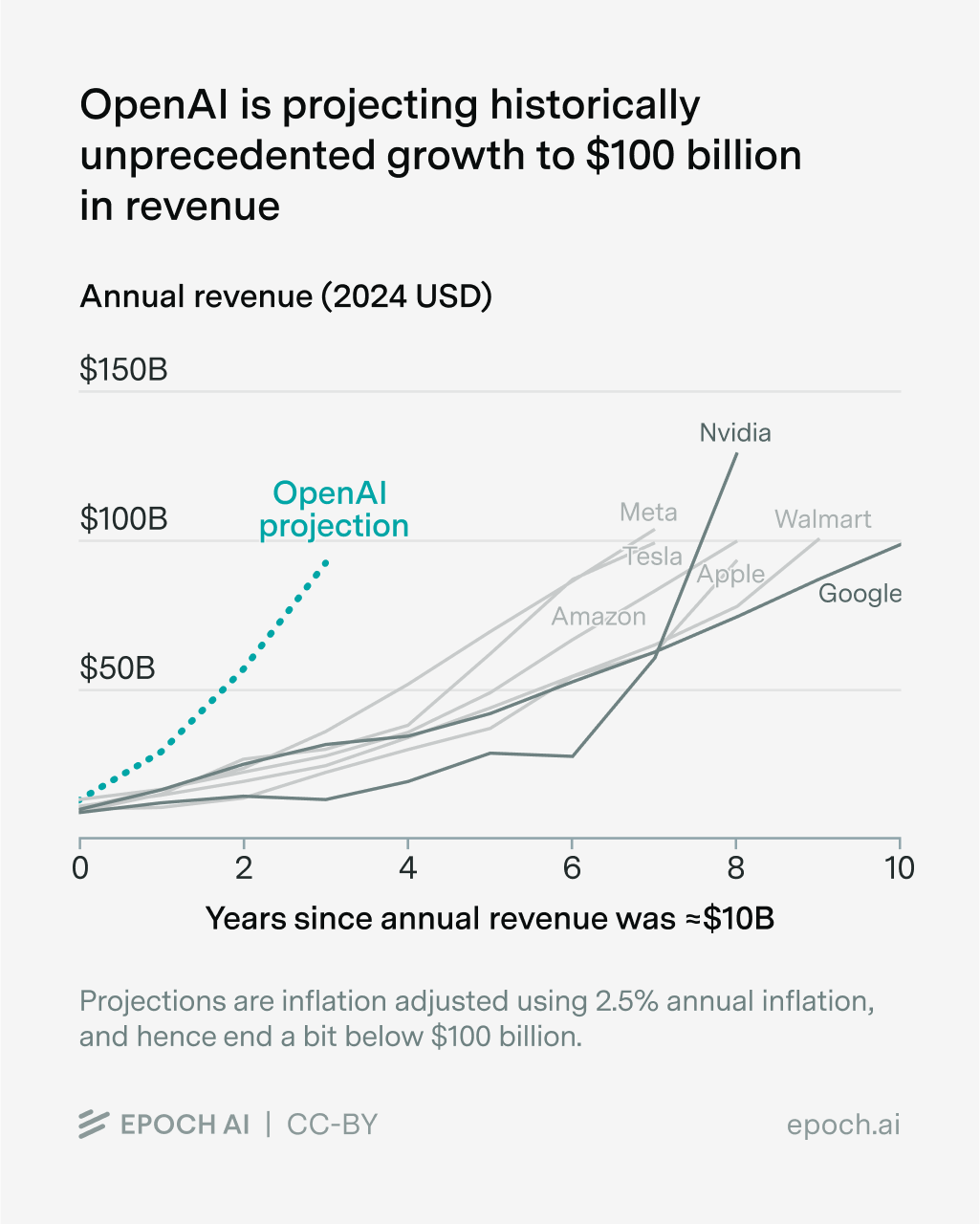

It’s the same for anyone looking to join a startup. A valuation might look pricey, but for the right companies it looks cheap in the rearview mirror. OpenAI feels expensive at $500B, especially when it was worth $300B in March. But maybe it’s not as expensive when you look at revenue forecasts like the chart below, and realize the company could be in the trillions soon:

The second reason it’s important to appreciate how fast things are changing: you should do things that don’t work today, but will work soon.

Maybe you’re a founder and your margins are terrible today. But with how fast things are changing in AI, those margins might actually be healthy long-term—maybe even in a few months. (This isn’t true for all companies, but it is true for some.) In a land grab, it’s not a bad strategy to disregard unit economics if you believe that the long term the math will work.

Long-Term Thinking vs. Short-Term Opportunism

Last week, a16z’s Bryan Kim wrote a tweet that quickly became infamous:

This is one of the more dangerous statements I’ve heard from a VC. Momentum is not a moat, and there are plenty of great companies not growing $0 → $2M ARR in 10 days. If it takes you a month or two to get to $2M, feel free to reach out to me :)

To be fair to Bryan, I understand where he’s coming from. Expectations have shifted. General Catalyst’s Hemant Taneja had a similar sentiment when he said you have to go from $1M to $15M to $100M these days. There are companies growing faster than we’ve ever seen a company grow, and firms like a16z and GC have large enough funds that they need to focus on those handful of companies.

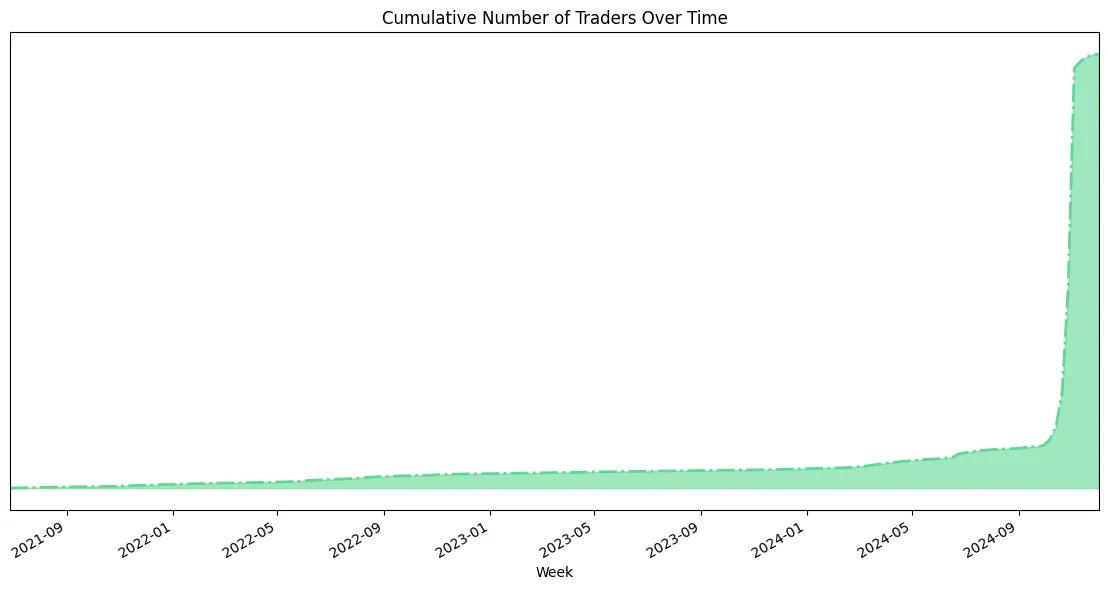

But the reason I take issue with these kinds of statements: not all companies explode out of the gate. Take Kalshi, which took a while to take off:

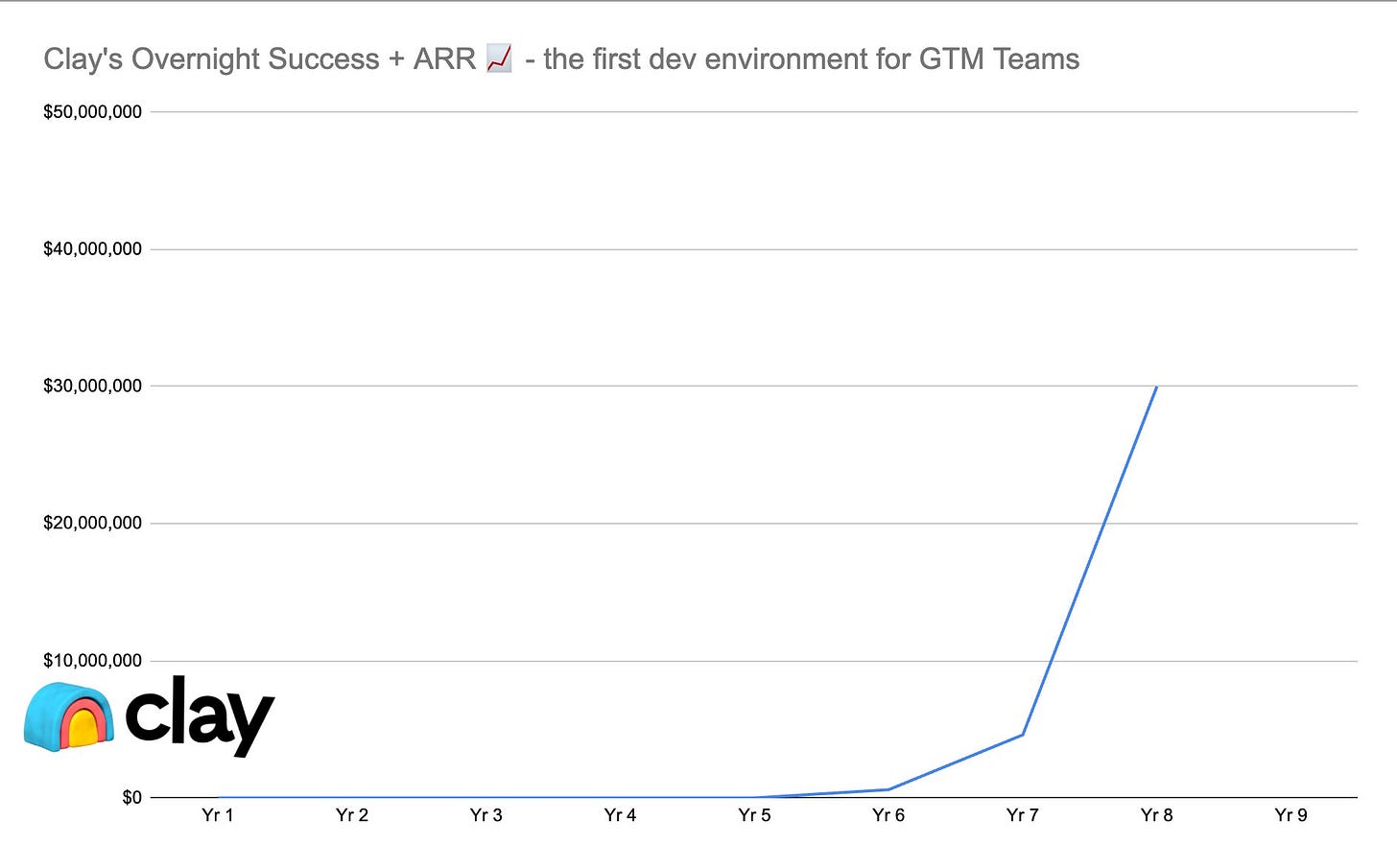

Or take Clay, which also was a late-bloomer but is firing on all cylinders now:

I’d rather a founder build a defensible product with sticky revenue and deep customer love than chase momentum out of the gate. Just because AI is the Wild West right now doesn’t mean we should lose sight of long-term value creation.

Final Thoughts

To sum up this piece:

It’s still (very) early. AI seems saturated, but it’s not. We’re in the early innings of a long and lucrative super-cycle.

Technological innovation happens faster than technological adoption. It may take years, or even decades, for AI to be meaningfully adopted.

In a gold rush, it can be tempting to grow at all costs. But it’s better to prioritize durable moats and sticky revenue over short-term growth.

Most of all, remember: when it comes to this cycle we’re in, the best is yet to come. It’s still 1995.

Sources & Additional Reading

Here’s the seminal Kevin Kelly piece from 2014, which is worth the read: You Are Not Late

Credit to a smart Wedbush analyst for making the 1995 comparison first—Business Insider piece here

My former colleague Kyle Harrison wrote a good piece about Bryan’s statement: Momentum Is Not a Moat

Carlota Perez’s book on technology cycles is worth reading: Technological Revolutions and Financial Capital

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week:

![US Ecommerce Market Share (2022–2028) [Updated Nov 2024] US Ecommerce Market Share (2022–2028) [Updated Nov 2024]](https://substackcdn.com/image/fetch/$s_!_UBX!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F07e1b353-f9bc-4b26-a625-2aa4ab7a4099_1760x900.png)