Talking Shop: The Transformation of Commerce

From Livestreaming and Social Commerce, to the Picks and Shovels

This is a weekly newsletter about how tech and culture intersect. To receive Digital Native in your inbox each week, subscribe here:

Talking Shop: The Transformation of Commerce

There’s a Vladimir Lenin quote that goes, “There are decades when nothing happens, and there are weeks when decades happen.”

This quote was trotted out often in the early days of the pandemic, when long-marinating trends were suddenly microwaved into a handful of weeks. Few trends accelerated faster than e-commerce penetration:

It took 10 years for e-commerce to grow from 6% to 16% of retail sales. It took just eight weeks in March and April 2020 to gain the next 10 percentage points.

We live in a consumerist culture, with commerce as the Sun around which our economy orbits. As Banksy put it in the exhibit I wrote about in Nomadland, Banksy, and the Future of Work:

The global retail market is $25 trillion, with e-commerce comprising about $9 trillion. For perspective, the global advertising market (which is the lifeblood of behemoths like Alphabet, Facebook, Snap, Twitter, and Pinterest) is around $700 billion. Digital advertising is about half that.

We’re at a unique moment in time for commerce. As spend moves online, commerce is becoming more sustainable, more efficient, more affordable, and more convenient. Power is shifting to the consumer. And commerce’s transformation is powered by both near-term shocks like Covid and long-term tailwinds like the rise of Gen Z.

I’m going to dig into 10 aspects of commerce:

Livestream Commerce

Social Commerce

Customer Acquisition

Creator-Powered

Creator-Led

Payments & One-Click Checkout

Sustainability

Resale

NFTs

Post-Purchase Experience

This week, I’ll cover #1-5. In a future piece, I’ll tackle #6-10.

For each aspect, I’ll explore what’s changing and examine a few companies powering those changes.

Let’s jump in.

📺 Livestream Commerce

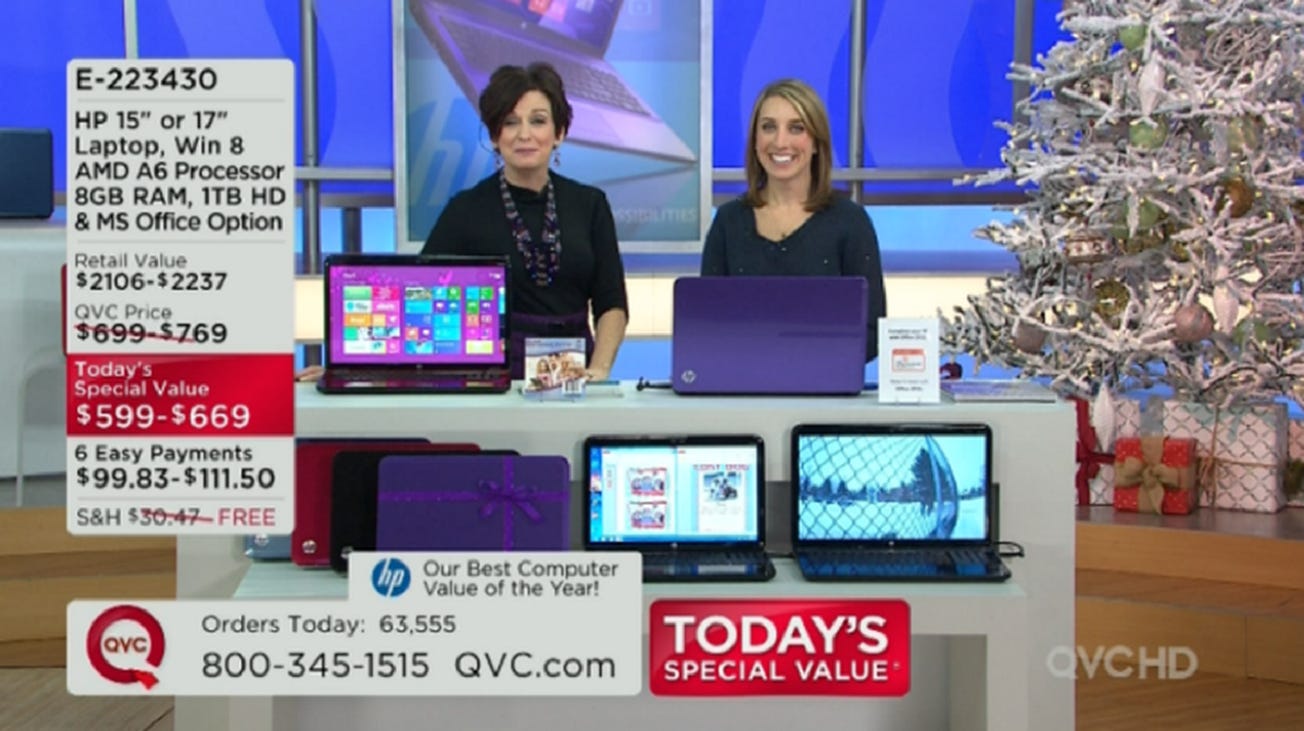

Live shopping is big business: QVC (which stands for Quality, Value, and Convenience) did $12 billion in revenue last year. QVC was founded in 1986, when television was the dominant medium. Internet penetration in the U.S. is now roughly equivalent to TV penetration (~90%), begging the question: what will be QVC for the internet?

There are a number of contenders. Popshop Live and Talkshop Live are always-live social shopping networks—mobile-first QVCs, if you will. Whatnot took off by relying on a more focused approach, starting with hardcore collectibles. Most of Whatnot’s sales, at least initially, were items like Pokémon cards and Funko Pops.

And while marketplaces like Whatnot encourage live sellers to drive traffic to the site, others leverage existing social platforms. Drip, for instance, allows sellers to simulcast to Facebook Live, Instagram Live, YouTube, and Twitch.

CommentSold, arguably the most underrated business in commerce today, also leans into streaming across other platforms. CommentSold was started in 2017 and is already doing over $1B in GMV.

To understand the size of the livestream opportunity, you can look to China. In a consumer survey, two-thirds of Chinese consumers reported buying a product via livestream in the last year. Livestream commerce is already a $350B industry in China, set to grow 60% this year to $550B.

China even has celebrity livestreamers like Li Jiaqi, better known as “The Lipstick King.” In October, he sold $1.7 billion worth of product during a single 12-hour livestream; 250 million people tuned in. That isn’t Li Jiaqi’s first time making headlines: he once tried on 380 lipsticks during a 7-hour livestream, and then sold 15,000 lipsticks in just five minutes.

Livestream commerce is finally becoming mainstream in the West. TikTok launched a livestream shopping experience in December. Instagram hosted live shopping broadcasts during the holiday season. And YouTube just held its first-ever livestream event, Holiday Stream and Shop, corralling big names like MrBeast and Gordon Ramsay to host QVC-style shopping events.

🗣 Social Commerce

Amazon owns about 50% of the e-commerce market in the U.S. In other words, 50 cents of every $1 spent on e-commerce flow to Amazon. But Amazon dominates with emotionless, search-driven shopping. Amazon’s rise left a gap in discovery-driven shopping—the more serendipitous form of commerce akin to browsing a catalog or wandering a mall.

Social networks like Instagram and Pinterest have tried to fill this gap with limited success. Back in 2020, I argued that Instagram should lean heavily into discovery-driven commerce and forget competing with the likes of TikTok (spoiler alert: they didn’t). Both Instagram and Pinterest remain more about content than commerce.

True social shopping has had more success in other geographies: in China, Pinduoduo popularized the idea of buying with a group to get discounts—the name Pinduoduo literally means “Together, more savings, more fun.” In Latin America, Facily is now replicating Pinduoduo’s playbook.

There are interesting social commerce models emerging in the U.S. The Lobby, for instance, lets you shop with your favorite influencers (more on influencers later). Howtank lets you embed chats on your site so that customers can talk to one another. Curated takes this a step further by bringing an expert directly into the purchase decision: with Curated, you can get advice on buying a pair of skis or a set of golf clubs from someone with deep domain expertise.

The lines between content and commerce continue to blur. Livestreaming, mentioned above, is a cousin of social commerce. And companies like Swaypay directly connect transactions to content: Swaypay lets you get paid if you post on TikTok about what you bought. The better your video performs, the more money you get.

Another interesting model is Goody, which we’re invested in at Index. Goody is reinventing gifting by leveraging your phone’s address book. There’s a lot of friction in gifting: for starters, how can I surprise you with a gift if I don’t even know your address? Goody lets me send you your gift over text message. Then you fill in the details to receive it.

For instance, here’s a screenshot from my last Goody purchase: sending my friend Cleo Abram (check out her YouTube channel!) Levain cookies for her birthday. The transaction all happens over text—the most intimate social channel we have.

Goody makes gifting (one of our most social forms of commerce) seamless. And brands want to be on Goody because they might acquire a new customer. Say Cleo had never heard of Levain Bakery, but loved the cookies; she might become a regular customer. Which brings us to…

🔎 Customer Acquisition

Both Goody and Swaypay are examples of new customer acquisition channels.

Finding customers is getting expensive: many successful direct-to-consumer brands hit a plateau around ~$50M in sales, which is when customer acquisition costs (CACs) skyrocket and the math just doesn’t work in relation to customer lifetime value (LTV). Competition makes this worse: at one point, Casper was competing with 300 (!) mattress-in-a-box startups.

Brands are looking for clever ways to find new customers and to do so efficiently. Buying Facebook ads, running TV spots, or optimizing your site for SEO no longer cut it.

There are large businesses built to acquire, engage, and retain customers. Over 4,000 brands use Attentive for SMS marketing. Klaviyo offers powerful email and SMS marketing automation. Yotpo is an all-in-one platform for reviews, loyalty, referrals, and user-generated content.

And younger companies are pioneering new ways to find customers. Canal, for instance, allows a brand to sell another brand’s products—and to showcase its own products on other people’s sites. If you run a plant nursery, you can display related products from your partners.

In this way, Canal is offering brands a new, cost-effective way to be discovered.

🤳 Creator-Powered

The 2010s brought the rise of influencer marketing, built on a simple premise: people like buying things that trusted people recommend. Estimates vary, but most studies find that about 50% of American consumers have bought something because it was recommended by an online influencer.

(Note: I prefer the term “creator” to “influencer”—Patreon’s Jack Conte puts it best by saying, “Influencer extracts what brands care about—influence. I don’t wake up to influence; I wake up to create.” That said, when it comes to sponsored posts and marketing, I often use the term “influencer.”)

Influencer marketing is now a $13.8B industry, up 8x from $1.7B in 2016:

Way back in summer 2020’s The Evolution of the Influencer, I wrote about why the concept of microinfluencers is so powerful: smaller influencers have higher engagement rates (likes and comments per post), which leads to better economics for brand campaigns. Using some (very) illustrative numbers, I gave the example of Nike choosing to work with Kim Kardashian vs. with microinfluencers:

Setting aside the question of why Nike would ever choose to work with Kim K (bad example on my part!), the takeaway remains: Nike could spend its entire $1,000,000 budget to hire Kim, who has a ~1% engagement rate on her posts, or it could hire 1,000 microinfluencers, each with 50K followers, and receive more impressions per dollar spent. As everyone becomes a creator, amassing an online audience, this concept becomes even more potent.

Of course, the campaign with 1,000 influencers is a lot more work to manage. An entire industry has sprung up to help companies acquire, manage, and pay influencers. The leading solution is Grin, software that helps brands manage creator partnerships.

Companies like Glossier and FabFitFun have built large businesses by leveraging microinfluencers and user-generated content. In an interview with Kara Swisher, Glossier’s Emily Weiss summed up how social platforms are changing commerce: “Every single person is now an influencer.”

🛍 Creator-Led

Speaking of Kim K, Kim has moved beyond renting distribution on her feed to brands: she now commands her own empire. She’s her own brand.

SKIMS, Kim’s shapewear clothing brand, raised funding last month at a $3.2 billion valuation. Last year, SKIMS sales grew 90% year-over-year to $275 million, and this year the business is targeting $400 million. Shapewear now accounts for less than 20% of SKIMS sales, with underwear the largest category.

To give a sense of the opportunity: Victoria’s Secret, despite being a stale brand operating with an out-of-date ethos, still does $12 billion in annual sales. SKIMS has the opportunity to be Victoria’s Secret for a new generation.

SKIMS is one of many success stories from celebrity-driven brands: Rihanna and Fenty; Gwyneth Paltrow and Goop; Jessica Alba and Honest; Ryan Reynolds and Aviation Gin; George Clooney and Casamigos. Kylie Jenner, Kim’s half-sister, has an entire army of brands of her own: Kylie Cosmetics (beauty), Kylie Skin (skincare), Kylie Baby (baby products), Kylie Swim (swimwear), and KENDALL + KYLIE (clothing line with Kendall).

Celebrity-led brands align with how the world is changing: power is shifting from institutions and corporations to people. As influencer marketing has shown, people trust people.

And every week brings more celebrity brands:

In the past, launching a business was accessible only to the biggest celebrities and creators—those with resources to figure out manufacturing and supply chain. But that’s changing: solutions like Pietra allow anyone to launch a product line. On Pietra’s website, I was able to order samples of a face serum and a candle. I could then customize the products, or simply white-label them as “Rex Skin” or “Rex Candles” and be good to go. All complexity around business creation is abstracted away.

Instead of creators only powering other businesses with their online megaphones, we’ll see creators—even the long tail—leverage social followings to launch their own businesses.

Final Thoughts

It’s stunning to think about how much commerce has changed in 25 years. (To get a sense of how modern e-commerce came about, I highly recommend Brad Stone’s The Everything Store and Amazon Unbound. Both books are phenomenal.) And over the next 25 years, commerce will again undergo a revolution.

In Part II, I’ll dive into five more fast-changing aspects of commerce:

Payments & One-Click Checkout

Sustainability

Resale

NFTs

Post-Purchase Experience

Power is steadily shifting to consumers. The arc of consumer businesses bends toward products that are more efficient, more affordable, and more convenient. The next generation of commerce companies will enable and accelerate this arc.

Part II

I began Part I by sharing a chart of how the pandemic inflected e-commerce penetration. It took 10 years for e-commerce to grow from 6% to 16% of retail sales; it took just eight weeks in March and April 2020 to gain the next 10 percentage points.

But that chart isn’t the full story. We’ve seen a regression in e-commerce penetration as the world opens up. We’re back on the long-term trend-line:

Some sectors and products aren’t natural fits for e-commerce. Luxury and high-ticket items (jewelry, for instance) will likely always have an offline component. And if I had a dollar for every time my aunt says some variation of: “I just like to feel my own produce at the grocery store—I can’t trust Amazon or Instacart to choose the right avocado!” 🥑

But e-commerce will continue it’s steady march, eating away at the retail pie. And it’s a big pie: the global retail market is $25 trillion, with e-commerce comprising only about $9 trillion (~35%) today. For perspective, the global advertising market—which is the lifeblood of behemoths like Alphabet, Facebook, Snap, Twitter, and Pinterest—is around $700 billion. Digital advertising is half that.

In Part I, I explored #1 through #5 on this list. This week, I’ll explore #6 through #10.

Livestream Commerce

Social Commerce

Customer Acquisition

Creator-Powered

Creator-Led

Sustainability

E-Commerce Enablement

Resale

NFTs

Post-Purchase Experience

For each aspect, I’ll explore what’s changing and examine a few companies powering those changes.

🌱 Sustainability

Commerce is becoming climate-conscious.

Consumers vote with their feet, and consumers (Millennial and Gen Z consumers, in particular) are flocking to brands that emphasize sustainability. You see this in the brands that break through today: direct-to-consumer brands like Allbirds and Everlane, for instance, have sustainability in their DNA. Old-guard names like Patagonia and North Face are enjoying resurgences because of their environmentally-friendly ethos.

Sustainable commerce will be one of the most important trends of the next 50 years. I expect it will soon become easy for any consumer to understand the carbon footprint of what they buy and to track the full lifecycle of a product and its supply chain.

New companies will power this. Sourceful, for example, is a company we work with at Index that offers a platform for sustainable sourcing. Sourceful works with brands to source eco-friendly packaging, merchandise, and components. About 83% of a consumer industry’s carbon footprint lives in its supply chain, and 84% of people think that brands have a responsibility to be more sustainable. Sourceful solves this, allowing brands to control and reduce the footprint of their supply chains.

Another company powering sustainable commerce is Patch. Patch is an API-first marketplace for carbon removal. Put more simply, Patch lets businesses buy carbon offsets so that they can get carbon neutral or carbon negative. To summarize the two sides of the marketplace:

Demand-side: Businesses that want (or, increasingly, need) to get carbon neutral or negative and must purchase offsets to do so

Supply-side: Carbon removal developers—people whose job is to sequester CO2 (reforestation, direct air capture, etc.), selling their capacity to sequester carbon to businesses

Businesses use the Patch marketplace to link up with developers for offsets. This often means offsetting commerce’s carbon footprint.

For instance, Patch works with Farfetch, the online luxury marketplace. The fashion industry is responsible for about 10% of global carbon emissions each year; mitigating climate change means getting fashion brands onboard. Brands on Farfetch can now use Patch to understand their estimated footprint, and then take steps to invest in carbon removal or offsets.

Patch also works with Afterpay, the “Buy Now, Pay Later” platform, to integrate into the Afterpay app. Afterpay customers can view their estimated carbon impact based on their historical spend, and then choose from a range of projects to purchase carbon removal or offsets.

💰 E-Commerce Enablement

Speaking of Afterpay, Afterpay—along with BNPL counterparts like Affirm and Klarna—is an example of innovation in “e-commerce enablement”. I wrote in Part I that the arc of commerce bends toward more convenient, affordable, and consumer-friendly experiences. That’s bearing out.

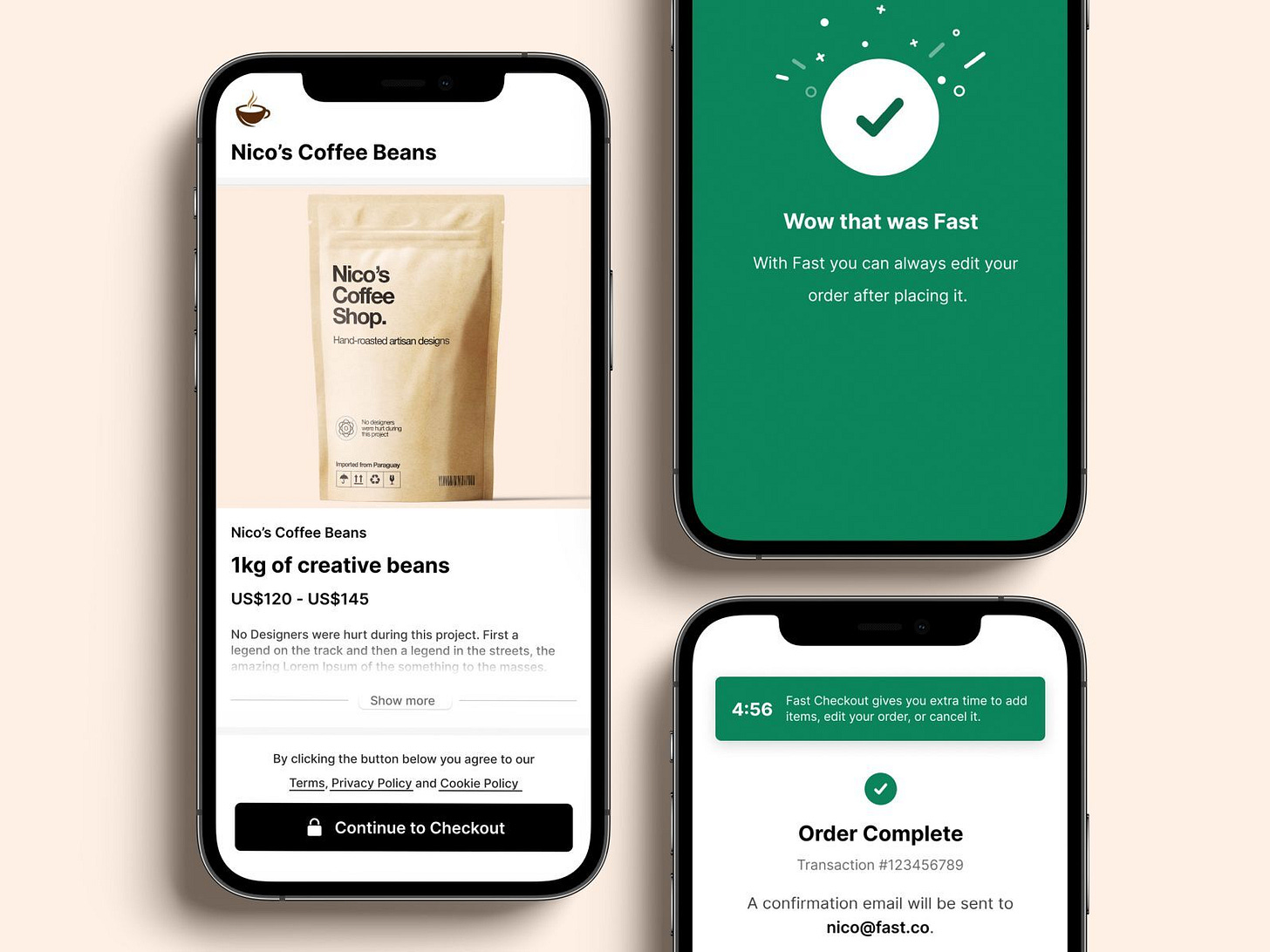

Take the one-click checkout space. Players like Fast (an Index company), Bolt, and Rally offer exceptional experiences for the consumer: easy, frictionless checkout.

Or take Primer, which offers no code automation for payments. Payment flows become highly-customizable and efficient, all built using easy-to-use drag-and-drop interfaces.

Tangential businesses tackle other parts of e-comm enablement. Shogun, for instance, is a headless commerce platform that lets you spin up custom storefronts. Companies like Okendo and Yotpo make reviews a frictionless experience for both merchants and customers. And Shippo powers a seamless shipping experience.

The underlying infrastructure of commerce has been one of the most dynamic spaces in commerce, and the arc will continue to bend toward efficiency, convenience, and consumer power.

♻️ Resale

Secondhand commerce is exploding. Ebay was always the 800-pound gorilla in the space, but has been picked apart over the years by more specialized marketplaces. My friend Justine Moore made this instantly-iconic graphic of Ebay’s unbundling:

Many of these are secondhand marketplaces, and many have become large businesses.

GOAT, for instance, is a company we work with at Index that has grown to 30 million users, 100,000 unique products, and 2 million listings. We recently shared the GOAT origin story on our website, and I love this anecdote:

The team needed to attract sellers despite having few buyers, and buyers despite having few sellers. So they used a growth hack. They bought some pairs of shoes and put them on the marketplace. To make it look like the shoes came from many sellers, they went to The Home Depot, came back with a variety of individual floor tiles, and photographed the shoes on them.

Secondhand fashion is one of the fastest-growing but least-talked-about industries. Resale is a $40B market expected to double to ~$80B by 2025 and to triple to ~$120B by 2030. About a quarter of the secondhand market is apparel, which will grow 40% per year through 2025. In 2019, secondhand apparel grew 21x faster than traditional apparel and in 2020, 36 million Americans sold items secondhand for the first time.

Both riding and accelerating this trend are secondhand fashion marketplaces like Depop, Poshmark, thredUp, and Curtsy.

These marketplaces are embraced by young, thrifty, environmentally-conscious consumers. Some of these consumers even make a living as professional resellers. I’ve written in the past about Bella McFadden, the first person to make over $1 million selling on Depop. She’s sold 40,231 items (!) through her Depop store, which has 379,000 followers.

There are also innovative business models building on the demand for secondhand.

Archive, for example, is a white-label peer-to-peer marketplace that lets brands own the resale experience. Archive launched with MM LaFleur as its first customer—you can see here Archive’s white-labeled site on MM’s website:

By bringing resale in-house, brands 1) control the brand experience, 2) communicate sustainability, and 3) acquire younger, thriftier customers. I expect to see a significant portion of commerce shift to resale in the coming years, much of it through brand-controlled channels.

Secondhand is closely aligned with sustainability. With fast fashion going out of…well…fashion (sorry), partly because of its environmental footprint, secondhand is booming. By 2030, the secondhand fashion industry will be nearly twice the size of the fast fashion industry.

Beyond sustainability, resale appeals to consumers as a cost-conscious and convenient form of commerce. Bringing resale online often turbocharges that convenience and price-transparency. Take Carvana, the largest online seller of used cars.

This year, Carvana is expected to become the 7th-largest U.S. retailer by online sales, leapfrogging Costco and Wayfair. Costco was founded in 1976; Carvana was founded in 2012.

🌐 NFTs

Just as commerce transactions are moving online, products are themselves becoming digital. Already, 75% of dollars flowing through the ~$200 billion gaming industry are from micropurchases of virtual clothes and accessories. (By 2025, it will be 95%.) In Fortnite, you can buy Balenciaga skins to outfit your avatar.

Increasingly, those items will live on-chain. What if you could wear your Balenciaga hoodie from Fortnite over into Minecraft, or Twitch, or Instagram?

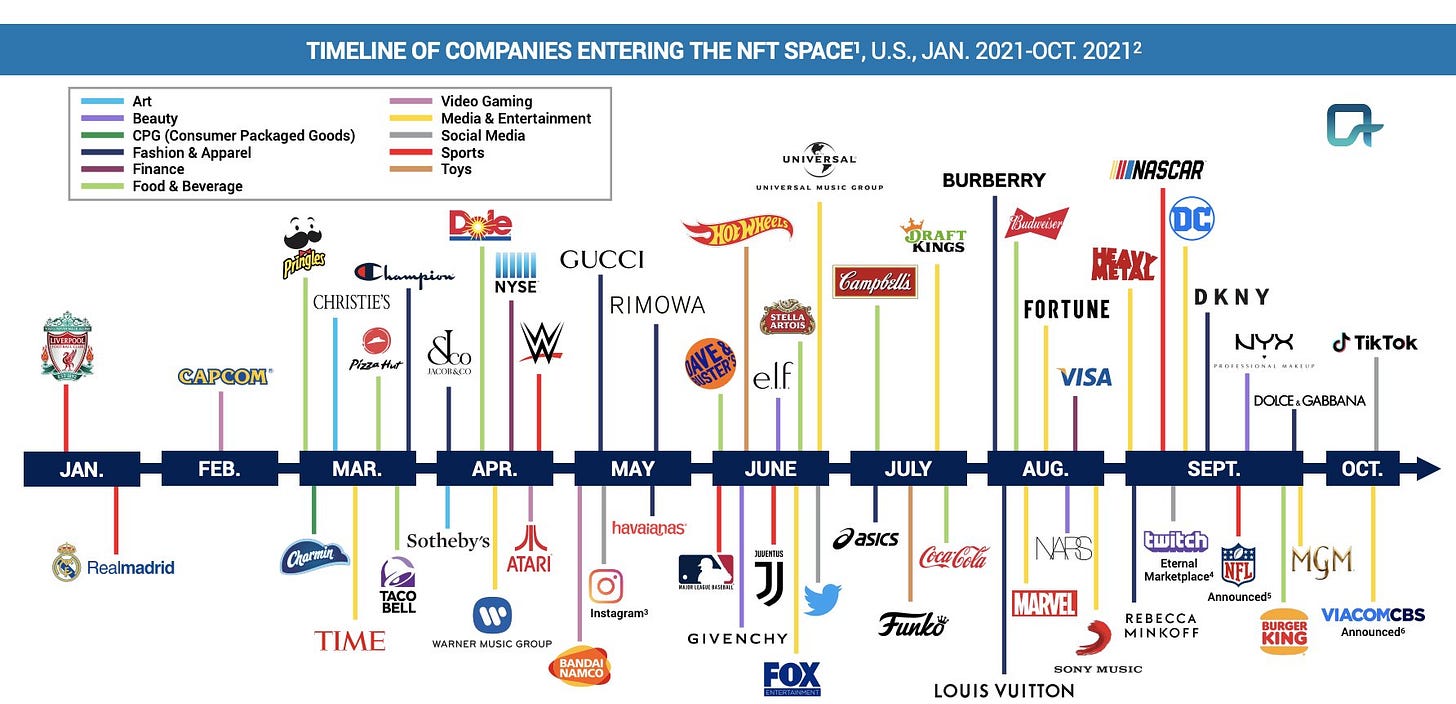

In 2021, dozens of brands launched NFTs:

One approach that will become more common this year is that of digital twins. When you buy a physical product, a brand will automatically grant you a digital, tokenized version. This digital twin may act as a collectible, or it may have utility, acting as a sort of loyalty program or ticket to a gated experience.

A hotly-debated question last year was: What will be Shopify for NFTs?

Increasingly, it seems the answer is simple: the Shopify for NFTs is…Shopify. Three months ago, Shopify began allowing merchants to list NFTs on their storefronts, powering a new form of on-chain digital commerce. Platforms like Novel build on this, allowing anyone to create, mint, and sell NFTs on a branded Shopify storefront.

In addition to new infrastructure for NFT commerce, there are net new brands being created. RTFKT, for instance, is a “metaverse fashion house” that creates tokenized digital sneakers and apparel. RTFKT (pronounced “Artifact”) was acquired by Nike last year. It’s interesting to think about what Nike’s arsenal of iconic brands will look like 10, 20, 30 years from now: Jordan, Converse, Air Force 1…and RTFKT?

As we spend more time in digital spaces, we’ll spend more money on digital commerce to better express ourselves. In the past, I’ve shared my Zoolander-esque avatar made by Genies.

Genies recently launched a platform called The Warehouse, in partnership with Dapper Labs (the company behind NBA Top Shot), to power digital commerce for outfitting Genies with NFTs. Part of the future of commerce is digital, and part of it is on-chain. Just as we’re crazy about shopping for physical items in the real world, we’ll partake in digital commerce with the same zeal.

📦 Post-Purchase

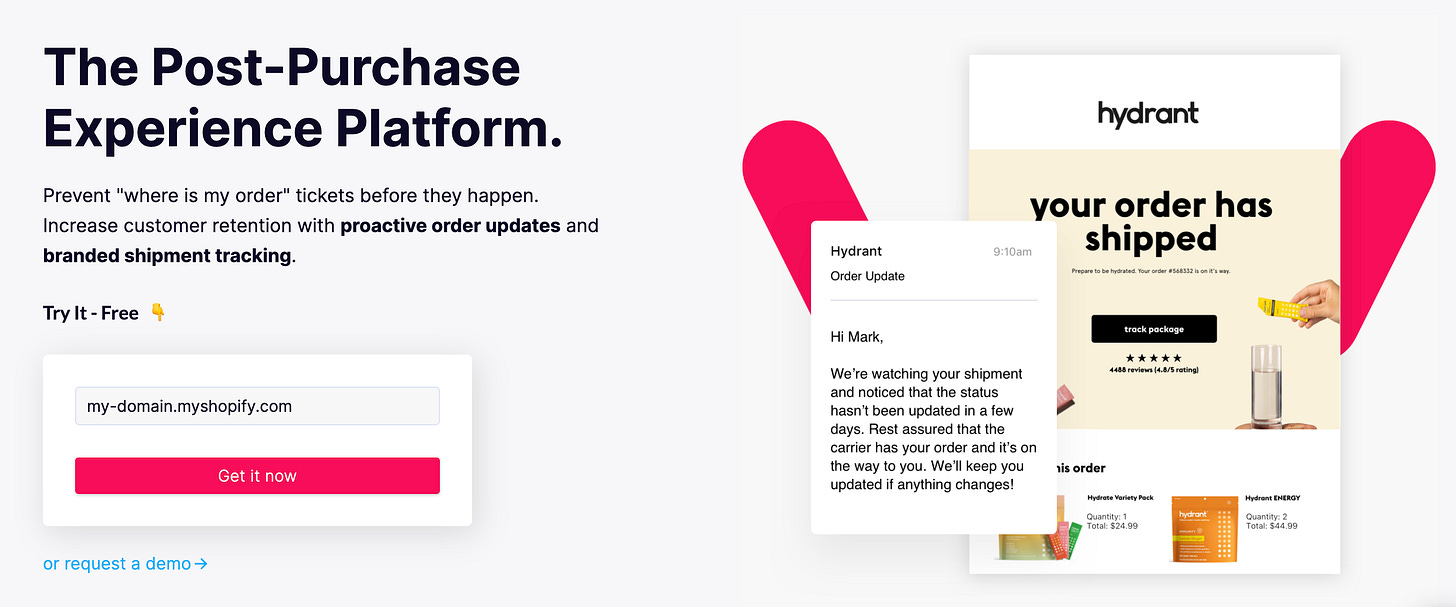

We’re seeing more focus shift to the post-purchase experience—how a brand engages with you and maintains a relationship after you buy something. Controlling the post-purchase experience is key to building customer loyalty and driving repeat buying behavior.

Companies building in this space take many forms.

Wonderment, for instance, is an order tracking platform for Shopify that provides order updates and shipment tracking—nipping the onslaught of “Where’s my order?” questions in the bud. Relatedly, Malomo lets brands hyper-personalize the order tracking experience.

Rebuy shows your customers personalized discounts to incentive them to transact with you again. Disco offers a post-purchase portal that shows your customers other brands, extending the customer journey and giving you the opportunity to do the same on other sites; this also acts as a customer acquisition channel, building on that topic from Part I. And Batch allows brands to add a QR code to their packaging, driving seamless repeat purchase behavior.

Post-purchase also intersects with creator-led commerce, which I also covered in Part I. An interesting example is Kale, which lets any consumer be a creator. After you make a purchase, you simply post about the brand on your Instagram or TikTok—and you get paid for the engagement you generate. If you make an expensive purchase, Kale enables you to “pay off” that purchase by giving the brand online attention.

Final Thoughts

Innovation in commerce is diverse and wide-ranging—from Shopify plug-ins, to payment flows, to metaverse fashion houses. Commerce is being rapidly digitized. And everyone wins: it’s never been easier to launch a brand, to open a storefront, or to shop. Every aspect of the transaction experience is being reimagined from first principles, built in a more efficient, flexible, and affordable way.

Sources & Additional Reading

Thank you to Sam Blumenthal and CircleUp for being sparring partners on commerce.

If you’re interesting in commerce, I highly recommend my colleague Damir’s newsletter Daily Consumer. It’s unmatched in its breadth and insight.

Read about how Patch works with Afterpay and Farfetch here

Read about Index’s investment in Sourceful here

Here is the GOAT origin story I mentioned

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: