How AI Is Reinventing Wealth Advisory

Case Study: Continuum Embodies AI's Revolution in Knowledge Work

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 70,000+ weekly readers by subscribing here:

How AI Is Reinventing Wealth Advisory

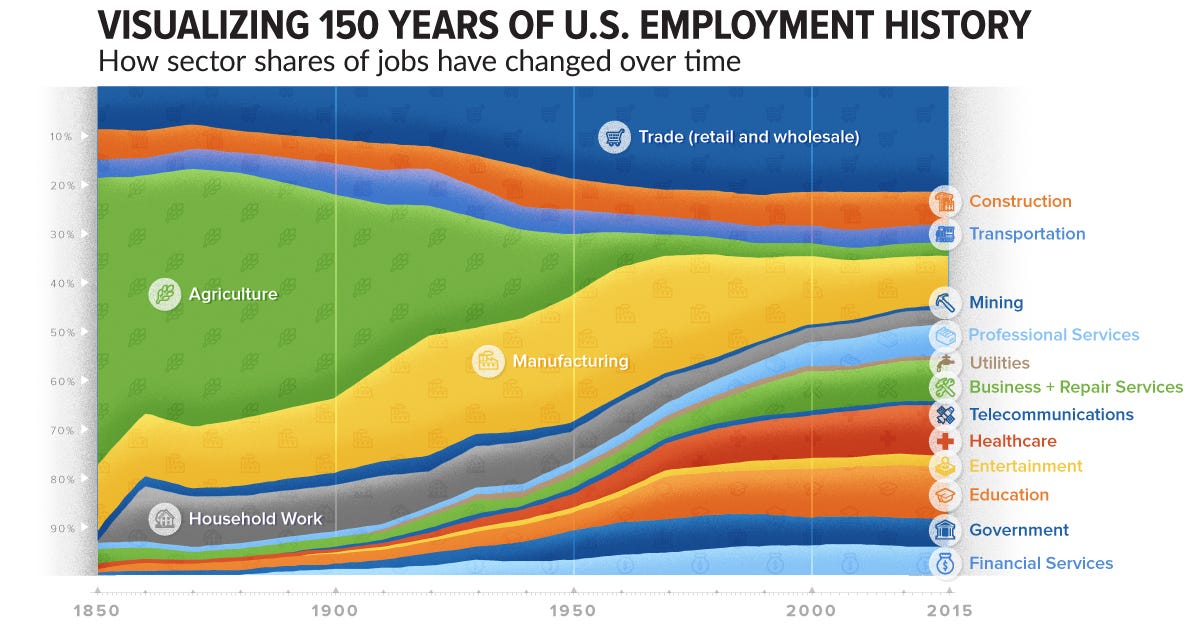

Over time, America’s economy has shifted from an agriculture economy, to a manufacturing economy, to a services economy. Check out the industries that have swelled over the past 50 years:

Healthcare. Education. Financial Services. Business Services. Professional Services. That’s a whole lot of services.

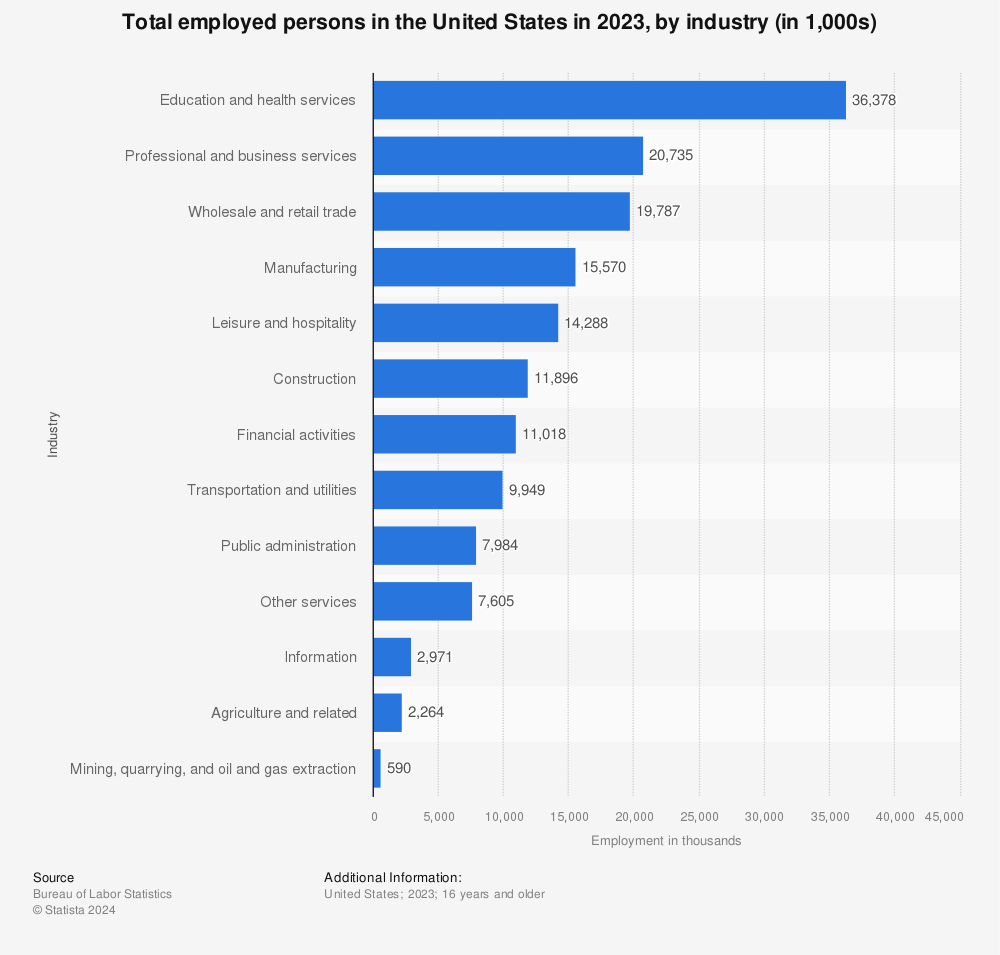

Here’s U.S. employment broken into major categories by Bureau of Labor Statistics data:

Again, services.

The Industrial Revolution gave birth to the manufacturing economy, and in the 250 years since, services have slowly seeped into the economy. The canonical 19th century workplace was a factory; the canonical 20th century workplace was an office. We shifted to desk-centric knowledge work—think Working Girl or Office Space. “Did you get the memo?” The most-popular TV show of this century is literally called The Office.

Now, the AI Revolution is set to reinvent the services economy. Why is this happening? Well, AI is pretty good at automating the kinds of tasks that dominate service-oriented work: note-taking and emailing and scheduling and writing memos and making slide decks and, yes, sending TPS reports.

In last summer’s AI Is a Services Revolution, we introduced a formula for AI startups:

Pick a large, text-heavy services industry.

Use LLMs to automate workflows and augment workers.

Leverage industry-specific data to fine-tune the model over time, improving the product in tandem. Specialization = your edge.

This week we’ll look at a case study: one of our early Daybreak investments, Continuum.

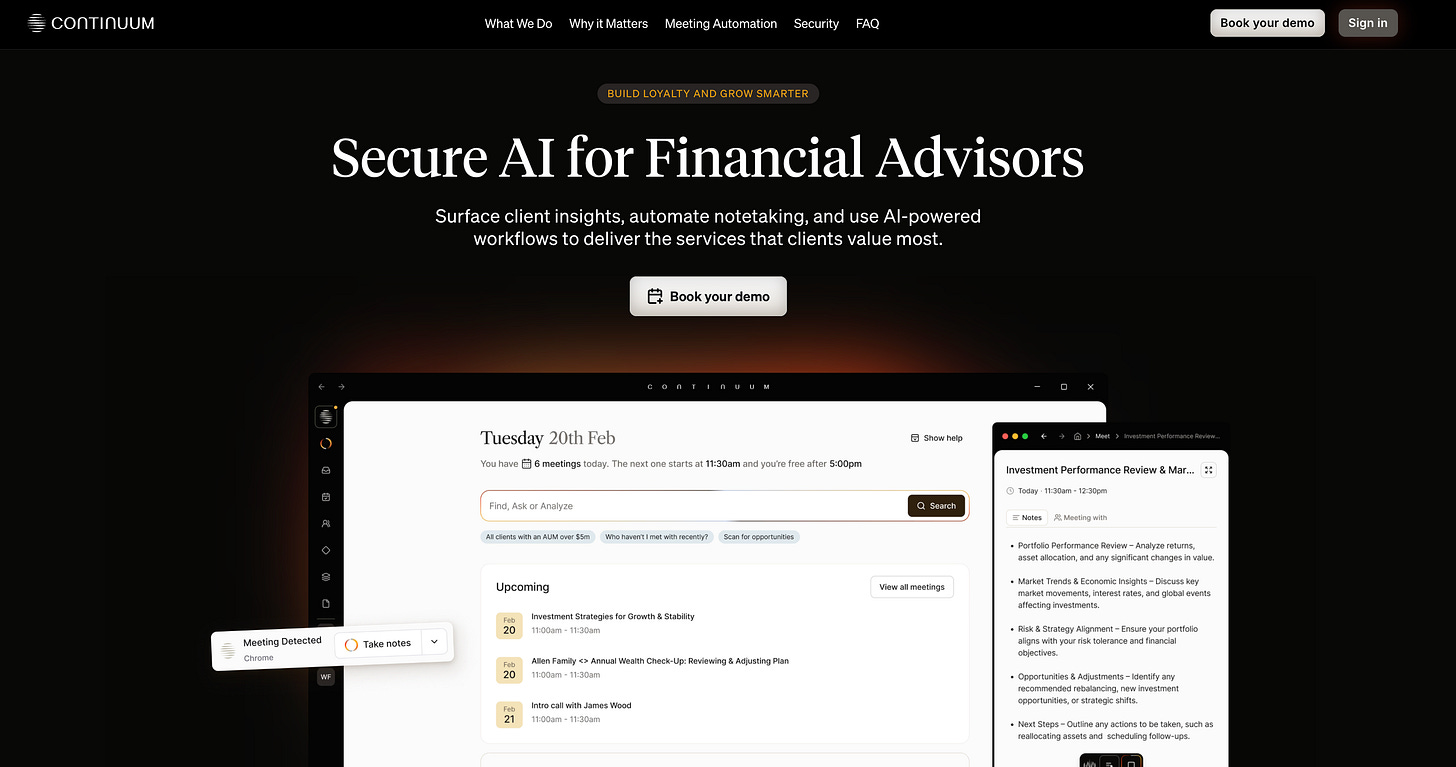

In Digital Native, we often look at broad shifts. Occasionally, it’s also helpful to look at specific examples of innovation—what’s happening in early-stage startups, in real time. Continuum came out of Stealth this week to reinvent the financial advisor space.

Back when I first met the Continuum team, I was struck by a statistic in their pitch deck: by 2045, $84 trillion (!) will be passed down to the next generation.

This stat keeps financial advisors busy, but the industry is sagging under its own weight: many workflows remain pen-and-paper; data is siloed and imperfect; products are generic and expensive. The world of financial advisory—a $100B+ global industry compounding 5% a year—is a perfect example of a services industry ripe for AI disruption.

The next slide in Continuum’s pitch deck made another important point about service work: humans spend way too much time on monotonous stuff that, to put it bluntly, is a massive pain-in-the-ass. Research has shown that 86% of a financial advisor’s time is spent on admin and pre- / post-meeting busy work.

Shouldn’t an advisor’s time, you know, be spent on more important stuff? Like how they can optimize the client’s financial future?

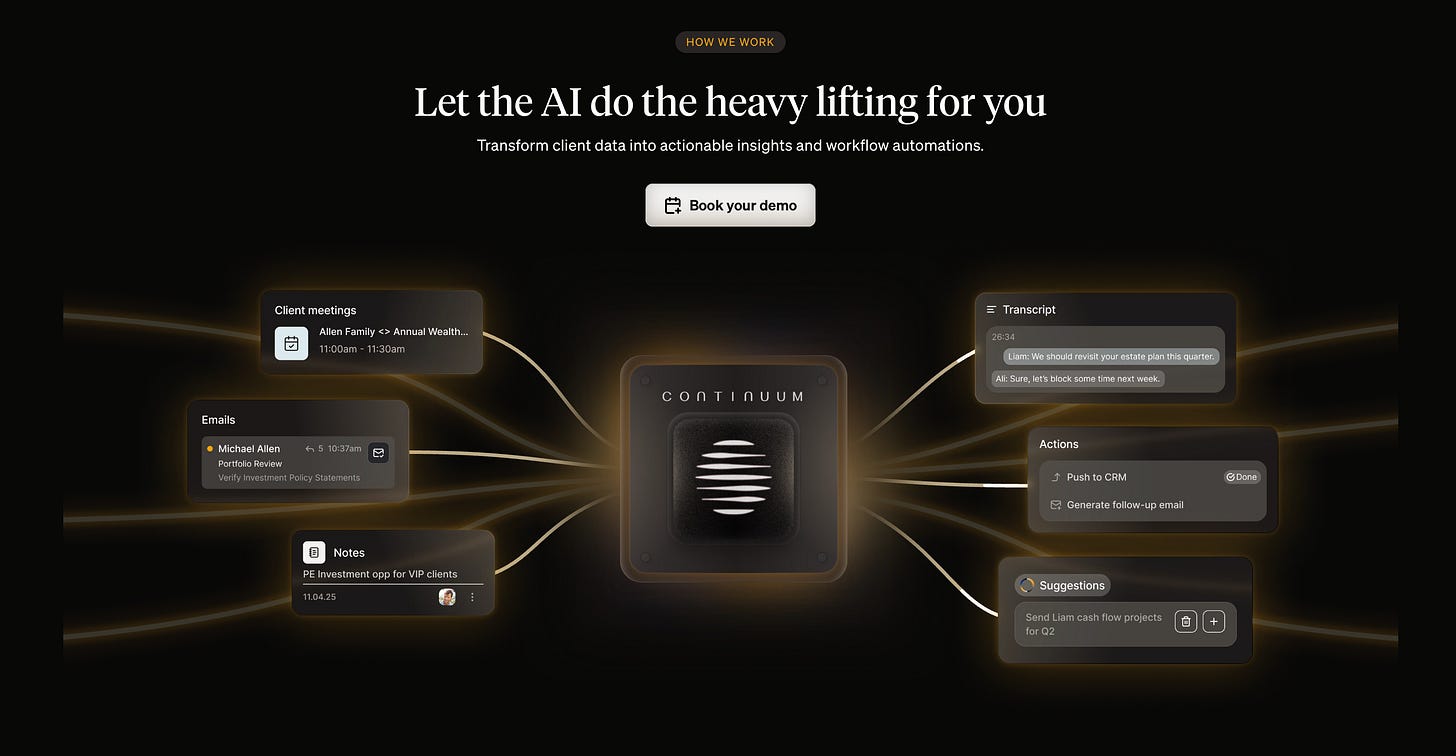

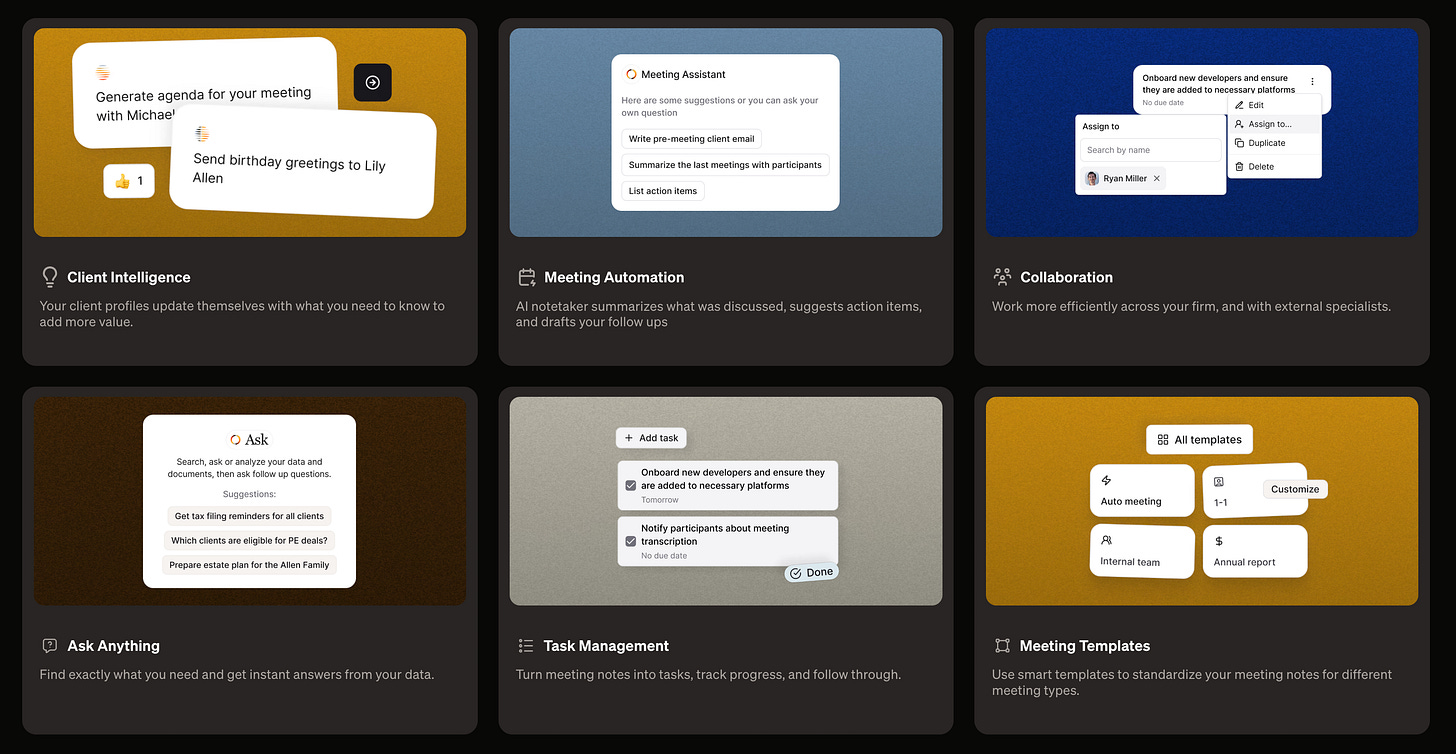

Continuum’s product ingests client data, then automates workflows and turns unstructured data into actionable insights. This is fancy language that roughly translates to: let Continuum listen in on your meeting, take notes, and summarize key takeaways on your behalf. Then let it actually execute the post-meeting follow-ups.

The wedge here is summarizing meetings: any advisor spends an enormous amount of time on meeting prep, notes, and next-steps. (This is also true in other spheres of knowledge work: lawyers, doctors, bankers, and so on.)

To digress for a moment, the history of financial advisory is an interesting one:

Wealth management actually began in the Renaissance to serve a rising merchant class. This was right around the birth of capitalism and industrial expansion. At this point, wealth advisory wasn’t really an outright profession, per se; rather, the industry formed as a network of trusted personal relationships. Wealthy families would share tips on managing wealth.

Before 1900, managing wealth basically meant protecting physical assets. “Get off my land!” “Hands off my gold!” You get the picture. But with the rise of the stock market and the digitization of financial systems in the 20th century, wealth got a lot more complicated. The financial advisory industry professionalized as a result, and in doing so, the industry standardized, with advisory work getting a lot less tailored and less personal (except for the super-rich).

Continuum’s vision is to return advisors to their roots, shifting from large-scale, impersonal service providers to hyper-personalized, deeply-trusted strategists.

The team comes from the finance world: Daniel Asper and Matthew Tory were long-time Shopify leaders in product and engineering, where they launched many of Shopify’s fintech products, while Alex Dashefsky was an investor at Torch. They approach Continuum with the mission of democratizing financial advisory: today, financial advisory has a reputation as a somewhat-snobby industry reserved for the super rich. But it shouldn’t be that way: everyone should get access to good advisory services, to build wealth and save intelligently.

Automating the mundane, time-intensive parts of the job makes financial advisory more efficient. This makes the job more economical, thereby making it profitable for advisory firms to take on clients with lower net worths. With current tools, it might only be profitable for a firm to take on a client with $1M+ in assets; hopefully, with AI streamlining workflows, that number drops to $100K or less.

The key questions: how can we use AI to (1) improve access to financial advisory, and (2) deliver incredibly personal services?

To revisit the formula above.

Pick a large, text-heavy services industry.

CHECK ✅

We have a $100B+ market that runs largely on paperwork—lots and lots of notes and memos and spreadsheets.

Use LLMs to automate workflows and augment workers.

CHECK ✅

Continuum’s product both digitizes offline workflows, and then executes the work, ensuring advisors can focus on more high-value-add, human tasks.

Leverage industry-specific data to fine-tune the model over time, improving the product in tandem. Specialization = your edge.

CHECK ✅

In this space, data privacy is key and services should be bespoke, meaning we need a vertical-focused, tailored product.

Check, check, check. Expect financial advisory to look a lot different in 2030 than it does in 2025.

If you’re an advisor interested in working with Continuum, you can reach the team at team@oncontinuum.com 📬

Hopefully this is an interesting snapshot of what’s happening in the early-stage markets. See you next week.

Related Digital Native Pieces:

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: