The Startups Transforming Education

How Technology Is Improving Quality and Lowering Costs

This is a weekly newsletter about tech, media, and culture. To receive this newsletter in your inbox each week, you can subscribe here:

Reinventing Education

Over the past 25 years, technology has reinvented huge swaths of our economy. We’ve gone from Nokias to iPhone 11s. The percentage of Americans on the Internet has leapt from 10% to 90%+. Twenty-five years ago, it took 28 hours to download a low-quality movie using high-speed internet—something that takes seconds today.

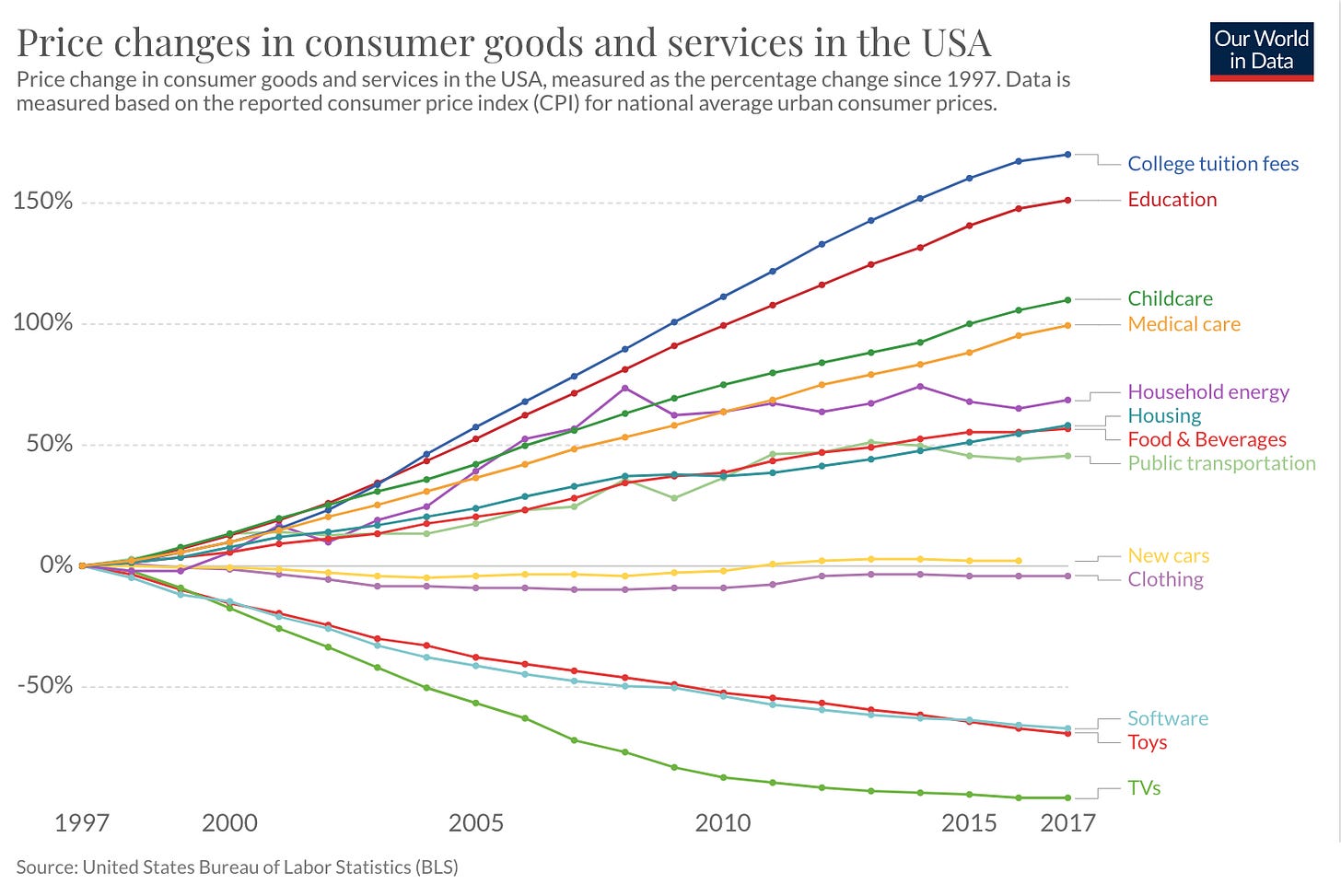

And yet, education has been largely untouched by the Digital Revolution. Despite these advancements, the cost of education has increased 150% since 2000:

This trend is even worse when put into context: the cost of education has grown 8x faster than the inflation-adjusted growth rate of real wages.

Education is a massive opportunity for startups: in the U.S., education is a $1.6 trillion market ($4.7 trillion globally) and the nation’s second-largest employer behind only healthcare. Technology can make education more affordable, more convenient, and higher quality.

Education is being reinvented by a new generation of startups that share one or more characteristics:

They are direct-to-learner and resemble consumer businesses. This means that they don’t sell into schools or have to deal with the slow, regulated K-12 system.

They are lifelong, extending education beyond the first ~20 years of life.

They have a FinTech component, as financing becomes a key part of education affordability.

They align learner and instructor incentives, often through Income Share Agreements.

They close the skills gap by better aligning learning and jobs.

Below are insights into each characteristic and, for each, three startups changing education.

1️⃣ Direct-to-Learner

The driving reason behind education’s resistance to change is an outdated, lethargic system. Education is highly regulated, both at the federal and state levels, and education companies are forced to navigate a labyrinth of decision makers: teachers, parents, superintendents, principals, policymakers.

For this reason, the most impactful education startups cut out the middlemen and go direct-to-learner. These startups resemble consumer internet businesses more than traditional education businesses.

Take the three most valuable education startups in the world: Byju’s ($10B valuation), Yuanfudao ($7.8B), and Zuoyebang ($6.5B). All three are tutoring businesses that sell directly to consumers, Byju’s in India and Yuanfudao and Zuoyebang in China.

Language learning apps like VIPKid and Duolingo and online learning platforms like Udemy and Skillshare have also opted for B2C models.

Across Asia, households spend ~15% of their income on supplemental learning. That’s 7x what the average U.S. household spends. I don’t expect Americans to fully close the gap—there are significant cultural differences—but I do expect the gap to shrink. USV writes:

We have hit the tipping point in consumers’ interest in self-driven, direct-to-learner education because technology has enabled higher quality education to be delivered at a lower price point.

That combination—higher quality education at lower prices—is what is enabling learners to circumvent archaic, limiting, analog K-12 and higher-ed systems.

Three startups selling direct-to-learner are Tynker, Outschool, and Brainly:

Tynker, like many kids learning companies, is “edutainment”—a mix of education and entertainment. Tynker gamifies coding.

Outschool is a business-in-a-box platform for online learning. Homeroom and Carter are other examples of business-in-a-box platforms, making it easier for teachers to be “solopreneurs”.

Brainly—like Byju’s, Yuanfudao, and Zuoyebang—is a consumer-facing tutoring business. Brainly is unique in its focus on social, peer learning.

2️⃣ Lifelong Learning

The lion’s share of education spend still happens in the first ~20 years of life:

This is a relic from a pre-digital world, when a worker could acquire all job-relevant skills through a high school and (sometimes) college education. This model isn’t a fit for the world today.

In the coming decades, I expect this chart to look more flat over time—perhaps with spikes in spend every ~5 years or so. Workers will “reinvent” themselves multiple times; many workers will have two, three, or four careers.

This future is in line with direct-to-learner education, as learners have more control over their own development. And this future will be enabled by new financing options and income share agreements (see the next two sections).

Guild, Degreed, and Strive are three startups building this future:

Guild offers “education-as-a-benefit”. Low-wage workers at companies like McDonald’s and Disney get access to high-quality education. Those big corporations are willing to pay for workers’ educations because doing so decreases employee turnover: it’s cheaper for McDonald’s to cover an employee’s tuition than to have to keep hiring new workers to fill an opening.

Degreed partners with 250+ organizations to reskill and upskill workers, while Strive is tackling management and leadership training—less tangible, but equally valuable skills.

The next generation of education startups will be built for a future in which learning is ongoing and not concentrated in the early years of life.

3️⃣ Blurring Lines Between EdTech & FinTech

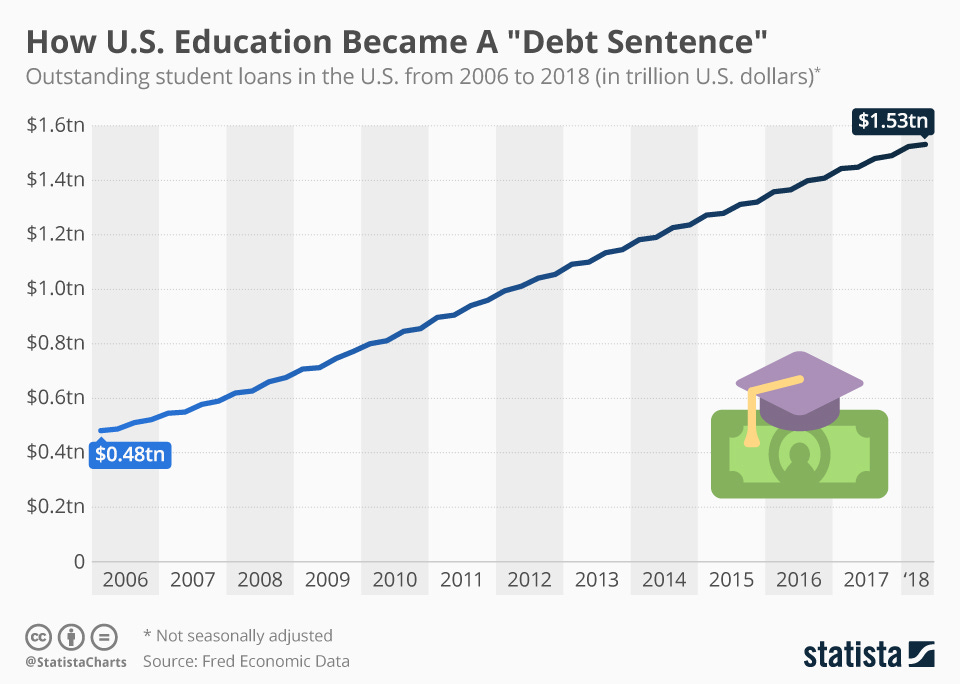

Education is the fastest-growing category of household spend, +200% since 2000. And over the last three decades, student loans have become the largest component of non-housing debt for Americans.

This means that education access is often inseparable from financial access. Three startups blending FinTech and EdTech are Mos, Goodly, and Edquity:

College-bound students don’t often know how to tap into all sources of financial aid. Mos makes it simple for students to access that aid.

Goodly offers student loan repayment as a benefit, and Edquity uses data to distribute emergency aid to college students who need it most.

Just taking a quick breather to remind you to subscribe if you haven’t already!

4️⃣ Aligning Incentives with ISAs

Income Share Agreements are a subset of “FinTech + EdTech” that’s growing in popularity. Traditional education has always put the onus on the learner: you acquire skills and then need to find yourself a job. ISAs align incentives: learners only pay the learning provider if they’re able to parlay their skills into a well-paying job. The provider only benefits if they do a good job teaching.

Lambda, Flockjay, and Leif are three ISA startups:

So far, most ISA companies are vertical.

Lambda, for example, trains software engineers. Other engineering ISA providers include Pathrise, Thinkful, Pursuit, Holberton, and Make School.

Flockjay, meanwhile, targets another niche: tech sales. Over 50% of roles in tech companies are “non-technical” and sales reps are often among the highest-paid employees in tech. Yet no top universities teach sales. Flockjay graduates see a 2.5x average salary increase.

There are also horizontal picks and shovels that power the broader ISA industry. Leif is an example, making it easy to create, manage, and finance an ISA.

I’m skeptical about the current economics of ISAs. Companies deliver products today, but don’t get paid until potentially years down the road. This creates unfavorable working capital and cash conversion dynamics. But I do believe in the broader concept—aligned incentives—and that there will be way to make the economics work.

Over the next decade, we’ll see more traditional institutions—colleges, grad schools—adopt ISAs. We’ll see learners use more creative forms of financing, such as income pooling with Pando. Aligning incentives will both improve learning outcomes and make learning more affordable.

5️⃣ Closing the Skills Gap

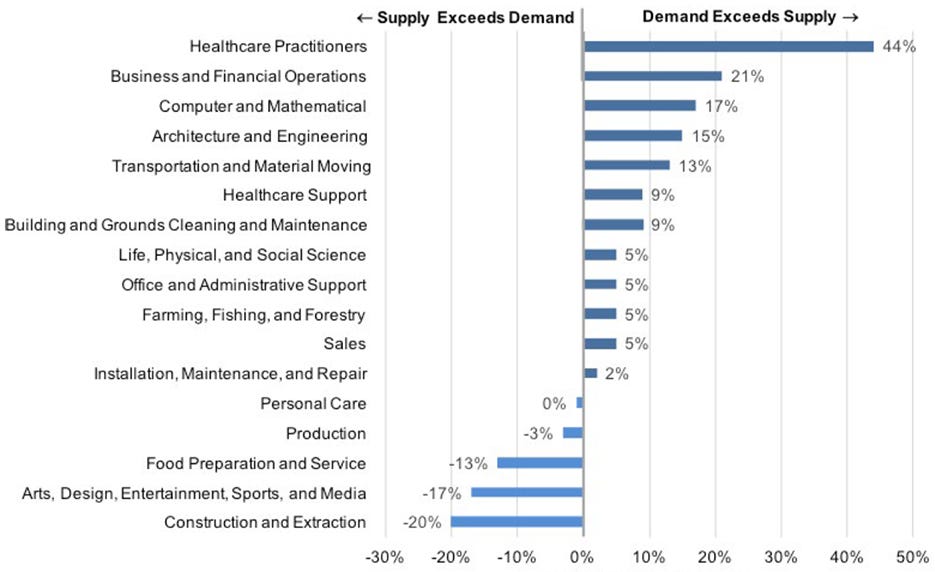

While ISAs align learners and learning providers, the learning content that’s supplied must also be aligned with the skills demanded by the job marketplace.

There’s a consistent supply / demand mismatch:

In one survey, 60% of managers said new hires lacked critical thinking and problem-solving skills, 44% of managers said new hires lacked writing proficiency, and 39% of managers said new hires lacked public speaking skills.

The World Economic Forum estimates that closing the skills gap could add $11.5 trillion to global GDP by 2028.

Three startups closing the skills gap are WhiteHat, Riipen, and SV Academy:

WhiteHat helps companies find workers to be apprentices for ~6 months, learning job-relevant skills, before being hired full-time. Workers are often non-college grads, offering an additional path into the labor market.

Riipen integrates real-world projects into the classroom, better preparing students for skills they’ll need in the workplace.

SV Academy puts workers through a 12-week training program to prepare for tech jobs, and then companies like PayPal and SurveyMonkey pay to hire those workers.

Final Thoughts: COVID-Driven Education Startups

I want to end by touching on the pandemic’s near-term impact. A new generation of education startups is preparing for a post-COVID world. Three interesting ones are Primer, Virtually, and SchoolHouse:

Each of these startups is benefiting by how the pandemic is changing education. Primer makes homeschooling easy. Virtually enables anyone to launch an online school. And SchoolHouse is especially timely as the school year starts: families can form small “pods” for their kids to learn with a few other kids around the same age.

When thinking about education in the COVID era, it helps to bifurcate opportunities:

Permanent step-change in growth: These are startups well-positioned for long-term trends in education. They might see a near-term boost from the pandemic, but will continue growing from a higher base when the world returns to normal.

Temporary spike in usage: These are startups that are surging now, but that will shrink after the pandemic. For example, a company that replaces K-12 education; when kids go back to school, usage will slow significantly.

I would put Primer in the first category. Is the pandemic creating more demand for homeschooling? No doubt. But long before COVID, homeschooling was on the rise:

Primer is seeing a surge in pandemic-related demand, but is operating in a market driven by secular tailwinds.

SchoolHouse, though, is an example of a company I’d put in the second bucket. Its price-point (~$15K) means that SchoolHouse is targeting the private school market. That’s a sizable market with 5.7M students, but I’m skeptical that families will form small-group learning pods in a post-vaccine world. There are so many benefits to a traditional school—socialization, networking, brand name. As a recent piece in The Atlantic put it:

School, for some kids, is a basic, important place: It is their source of food, or where no adult hits them, or where they find reliable heat in the winter. But even for children whose needs are less physical, school is often their entire external world. It is a place where their relationships are not dependent on their parents, where they try and fail and then try and succeed. School is where they make friends and mortal enemies and friends again. School is where my children are not my daughter or son; they are themselves, figuring out who that is every day.

The next 2-3 years will see the most dramatic shift in how education is delivered in over a century. New startups will drive that shift. They will break down the barriers that have limited innovation, finding new ways to deliver higher quality, more convenient, and more affordable education.

Sources & Additional Reading—here are the pieces that inspired and informed this content; check them out for further reading on this subject:

I admire USV’s education portfolio and thesis. Two good pieces are Education by the Numbers and The Education Transformation

I also enjoy Mercedes Bent’s writing on education—here is a sample piece

If you liked this piece, you might like a piece I wrote earlier this year: How Technology Is Transforming Education

Chart of the Week

This Axios chart shows how streaming platforms stack up:

Of the new entrants into the “Streaming Wars”, Disney+ is the clear winner. Disney+ added 10M subscribers on its first day and has added 28M since December.

AT&T hasn’t been so lucky. HBO Max has struggled (and is firing much of its leadership) and cord-cutting is accelerating: in Q2, 2M pay-TV customers cut the cord, half of them from AT&T’s DirectTV.

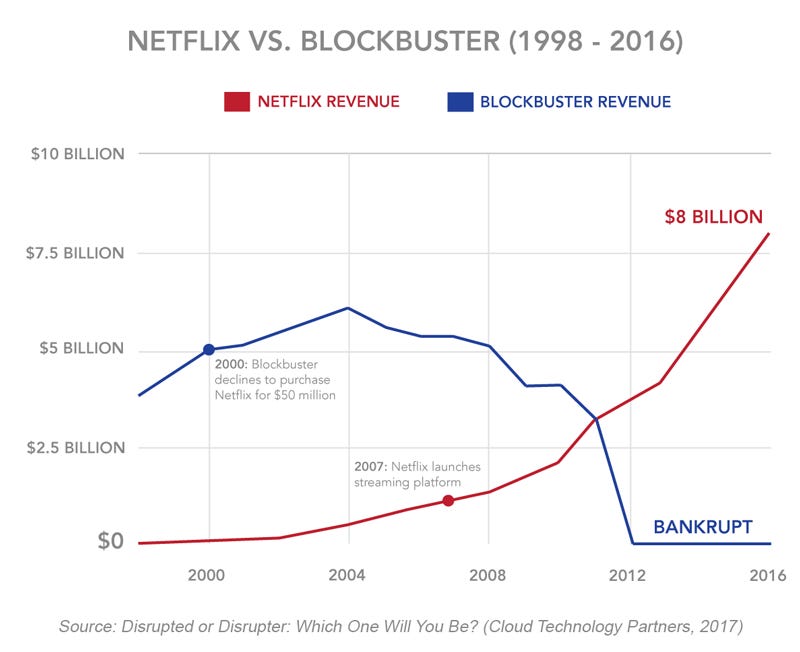

Side note: I recently came across the all-time-great chart below. For reference, Netflix is on track for ~$25B in revenue this year while Blockbuster just listed its last store on Airbnb for nostalgia purposes.

Quick Hits

Here’s what to read and what to know from the week:

🗞️ The New York Times’ digital revenue surpassed print revenue for the first time ever, with 5.7M digital subscribers.

🦠 Zoom has been the breakout startup of the 2020 pandemic. A century ago, Dixie Cups were the breakout startup of the 1918 pandemic. Disposable cups were, literally, a life-saving invention that stopped the spread of the virus. Dixie Cups became a household name.

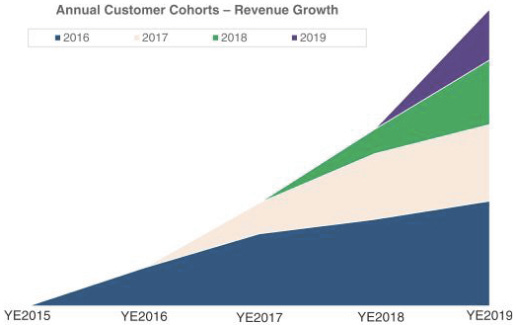

🎮 Unity is out with its S-1 filing. 1.5M monthly creators building over 50% of all the world’s games. And some nice-looking cohorts:

🧱 Roblox has 164M MAUs, up from 115M in February. More than 75% of American 9- to 12-year-olds are players, logging 3B hours in July, +100% from the spring. And Roblox has a long tail of popular games: over 5,000 games have had over 1M plays and 20 have had over 1B plays.

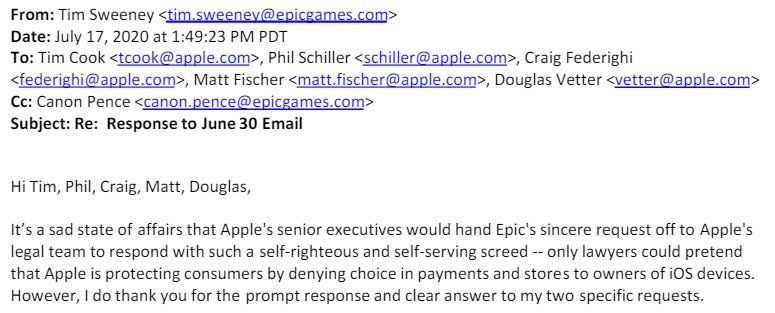

🌶️ In other gaming news, some spicy emails emerged in the Apple-Epic lawsuit. In one, Tim Sweeney tells Tim Cook that Apple’s response is “a self-righteous and self-serving screed”:

🛍️ Last week, I wrote about how Instagram is merging social media and commerce. Weibo, one of China’s biggest social platforms, is now wading into commerce.

🎵 Cardi B’s and Megan Thee Stallion’s “WAP” broke the record for most first-week streams—even though 65,000 people signed a petition to remove Kylie Jenner from the music video. Also last week, BTS’ “Dynamite” broke the YouTube record for most first-week video views, with 101M views.

🌐 In the last decade, LTE made companies like Lyft, Airbnb, and Waze possible. 5G will be much, much bigger. 5G is beginning to revolutionize the world—starting with hospitals.

👧 Six-year-old Diana is YouTube’s biggest star. She has 143 million subscribers and gets 5 billion monthly views. Pocket.watch—a kids’ media studio (yes, that’s a thing)—signed Diana to make consumer products, a mobile game, and a 40-episode TV series.

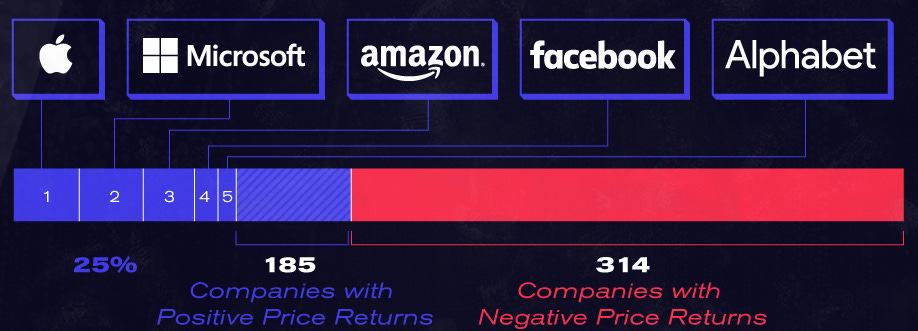

🤯 Last week, Apple’s market cap hit $2 trillion. It took Apple 42 years to reach $1 trillion, and less than two years to add the next trillion. The stocks of Apple, Amazon, Alphabet, Microsoft and Facebook have risen 37% this year, while all other S&P 500 stocks have fallen 6%. Those five stocks make up a whopping 25% of the S&P 500:

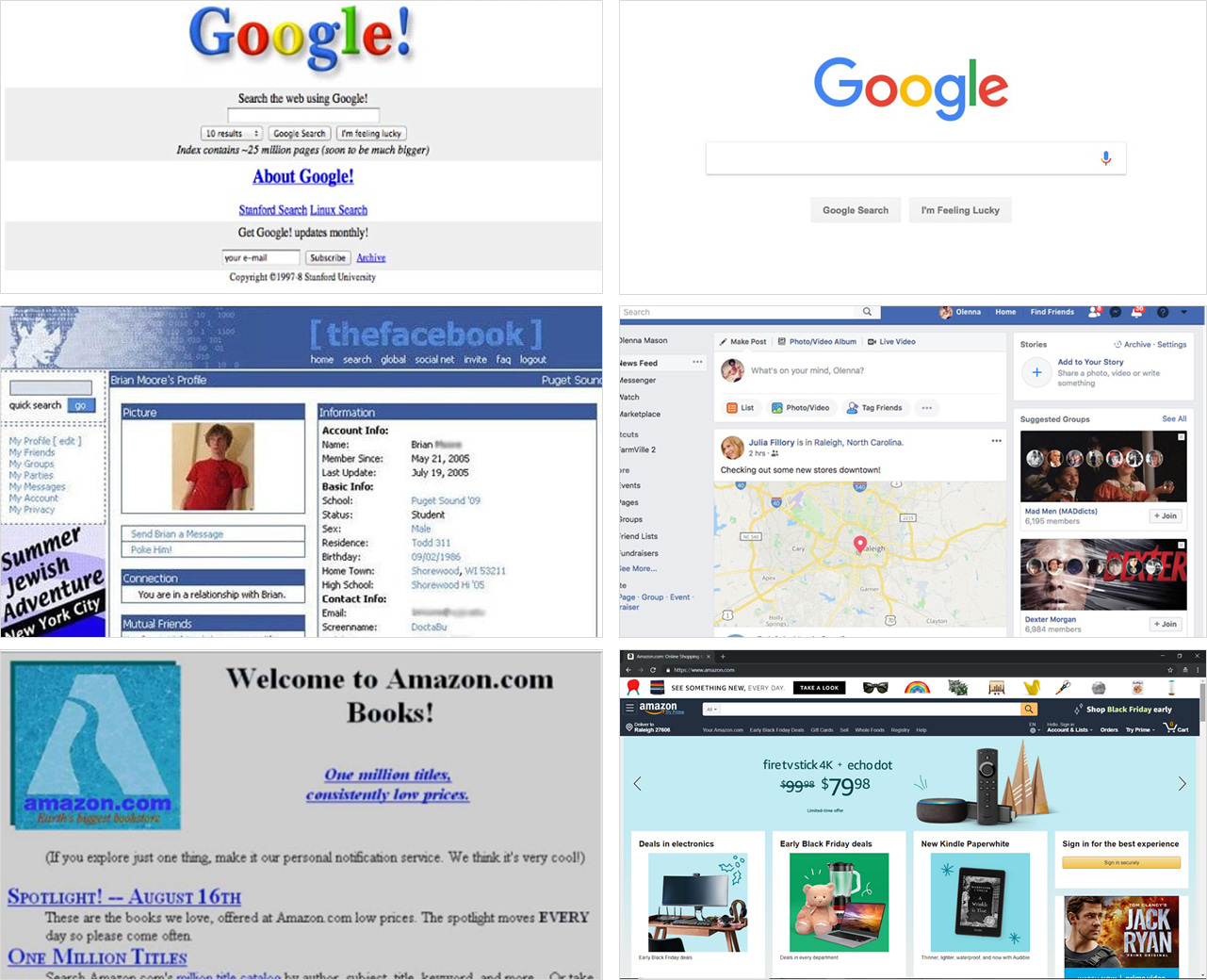

To end on one fun thing, check out the Big Tech websites then vs. now:

Thanks for reading! To receive this newsletter in your inbox weekly, subscribe here 👇