The Future of Creator Commerce

How Flagship Turns Creators Into 21st-Century Retailers

Weekly writing about how technology shapes humanity, and vice versa. If you haven’t subscribed, join 45,000+ weekly readers by subscribing here:

The Future of Creator Commerce

I’ve been writing Digital Native for over three years now, putting out ~150 pieces every Wednesday morning (with the occasional Thursday when things get hectic 🤷♂️).

Many of those pieces are high-level, analyzing tectonic shifts in technology and consumer behavior. One of my favorite parts about being an early-stage venture investor is being able to act as an anthropologist of sorts—getting to study human behavior and form a point of view on how those behaviors influence next-generation technology products.

But at the end of the day, venture is about having conviction—conviction in an entrepreneur, in an idea, and in a company’s potential be an iconic, generational technology company. While many of my pieces take the 10,000-foot view, making investments requires being granular, choosing the company that fits a thesis and is the one to back. In this week’s piece, I’ll be focusing on one company. I’ll explore how those zoomed-out tectonic shifts apply to a specific investment thesis.

The company is Flagship, a company I work closely with as an investor (Index and Sequoia co-led the Seed round) and a company that opened to the public this week. Flagship is building the infrastructure for creator commerce. Let’s unpack what that means.

Setting the Stage

When I think of 20th-century retail, I think of Nordstrom and Macy’s and Kohl’s. Want a new sweater? Check out Macy’s. Need a TV? Head to Best Buy. Gardening supplies? Home Depot is your best bet. Retailers aggregated brands to make things easier on consumers. Shopping malls then aggregated retailers to create the ultimate hubs of commerce.

But who are 21st-century aggregators of products? Creators. People who have cultivated large online communities, built parasocial relationships at scale, and earned the trust of their followers. We’ve seen the rise of celebrity brands—SKIMS and Fenty, Chamberlain Coffee and Casamigos. But most creators aren’t necessarily great brand founders. Most creators, rather, excel at curation. They’re tastemakers. They’ve earned the trust of a large community, yet they aren’t able to effectively monetize that community.

For a long time, I’d been searching for a company that reinvents modern retail by leveraging creators. That company would have to solve specific problems for three major constituents: the creator, the brand, and the consumer.

The Creator Side

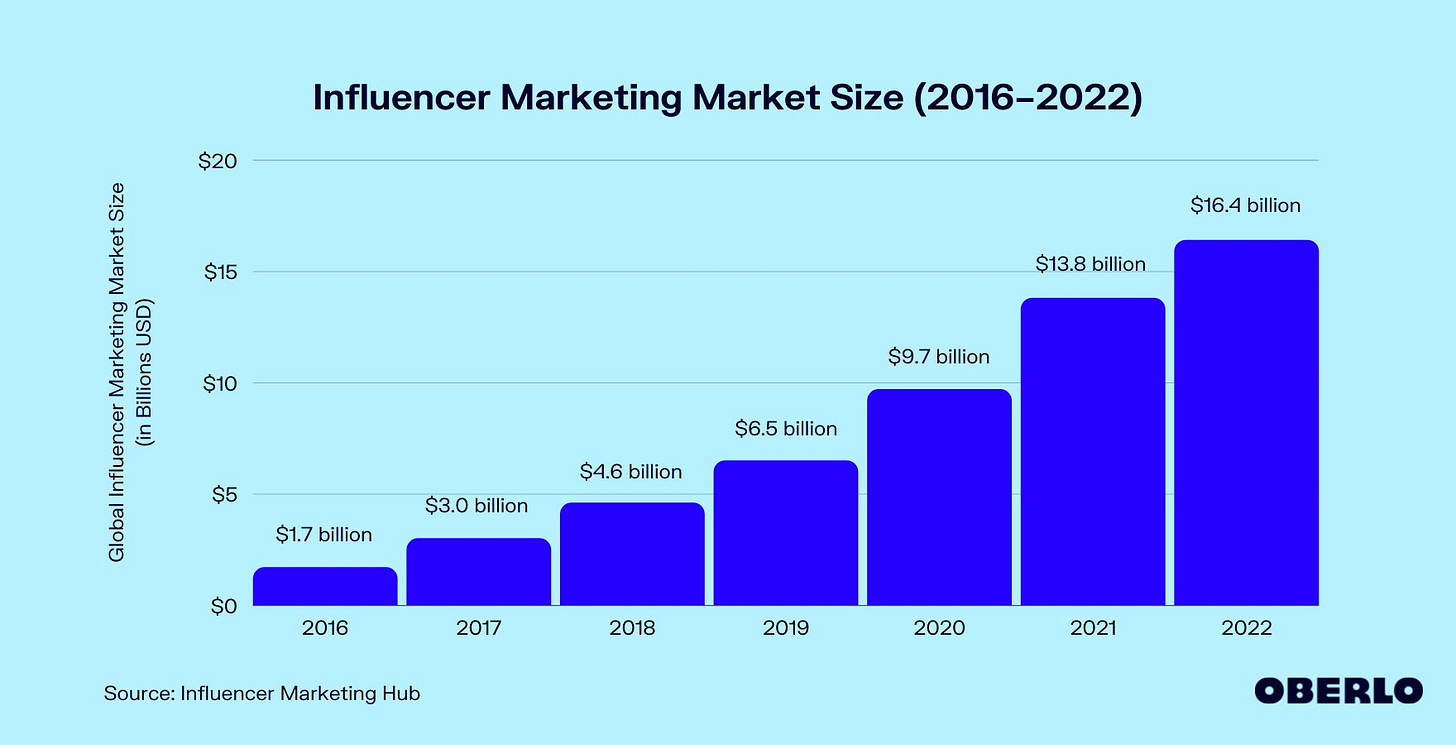

Influencer marketing has swelled from $1.7 billion industry in 2016 to $16.4 billion in 2022 (a 46% CAGR).

But influencer marketing is broken. As I wrote in May 2022’s Influencer Marketing 2.0, most influencer campaigns rely on hefty upfront payments and use hacks like discount codes to track attribution. ROI is often poor, and measurement is even worse. The channel is difficult to scale efficiently.

From the creator perspective, influencer deals are clunky, unreliable, and tough to manage. Many are one-off. What’s more, in this macro environment, many sponsorships are drying up altogether.

Creators are asking, what’s a scalable way for me to earn a living?

The Brand Side

At the same time, the brand side of the equation is also broken.

Brands are facing rising customer acquisition costs. Part of this is simple supply and demand: even digital real estate is finite, and there’s only so much space on Google, Meta, and Amazon. Those three companies form a triopoly in online advertising, vacuuming up 65% of the U.S. market (26.4% for Google, 24.1% for Meta, and 14.6% for Amazon). Things are getting crowded.

Apple’s App Tracking Transparency (ATT) changes, meanwhile, dealt another blow. ATT is Apple’s opt-in privacy framework that requires all iOS apps to ask users for permission to share their data. Spoiler alert: many people do not opt in. Meta estimates that it will lose $10 billion in ad sales revenue (about 8% of its annual revenue) because of ATT.

I’ve heard from friends in the industry that social advertising CACs have risen 50%, and return on ad spend (ROAS) has declined from 3 to 2 ($2 revenue for every $1 spent on advertising). The older CAC playbook—turn on Facebook Ad Manager, spin up SEO/SEM, sprinkle in some influencer campaigns—doesn’t cut it anymore.

Brands are desperate for a new customer acquisition channel.

The Consumer Side

In the 21st century, e-commerce has ballooned to a $6 trillion global market. But online shopping is primarily search-driven: you go to Amazon and search for paper towels. When a Prime member visits Amazon.com, they end up buying something 74% of the time. E-commerce is built around utility. No one, meanwhile, has really figured out discovery-driven commerce online—a way of recreating the browsing, serendipity-fueled experience of 20th-century shopping.

Consumers want a better way to discover products. Many already do so through creators, but the experience is poor: consumers wade through a labyrinth of affiliate links, discount codes, and #sponsored hashtags to finally get to the checkout point. Consumers want a better way to shop.

Enter: Flagship

I first met the Flagship team before they had a name or a set business model; they were early days, but passionate about solving the problems outlined above. The team had experienced those problems firsthand, building commerce and creator products at Instagram and YouTube.

What Youssef, Khalil, and Juhana workshopped was a business model that would align incentives for everyone involved. Creators would benefit from a sustainable income stream—they could themselves become entrepreneurs. Brands would get a new customer acquisition channel, with better measurement and efficiency than the atrophying channels of yesteryear. And consumers would enjoy a new infrastructure for discovery-driven shopping—a way to marry the serendipity of offline shopping with the online tastemakers consumers had learned to trust.

The business model was elegant. From the investor perspective, I ask myself: if this works, is this a business that could become a generational, multi-billion-dollar company? Early-stage investing is a power law business, and this industry is built on optimism; as investors, we have to ask, “What can go right?” My view was that Flagship had the potential to reinvent how we shop.

In short, Flagship is a marketplace between creators and brands that allows anyone to launch an online boutique. I’ve written many times about the rise of the digitally-native job—new, internet-born careers that are uniquely possible because of an underlying technology platform. We’ve seen many such jobs emerge over the past decade: Roblox developer; Etsy merchant; TikTok creator; Whatnot seller. Flagship underpins a new job: that of the Flagship boutique storeowner. That job is a 21st-century iteration of the 20th-century brick-and-mortar shopkeep—the small business you and I walk past Main Street.

Flagship is best illustrated with a tangible example.

Julia Dzafic started the Lemon Stripes blog 13 years ago to share recipes, products, and lifestyle content with her friends. A few years later, seeing the success of her blog, Julia tried to build her own store, the Lemon Stripes Market, for her community to shop her favorite products. But she realized that running her own store was taxing and cumbersome; she found herself carrying packages out of her apartment in Manhattan and manually tracking inventory.

Julia now re-launched Lemon Stripes Market on Flagship, featuring her favorite products. As a mom of two, much of her store focuses on products for kids and things you’d want in a toddler-centric household. Flagship abstracts away the complexities of running a shop, handling headaches like fulfillment, returns, and customer service.

For creators, getting started is simple: Flagship has an AI engine that uses a creator’s digital footprint to generate an online storefront that matches their visual identity.

Creators then browse brands and choose specific products they want to showcase in their store. Today, Flagship gives creators access to a catalog of over 100 brands and 25,000 products, including brands like Caraway, Boll & Branch, and MM LaFleur.

With each brand, creators agree with the brand on a commission rate and then earn that cut (for example, 20% or 30%) of every product bought on their store. Over time, as products sell, Flagship leverages data from the creator’s store to recommend new brands and products to the creator, thereby increasing revenue.

On Tuesday this week, Flagship launched to the public. Any creator can sign up—here’s the launch video:

You can see here examples of boutique stores built on Flagship—Gee Thanks, Just Bought It from Caroline Moss; Lemon Stripes from Julia Dzafic; and 9to5chic from Anh Sundstrom:

Flagship is unique in how it solves problems for the creator, the brand, and the consumer. Those three pieces formed the foundations for the investment thesis:

Creators have tremendous influence, but few ways to monetize that influence. There has to be a better solution than sponsored posts; influencer marketing is ready for its next era.

It’s never been harder for a brand to acquire customers. CAC headwinds are severe, and now’s the time that brands are looking for new channels.

Consumers want a serendipitous online shopping experience. There’s a massive opportunity in the discovery-driven side of commerce.

These three pieces combine with a team that has clear “founder-market fit” (having worked directly on creator and commerce products at large social platforms) and a team that’s driven by the vision of allowing anyone to be a small-business owner. There’s a long road ahead, but Flagship’s public launch this week, that vision is beginning to be realized.

Final Thoughts

Flagship builds on many of the themes and topics I often write about in Digital Native: marketplaces (The Rise of B2B Marketplaces); shifts in commerce (The Retail Revolution); Gen Z seeking more autonomous forms of work (What Gen Z Thinks About Work, College, and the Internet).

Last week’s piece was high-level, focusing on big shifts happening in technology: the march toward more immersive 3D content; the gamification of every product; and technology opening the floodgates of content production.

This piece is the opposite: it’s about the nitty-gritty of innovation happening in real time. What’s cool about the startup world is how it distills those big-picture, broad changes into day-by-day, tactical manifestation—one Lego block at a time.

In the future, I’ll aim to mix in pieces about specific companies with pieces about large-scale shifts. Every once in a while, it’s good to ground those shifts in a snapshot of the companies that are riding them and accelerating them.

If you’re a brand or creator, you can join Flagship here:

Brands can email brands@flagship.shop 📬

Creators can email creators@flagship.shop 📬

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: