10 Charts That Capture How the World Is Changing (Part II)

From Gen AI Music to VC Secondaries, Shopify Growth to Online Video Consumption

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 65,000+ weekly readers by subscribing here:

10 Charts That Capture How the World Is Changing (Part II)

Last week in Part I, we tackled charts on topics ranging from prediction markets, to VC distributions, to space launches.

The Rise of Prediction Markets

Will 2025 Be the Year of VC Distributions?

The Experience Economy Roars Back

What Does It Mean to Be “Financially Successful”?

The Space Race (2020s Edition)

This week we’ll cover #6-10:

Music’s Next Act: Generative Music

Shopify’s Reacceleration

Venture Capital’s Power Law

VC Fund Cycles and Secondaries

Video Consumption Over Time

The goal here is to visually capture some key ways the world is changing.

Let’s dive in.

6️⃣ Music’s Next Act: Generative Music

A month ago in The Second $100B AI Company, I wrote that there are 31 U.S. technology companies with a market cap over $100B, but only one founded in the last 15 years: Uber, which trades at $178B (now $138B). The point of that piece was to emphasize that consumer tech companies are often larger than enterprise companies.

There’s one company that has since joined the $100B+ club, though it was founded slightly before our 15-year cut-off: Spotify, which traded above $100B for the first time last week.

Spotify’s big week comes on the back of Spotify Wrapped, still one of the savviest forms of viral marketing ever. These are 2022 numbers, but an estimated 50% of Spotify Wrapped users share their results to social media (made easy with one-click sharing), generating 300M tweets and driving a +20% week-over-week bump in Spotify sign-ups. Not bad for a single feature.

The highlight from my Wrapped this year:

😌.

It’s impressive that Spotify has ridden music to a $100B+ valuation, given how under-monetized music is: music’s cultural impact far exceeds its economic value. Compare music to gaming: gaming is about $200B in market size to recorded music’s $30B, largely because of better business models.

Here’s a visual we made for one of our first-ever Digital Native pieces, back in 2020:

The takeaways here: (1) music is very, very complicated, and (2) Spotify doesn’t get to keep much of its revenue. This is one reason Spotify has moved aggressively into other audio formats, like podcasting and audiobooks: its margins are better here, given the company doesn’t have to shell out most of its revenue to the labels.

So what comes next for music? Well, generated music.

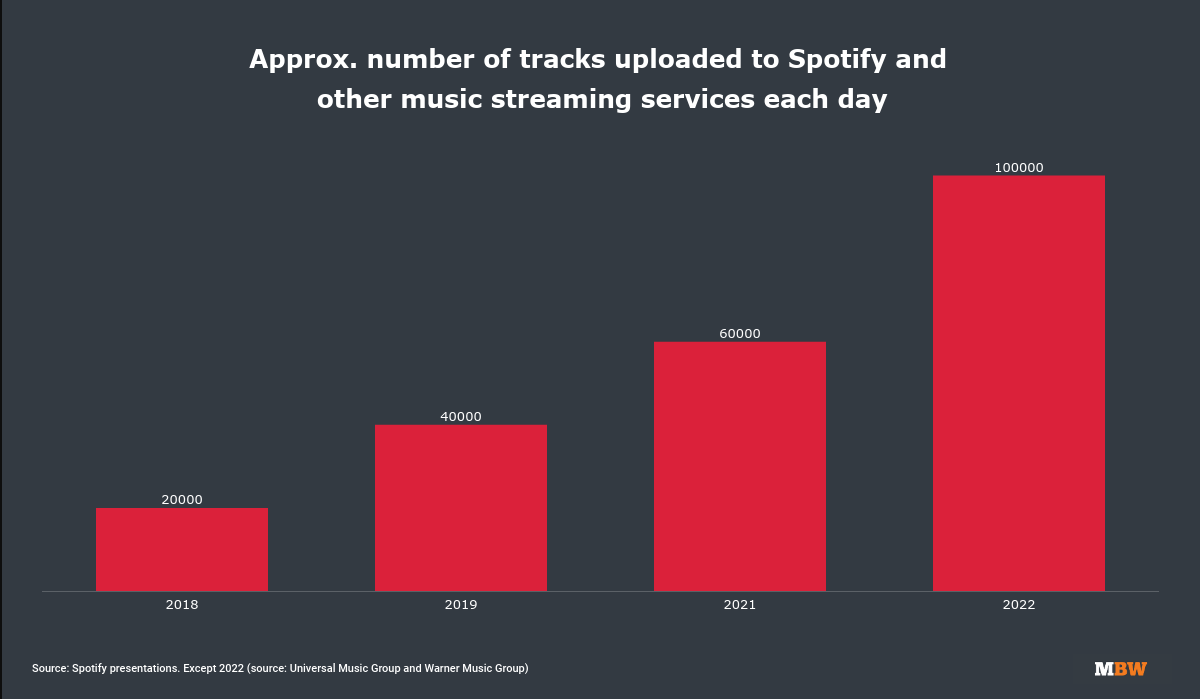

We’ve already seen the number of tracks uploaded to Spotify explode—now in the hundreds of millions a year. Generative AI will further open these floodgates.

Something that’s been interesting to watch: Google’s DeepMind created an artist-mimicking AI music generator, which it codenamed Orca. Apparently, Orca worked so well that Google couldn’t release it, fearing legal repercussions. Consider that most AIs are trained on vast amounts of copyrighted data—then look at the flow chart above, and you get a sense of why gen AI is a legal minefield for music. For Orca, Google collaborated with YouTube on the copyrighted data.

In last year’s Barbie and the AI-Generated Internet, we wrote:

AI songs are blowing up on TikTok—you can listen to Britney sing “Part of Your World” from The Little Mermaid, or The Beatles cover Harry Styles’s “Watermelon Sugar.” An entirely-new, surprisingly-plausible AI-generated Drake song recently went viral.

Is this the future of music? You can envision a user selecting options from “Artist” + “Genre” + “Mood” to generate a brand new song.

This is basically what Orca does: Orca lets you select an artist, a genre, and write some lyrics. The results are reportedly stunning. According to insiders, Google wanted to release the tool, but labels basically said, “Over our dead bodies.”

But something like this is inevitable. The “songs created” chart above will explode, with generated songs eventually overtaking “real” songs. Hopefully, gen AI can be the technology that finally narrows the gap between music’s cultural impact and its economic value capture.

7️⃣ Shopify’s Reacceleration

Last week, we talked about how the U.S. consumer is doing just fine.

Despite hand-wringing around inflation—and the chart last week did show record-high grocery inflation—consumer spending remains strong. On Black Friday last month, U.S. e-commerce spending was up +14.6%.

This week, let’s look at Shopify’s GMV—the chart below is from Dan Frommer’s New Consumer. Growth has re-accelerated to levels not seen since 2021:

Shopify has now grown 5x in five years, and more than 10x since fall 2017. Frommer notes that Shopify GMV is approaching $300B, now more than a third the size of Amazon’s GMV. How will this trickle into the startup ecosystem? E-commerce has fallen out of favor in recent years, despite big IPOs like Klaviyo ($10.7B market cap) and Instacart ($10.8B market cap) last year. But commerce continues to roar ahead, and online penetration remains only ~20%. There’s a lot of room to run.

Also interesting to watch: digital commerce. Adobe tracks digital commerce spend and expects U.S. holiday e-comm digital spend to grow +8.4% this year, outpacing inflation and faster than last years 4.9% growth. Online commerce is more than buying paper towels, diapers, and shoes. We’re seeing new categories of products—for instance, you can buy sneaker bots and IP proxies and community memberships on Whop. Or you can shop at IKEA in Roblox’s new IKEA store:

This is part of a broader “internet economy” that shifts spend from the physical world to the digital.

8️⃣ Venture Capital’s Power Law

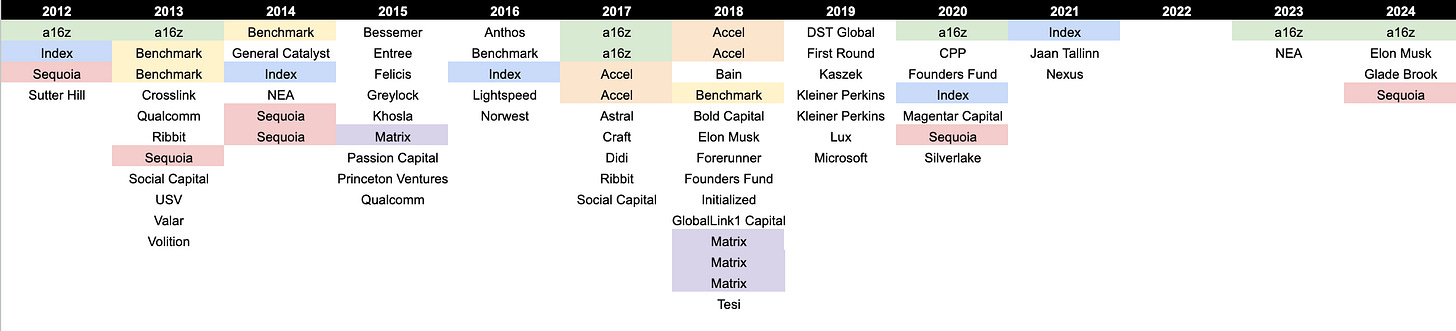

A common topic in Digital Native is venture’s power law. Only a handful of companies really drive returns. DST’s Cole Rotman crunched the numbers in an interesting exercise. This is more of a table than a chart—sorry!—but allow me to break the rules. Cole’s table here shows Series A rounds for companies that would go on to achieve $5B+ valuations.

Of all venture firms, Sequoia, Benchmark, Index, and a16z have the most companies on the list.

Check out Cole’s Twitter thread for more detail on each company: for instance, the 2012 Index entry is Datadog; the 2018 Benchmark entry is Chainalysis; the 2020 a16z entry is Deel; and so on. This is a cool visualization of a topic we talk a lot about.

9️⃣ VC Fund Cycles and Secondaries

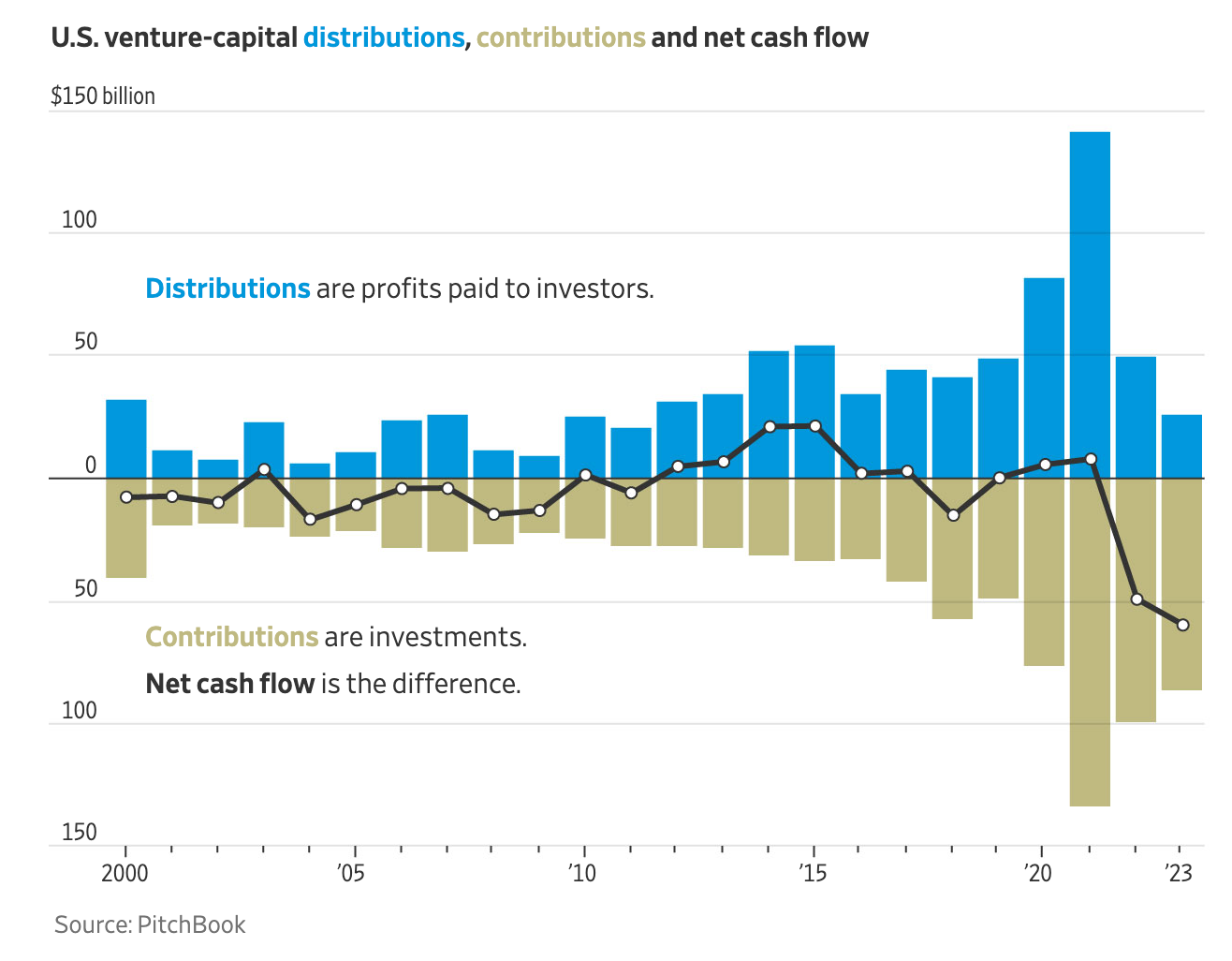

One more set of charts on venture. Last week we looked at how venture inflows are far outpacing venture outflows ($60B vs. $26B last year), starving LPs of distributions. Here was that chart:

Well, why is this? For one, companies are staying private longer. Companies used to IPO pretty quickly. Amazon was founded in 1994. It went public in 1997. Google was founded in 1998, and went public in 2004. And so on.

Not anymore. My friend Mario at The Generalist had an interesting visualization this week of how tech companies are staying private longer:

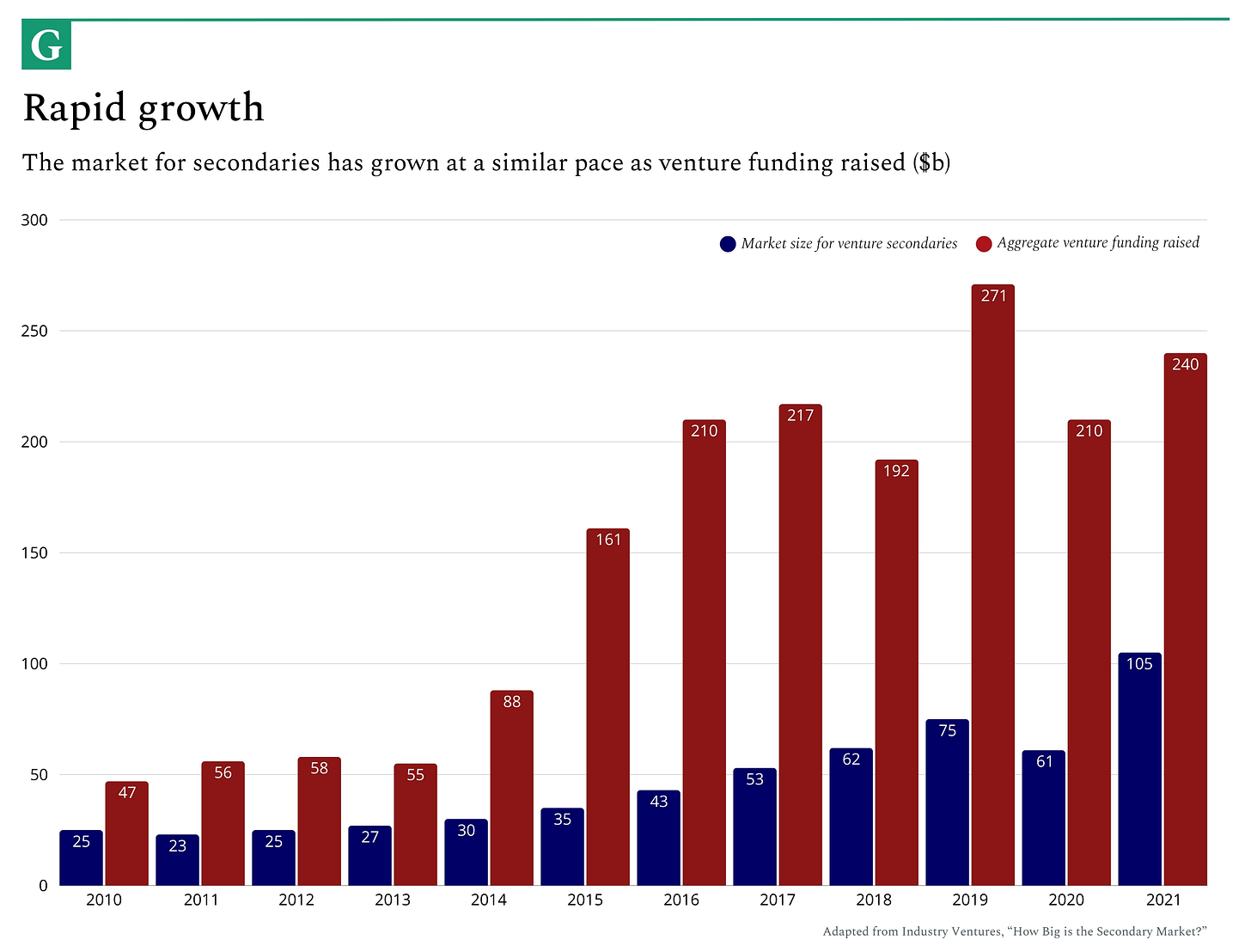

And as you’d expect, this means that the market for secondaries is booming:

And for good reason. SpaceX is reportedly doing a round of secondary at a $350B price. As Mario puts it: “SpaceX is the same age as The Wire, Eminem’s ‘Lose Yourself,’ and the circulation of the Euro – all products of 2002.” And according to Industry Ventures, the average company going public in 1989 was six years old and had $30M in revenue, while by 2021, the average business was 12 years old and had $200M in revenue. The times they are a-changin’.

🔟 Video Consumption Over Time

It seems quaint that we used to use the internet primarily for text and, later, for photos. Today, video dominates. As of 2023, about 65% of internet traffic comes from online video, up from 51% in 2016. Here’s a look at how much time Americans spend consuming digital video:

Why is this timely? Well, video is getting a bit of a shake-up. This week, OpenAI launched Sora, its video generation model, to the public. Users can generate videos up to 1080p resolution, up to 20 seconds long, in widescreen, vertical or square aspect ratios. You can play around with Sora at sora.com.

MKBHD reviews Sora on his YouTube channel, and plays the game: “Is this video real or AI-generated?” We’re already at the point where it’s near-impossible to tell.

We’re going to see a lot more video get created—and we already get 500 hours of video uploaded to YouTube every minute—and we’re going to see a lot more video get consumed. The chart of consumption above will continue creeping upwards until it becomes dangerously close to encompassing our entire waking hours.

Check out charts #1-5 in last week’s piece. And we’ll be back next week with a recap of 2024 predictions and some predictions for 2025.

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: