The Glass-Half-Full View of Technology

Startups Tackling Climate, Education, Healthcare, Fintech, and Childcare

This is a weekly newsletter about how tech and culture intersect. To receive Digital Native in your inbox each week, subscribe here:

The Glass-Half-Full View of Technology

Tech has had a rough couple of years in the media. Amidst (often warranted) public scrutiny on regulation, anti-trust, and fake news, it’s hard to remember the good that tech does. But I’m an unapologetic tech optimist, and I get excited by the ways technology companies are making the world better.

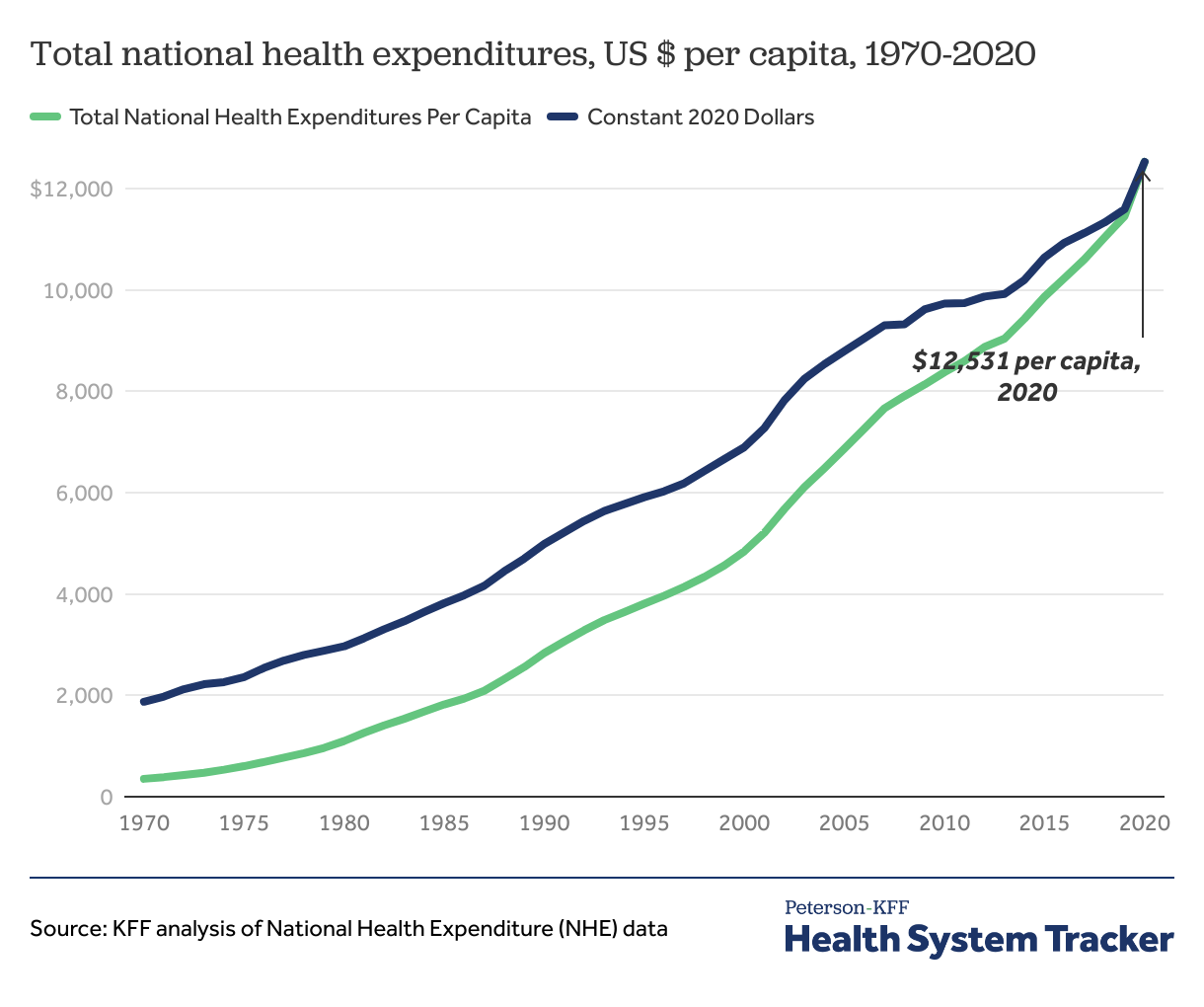

That said, tech’s impact is admittedly uneven. Take a look at price changes in the U.S. over the past 20 years.

If you bought a flatscreen TV in 2000, it would’ve cost you $5,000. If you go to Best Buy today to buy that same TV, you can get it for $75. That’s a 98.5% drop in price. Yet a college graduate in 2000 paid $50K for her four-year degree at a public university; today, she has to shell out $100K (and $170K+ if she’s out-of-state).

But this means that there remains enormous opportunity to channel tech’s potential into the right places. And there are hundreds of startups and entrepreneurs doing just that. This week, I’m going to look at five “impactful” sectors and a few companies building in each. This isn’t meant to be comprehensive, but rather to highlight 1-3 tangible examples of how startups can have meaningful impact.

I’ll tackle:

🌱 Climate

🍎 Education

💊 Healthcare

💰 Fintech

🍼 Childcare

Let’s jump in.

🌱 Climate

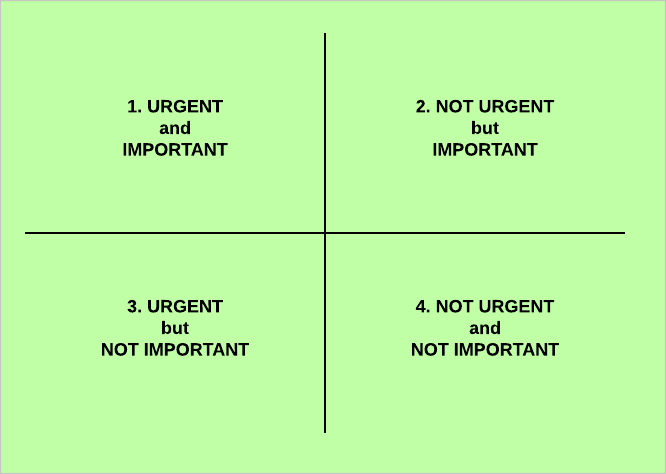

When I think of climate change, I think of the Eisenhower Matrix. In a 1954 speech, President Eisenhower said, “I have two kinds of problems, the urgent and the important. The urgent are not important, and the important are never urgent.” Thus was born the Eisenhower Matrix, a staple of workplace task management.

The problem with climate change is that it’s incredibly important, but doesn’t seem urgent; its effects are felt gradually, escalating steadily over time. Climate change deceives us into thinking it fits in Quadrant 2, when really it belongs squarely in Quadrant 1. Meanwhile, we’re distracted by important and more obviously-urgent events like the COVID-19 pandemic or the Ukraine-Russia conflict. During the first few months of the pandemic, for instance, media mentions of “climate change” fell precipitously.

But climate change is arguably the defining story of our generation, and the sector remains a massive and overlooked opportunity for startup innovation and venture capital investment.

Take the carbon management space. Businesses are facing pressure to reduce their carbon footprints from all sides—1) from regulators, 2) from employees, and 3) from customers. Europe is leading the way here, but the U.S. isn’t far behind. Within a few years, I expect all businesses will be required to report and reduce their footprints.

I think of the carbon management space in two broad buckets:

First comes carbon accounting. This is how an organization gets a sense of its carbon footprint, involving reporting and measurement.

The question to answer here is: What is my carbon footprint?

Next comes carbon markets. This is how an organization—now armed with data around its carbon footprint—manages and reduces that footprint.

The question to answer here is: What can I do about my footprint?

Last week, I wrote about Patch’s marketplace, which fits into bucket #2. Patch lets companies connect with supply-side projects to purchase carbon offsets. Another company in this bucket is Sylvera, a company we work with at Index, which rates the quality of those projects. You can think of Sylvera as the S&P / Fitch / Moody’s of the carbon ratings world. Voluntary carbon offset markets grew ~60% last year, and demand for carbon credits is expected to increase by a factor of 15x by 2030 and by a factor of 100x by 2050.

Watershed is an example of a startup that falls more into the first bucket, carbon accounting. Watershed helps companies like Airbnb, Shopify, and Sweetgreen measure and report their carbon footprint. (Watershed is also helping companies reduce their footprint, though the business started more squarely in the carbon accounting space.)

Pressure and scrutiny—from governments, workers, and customers—will only increase over the coming years. In order to meet the goals set in the Paris Climate Accords, the private sector—and technology businesses in particular—will need to create new ways to track, reduce, and offset carbon emissions.

🏡 Bonus: Housing

Adjacent to climate change is housing, another sector in the chart above that’s appreciated dramatically in price. House prices are becoming inextricably tied to climate change risk, and there are innovative startups building at the intersection of climate and housing:

Homebound, for instance, is a one-stop-shop for homebuilding. Homebound’s co-founders started Homebound to help their Santa Rosa community recover from the wildfires of 2017. Now, Homebound works with anyone to simplify homebuilding.

Firemaps, meanwhile, focuses on wildfire defense for homes. Using Firemaps, anyone can prepare for wildfire season by fireproofing and insuring their home.

🍎 Education

The cost of education is growing 8x faster than real wages and Americans collectively hold $1.5 trillion in student debt. As a $1.6 trillion market in the U.S. ($4.7 trillion globally) and the nation’s 2nd-largest sector by employment (behind only healthcare), education is an attractive space for entrepreneurs. The sector is ripe for reinvention.

I wrote about innovation in education in November 2020’s How Technology and COVID-19 Are Reinventing Education. As we (finally) emerge from the pandemic, we’re beginning to see new behaviors and structures calcify.

First, education has undergone a step change in digitization. Teachers and students are more comfortable with remote and hybrid learning formats, and more open to leveraging tech tools for learning. Everyone realizes that technology—when thoughtfully deployed—can augment the learning experience.

Take Paper, a startup that partners with schools to offer scalable and personalized tutoring to students. Teachers can use Paper to amplify what they’ve taught in class, tracking learning gaps and better allocating instructional time.

Another accelerating trend is what I call the shift from education to learning. “Education” connotes one-time consumption. You get your education, and then you graduate into the working world. Check ✅ “Learning” (in my mind) connotes something more—an ongoing, never-ending process of accumulating knowledge and mastering skills.

Education was a fit for an industrial world, when learning a trade was enough to last you through your career; this gave us our modern education system, in which you consume education as a lump-sum in your first ~20 years of life. But this structure is no longer a fit for a world being rapidly reinvented and automated by technology.

Today’s world requires more lifelong learning: the average worker might reinvent herself 3, 4, 5 times. Early years of education might focus on more horizontal, foundational skills—learning how to learn. Later years might be more job-specific, keeping up with the labor market’s pace of change. Many careers haven’t been invented yet: 85% of today’s college students will have jobs in 11 years that don’t currently exist.

There are a number of innovative startups shaking up how we learn. Outlier, for instance, lets students earn college credits by taking cinematic online courses taught my leading professors. Guild, meanwhile, works with companies like Chipotle, Disney, and Walmart to offer low-skilled workers education-as-a-benefit. (The companies benefit from better employee retention.)

One of the most interesting companies is Reforge. Reforge is reinventing skills-based, job-relevant learning with a scalable and community-centric format. With Reforge, you can take courses like: Data for Product Managers, Growth Marketing, and Monetization + Strategy. Each course is taught by experienced leaders from the field:

Reforge uses a clever model of low-cost, evergreen production to scale its courses and better leverage its experts. The goal is to tap into the latent knowledge that all knowledge workers have—the “expert economy”—and channel that knowledge into training the next generation of workers. Rather than education being about degrees and signaling, it becomes about tangible skills.

This is the future of education: more digitized, tech-enabled classrooms, and more lifelong and scalable job-specific learning. COVID was an inflection point, but the real catalysts are the pace of change in the job market and the stale lethargy of the modern education system.

💊 Healthcare

Healthcare in the U.S. is broken. First, it’s hard to access. Then, when you can access it, it’s hard to afford. And if you can afford it, it often isn’t pleasant; economic incentives aren’t aligned for practitioners to prioritize customer experience.

The best digital health companies make healthcare 1) more accessible, 2) more affordable, and 3) more pleasant. We see this in DTC healthcare companies like Ro, Hims, and Nurx; in new models of care like Maven, One Medical, and Tia; and in better patient experience management with companies like Cedar, Alan, and Oscar.

One space that I find particularly fascinating is mental health. Mental health is unique in that it sits at the intersection of structural changes (becoming more accessible, with telehealth, and more affordable, with insurance coverage), and a massive shift in consumer behavior. Younger generations are more candid about mental health and more open to therapy than those before them.

I’m a huge believer in therapy—I think everyone should go to therapy (who wouldn’t want to talk about themself for an hour every week?), and I admire when leadership figures are candid about going to therapy—many of the best entrepreneurs I know have therapy publicly viewable on their work calendars.

The best startups in the space make therapy easier, faster, and more cost-efficient. Headway, for example, is a marketplace connecting patients and therapists. You can quickly find a therapist in your area and in your network, and then schedule a virtual or in-person visit.

Regulation is slow-moving and state-by-state, and therapy will remain too inaccessible and unaffordable for much of this decade. But eventually, the tide will turn—regulatory changes will collide with behavior changes, and mental healthcare will be destigmatized and widespread. Technology will underpin this shift.

💰 Fintech

Last fall, I used the example of Squid Game to examine consumer fintech. On the surface, Squid Game is a bloody, Hunger Games-style thriller. But on a deeper level, the show is a dark and biting social satire—a commentary on income inequality.

Squid Game paints a picture of an exploitative financial system. And while Squid Game takes place in Korea, it could just as well take place in the U.S. A few examples of America’s broken financial system:

25% of the population is unbanked or underbanked.

A survey from the Federal Reserve revealed that 50% of Americans would struggle to pay a $400 emergency expense; 19% wouldn’t be able to come up with the money at all.

The average borrower now takes 20 years—20 years—to pay off a college student loan.

Only about 1 in 2 Americans has any exposure to the stock market, and that exposure is stratified by income: only 15% of families in the bottom 20% of income earners hold stock, while 92% of families in the top 10% of the income distribution own stock. The top 10% of income earners own 10 times as much of the stock market as the bottom 60%.

America’s middle class has all but disappeared: 87% percent of U.S. adults have less than $10,000 to their name.

The consumer fintech movement is a reaction to this reality. The neobank movement, for instance, has popularized no-fee banking. The term “neobank” was popularized around 2017 and encompasses digital banks like Monzo, Varo, and Current. In 2021, 30 million Americans have accounts with neobanks; by 2025, this will swell to 54 million.

At its best, technology can make financial services more accessible and affordable. I’ve written in the past about startups leading the way in banking (Chime, Greenlight, Step) and investing (Titan, Acorns, Stonks). To give another example, take Mos.

Mos offers banking for students, helping young people start their financial lives on the right foot—reducing student debt, avoiding banking fees, and getting personalized advice from a financial advisor. For instance, Mos has helped 400K+ students save a collective $1.5 billion on college tuition by connecting students with scholarships and hard-to-find government aid.

Mos was founded by Amira Yahyaoui, a force-of-nature human rights activist who was a key player in the Arab Spring. Mos and Amira are showing that fintech can go mainstream when products are built with accessibility, affordability, and ease-of-use in mind.

🍼 Childcare

Childcare—which is provided by or subsidized by the government in many countries—is prohibitively expensive for many Americans.

Helen Mayer was the mother to two 16-month-old twins when the pandemic hit. She lost her job, but then found another one—except that she couldn’t take the job, because she couldn’t afford childcare. Mayer realized she wasn’t alone: the National Women’s Law Center estimates that two million women were forced to leave their jobs during the pandemic because they lacked childcare.

This realization was the genesis of Otter, a marketplace Mayer started to match stay-at-home parents with parents who need childcare. One day, you might be off work and free to supervise the neighbor’s kids; the next day, you might need to rely on your neighbor to watch yours. Otter will (hopefully) defray the costs of childcare for millions of Americans, while providing a new source of income for others.

Final Thoughts

Technology, startups, and venture capital dollars aren’t panaceas. We still need thoughtful government regulation and substantial public investment. But at its best, the private sector can augment the public sector—or (too often) fill in the gaps where the public sector is lacking. Capitalism, when channeled productively, is a powerful mechanism for creating impact at scale.

There’s still a lot of work to be done—the companies mentioned here will only make a dent in many of the systemic issues we’re facing. But they’re a start, and I’m energized by the enthusiasm, vision, and ambition of a new generation of entrepreneurs.

Related Digital Native Pieces

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: