Make America Healthy Again

With Silicon Valley, Not RFK Jr.

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 70,000+ weekly readers by subscribing here:

Make America Healthy Again

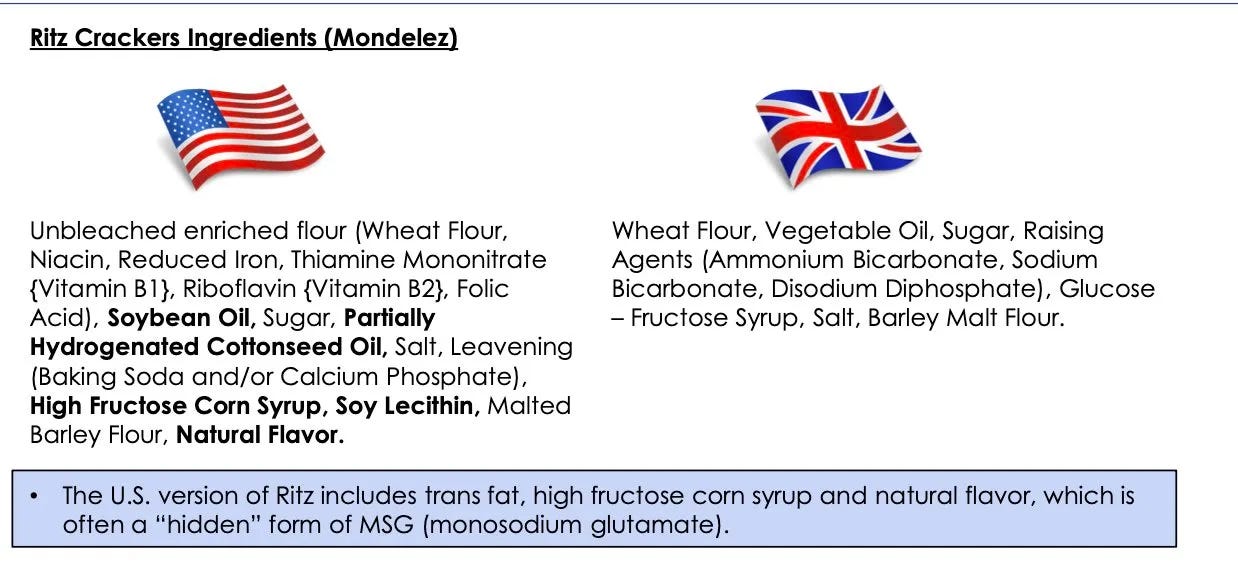

When I think of America’s health, I think of Ritz Crackers. Let me explain.

A few years back, I remember seeing this image from Justin Mares. It shows the ingredients for Ritz Crackers in the U.S. vs. in the U.K. America’s version has…a lot more junk in it.

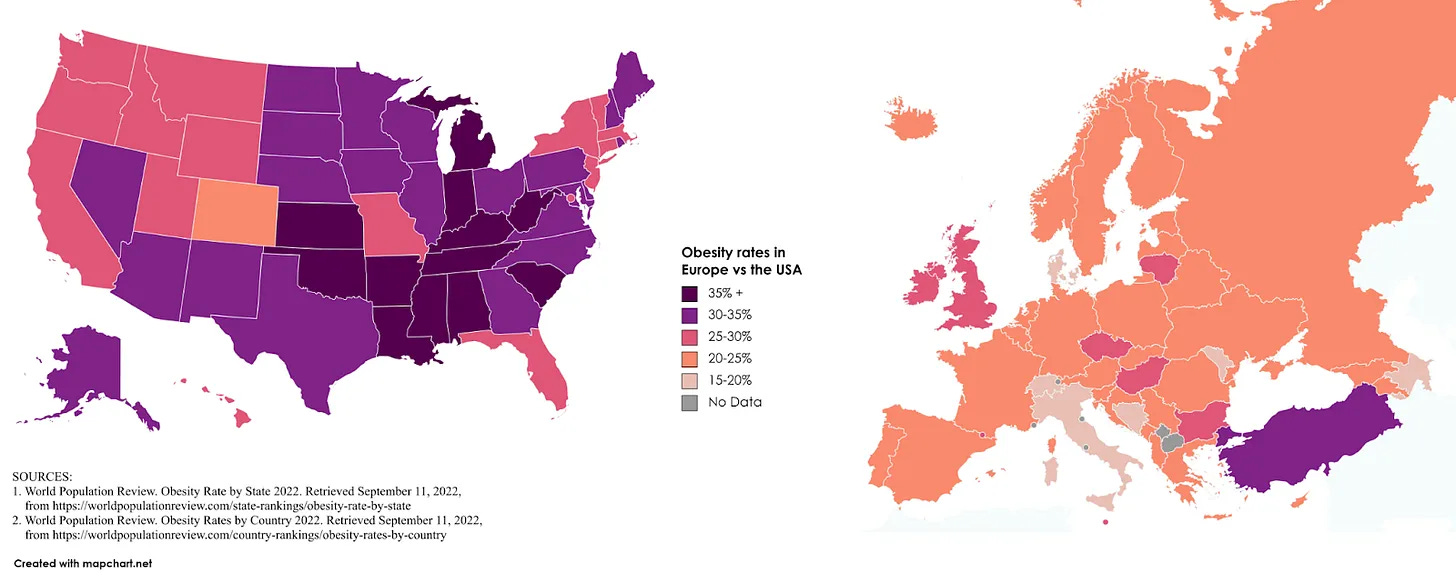

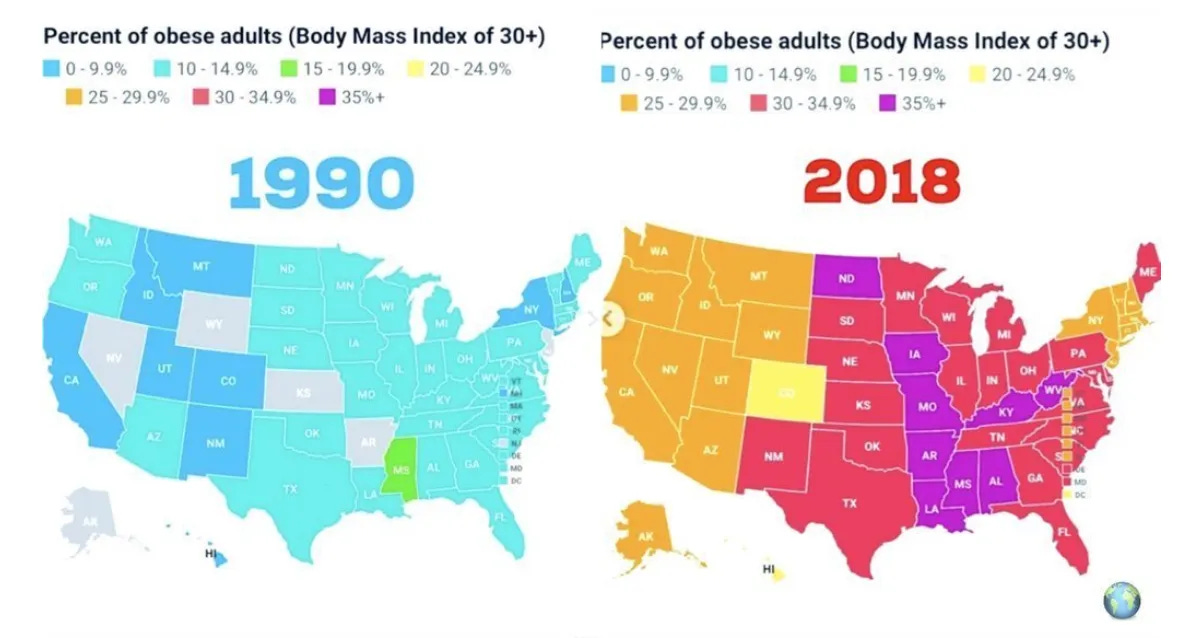

You can’t really separate the Ritz Cracker comparison from this map:

Here’s the headline stat to go alongside it: in 1990, zero states had obesity rates above 20%; in 2018, zero states had obesity rates below 20%. (For what it’s worth: 19 states now have obesity rates over 35%.)

Here’s a view comparing us to Europe:

Yikes. Obesity is a uniquely American problem. I don’t agree with RFK Jr. on much nearly anything, but I do agree with him on one thing: America is sick, and it’s because of our food supply. “It’s the food, stupid.” RFK picked a great slogan with “Make America Healthy Again.”

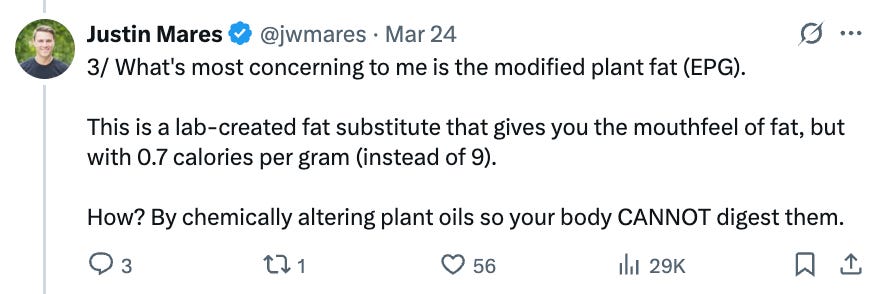

This crisis isn’t going away, though GLP-1s will distract us from the root of the problem. One recent example of how ever-present this problem is: in March, Justin tweeted a take-down of David Protein, the new golden child of CPG (David was founded by the RxBar founder).

David, named for Michelangelo’s most famous sculpture, bills itself as the most protein-dense bar on the market (and as we wrote about in June, America is protein-crazed). The company boasts a $725M valuation one year in.

But Justin calls David “a nuclear bomb for your gut, metabolism, and overall health,” and breaks down what’s wrong with it in a Twitter thread:

The takeaway for me: even if you’re trying to be healthy, America makes it damn hard.

Back to MAHA: there are plenty of government policies that should be in place to fix our health problems, though getting rid of vaccines isn’t one of them. But policy is the focus of another piece. In this piece, I want to look at how Silicon Valley can make America healthier.

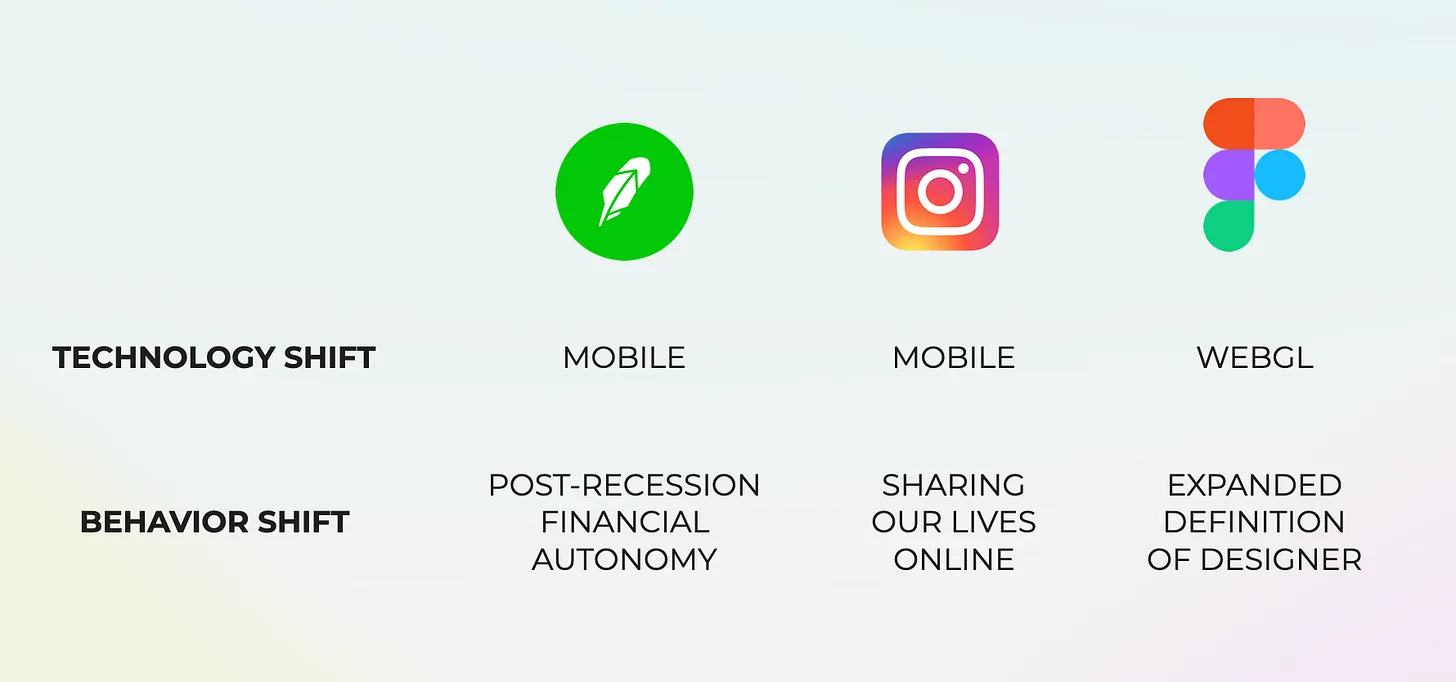

A common theme in Digital Native is the belief that the biggest companies are built at the nexus of technology shifts and cultural shifts. We’ve given examples in the past like Figma, Instagram, and Robinhood:

I believe some of the biggest companies founded in the 2020s and 2030s will be built in healthcare.

Healthcare is benefiting from dual forces on the technology side—telehealth and AI—while we’re seeing a seismic cultural shift around health: a McKinsey survey found 80% of American consumers say wellness is a top priority in their lives. Another survey asked people whether they’d rather be healthy, wealthy, or happy. The majority opted for healthy (52%) over happy (28%) or wealthy (20%). People care more about their health these days, and they’re willing to put their money behind it.

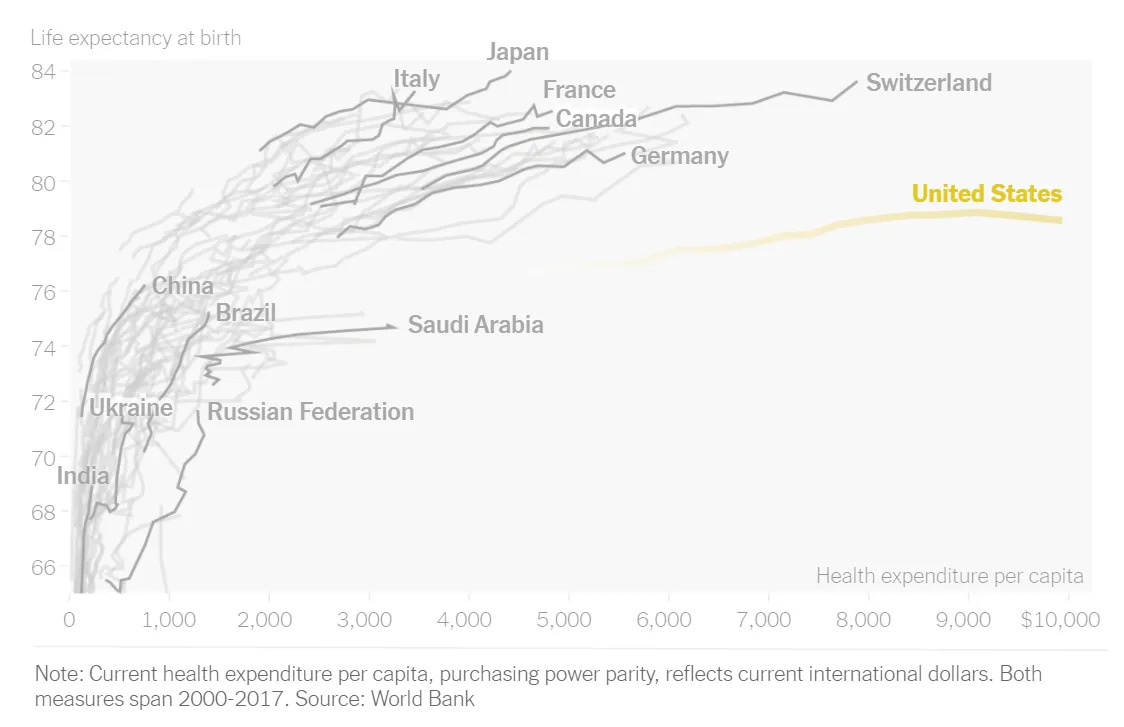

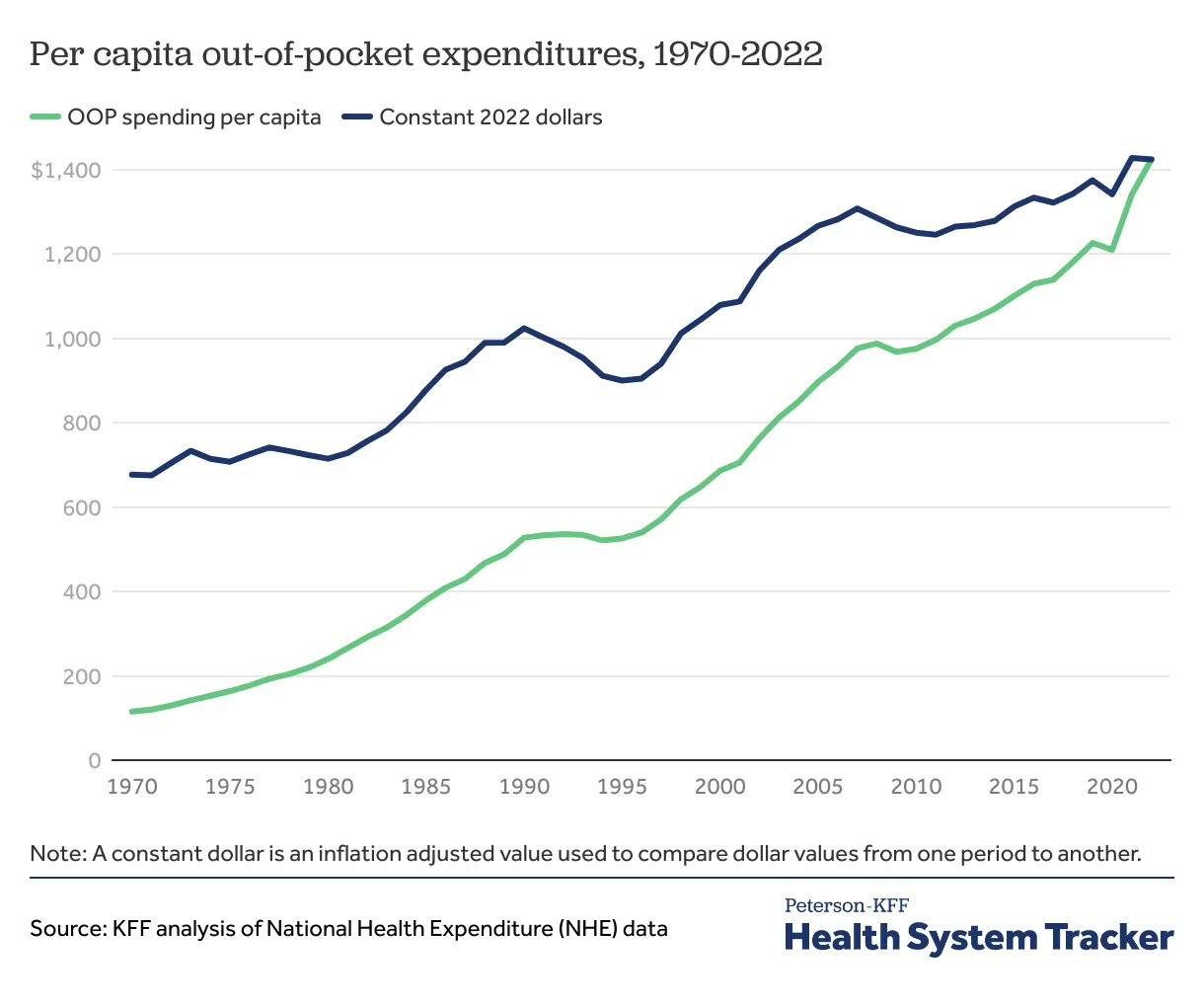

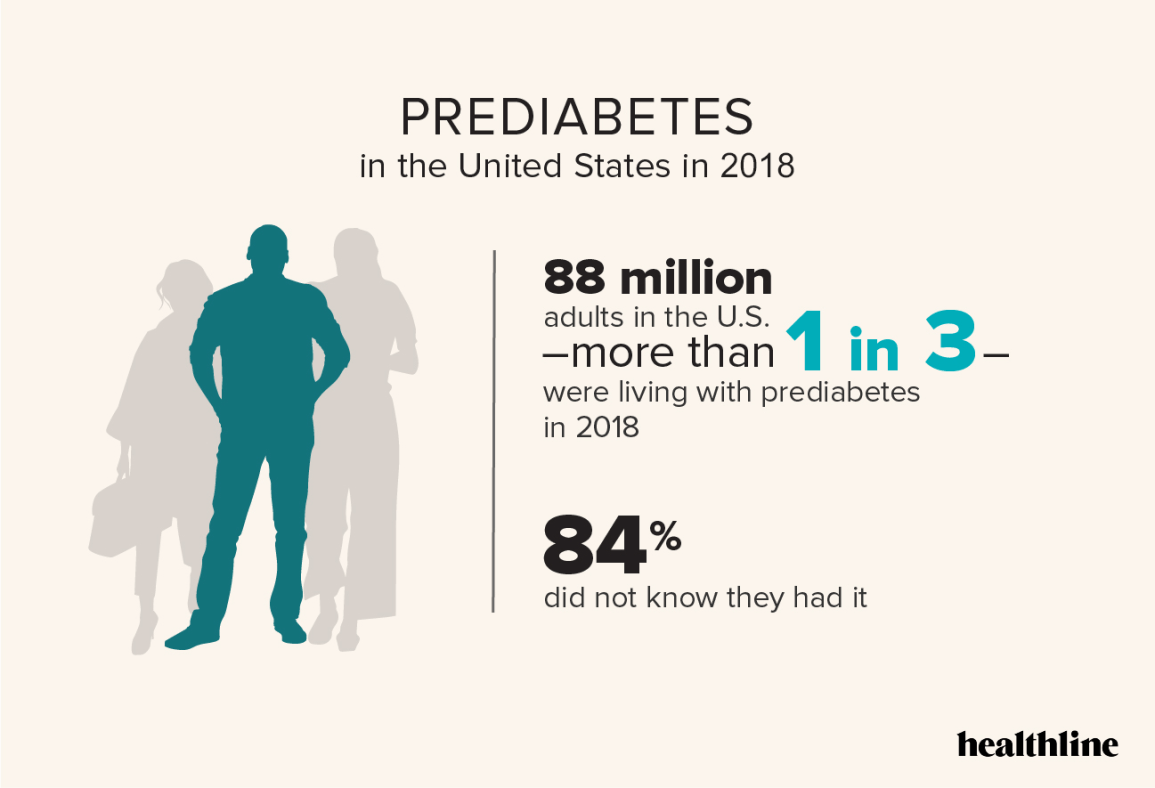

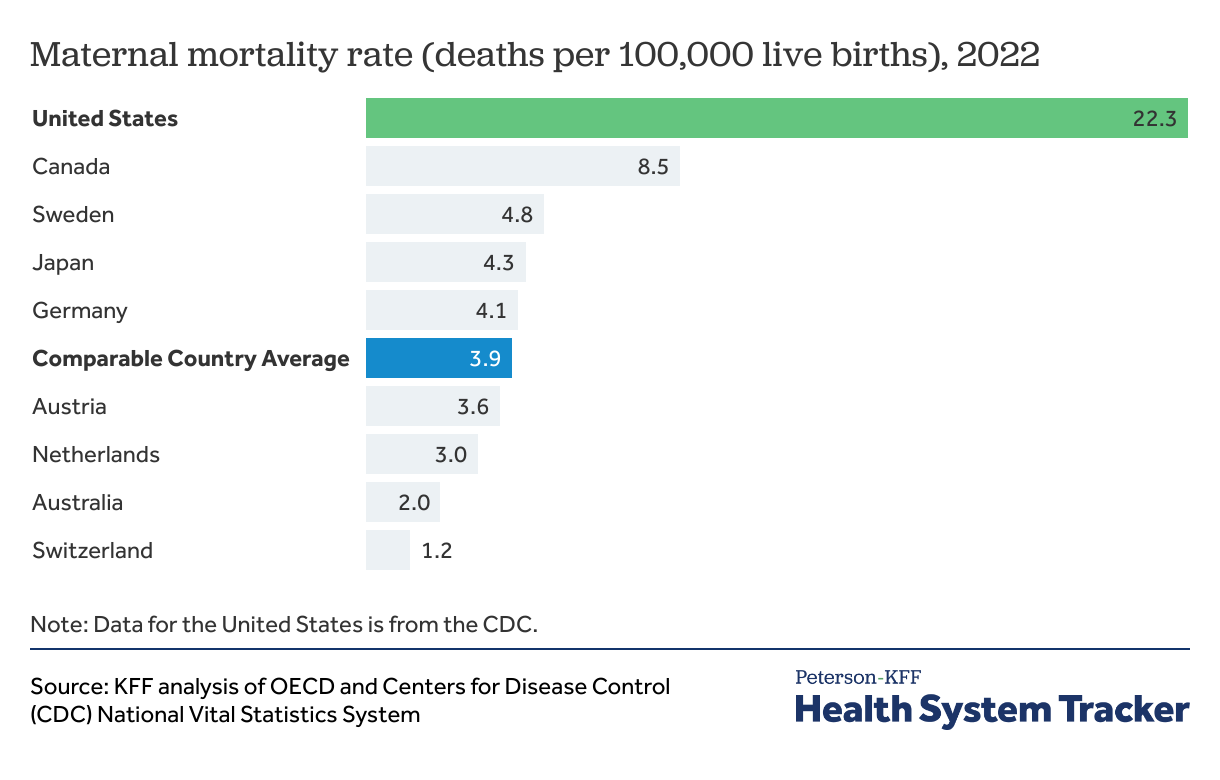

Over the years, we’ve shared a lot of charts in Digital Native that underscore America’s health crisis. I don’t want to spend too much time rehashing those (most of this piece should focus on innovations to solve the crisis), but I’ll share a few standouts here to set the stage:

You get the picture: things are grim. Yes, the food supply is a major issue making us sick, but the problems are deep and widespread. Healthcare is America’s largest industry, its most important, and also its most broken.

When I think about healthcare, I tend to think about:

The Access Problem

The Workflow Problem

The Access Problem

A key way Silicon Valley addresses our declining health is by solving access. I think of access on two axes: (1) time, and (2) money. Relevant charts here are (1) the physician wait time chart above, and (2) the chart of rising expenditures. Most people can’t get in to see a doctor. When they do manage to get in to see one, they can’t afford care.

What’s an example of a company solving the access problem?

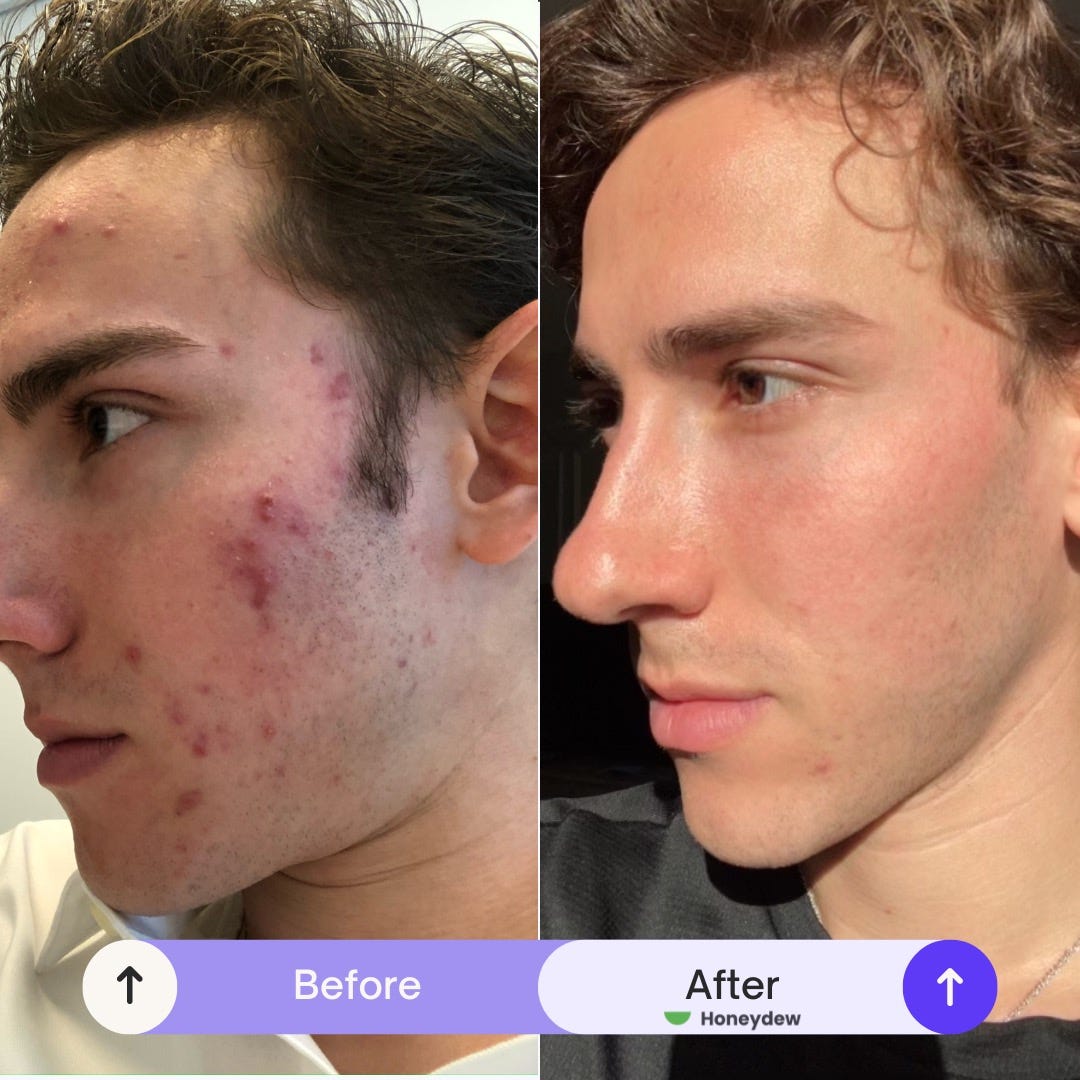

I’ve written before about Honeydew, one of our Daybreak portfolio companies. Honeydew is a consumer subscription company for skincare and dermatology. A Honeydew customer gets instant access to a dermatologist, and access to medical-grade skincare products—think medications for acne, for eczema, for psoriasis.

Honeydew’s co-founder and CEO David Futoran started Honeydew after a years-long struggle to treat his own acne. Here’s David’s own before-and-after:

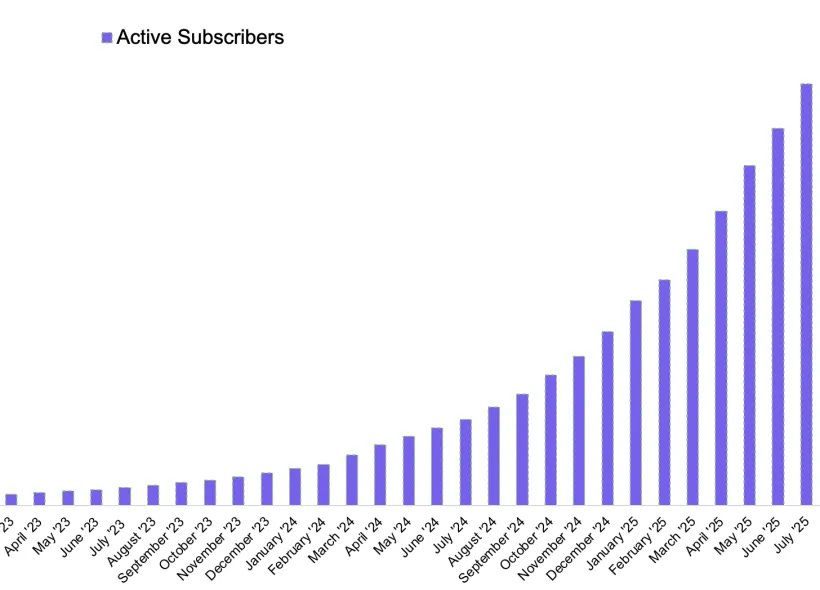

David teamed up with his dermatologist, Dr. Joel Spitz, to found Honeydew. And the business is growing rapidly, with extremely consistent month-over-month compounding:

More about Honeydew’s founding story in this video:

Honeydew solves access on both axes, time and money. I often think about my own experiences: I’m lucky that my dad’s med school roommate is a dermatologist. I get to text him photos of skin issues and get advice on treatments. Most people aren’t so lucky. Technology should solve the access problem for the 100M Americans with a chronic skin condition (2x the number with diabetes, by the way).

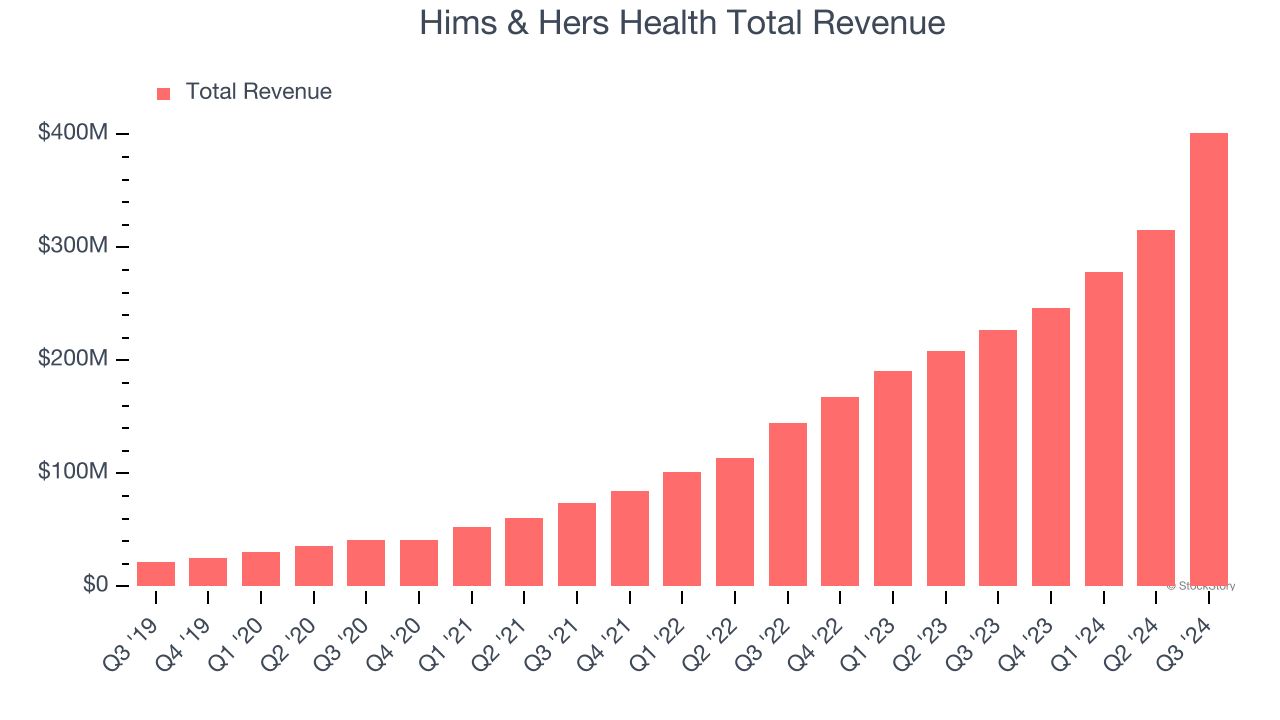

Derm is a supply-constrained market. Typical TAM analyses would probably lead you astray here, as most people who need care can’t get it. (An alarming stat from David: 9 of 10 people with a skin disease don’t get treatment for it.) Hims did $1.5B in revenue last year, +69% year-over-year, with ~77% gross margins. The original flagship ‘sexual health’ category did an estimated $500M+. Who would have thought that ED would be such a big business? Companies like Hims and Ro no doubt solved the access problem for ED, hair loss, and now GLP-1s, meaningfully expanding those markets.

We should see the same thing play out in other categories. Last year I went to a brick-and-mortar dermatologist and left with $500 of products—spot treatments, Tretinoin, snail cream, eczema medication. I still pay for many of those products (I’m a Tretinoin loyalist for life 🫡 ). In the future, that spend probably gets captured by a remote visit and a clean, intuitive online subscription service.

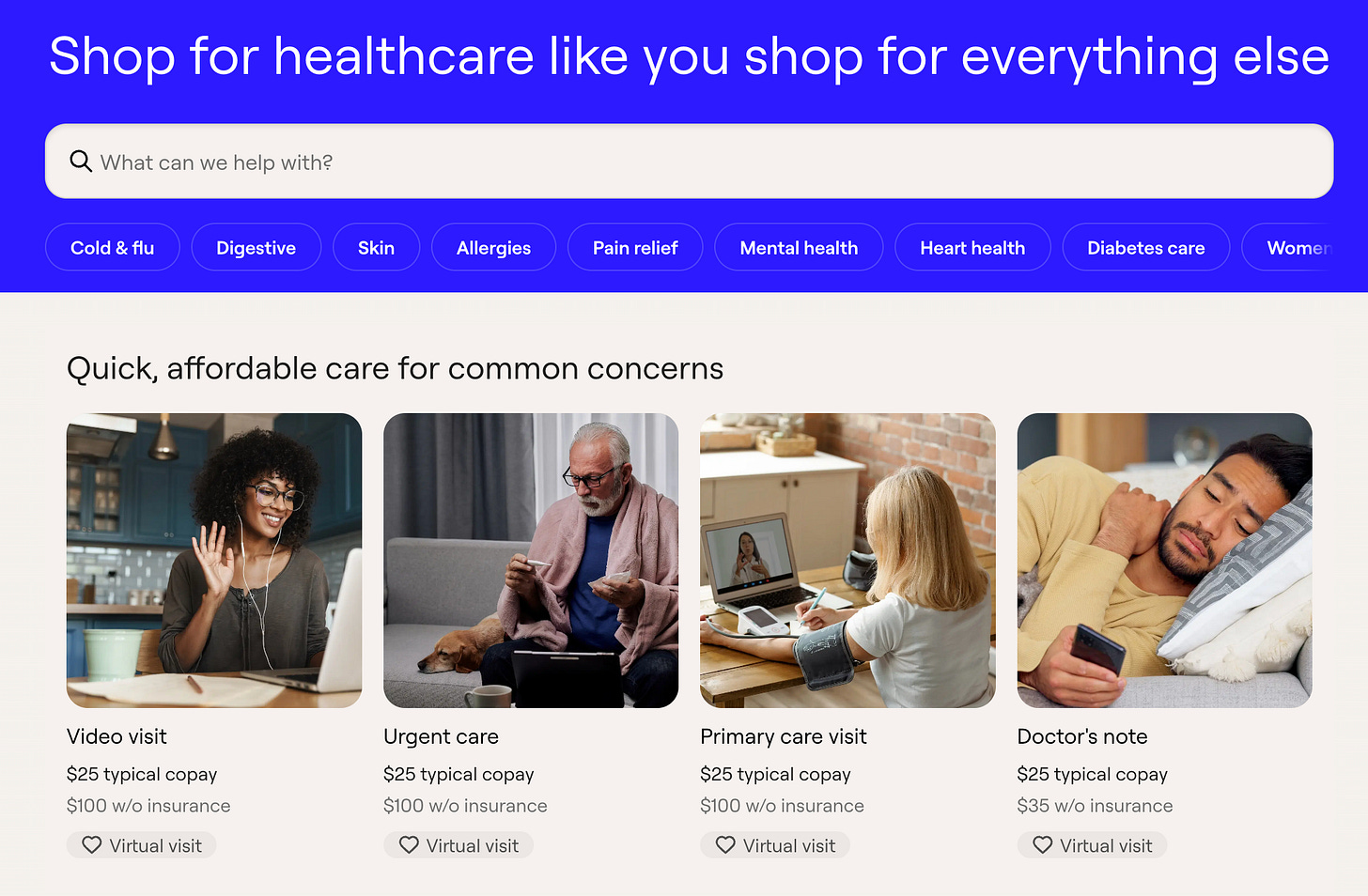

Telehealth (and eventually AI) will gobble up more and more of healthcare. We’ll see vertical players like Honeydew for major segments of spend. And we’ll see horizontal players too—an example there: General Medicine, the new company from the PillPack founders (PillPack was acquired by Amazon for $1B in 2018).

Shouldn’t shopping for healthcare be as easy as shopping on Amazon? That’s the goal. We still have a ways to go, but eventually it will be.

The Workflow Problem

In addition to solving the access problem, Silicon Valley helps solve what I call the workflow problem. What does that mean? Healthcare runs on mind-numbing, monotonous, slow, human-intensive workflows. Thankfully, LLMs turn out to be pretty good at automating these workflows.

There are dozens of exciting companies here. Of course, consumer-facing and care delivery companies can still innovate in workflows; think: Honeydew automating workflows for prescribing intensive treatments, i.e., Accutane or injectable biologics. But we also see B2B innovation here. Administrative overhead in healthcare is over $1T annually, about 25% of healthcare spending. Clinicians spend a third of their time on admin work. There’s a lot of inefficiency to streamline and labor spend to capture.

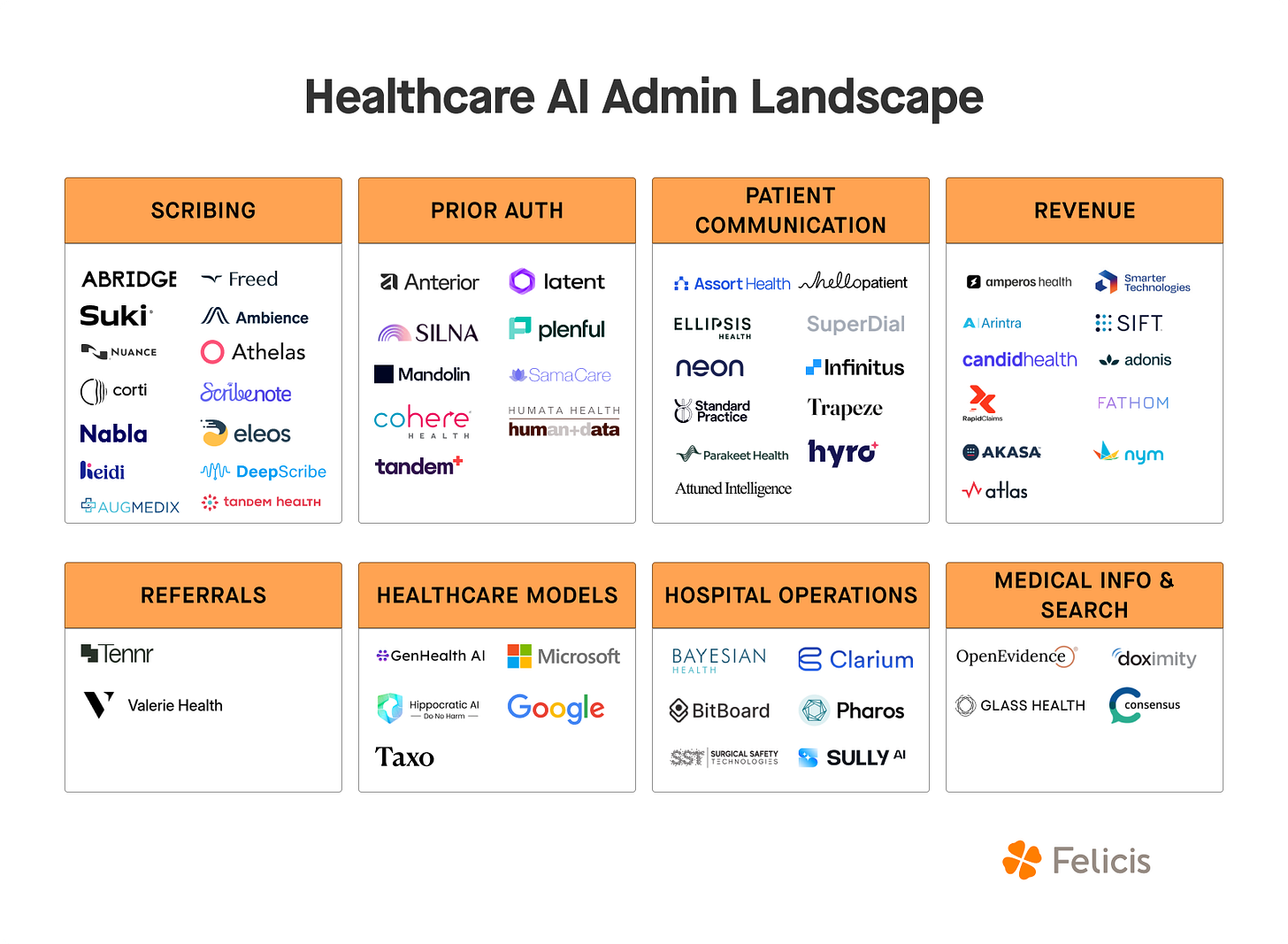

Felicis has a good deep-dive into the companies reinventing healthcare admin. Here’s a nice market map:

Of course, many of these companies don’t fit neatly into one bucket. I texted a couple founders on this market map and got back, “Oh, interesting! They put us in ___ bucket.” The various players are moving horizontally into different spheres of healthcare admin; some logos here belong in two, three, even four categories. Things are getting crowded, but the size of the prize is enormous and most of these segments won’t be winner-take-all.

What Else Is Interesting?

Let’s finish by touching on some other tailwinds within healthcare worth paying attention to.

Aging Population

America is getting older: every day, 10,000 Americans turn 65.

We’re on track for more than one in five Americans to be a senior citizen by 2040. Half the country is already over 50. There are already more Baby Boomers in the U.S. than there are people in the U.K., Israel, and Switzerland combined. And this is a global phenomenon: people 65 and older will soon outnumber children under 5 for the first time in history.

This means we get the caregiving generation: someone has to take care of our old. This is the predominant demographic shift in America.

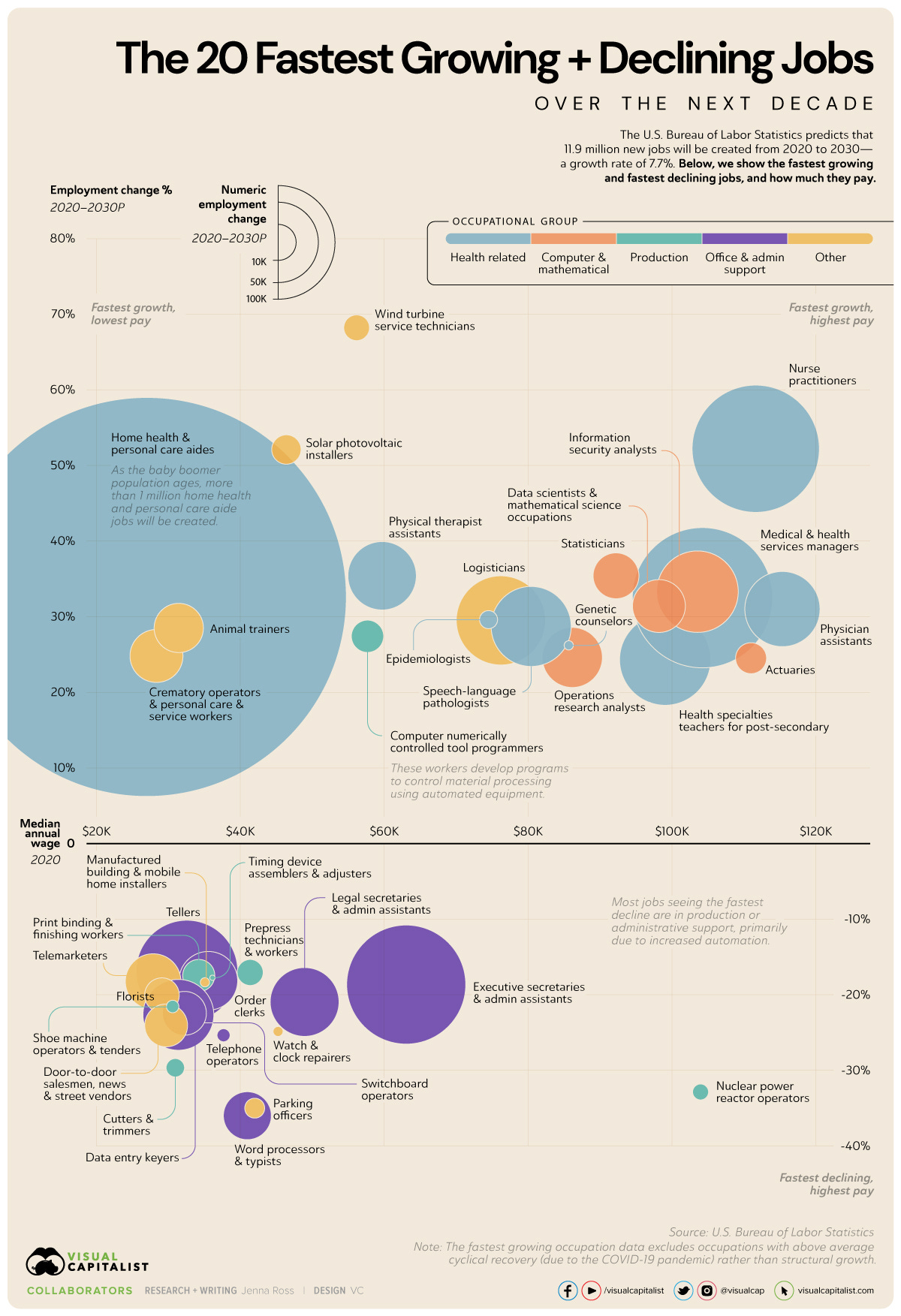

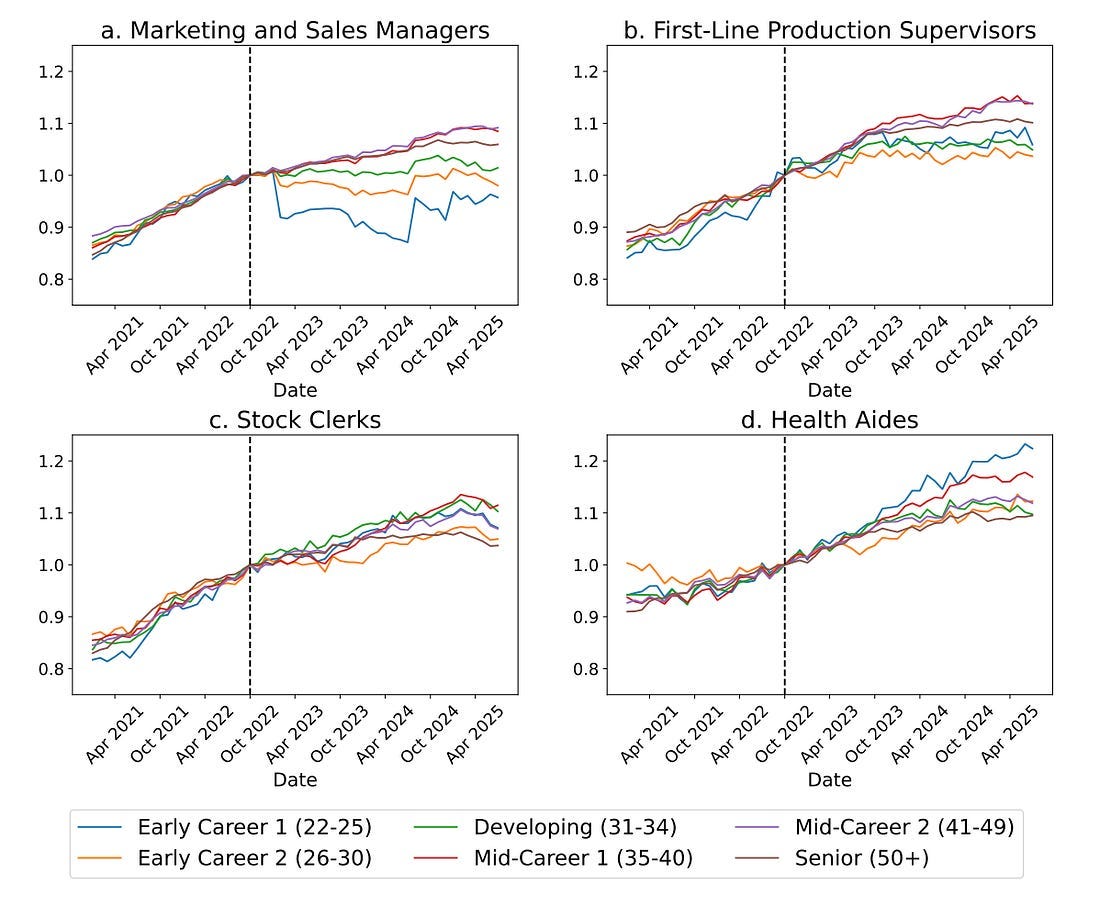

Remember last week when we wrote about AI taking our jobs? One of the only jobs not being taken by AI is that of the home health aide. Check out the bottom right quadrant:

Here’s a nice visualization of the fastest-growing professions in America across the 2020s—the enormous blue bubble is home health / personal care aides:

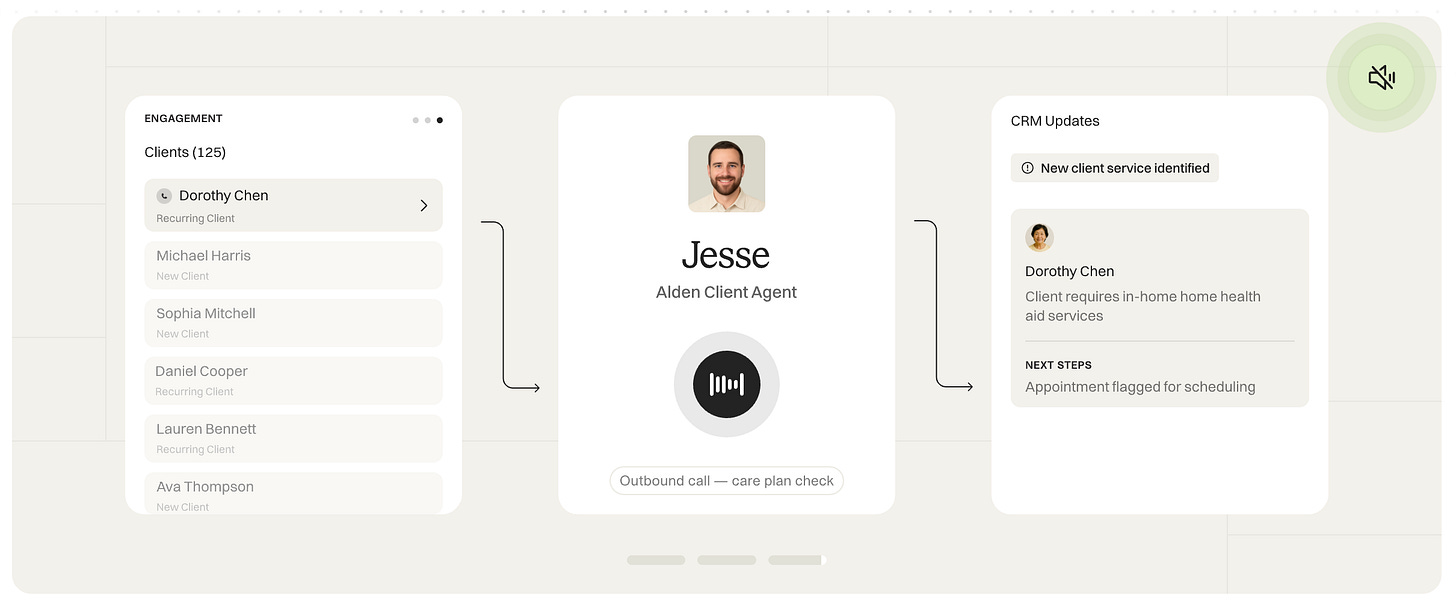

One of our Daybreak companies, Alden, uses AI to supercharge coordination for this workforce. Think: intelligent agents to help with staffing and scheduling, currently a nightmare for home care, senior living, and staffing orgs.

Alden is also a great example of solving the workflow problem: how can AI better handle the challenging, complex, time-intensive coordination problems within healthcare?

If you’re passionate about serving the caregiving generation (and about AI), Alden is hiring for engineering and business roles—shoot a note to catherine@alden.health 📬

Fertility

Another long-term shift that interests me: fertility, namely the phenomenon of women having kids later. Here’s a good visualization of that trend-line:

This means more egg freezing and more IVF. We have one Daybreak company tackling this space, solving both the access problem (helping women connect to clinics) and the workflow problem (helping clinics automate their tasks).

In my mind, derm and fertility are the two big cash pay segments within healthcare.

Nutrition & Food

We started this piece by talking about America’s food crisis. What do we do about it?

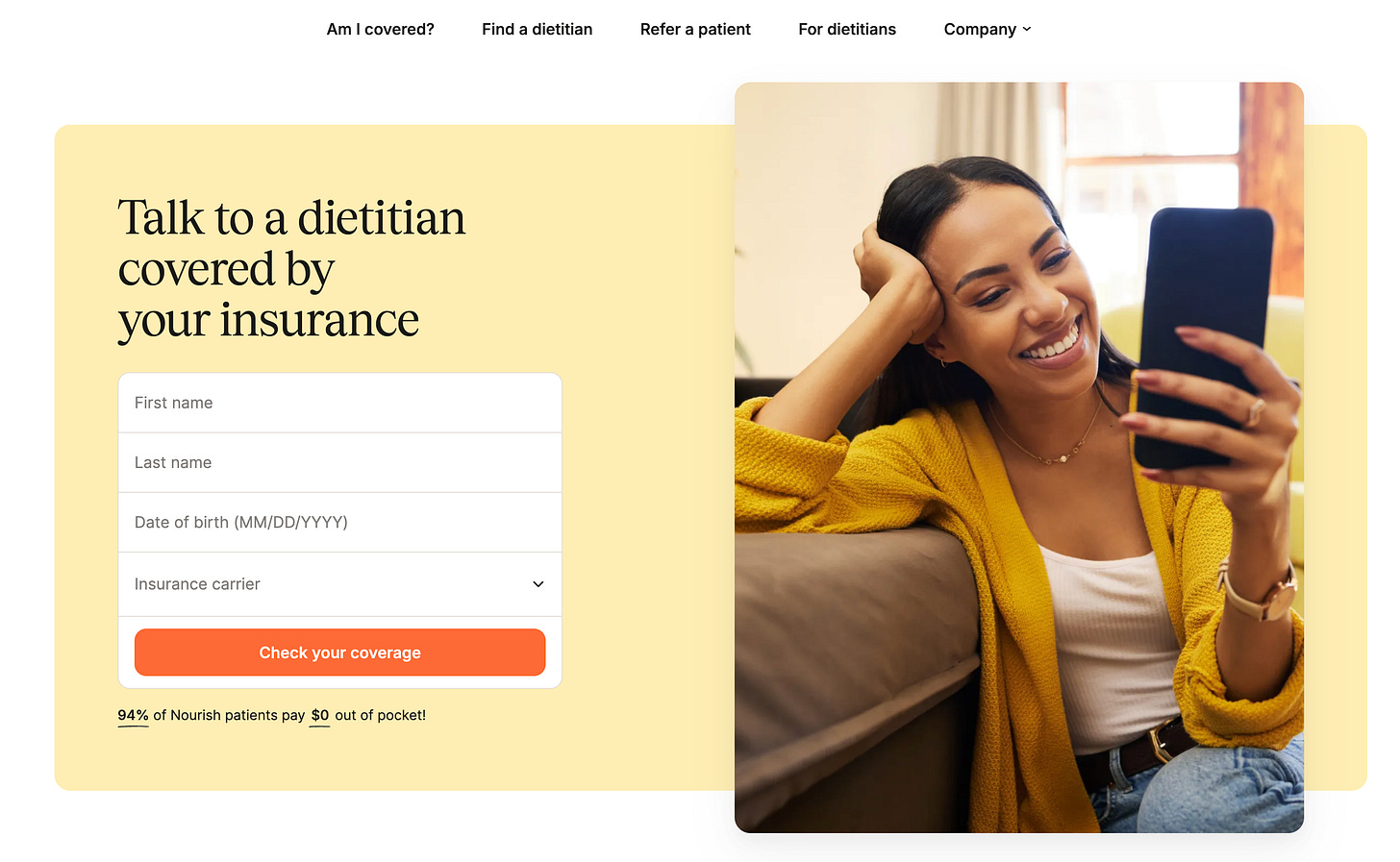

Thankfully, startups are innovating here, often paired with new coverage on the payer side. Nourish, a company in which I’m angel investor, offers access to a dietitian covered by insurance. They’ve grown rapidly in a few short years.

Or take Equip, which offers eating disorder treatment at home. This is another category in which payers are deeply involved: severe EDs can be very, very expensive for the healthcare system. When you have high per-patient spend, as you might in the eating disorder space, you don’t need many patients to hit $100M in ARR. More importantly, companies like Equip expand access through telehealth. Formidable and deeply impactful businesses can be built in these categories.

Mental Health

Mental health was a first-mover category for telehealth. As a result, many people thought the space was saturated far too early. I was chatting with one VC this week, who remarked that her firm missed breakouts like Headway, Grow, and Alma because the space seemed too crowded. It turns out, the market is enormous and can support multiple $1B+ (maybe even $5B+) companies.

Now, we’re seeing new angles on mental health underpin large companies.

Marble Health, in our Daybreak portfolio, addresses the teen mental health crisis. The stats on teen mental health are alarming, and companies like Marble give teens access to a network of providers (while stitching together care delivery across the various constituents—schools, counselors, parents, kids, providers, payers).

A less talked-about issue: mental health for older Americans.

This also builds on the aging population topic above. About one in five seniors has a mental health condition. About one in three reports loneliness and social isolation. Solutions here need to be different, both in the payer specifics (e.g., Medicare) and in the go-to-market motions (e.g., senior care homes). Sailor Health, in which I’m an angel, is an example of a company building here.

Empowering Providers

I’m also excited about tools that empower providers, helping them do their jobs better. The obvious examples are the startups building in the medical scribing space. Those were early movers. As another example, we have one Stealth company in our portfolio building financial products for doctors (think: helping doctors manage malpractice insurance, and so on). And arguably the fastest-growing company in healthcare history is OpenEvidence, which you can think of as “ChatGPT for Doctors.” OpenEvidence, founded in 2021, is already used by 40% of doctors nationwide and gets 65,000 new clinician registrations per month. We’re only at the tip of the iceberg in terms of products built for providers, which should allow providers to do their jobs faster and more effectively.

Final Thoughts

Healthcare is a tough space. There’s red tape, there’s bureaucracy. There’s tremendous regulatory capture, which we’ve touched on in past pieces. (Check out this Bill Gurley talk for great examples about Walgreens, COVID testing, Judith Faulkner, and Epic.)

But there’s also room for innovation. And often new entrants can win. Speaking of Epic: last month’s Design Is the Differentiator argued that well-designed products can beat out lethargic incumbents like Epic.

Many skeptical VCs point to a lack of exits in healthcare. This is short-sighted. Timing is everything. Telehealth and AI are dual forces providing the key “why nows” for healthcare innovation, combined with a massive cultural sea change around health.

America’s health check-up probably gets a failing grade, but we can turn things around. The public sector will help, sure, but the private sector is where much of the change will stem from.

We have a lot of issues, but none are insurmountable. Though sorry if I ruined Ritz Crackers for you.

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: