10 Charts That Capture How the World Is Changing (Part I)

From Prediction Markets to VC Distributions, Gen Z Finances to Space Launches

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 65,000+ weekly readers by subscribing here:

10 Charts That Capture How the World Is Changing (Part I)

It’s been a few months since we’ve done a “10 Charts” edition: our last was in August, split into Part I and Part II. That piece dove into topics ranging from ketamine to WhatsApp user growth to mobile gaming.

I’ve committed to doing these quarterly, so we’re due for a fresh set. I started writing this new edition last week, beginning with charts on Ozempic and med spa spending—but those charts ballooned into their own standalone piece, last week’s Beauty Is in the Algorithm of the Beholder. So let’s try this again.

This week we’ll cover charts #1-5, and next week we’ll cover #6-10. Topics covered this week:

The Rise of Prediction Markets

Will 2025 Be the Year of VC Distributions?

The Experience Economy Roars Back

What Does It Mean to Be “Financially Successful”?

The Space Race (2020s Edition)

I like the “10 Charts” series because I’m a visual learner and charts help me process information. Charts also happen to be an efficient way to show how the world’s changing, across a wide range of subjects.

Let’s dive in.

1️⃣ The Rise of Prediction Markets

Last week, I won a bet with a friend. All fall, Billboard has been counting down the 25 greatest pop stars of the 21st century, now that we’re coming up on 2025, a quarter-century into the new millennium. Billboard last week unveiled its #2 pick: Taylor Swift. I had bet my friend Peter $100 that Billboard would name Beyoncé #1 and Taylor #2 (he thought the inverse), and I won the bet. 💁🏼♂️

I also made this bet on Kalshi, a site where you can bet real money on your predictions. I figured: I’m pretty good at pop culture, if I can say so myself, so why not monetize that knowledge? I put down $100 and would have made $500—if only Kalshi had accepted my profile in time. 😑

I give this example because it demonstrates a new market: the prediction market. This is a new phenomenon, one in which you can bet actual money on real-life events.

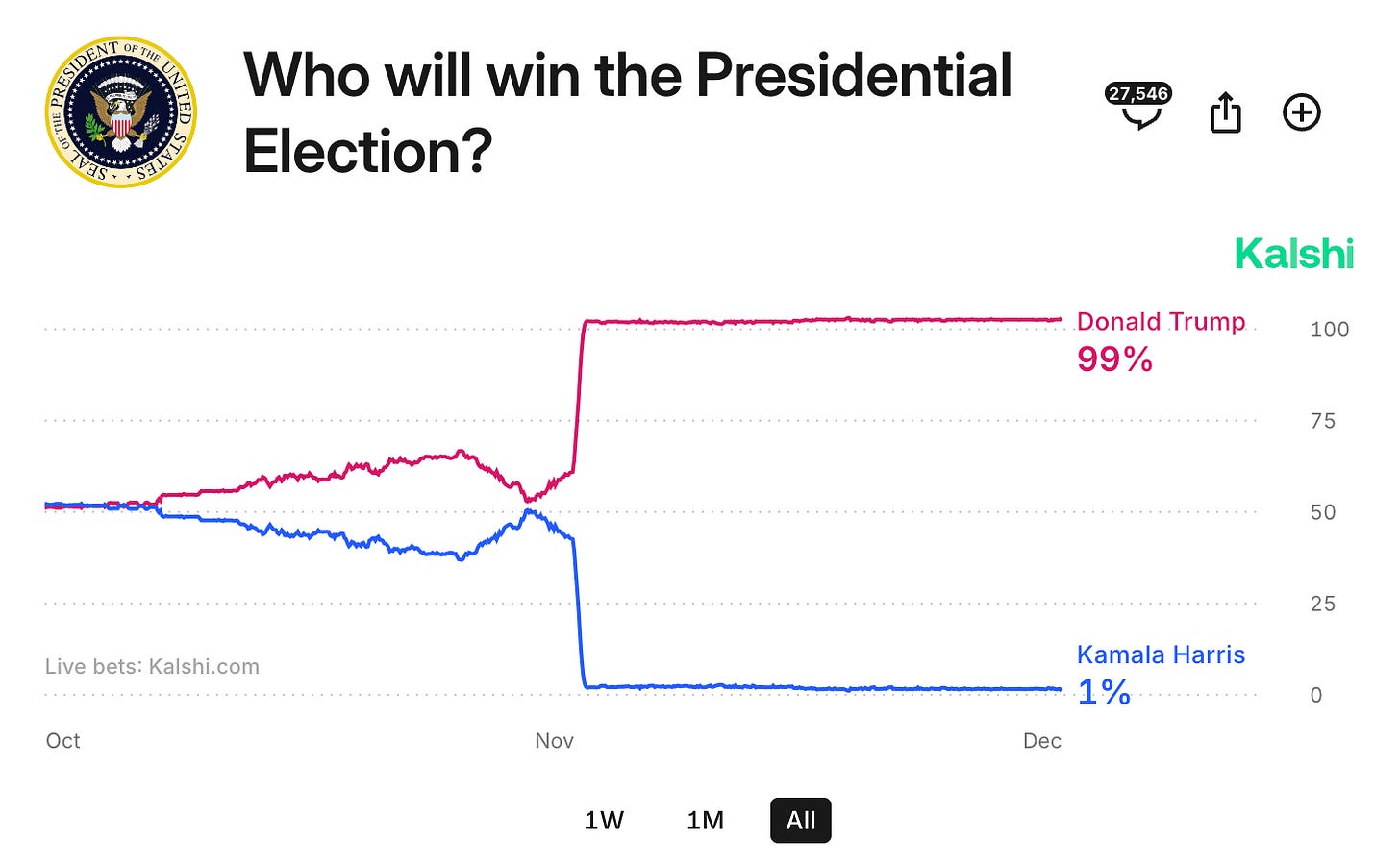

This phenomenon has taken off over the last month, driven by the U.S. election, which brought Kalshi and Polymarket (the other major player) into the mainstream. Here’s a type of chart you should get familiar with—it tracks the betting markets of an event, in this case the U.S. election, and how the odds change over time. Naturally, the election’s betting markets moved quickly once it became clear that Donald Trump was headed for victory.

On betting sites like Kalshi, you can bet on almost anything. When will Bitcoin hit $100K? Who will be Trump’s Secretary of Defense? Who will win the Grammy for Album of the Year?

I asked Kalshi’s co-founder and CEO, Tarek, to share some charts that show how prediction markets are taking off. Here’s what he and Philip on his team shared:

Damn.

Clearly, we’re seeing prediction markets inflect. This is a fascinating phenomenon: knowledge, for the first time, can be properly monetized. Many people viewed the betting markets as a better predictor of the U.S. election than professionally-administered polls. The thinking goes: trust the markets, where real money is at stake.

Kalshi and Polymarket have surged in trading volume in recent weeks, and while this is a challenging regulatory area to navigate, prediction markets seem to be a large category here to stay. This is part of a bigger trend—the financialization of everything—that we’ve seen power similar areas like retail investing, web3 / NFTs, and sports betting.

2️⃣ Will 2025 Be the Year of Distributions?

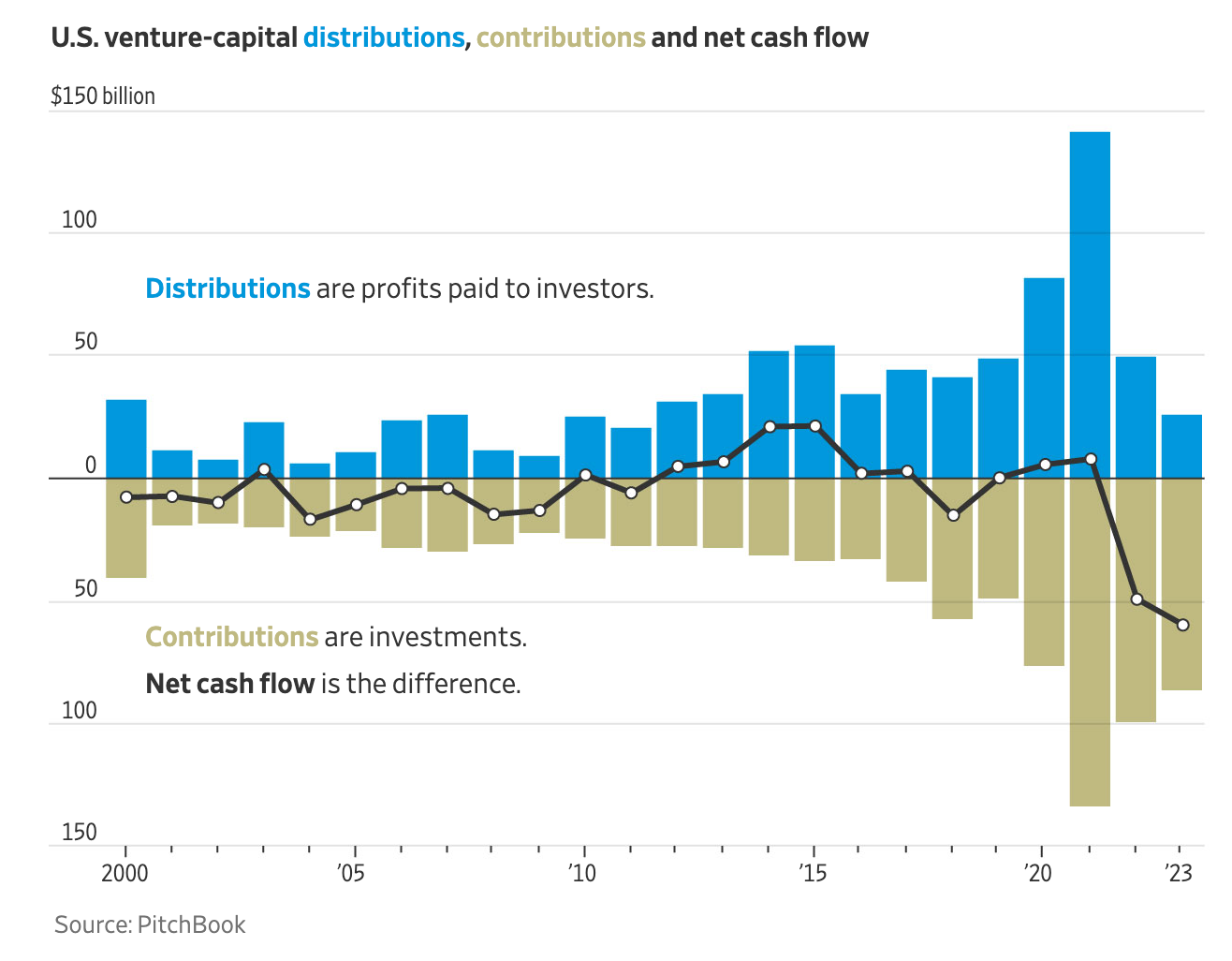

Last year, U.S. venture firms returned $26B to their limited partners—the lowest amount since 2011. Venture firms invested $60B more than they collected, the highest deficit in PitchBook’s 26 years of reporting. As a result, LPs are…well, frustrated. They’re waiting to see distributions.

This is one reason the fundraising market has been so tough: LPs need to get money back in order to invest in more funds. According to PitchBook, the number of active VC firms has fallen by more than 25% year-over-year, and 2024 is set to be the second straight year in which VC fundraising is less than half of 2021 or 2022. We’re seeing a reset of the venture ecosystem—many firms will wind down, and others will be born.

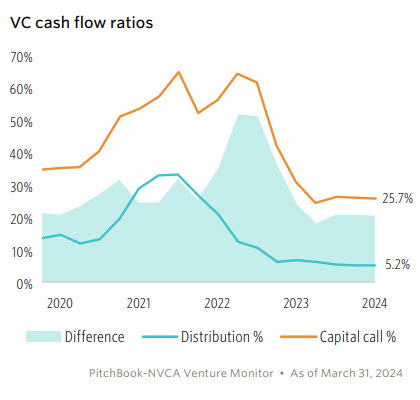

One important metric to track: the rate of distributions to net asset value. Over the past decade, this rate averaged 17.1% for US venture capital firms. In 2020 and 2021, we rose to 35%. Today, we sit at 5%.

There’s reason to think things will turn around in 2025. The FTC’s Lina Khan seems on her way out. Khan has been aggressively fighting acquisitions—for instance, blocking Adobe’s $20B Figma acquisition, which would have been a record for a venture-backed startup, surpassing Meta’s $19B purchase of WhatsApp. With Khan out, acquisitions—and thus distributions—might be back on the table.

The IPO window is also expected to open in 2025. With ServiceTitan about to go public ($772M implied ARR growing 24% YoY), some people are thinking the IPO window is already opening. But ServiceTitan is a special case: the company actually has a compounding IPO ratchet from its November 2022 Series H. Starting back in May—the 18-month anniversary of the Series H—the ratchet started, growing its hurdle price 11% annually. This means that the longer ServiceTitan stays private, the more dilution it faces—so the IPO clock began ticking in March. Meritech has a good breakdown of the S-1 and ratchet here.

So ServiceTitan is a special case. But we should see a slew of high-profile IPOs in 2025. There are currently over 1,400 (!) startups valued at $1B or more—“unicorns”—and investors are waiting to see a return from them.

We’re three years into a tough market for venture—a distribution drought. But there’s reason to think the tides are turning, and 2025 will open the floodgates.

One bonus chart to make you bullish on the next 50 years of company creation and growth: here’s a chart that showcases US innovation beside the EU, a good example of how policy and culture influence business creation and success.

3️⃣ The Experience Economy Roars Back

Unfortunately for Kamala Harris, U.S. consumers don’t feel like they’re doing very well. Arguably no chart better explains the election results than this chart via Dan Frommer’s New Consumer:

Grocery prices haven’t risen this quickly since the early 1980s. The Atlantic dubbed this “The English Muffin Problem” last year and I think it explains Trump’s win—and the punishment of incumbents around the world.

But the thing is, U.S. consumers are doing just fine.

On Black Friday last week, U.S. e-commerce spending was up +14.6%. Shopify shattered records with $5B in global sales, building on its blockbuster Q3 earnings report: $70B in store spend during the quarter, +24% year-over-year and $2B ahead of Wall Street expectations. Adobe, which tracks digital commerce, expects U.S. holiday e-comm spend to grow +8.4% this year, outpacing inflation and faster than last year-s 4.9% growth.

The CEO of American Express said recently, “The U.S. consumer has been really stable.” Amex’s percentage of past-due loans and receivables was 1.3% last quarter, in line with recent quarters, and below the late-2019 pre-pandemic level of 1.5%.

So spend is pretty healthy. And in particular, spend on experiences is surging.

Here are some charts from Get Your Guide that look at indexed sales growth for consumer goods vs. experiences:

In the mid-to-late 2010s, we talked about “the experience economy.” This was the era of people visiting the Museum of Ice Cream and buying a Coachella ticket instead of a Coach bag. Travel boomed, buoyed by Instagram and Airbnb. In my favorite example of Insta-powered travel: in 2010, 800 people visited Trolltunga, a scenic rock formation in Norway. In 2018, 87,000 people visited—an 11,100% increase. What changed? Instagram.

We see spending on experiences surging across the economy—check out Live Nation attendance:

This trend is here to stay, and we’ll see resulting tailwinds in a variety sectors.

4️⃣ What Does It Mean to Be “Financially Successful”?

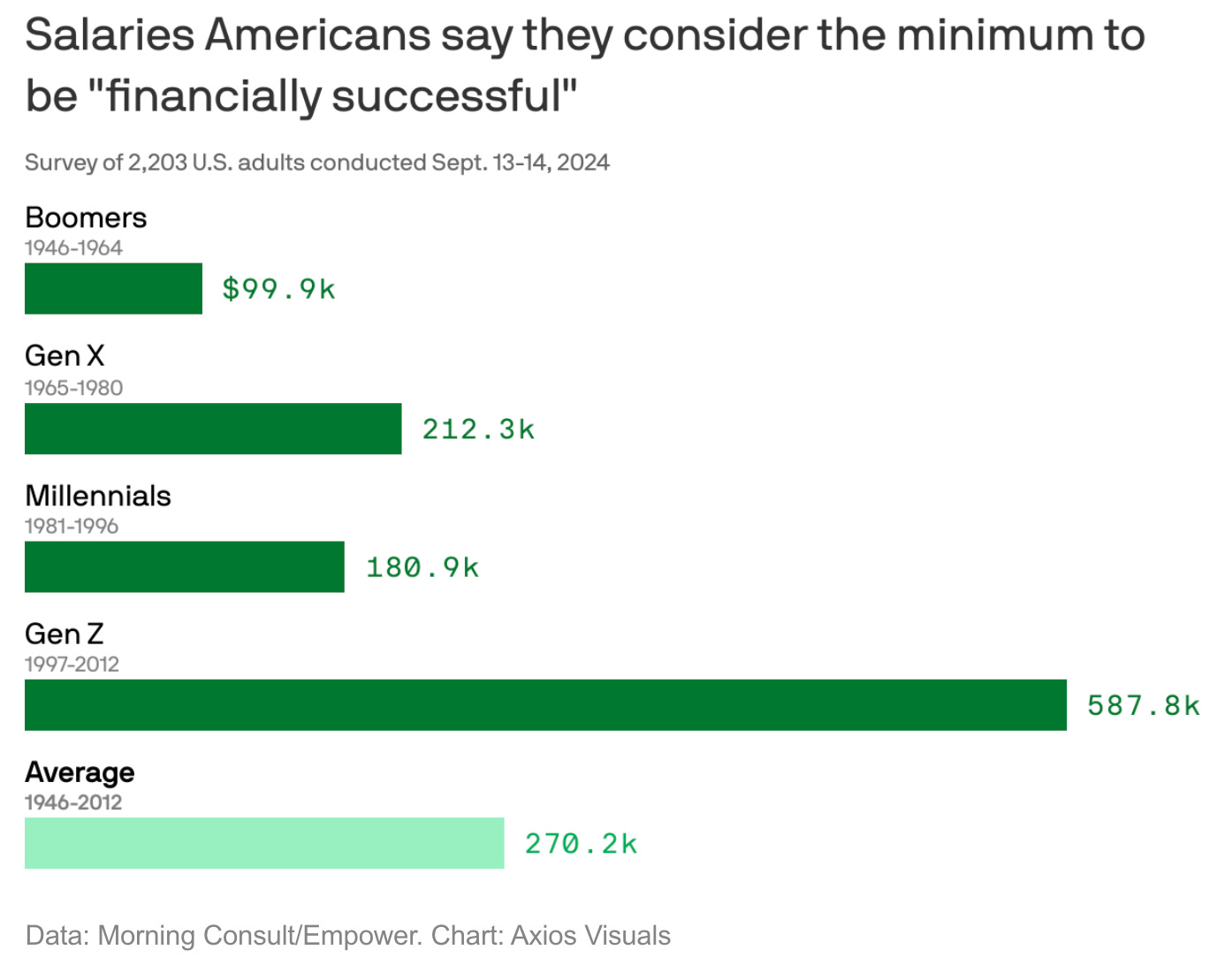

One of the more eye-catching charts I’ve seen recently is this one from Axios:

Notice an outlier?

Gen Z responds with 3-6x what any other age group says—and there’s a surprisingly stark distinction between Gen Zs and Millennials, the generation one above. Gen Z thinks you need to make 9x (!) the average American salary to be financially successful. What gives?

Well, we already know that Gen Z is a nihilistic generation; that’s been a frequent topic on Digital Native. But I also suspect some of the above is the result of social media and influencer culture: when you’re exposed to the ultra-wealthy and ultra-luxurious, 24 hours a day, that warps your thinking. Keeping up with the Joneses is no longer keeping up with your neighbor, but with the top 1% broadcasting their lives on Instagram. Other factors—like the cost of living, the pandemic, and inflation—also play a factor here.

What’s even more surprising: despite these high expectations, 71% of Gen Zs say they expect to achieve financial success, more than any other age group. Talk about confidence.

It’s interesting to think through the ripple effects of these types of financial expectations. More Gen Zs may want to be creators, sure. More may pursue side hustles, and according to one recent survey, 48% of Gen Zs already have one. This should power businesses like Whop, a platform for selling digital products (think: sneaker bots, online communities, IP proxies), as well as the usual suspects—Shopify, YouTube, and so on.

More Gen Zs will also want financial autonomy and upside by being their own boss. This powers two other years-long trends: the increasing number of businesses being created, and the rise of freelancing.

5️⃣ The Space Race (2020s Edition)

Check out this chart:

Pretty wild.

The 1950s and 1960s brought the so-called “space race,” a competition between two Cold War rivals, the Soviet Union and the U.S. The 2020s are bringing the space race 2.0, this time around space launches. All of a sudden, we’re putting a lot of stuff in space.

Why? The costs to launch are plummeting, and we’re seeing a slew of venture interest in space as a result. In response to Play It Cool: Chasing Heat vs. Being Contrarian in Venture two weeks back, which wondered which categories are under-the-radar today but will be frothy in a couple years, my former colleague Martin (one of the sharpest investors I know) responded: “space.” That same day, a company called Inversion announced its $44M Series A. Inversion uses space as a tool for precision delivery; from the announcement:

Inversion is using space as a tool to achieve this long standing “holy grail” of logistics – delivery in minutes, anywhere – with autonomous re-entry vehicles that orbit the Earth and re-enter through the atmosphere on a moment’s notice to the planet’s toughest spots – at lower total cost than terrestrial solutions.

Pretty cool. As is the image from the website:

Space is opening up as a frontier, and there’s a clear “why now” for startups building here. Any time you see a chart like the one above, it’s worth paying attention.

Back next week with charts 6 through 10. Until then 👋

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: