The Retail Revolution (Part 2/2) 🛍

From AI to Roblox to Sustainability, 10 Forces Changing Commerce

Weekly writing exploring how technology and humanity collide. If you haven’t subscribed, join 40,000 weekly readers by subscribing here:

The Retail Revolution (Part 2/2) 🛍

It’s no secret that I adore Taylor Swift. She’s the songwriter of our generation (I’m willing to debate anyone on this), and one of my greatest skills is that I can apply a Taylor Swift lyric to anything. A piece about how retail is changing in the digital age? No problem. From the song “Coney Island”:

We were like the mall before the internet

It was the one place to be

In the late 20th century, the mall was, indeed, the place to be.

Malls are a relatively recent creation. The first shopping mall sprung up in Missouri in 1922. With car production booming, malls were a convenient way to cluster a consumer’s shopping needs in one geographic location. In 1931, a mall in Texas had the idea to make stores face inwards, away from the street; this was the birth of the modern mall layout. The 1940s brought the rise of the suburban mall, and the 1950s saw malls tap department stores as “anchor tenants” surrounded by clusters of smaller retailers.

Malls soared throughout the late 1900s and into the early 2000s. That growth lasted until the financial crisis: 2007 was the first year that a new mall wasn’t built in the U.S. since the 1950s, and over 400 malls closed between 2007 and 2009. The recession, combined with the boom in e-commerce, spelled the end of the shopping mall’s heyday.

In my formative years, the mall was still the place to be. Food courts were the nuclei of middle school socializing. I went on my first date was to the Park Place Mall in Tucson, AZ (we each got rubbery slices of Sbarro). The “cool” stores were Hot Topic and Zumiez, Aeropostale and American Eagle, Billabong and PacSun.

PacSun provides an interesting case study of retail in the 2000s vs. retail today. PacSun had a big 2022 in part due to its investment in PacWorld, an expansive virtual world in Roblox. Roblox users could shop at PacSun through their blocky avatars. Last week, PacSun doubled down with its “Los Angeles Tycoon” world that lets Roblox users design LA neighborhoods, unlock dedicated pieces of a PacSun store, and wear 20 new digital items inspired by the brand’s Spring 2023 collection.

PacSun has adopted a “digital-first strategy,” in the words of its CEO, resulting in +30% sales growth over the past two years. The company’s reinvention captures how commerce has evolved from the shopping mall days to the internet-fueled modern era.

Technology is reinventing commerce. Last week, in Part 1, I looked at five forces shaping retail, from TikTok to CACs to celebrity brands. This week covers #6 through #10:

AI 🤝 Retail

Immersive Shopping

B2B Commerce Makes Life Easier

Sustainable Commerce

Don’t Discount Discounters

Let’s dive in.

6) AI 🤝 Retail

There are about 12 million items in Amazon’s inventory. If you expand that to include Amazon Marketplace’s third-party sellers, the number swells to about 550 million. Sifting through millions of products is already a challenge, made even more difficult by the various incentives at play. Brands, for their part, vie for paid placement at the top of search listings. Amazon, meanwhile, promotes its own private-label products: the company now has 118 distinct private-label brands, many carrying the Amazon name (Amazon Basics was the first private label, launched in 2009) and others operating in disguise (Solimo home products, Goodthreads clothing, Happy Belly snacks).

A search for “paper towels” yields four sponsored results (three from Bounty), followed by results from two Amazon private-label brands—Amazon Basics and Presto!

Amazon is famously customer-obsessed, but its shopping experience is deteriorating. That decline will only continue, as Amazon seeks to earn more from private labels: private-label brands typically have 25-30% higher profit margins. Amazon only gets about 3% of its sales from private labels today, compared to 59% for Trader Joe’s and 30% for Costco (Kirkland Signature is Costco’s private label). Target, for its part, owns 12 brands each worth $1B or more.

The bottom-line is: online shopping means sorting through a glut of products to figure out what’s actually good. This isn’t only a problem on Amazon; there are over 6.3 million Shopify Plus stores on Shopify. Consumers are tasked with extensive research on quality, price, and convenience.

So how does a consumer wade through mountains of stuff? With the help of AI-powered tools.

Vetted, a company we work with at Index, is an AI-driven product search engine. In the words of co-founder Stuart Kearney: “We founded Vetted because we felt that shopping online has become an overwhelming and frankly anti-consumer experience. People shouldn’t have to spend hours sifting through indistinguishable products littered across thousands of ad-infested sites loaded with fake reviews and unreliable information.”

Vetted is available on web or as a browser extension, culling information from reviews across Wirecutter, Reddit, YouTube, and other sites. The goal is to help shoppers make better and faster buying decisions.

We’re also seeing machine learning power discovery-driven shopping. Just as TikTok has infiltrated U.S. media, SHEIN has infiltrated U.S. fast fashion:

Here’s another view, comparing SHEIN to H&M and Zara sales:

SHEIN’s explosion is nothing short of remarkable: SHEIN has grown over 100% every year for eight straight years (!), and its latest private market valuation makes it worth more than Zara and H&M combined. Last June, SHEIN dethroned Amazon as the No. 1 shopping app in the iOS and Android app stores.

SHEIN’s velocity is something to behold: 2,000+ new items are added to SHEIN every day, while Zara adds 500 every week. SHEIN is basically an internet-native reincarnation of Zara and H&M, leveraging better technology to squeeze three week design-to-production timelines into three days. SHEIN combs competitor’s websites and Google Trends to figure out what’s in style, then creates designs quickly, forecasts demand, and adjusts inventory in real-time.

To bring us back to AI, one aspect of SHEIN that’s impressed me is its recommendations. Just as Bytedance anticipates the content you’ll want to watch, SHEIN anticipates the clothes you’ll want to buy. SHEIN is to commerce what Bytedance is to content. In The TikTokization of Everything, I wrote about how SHEIN is able to anticipate my needs and wants, based on limited data. From that piece:

Though Stitch Fix is now struggling, it was on to something groundbreaking—personalized commerce. The company just arrived at the concept a few years too early, when AI wasn’t yet sophisticated enough to take the place of a lengthy questionnaire and small army of data scientists. SHEIN is a step in the right direction, but we’re still only at the cusp of AI-driven recommendations.

Imagine a company that combs your camera roll and—with stunning accuracy—recommends a new wardrobe for you. Or the company simply asks you to link your Instagram account, and then it digests every like and follow you’ve ever made to deliver incredibly accurate, incredibly personalized fashion recommendations.

AI will continue to reinvent product recommendations, taking the onus off the consumer.

One final area for reinvention with AI: customized product design. Last week, I wrote about how Nike (always at the forefront of the industry) allows shoppers to design their own sneakers online and pick up in-store. That design process, though, is clunky and limited—I can tweak some colors and add my name, sure, but that’s about it.

What about when generative AI plays a part? I’ll be able to enter the text prompt “bright orange high-tops emblazoned with the swoosh and ‘REX’ on the back” and get a custom-made shoe in seconds. Everyone will become a product designer, unlocking new levels of personalization.

7) Immersive Shopping

Talking to Gen Zs, it’s clear that Millennial-era brands are back in vogue. We already covered PacSun, but J. Crew and Abercrombie & Fitch are also back with a vengeance. Some comebacks are the result of new leadership (creative director Olympia Gayot has injected new energy into J. Crew) and others are the result of ditching outdated and exclusionary norms (Abercrombie announced it would stop “sexualized marketing” and expand its sizes to include XL and XXL).

But many brands are “cool” again because they’re meeting young people where they are. PacSun’s Roblox world is one example. Nike, which consistently tops Gen Z rankings of favorite brands—20% of Gen Zs say it’s their favorite, well-ahead of #2 Apple (8.5%) and #3 Adidas (8%)—also has an expansive virtual world in Roblox, Nikeland. Players can outfit their avatars in Nike gear, unlock sports superpowers, and play soccer and basketball in Nike stadiums.

This strategy is savvy. Roblox users skew young—about 50% are 12 or under—and users spend a lot of time in Roblox: a recent Qustodio study made headlines for showing how TikTok is running circles around YouTube in daily engagement (113 minutes per day vs. 77 minutes per day, for daily actives), but Roblox trumps them both at a staggering 190 minutes per day, up 90% since 2020.

Brand presence in Roblox speaks to an interesting trend: more immersive digital shopping experiences. How do brands recreate the richness of offline shopping in an online realm?

We’ve seen Whatnot do so with livestreaming, leaning on charismatic sellers pushing product in real time. CommentSold has taken a similar tack, with far less fanfare, becoming one of the fastest companies to hit $1B in GMV by allowing sellers to simulcast across their websites, Facebook Live, Instagram Live, and TikTok Live. And newer startups like Showday let brands create interactive shoppable videos on their websites, either live or prerecorded.

Young consumers are early adopters of more immersive commerce: 47% of U.S. consumers who made livestream purchases last year were members of Gen Z. And while brands launch virtual worlds in platforms like Roblox, Minecraft, and Fortnite, those platforms themselves operate robust, immersive digital economies. Players spend billions of dollars a year on digital clothing and accessories using Robux, Minecoins, and V-Bucks.

I often think of social media as a march toward progressively richer media formats: Twitter (text) to Instagram (photos) to TikTok (videos). Commerce may follow a similar pattern, as innovative new products bring the richness of the analog world to online shopping.

8) B2B Commerce Makes Life Easier

The consumer-facing shopping experience has come a long way in the past few years. It’s hard for me to remember the last time I didn’t check out with Apple Pay. Business-to-business, meanwhile, lags far behind. Only about 5-10% of B2B transactions happen online and—in the year 2023!—about 50% of transactions are still done over the phone, over fax, or via in-person meetings with sales reps. The entire B2B ecosystem is inefficient, opaque, and convoluted.

In The $100 Trillion Opportunity in Marketplaces last fall, I wrote about how this is changing. The main example in that piece was Faire, which operates a wholesale marketplace between retailers and independent brands. Every year, U.S. consumers spend about $3.5 trillion. Independent retailers—small businesses with only a handful of employees and often just a single location—make up $750 billion of that spend, or about 25%. Faire digitizes that portion of retail.

There are many other examples of B2B innovation. Mable operates a similar model to Faire for specialty grocery. Fleek offers a B2B marketplace for vintage wholesalers, a fast-growing category. And Pepper, a company we work with at Index, digitizes how restaurants interface with their inventory suppliers, like providers of ingredients, utensils, and packaging. What was once a massive headache becomes fast and simple.

As my partner Damir puts it, “While the frontend of the restaurant is benefiting from technology, the backend has not received the same attention.” That trend is true across commerce: B2B innovation lags B2C innovation (the problems are less obvious), but B2B is often an even bigger prize. A new generation of startups aim to bring B2B spend and manual workflows into the 21st century.

9) Sustainable Commerce

Simply put, retail is bad for the environment. Retailers are responsible for about 25% of global carbon emissions. Scientists estimate that, globally, 35% of the microplastics found in oceans can be traced to textiles. Going back to the SHEIN example earlier, 95.2% of SHEIN clothing contains new microplastics.

The good news is that, 1) consumers are waking up to the problem, and 2) they’re pressuring brands to clean up their acts. The shift to more sustainable commerce—arguably the biggest retail shift of this generation—can be seen across various sub-sectors of commerce.

Secondhand is an obvious one, as consumers look to buy used and to recycle products. Resale is a $40B market expected to double to ~$80B by 2025 and to triple to ~$120B by 2030. By 2030, the secondhand fashion industry will be nearly twice the size of the fast fashion industry. On the B2C side, marketplaces like Depop and Vinted ride this tailwind. On the B2B side, companies like Archive and Reflaunt power resale for brands. In my mind, resale is still relatively unsolved by software; there’s a lot of work to be done to unlock supply, which is a thorny problem.

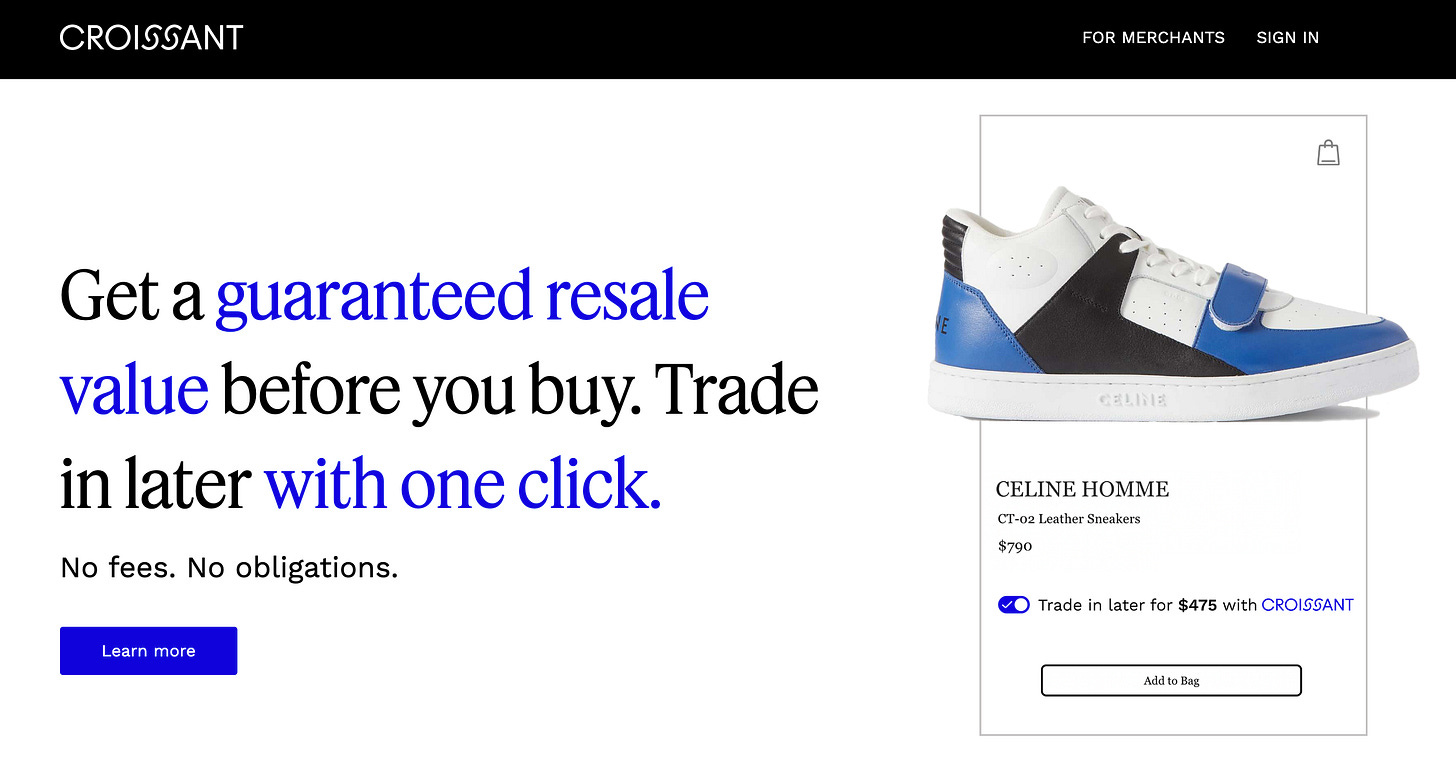

One interesting new area is recommerce at checkout. Naturally, consumers are more likely to convert (and spend more) if they know the estimated resale value of the item they’re buying. If this flow can also lessen the future logistics burden of resale (pulling in product details, for example), it can unlock latent supply. Examples here are AirRobe and Croissant.

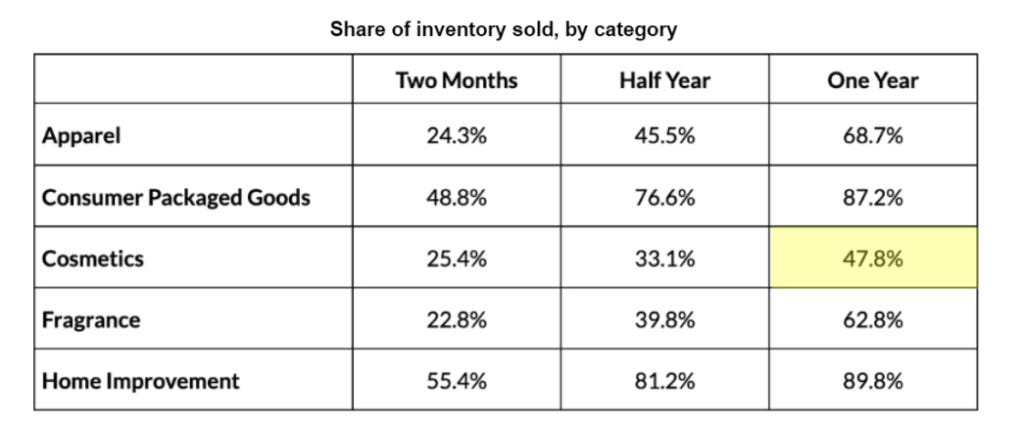

Another sub-sector within sustainable commerce is managing excess inventory. Brands overproduce more than $500B of goods annually. I like this chart from USV’s Hannah Murdoch and Rebecca Kaden, which shows that in some categories, like cosmetics, less than half of inventory is sold:

Much of this unsold product ends up in landfills like the Great Pacific Garbage Patch, which covers 1.6 million square kilometers in the Pacific Ocean between Hawaii and California. The garbage patch is growing exponentially, swelling 10x each decade since 1945.

Excess inventory is a big problem. In 2017, a Swedish power plant abandoned coal as a source of fuel, instead choosing to burn mountains of discarded clothing from H&M. You can’t make this stuff up.

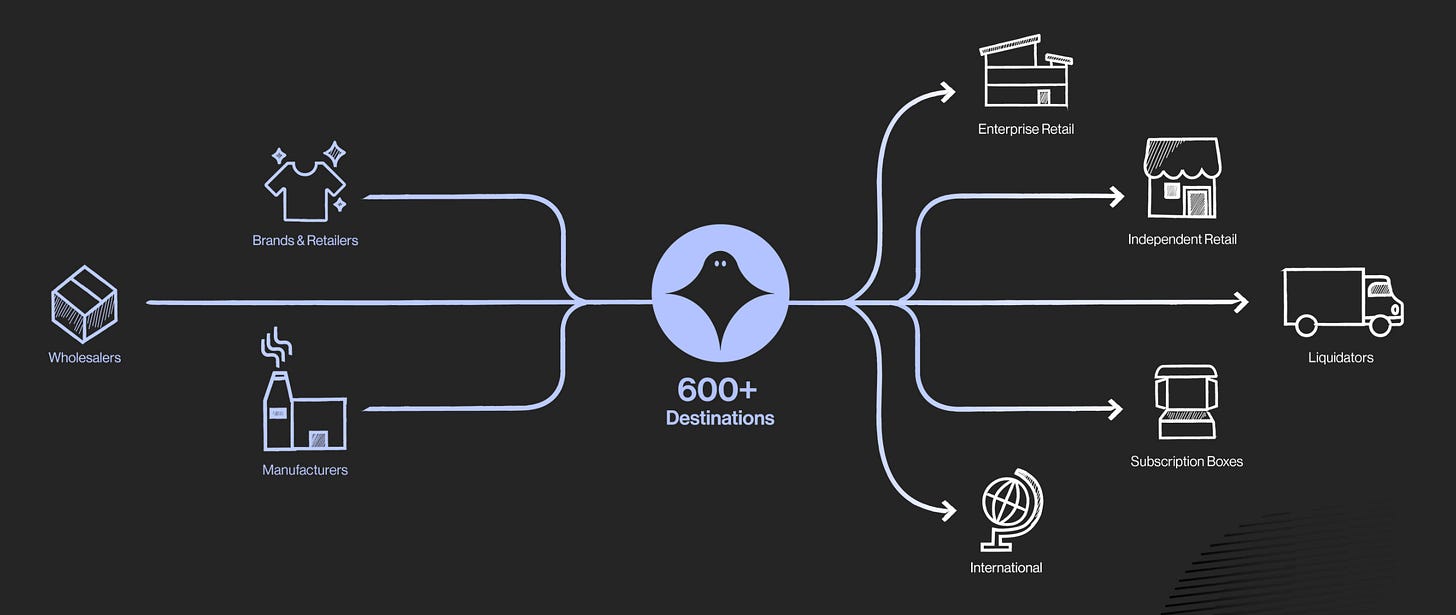

New startups are helping brands manage solve this problem. Ghost, for instance, is a B2B platform that allows brands to route surplus product to the right channels.

Sometimes this means liquidators, but increasingly this means off-price retailers. Better-managed excess inventory means increased supply for discounters, which are more in demand than ever. This brings us to the final force shaping retail…

10) Don’t Discount Discounters

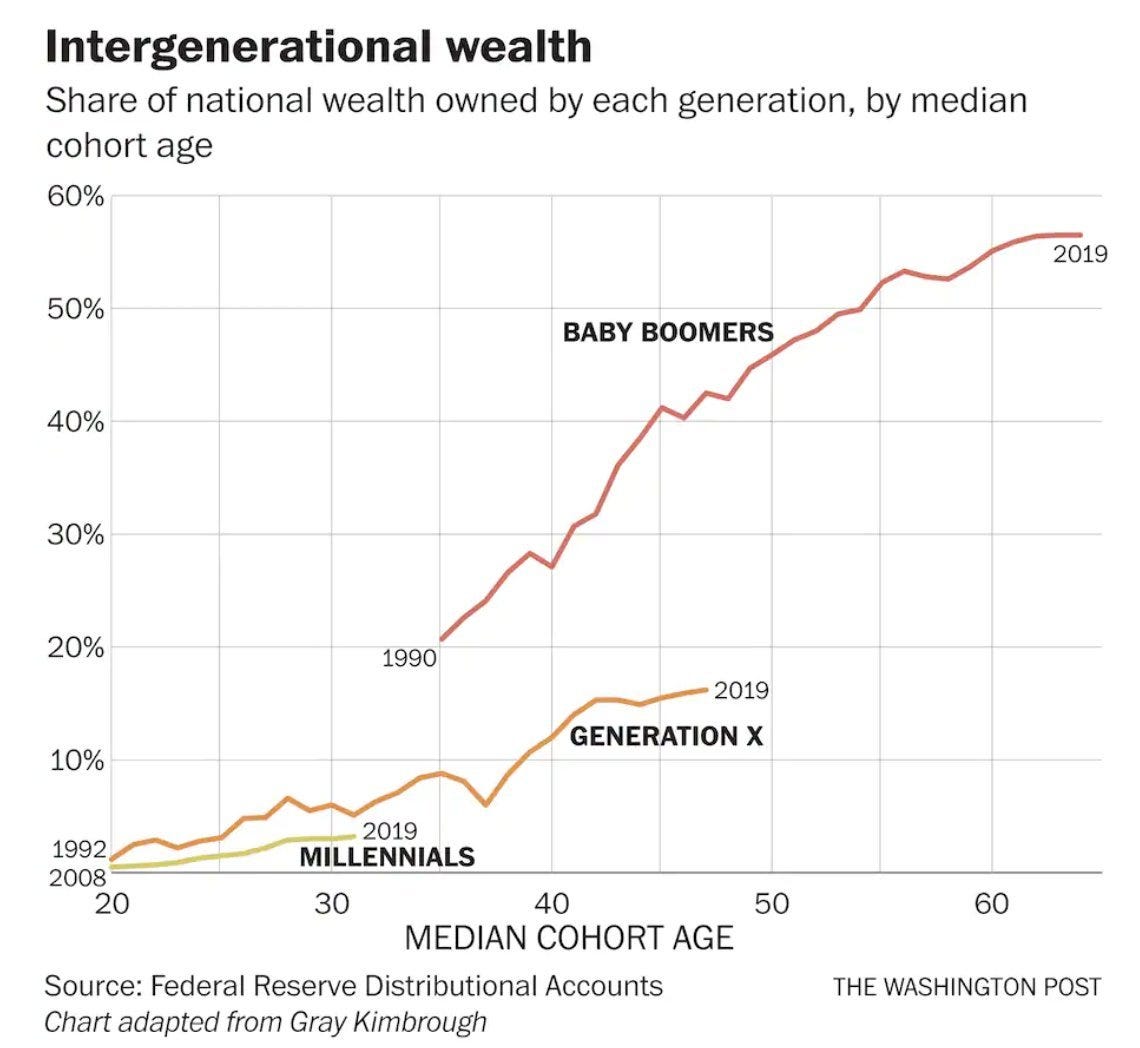

Just as malls have gone out of fashion, so has the middle class. This chart from The Washington Post tells us a lot about younger consumers’ purchasing power:

The Gini coefficient, a measure of income inequality, continues to creep higher and higher:

One consequence of the disappearing middle class is a boom in discount retailers. The top six retailers opening stores in 2022 were all dollar chains and discounters, led by Dollar General, Family Dollar, and Dollar Tree. In 2021, nearly 1 in 3 new chain stores opened in the U.S. was a Dollar General.

Young consumers are pessimistic. A study by McKinsey last year found that a quarter of Gen Zs doubt they’ll be able to afford to retire, and less than half believe they’ll ever own a home. Inflation exacerbates the problem, eroding the purchasing power of wages and savings. Procter & Gamble, which makes everything from Crest to Pantene to Gilette, just reported that it raised prices 10% year-over-year. Consumers feel the hurt.

Startups are also getting in on the rise in discounting. Ditto is a social shopping app that helps brands sell their excess inventory, passing savings along to consumers with dirt-cheap deals. In some ways, it aspires to be an online version of TJ Maxx, which counts $50B in revenue but only 2% digital penetration. Temu, meanwhile, exploded last fall and has remained at the top of the App Stores for months.

Temu is effectively an online dollar store, owned by the Chinese e-commerce giant Pinduoduo. Pinduoduo is following the Bytedance playbook of spending aggressively on user acquisition to win the U.S. market. Part of that plan included not one, but two Super Bowl commercials (costing $7M apiece). The strategy seems to have worked: Temu saw a 45% surge in downloads and a 20% uptick in daily active users on the day of the Super Bowl.

But Pinduoduo is no doubt bleeding money on Temu. E-commerce is challenging for discounters; the unit economics often don’t work. (How do you profit on shipping a bunch of $1 items from China to the U.S.?) There’s a long history of startups that have attempted discount retail online, but failed. Temu is the latest to tackle the space, with a $110B market cap company behind it, but the jury is out on whether it can ever make the math work.

Final Thoughts

Consumer spending makes up two-thirds of the U.S. economy. Our lives revolve around commerce. That’s been true for millennia, with only the venue changing. Hundreds of years ago, it was the town square. In the 1900s, it was the shopping mall. Today, it’s online. Taylor Swift’s lyrics hold true: today, the internet is the place to be. Technology is working its tendrils into every facet of retail.

Sources & Additional Reading

The History of Malls in the U.S. | Sunset Plaza

The ATT Recession | Eric Seufert (one of the best reads you’ll find on CACs)

The Fashion Industry’s Environmental Impact | Bloomberg

Related Digital Native Pieces

Last week’s Part I is here

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week:

![OC] Fast fashion companies add new items to their sites all the time. Shein is the worst, with 60,000 new items each month. : r/dataisbeautiful OC] Fast fashion companies add new items to their sites all the time. Shein is the worst, with 60,000 new items each month. : r/dataisbeautiful](https://substackcdn.com/image/fetch/$s_!atis!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F888530a0-1cc0-4080-95df-2569b6614954_3600x3600.png)