The Consumer Renaissance

From Predicting Consumer AI Applications to Analyzing Consumer Spend

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 60,000 weekly readers by subscribing here:

Hey Everyone 👋,

This week’s piece is about the renaissance happening in consumer technology. On that note, next Tuesday evening I’m co-hosting an event in New York with my friends at General Catalyst.

All founders and operators are welcome, and you can register here. Hope to see you there!

With that, on to this week’s piece…

The Consumer Renaissance

“Consumer” has become something of a bad word in venture capital circles.

We see this reflected in the early-stage markets: recent data from Carta showed that just 7.1% of Seed capital raised last year went to consumer startups. That’s less than half the share from 2019 (14.3%).

But I think consumer is actually a great place to be building and investing. Whenever something is out of favor, that’s a sign it’s probably a good place to spend time: this is an industry built on being contrarian, not built on following the herd. We’re entering a compelling few years for consumer entrepreneurship.

First, I’d argue that consumer is too narrowly defined. When people think consumer, they often think consumer social (a tough category) or consumer brands (a tough fit for venture compared to internet and software businesses, with typically lower return profiles). But consumer is broader. Consumer encompasses businesses that sell to consumers and those that rely on consumer spending. This means the obvious names—apps on our phones like Uber, Instacart, Spotify—and the enablers: Shopify, for instance, powers online retail; Faire powers offline retail; Unity powers game development. Each of the latter three is B2B2C, in its own way, but I would categorize each is also a consumer technology business.

The wins in consumer can be massive. The biggest technology businesses in history began as consumer businesses—Google, Facebook, Apple, Amazon. The original companies comprising FAANG—with Microsoft conspicuously absent—were all consumer.

And some of the best returns of the last five years have stemmed from consumer tech IPOs. At Daybreak, we invest ~$1M at Pre-Seed and Seed. Here’s how much a $1M investment in the Seed round of five recent consumer IPOs would yield:

Big consumer wins compare favorably to big enterprise wins—relative to Snowflake’s market cap, Uber is ~3x in size, Airbnb is ~2x in size, and DoorDash is roughly equal. (Snowflake is the biggest enterprise IPO of the last decade.) The last few years produced a windfall of consumer outcomes, yet investors today almost write off the category.

At Daybreak, we don’t focus exclusively on consumer; my view is that you need to balance more binary consumer outcomes with B2B SaaS and B2B marketplaces. But we do approach investing through the lens of the consumer—how people make decisions. The buyers of products like Figma and Ramp, after all, are people, and software companies are increasingly selling bottom-up into organizations. The line between consumer and enterprise has been blurring for years.

This week’s Digital Native makes the argument that consumer tech is a compelling place to build and invest. We’ll look at the data to back up this argument, then delve into three categories of consumer that I’m particularly interested in right now:

Checking in on Consumer Spend

Consumer Tech: The Data Doesn’t Lie

What to Watch: AI Applications

What to Watch: Shopping

What to Watch: Consumer Health

Rule of Thumb: Follow the Spend

This week we’ll cover #1-3, and next week in Part II we’ll tackle #4-6.

Let’s dive in 👇

Checking in on Consumer Spend

Joe Biden’s reelection hopes hinge on how voters view the economy. And right now, voters aren’t too thrilled.

An April poll from Echelon Insights found that 57% of voters somewhat or strongly disapprove of how Biden is handling the economy. Yet most economic indicators are strong—GDP, unemployment rate, job growth, inflation. Each is trending in the right direction. What gives?

While inflation is down overall, the prices of lower-priced goods are up. These are our more frequent purchases. Car prices may drag down inflation broadly, but if you see higher prices during your weekly grocery run, you’ll be upset. A good piece in The Atlantic last December characterized this as “The English-Muffin Problem.” When people were surveyed about what factors they consider when deciding how the national economy is doing, the most-cited factor was “The price of groceries for your home.” When asked what they had in mind when reporting that their personal finances were getting worse, 81% of people chose groceries. No one wants to shell out $5.99 for a pack of English Muffins.

This is a key reason that Biden is struggling with working class voters. We see the same concept at work in fast-food prices:

Yet despite voter sentiment, consumer spending remains strong.

Even amidst high inflation rates in 2022, even with the S&P 500 dropping -19.64%, people kept spending. A Bank of America study found that credit and debit card spending rose +5.9% in 2022. Last year was up on 2022, and Q1 2024 was up on Q4 2023.

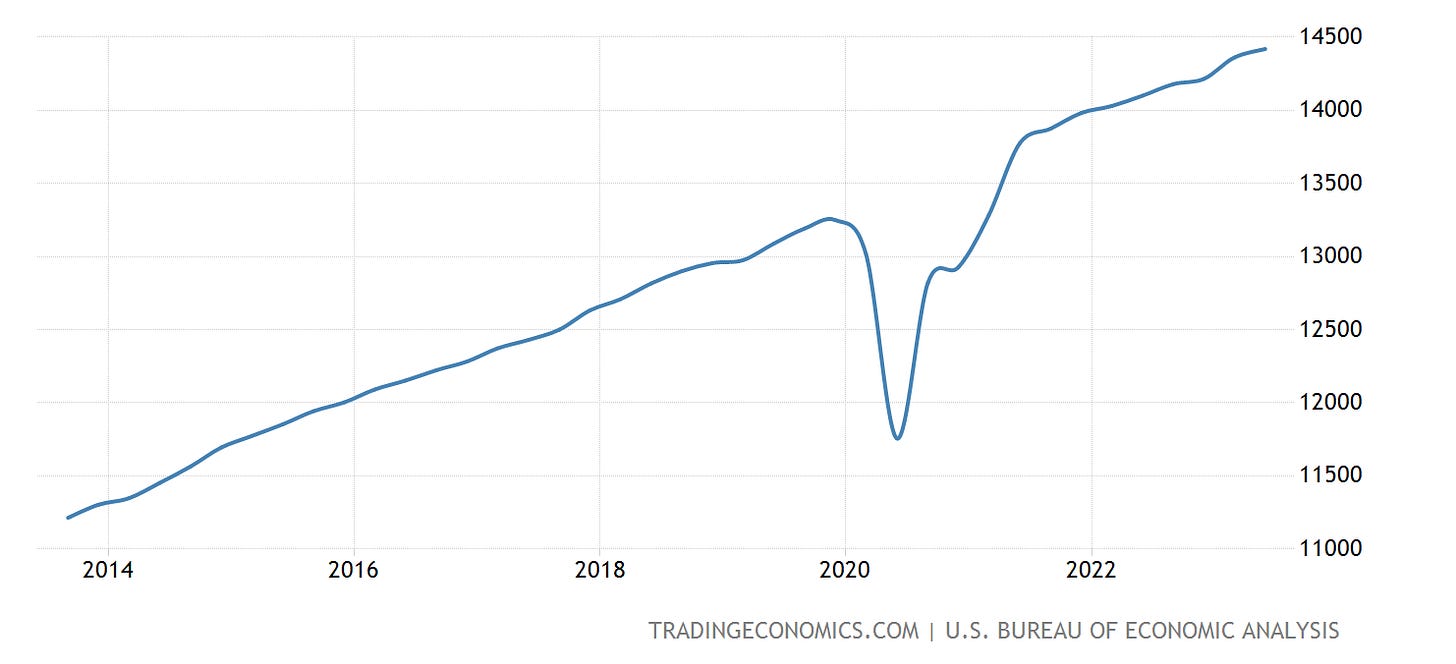

The chart below commits egregious Y-axis crime—starting at 11,000? come on!—but it’s helpful nonetheless. After a COVID dip in 2020, spending rebounded and has been rising steadily the past few years. The Y-axis is in billions here and data is quarterly, meaning that the chart ends at around ~$14.5 trillion in quarterly U.S. consumer spend.

A lot of headlines in the media tell the same story—that of the broke Millennial. But as Jean Twenge pointed out in The Atlantic recently, this narrative is wrong; Millennials are actually thriving.

It’s true that the 2008 Great Recession was hard on Millennials: by 2012, the median household income of 25-to-34-year-olds had dropped 13% from its peak in 2000. But the 2010s brought a strong rebound. By 2019, Millennial households were making more money than households headed by Boomers or Gen Xers at the same age. Data from the U.S. Census showed that the median Millennial household brought in $9,000 more a year than the median Gen X household at the same age, and $10,000 more than the median Boomer house at the same age (inflation-adjusted, in 2019 dollars).

Here’s how wealth looks by age for each generation—Millennials (and Gen Zs) are tracking closely to prior generations.

The kids are alright.

I would argue that in venture capital, we shouldn’t pay too much attention to short-term fluctuations in consumer spend. Early-stage startups are about the long-game, and consumer spend has historically climbed up-and-to-the-right. When you zoom out, that trajectory will continue.

Consumer Tech: The Data Doesn’t Lie

When it comes to technology, how do consumer startups compare to enterprise startups?

Kirsten Green and Jason Bornstein at Forerunner crunched the data for a good piece in The Information, and their findings were interesting. They analyzed over 12,000 venture-backed startups that have raised a Series B since 2010, categorizing the companies into consumer and enterprise. They found that consumer companies are more likely to go public if they’ve raised a Series B. And of the consumer companies that went public, 18.8% did an IPO at a valuation of more than $10B, nearly double the 9.6% rate for enterprise companies.

This makes sense when you think of the big names mentioned earlier—the Ubers and Airbnbs and DoorDashes of the world—and how massive consumer IPOs can be. There may be more B2B SaaS companies going public, in sheer numbers, but those outcomes are typically smaller.

I expect the next few years will yield more strong consumer outcomes. Take the example of Canva, which I’ve been thinking a lot about on the tail of last month’s Canva Create conference. Canva continues to fly under the radar, but the business actually generates more revenue than Figma, Miro, and Webflow combined. Canva does $2.3B per year in top-line, has 185M monthly users across 190 countries, and has been profitable every year for over seven years. Damn.

Yes, Canva straddles the lines between consumer and enterprise, but it has consumer DNA. The company is another reminder that consumer home runs can be huge. Add in companies like SHEIN, Revolut, Faire, Chime, and Discord, and it should be a strong next few years for consumer IPOs.

But what’s happening at the early stage? What will be the names we mention as IPO candidates in 5-10 years?

What to Watch: AI Applications

So far, most of the innovation in AI has taken place at the infrastructure layer. We’re still early days for applications. But that’s beginning to change, and now’s a compelling moment to build and invest in AI consumer apps.

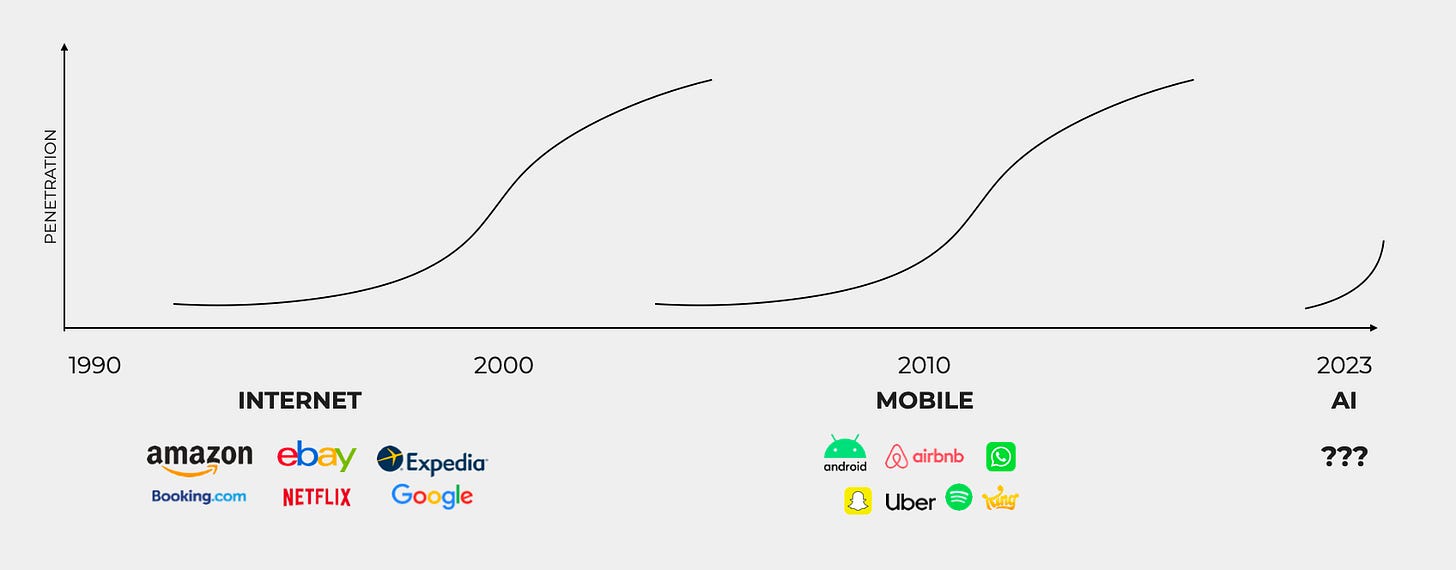

I’ve shared this visual many times on Digital Native—it’s part of the “why now” behind Daybreak—but it concisely captures why Seed is so attractive right now:

We’re seeing a lot of interesting companies emerge.

Amori is using LLMs to power AI matchmakers for dating. Can of Soup is building a new social network around AI-generated images. Suno just raised $125M for AI-generated music, and Perplexity is in talks to raise another $250M to take on Google in search.

One space I’m excited: AI-powered avatars.

Praktika offers language learning with real-time, smart avatars and has grown quickly to $20M in annualized revenue. In contrast to Duolingo’s text-based learning, Praktika offers human-like tutoring at a fraction of the cost. I’ve always been interested in language-learning marketplaces like Cambly and Preply. An estimated 1.5B people (!) are currently learning English. But the economics never quite made sense. English-language speakers are on average higher earners than English-language learners—how do the hourly rates for tutoring make sense? AI, of course, solves this problem by removing the human tutor from the equation.

I expect there are many more use cases for real-time AI avatars, beyond language learning.

In my mind, every major consumer internet incumbent is vulnerable. For example:

The main takeaway here—other than that startups need more transparent logos online—is that every incumbent becomes vulnerable at a moment of seismic technological change. AI rewrites the playbook, and established players face an Innovator’s Dilemma.

Some incumbents, of course, are less vulnerable than others—Instagram’s network effects, for instance, are incredibly strong, and that company is difficult to displace; and I don’t see Spotify losing its stranglehold on music distribution anytime soon (though there’s an opening for a music creation app, which is really where Suno, Udio, and others focus). But overall, I do expect we’ll see a major shake-up in consumer internet. Big technology shifts often lead to big changes in the dominant companies.

We’ve already seen big consumer AI wins. ChatGPT has powered OpenAI to a reported $2B in revenue. Midjourney, still bootstrapped, brought in over $200M last year.

In some ways, Midjourney is cut from the same cloth as Canva—a prosumer design tool used both by consumers and by workers within companies. Klarna’s founder tweeted last week that generative AI would save the company $10M in marketing this year. He wrote that Klarna is spending $6M less on producing images alone, generating 1,000 in-house images with AI tools like Midjourney, DALL-E, and Firefly. This has cut external marketing agency costs by 25%, and the in-house marketing team is half the size it was last year but producing more. (He later deleted the tweet, possibly because of backlash on how AI is changing the workforce.)

Stories like this will become the norm. Image and video models are improving rapidly, augmenting human teams. And as models improve, use cases will expand and quality of work will get better. Midjourney can now even produce iPhone-level images. The prompt for “iPhone photo of salmon nigiri” produces an incredibly high-fidelity generation:

So impressive compared to where Midjourney was 18 months ago.

And on video, companies like Captions continue to fly under the radar, but have rapid product velocity and are doing real revenue.

Finally, we’re just beginning to see the tsunami of AI agents. I liked this slide from Vinod Khosla’s TED Talk about the future of technology—a prediction that most consumer access of the internet will soon be done by agents that act on our behalf.

We’re early days for AI applications, and there’s a blue ocean opportunity for startups.

Next Week

In Part II next week, we’ll tackle #4-6. First, we’ll look at two more categories to watch with Shopping and Consumer Health—then, we’ll finish by analyzing what patterns in consumer spend can teach us about startup opportunities.

What to Watch: Shopping

What to Watch: Consumer Health

Rule of Thumb: Follow the Spend

In the meantime, hope to see you at the NYC event on Tuesday. Until next week 👋

Sources & Additional Reading

Consumer Startups Analysis | Kirsten Green & Jason Bornstein for The Information

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: