Talking Shop: The Transformation of Commerce (Part I)

Livestream, Social, Creators, and Customer Acquisition

This is a weekly newsletter about how tech and culture intersect. To receive Digital Native in your inbox each week, subscribe here:

Talking Shop: The Transformation of Commerce

There’s a Vladimir Lenin quote that goes, “There are decades when nothing happens, and there are weeks when decades happen.”

This quote was trotted out often in the early days of the pandemic, when long-marinating trends were suddenly microwaved into a handful of weeks. Few trends accelerated faster than e-commerce penetration:

It took 10 years for e-commerce to grow from 6% to 16% of retail sales. It took just eight weeks in March and April 2020 to gain the next 10 percentage points.

We live in a consumerist culture, with commerce as the Sun around which our economy orbits. As Banksy put it in the exhibit I wrote about in Nomadland, Banksy, and the Future of Work:

The global retail market is $25 trillion, with e-commerce comprising about $9 trillion. For perspective, the global advertising market (which is the lifeblood of behemoths like Alphabet, Facebook, Snap, Twitter, and Pinterest) is around $700 billion. Digital advertising is about half that.

We’re at a unique moment in time for commerce. As spend moves online, commerce is becoming more sustainable, more efficient, more affordable, and more convenient. Power is shifting to the consumer. And commerce’s transformation is powered by both near-term shocks like Covid and long-term tailwinds like the rise of Gen Z.

I’m going to dig into 10 aspects of commerce:

Livestream Commerce

Social Commerce

Customer Acquisition

Creator-Powered

Creator-Led

Payments & One-Click Checkout

Sustainability

Resale

NFTs

Post-Purchase Experience

This week, I’ll cover #1-5. In a future piece, I’ll tackle #6-10.

For each aspect, I’ll explore what’s changing and examine a few companies powering those changes.

Let’s jump in.

📺 Livestream Commerce

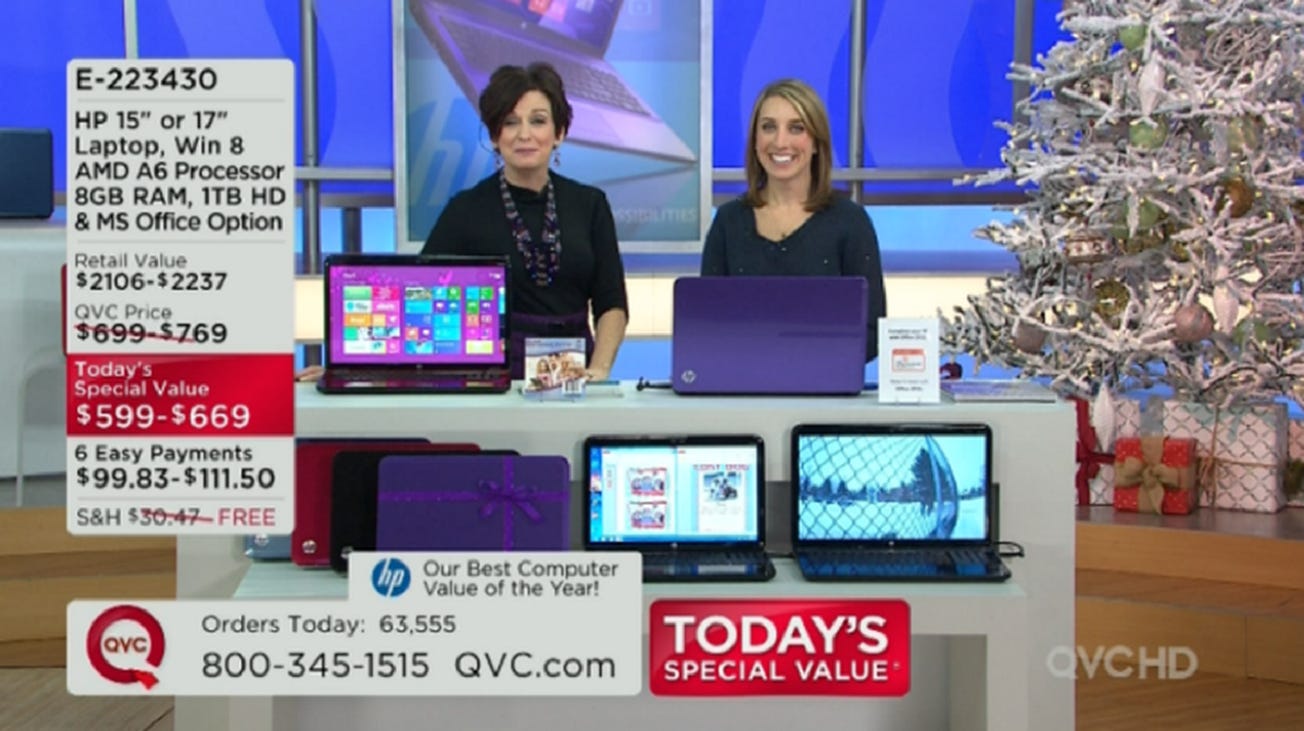

Live shopping is big business: QVC (which stands for Quality, Value, and Convenience) did $12 billion in revenue last year. QVC was founded in 1986, when television was the dominant medium. Internet penetration in the U.S. is now roughly equivalent to TV penetration (~90%), begging the question: what will be QVC for the internet?

There are a number of contenders. Popshop Live and Talkshop Live are always-live social shopping networks—mobile-first QVCs, if you will. Whatnot took off by relying on a more focused approach, starting with hardcore collectibles. Most of Whatnot’s sales, at least initially, were items like Pokémon cards and Funko Pops.

And while marketplaces like Whatnot encourage live sellers to drive traffic to the site, others leverage existing social platforms. Drip, for instance, allows sellers to simulcast to Facebook Live, Instagram Live, YouTube, and Twitch.

CommentSold, arguably the most underrated business in commerce today, also leans into streaming across other platforms. CommentSold was started in 2017 and is already doing over $1B in GMV.

To understand the size of the livestream opportunity, you can look to China. In a consumer survey, two-thirds of Chinese consumers reported buying a product via livestream in the last year. Livestream commerce is already a $350B industry in China, set to grow 60% this year to $550B.

China even has celebrity livestreamers like Li Jiaqi, better known as “The Lipstick King.” In October, he sold $1.7 billion worth of product during a single 12-hour livestream; 250 million people tuned in. That isn’t Li Jiaqi’s first time making headlines: he once tried on 380 lipsticks during a 7-hour livestream, and then sold 15,000 lipsticks in just five minutes.

Livestream commerce is finally becoming mainstream in the West. TikTok launched a livestream shopping experience in December. Instagram hosted live shopping broadcasts during the holiday season. And YouTube just held its first-ever livestream event, Holiday Stream and Shop, corralling big names like MrBeast and Gordon Ramsay to host QVC-style shopping events.

🗣 Social Commerce

Amazon owns about 50% of the e-commerce market in the U.S. In other words, 50 cents of every $1 spent on e-commerce flow to Amazon. But Amazon dominates with emotionless, search-driven shopping. Amazon’s rise left a gap in discovery-driven shopping—the more serendipitous form of commerce akin to browsing a catalog or wandering a mall.

Social networks like Instagram and Pinterest have tried to fill this gap with limited success. Back in 2020, I argued that Instagram should lean heavily into discovery-driven commerce and forget competing with the likes of TikTok (spoiler alert: they didn’t). Both Instagram and Pinterest remain more about content than commerce.

True social shopping has had more success in other geographies: in China, Pinduoduo popularized the idea of buying with a group to get discounts—the name Pinduoduo literally means “Together, more savings, more fun.” In Latin America, Facily is now replicating Pinduoduo’s playbook.

There are interesting social commerce models emerging in the U.S. The Lobby, for instance, lets you shop with your favorite influencers (more on influencers later). Howtank lets you embed chats on your site so that customers can talk to one another. Curated takes this a step further by bringing an expert directly into the purchase decision: with Curated, you can get advice on buying a pair of skis or a set of golf clubs from someone with deep domain expertise.

The lines between content and commerce continue to blur. Livestreaming, mentioned above, is a cousin of social commerce. And companies like Swaypay directly connect transactions to content: Swaypay lets you get paid if you post on TikTok about what you bought. The better your video performs, the more money you get.

Another interesting model is Goody, which we’re invested in at Index. Goody is reinventing gifting by leveraging your phone’s address book. There’s a lot of friction in gifting: for starters, how can I surprise you with a gift if I don’t even know your address? Goody lets me send you your gift over text message. Then you fill in the details to receive it.

For instance, here’s a screenshot from my last Goody purchase: sending my friend Cleo Abram (check out her YouTube channel!) Levain cookies for her birthday. The transaction all happens over text—the most intimate social channel we have.

Goody makes gifting (one of our most social forms of commerce) seamless. And brands want to be on Goody because they might acquire a new customer. Say Cleo had never heard of Levain Bakery, but loved the cookies; she might become a regular customer. Which brings us to…

🔎 Customer Acquisition

Both Goody and Swaypay are examples of new customer acquisition channels.

Finding customers is getting expensive: many successful direct-to-consumer brands hit a plateau around ~$50M in sales, which is when customer acquisition costs (CACs) skyrocket and the math just doesn’t work in relation to customer lifetime value (LTV). Competition makes this worse: at one point, Casper was competing with 300 (!) mattress-in-a-box startups.

Brands are looking for clever ways to find new customers and to do so efficiently. Buying Facebook ads, running TV spots, or optimizing your site for SEO no longer cut it.

There are large businesses built to acquire, engage, and retain customers. Over 4,000 brands use Attentive for SMS marketing. Klaviyo offers powerful email and SMS marketing automation. Yotpo is an all-in-one platform for reviews, loyalty, referrals, and user-generated content.

And younger companies are pioneering new ways to find customers. Canal, for instance, allows a brand to sell another brand’s products—and to showcase its own products on other people’s sites. If you run a plant nursery, you can display related products from your partners.

In this way, Canal is offering brands a new, cost-effective way to be discovered.

🤳 Creator-Powered

The 2010s brought the rise of influencer marketing, built on a simple premise: people like buying things that trusted people recommend. Estimates vary, but most studies find that about 50% of American consumers have bought something because it was recommended by an online influencer.

(Note: I prefer the term “creator” to “influencer”—Patreon’s Jack Conte puts it best by saying, “Influencer extracts what brands care about—influence. I don’t wake up to influence; I wake up to create.” That said, when it comes to sponsored posts and marketing, I often use the term “influencer.”)

Influencer marketing is now a $13.8B industry, up 8x from $1.7B in 2016:

Way back in summer 2020’s The Evolution of the Influencer, I wrote about why the concept of microinfluencers is so powerful: smaller influencers have higher engagement rates (likes and comments per post), which leads to better economics for brand campaigns. Using some (very) illustrative numbers, I gave the example of Nike choosing to work with Kim Kardashian vs. with microinfluencers:

Setting aside the question of why Nike would ever choose to work with Kim K (bad example on my part!), the takeaway remains: Nike could spend its entire $1,000,000 budget to hire Kim, who has a ~1% engagement rate on her posts, or it could hire 1,000 microinfluencers, each with 50K followers, and receive more impressions per dollar spent. As everyone becomes a creator, amassing an online audience, this concept becomes even more potent.

Of course, the campaign with 1,000 influencers is a lot more work to manage. An entire industry has sprung up to help companies acquire, manage, and pay influencers. The leading solution is Grin, software that helps brands manage creator partnerships.

Companies like Glossier and FabFitFun have built large businesses by leveraging microinfluencers and user-generated content. In an interview with Kara Swisher, Glossier’s Emily Weiss summed up how social platforms are changing commerce: “Every single person is now an influencer.”

🛍 Creator-Led

Speaking of Kim K, Kim has moved beyond renting distribution on her feed to brands: she now commands her own empire. She’s her own brand.

SKIMS, Kim’s shapewear clothing brand, raised funding last month at a $3.2 billion valuation. Last year, SKIMS sales grew 90% year-over-year to $275 million, and this year the business is targeting $400 million. Shapewear now accounts for less than 20% of SKIMS sales, with underwear the largest category.

To give a sense of the opportunity: Victoria’s Secret, despite being a stale brand operating with an out-of-date ethos, still does $12 billion in annual sales. SKIMS has the opportunity to be Victoria’s Secret for a new generation.

SKIMS is one of many success stories from celebrity-driven brands: Rihanna and Fenty; Gwyneth Paltrow and Goop; Jessica Alba and Honest; Ryan Reynolds and Aviation Gin; George Clooney and Casamigos. Kylie Jenner, Kim’s half-sister, has an entire army of brands of her own: Kylie Cosmetics (beauty), Kylie Skin (skincare), Kylie Baby (baby products), Kylie Swim (swimwear), and KENDALL + KYLIE (clothing line with Kendall).

Celebrity-led brands align with how the world is changing: power is shifting from institutions and corporations to people. As influencer marketing has shown, people trust people.

And every week brings more celebrity brands:

In the past, launching a business was accessible only to the biggest celebrities and creators—those with resources to figure out manufacturing and supply chain. But that’s changing: solutions like Pietra allow anyone to launch a product line. On Pietra’s website, I was able to order samples of a face serum and a candle. I could then customize the products, or simply white-label them as “Rex Skin” or “Rex Candles” and be good to go. All complexity around business creation is abstracted away.

Instead of creators only powering other businesses with their online megaphones, we’ll see creators—even the long tail—leverage social followings to launch their own businesses.

Final Thoughts

It’s stunning to think about how much commerce has changed in 25 years. (To get a sense of how modern e-commerce came about, I highly recommend Brad Stone’s The Everything Store and Amazon Unbound. Both books are phenomenal.) And over the next 25 years, commerce will again undergo a revolution.

In Part II, I’ll dive into five more fast-changing aspects of commerce:

Payments & One-Click Checkout

Sustainability

Resale

NFTs

Post-Purchase Experience

Power is steadily shifting to consumers. The arc of consumer businesses bends toward products that are more efficient, more affordable, and more convenient. The next generation of commerce companies will enable and accelerate this arc.

Sources & Additional Reading

Thank you to Sam Blumenthal and CircleUp for being sparring partners on commerce.

If you’re interesting in commerce, I highly recommend my colleague Damir’s newsletter Daily Consumer. It’s unmatched in its breadth and insight.

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: