New York Is An Industry Town

Why New York Is the Natural Base for Applied AI

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 70,000+ weekly readers by subscribing here:

New York Is An Industry Town

San Francisco and New York are the two biggest startup hubs in the world.

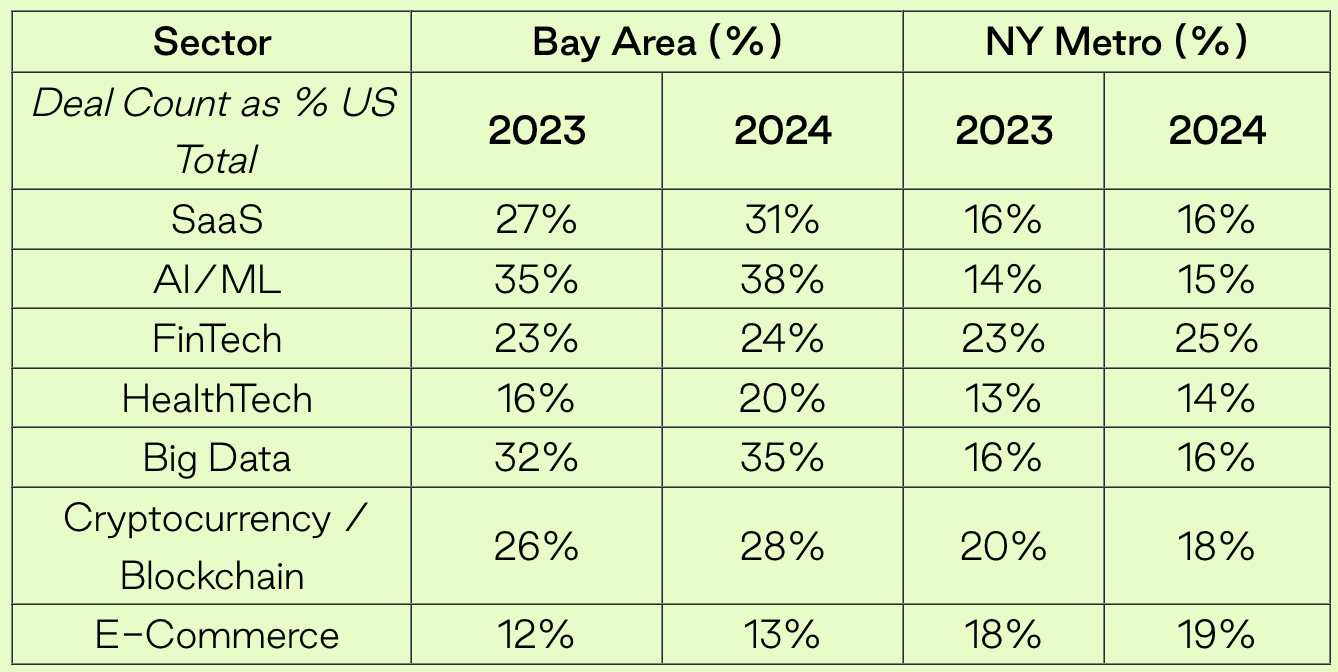

The Bay Area ranks first, with ~25% of U.S. venture deals (measured as a percent of the total number of deals). New York follows with ~14% of deals last year. Here’s a breakdown by sector:

This is U.S. data, but we see the same trend globally, with SF and NYC meaningfully outpacing 3rd-place Beijing. For many years, we’ve had a clear #1 and a clear #2.

This gets at a familiar debate in tech: NYC vs. SF.

I lived in the Bay for five years before moving back to New York a few years ago. The right answer is: both cities are great places to build startups! There’s a reason they rank #1 and #2, and they probably will for years to come.

AI has been a deus ex machina for San Francisco, which saw a pandemic exodus that spurred lots of hand-wringing and “SF is dead” proclamations. Those proclamations were always overblown; SF never lost its seat as the nucleus of technology.

But New York has boomed in recent years, and I think its star is only rising. The Bay dominates for foundation models and infrastructure companies. But New York is perfectly suited to applied AI. Why? Well, because New York is an industry town.

You could make the argument that New York is a (the?) global epicenter for a dozen major industries. To take 10 examples:

Let’s tick through New York industries and look at opportunities for reinvention.

Restaurants

To start with a fun one: food. New York has about 18,000 restaurants, cafes, and bars—more than any other city in the world. There are a few “global capitals” for food (I’d put Tokyo and Paris on the list as well), but New York is certainly Tier 1, and far and away America’s culinary capital.

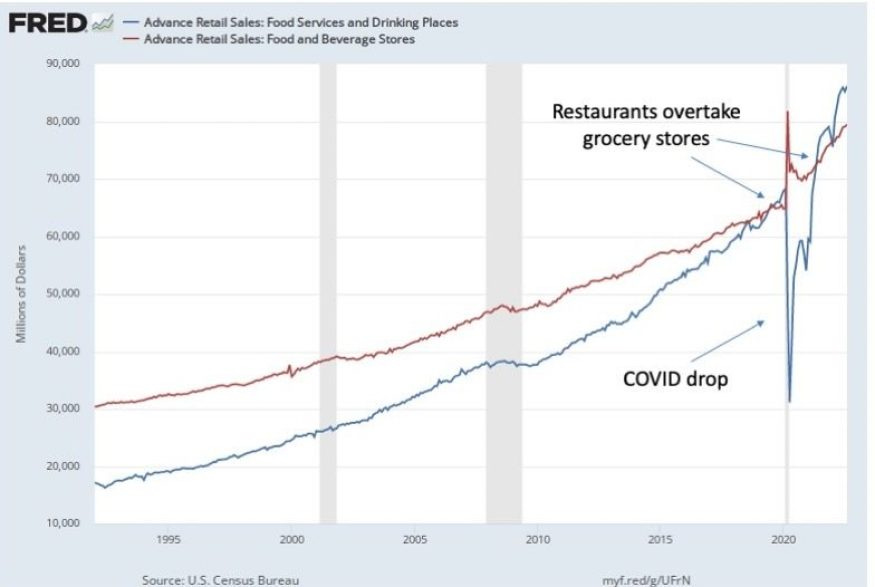

I’ve been interested for a while in how AI can reinvent restaurant operations. Americans are eating out more and more: check out the chart below of FRED data, which shows restaurant spending finally overtaking grocery spending a few years back.

After a COVID dip, the gap is now widening. Americans love dining out 🍴.

Restaurant operations, meanwhile, are full of manual, slow, frustrating tasks—the exact kind of tasks perfectly suited for AI automation. In a low margin industry, improving efficiency by even fractions of a percent can mean staying in business vs. shutting down.

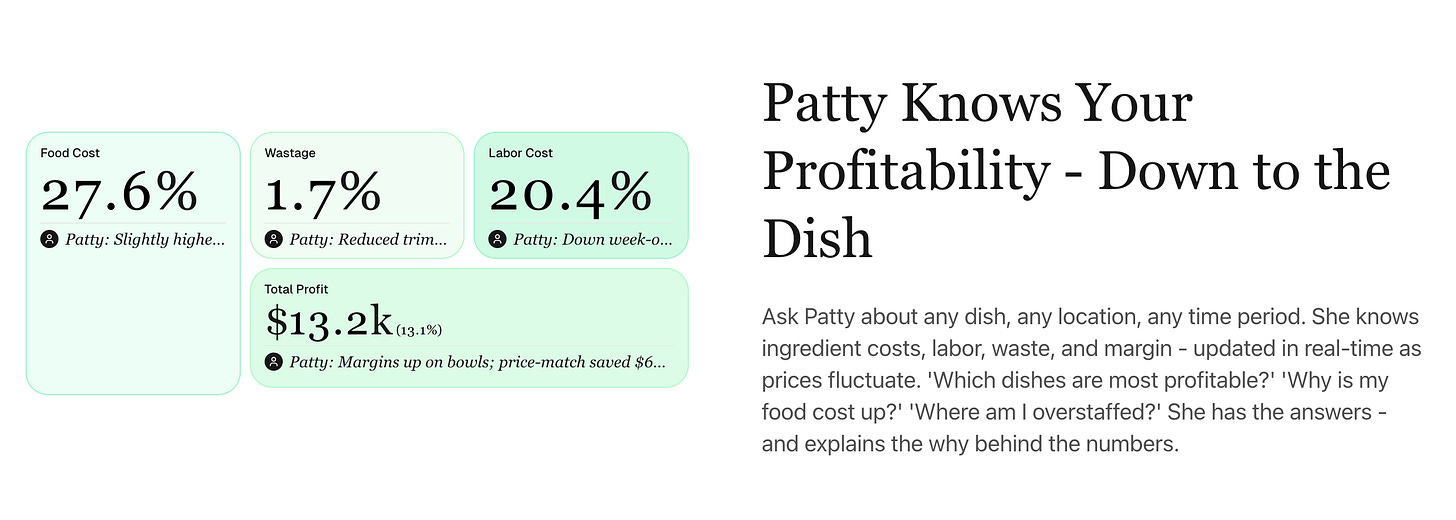

Earlier this year Daybreak invested in Pathway, co-leading the company’s first round alongside Khosla. Pathway is building the AI brain for restaurants: their agent, Patty, optimizes restaurant operations to drive profitability.

Pathway’s founders, Luis (ex-DoorDash) and Adarsh (ex-Uber Eats), come with deep industry knowledge. And fittingly, they just moved the company from San Francisco to New York, America’s culinary capital.

Finance & Banking

New York dominates global finance.

The “bulge bracket” investment banks—the Goldmans, Morgan Stanleys, and JP Morgans of the world—are nearly all based in Manhattan.

Same for the biggest private equity forms, which are even more tightly clustered: Blackstone (~$1T AUM) is on 52nd and Park; KKR (~$700B AUM) is newly based in Hudson Yards after moving from 57th and 5th; and Apollo (~$500B AUM) is still in KKR’s old building.

And the world’s two largest stock exchanges are also in Manhattan: the NYSE and NASDAQ each have about $32T in market capitalization, while the 3rd-largest exchange (Shanghai) lags far behind with $8T.

The leading applied AI companies in finance are likewise based in Manhattan.

Hebbia was the early mover here; my prior firm, Index, led the early rounds, while Andreessen Horowitz led a $130M Series B last year. Hebbia’s website lists customers like KKR, Centerview, and MetLife.

Over the past 12 months, though, Rogo has been on a tear, raising from Khosla (Series A), Thrive (Series B), and Sequoia (Series C) in quick succession. The website points to customers like Lazard, Tiger Global, and Moelis.

Any banking analyst knows how ripe the job’s workflows are for automation and augmentation. Regardless of who wins, New York seems poised to own the intersection of AI and finance.

Insurance

Hartford is often called the insurance capital of America (sometimes the world), but New York is actually the bigger market. Hartford is more concentrated, but New York wins in size, just as it does in finance. Insurance stalwarts like MetLife call NYC home, as do pre-AI insurtech companies like Lemonade.

We can expect this dominance to continue with AI. There are compelling business models newly possible in insurance. WithCoverage, for example, is an AI-native insurance brokerage that improves coverage and helps you save on premiums. The team includes attorneys who handle the claims process for customers.

An example from our Daybreak portfolio is Docshield, which is building an AI-native brokerage, starting with malpractice insurance. Specialty insurance brokerages are high quality businesses with strong recurring revenue, but operations have remained mostly human-driven, with fragmented and unstructured data. AI is a clear “why now,” streamlining a slow and broken industry.

America’s insurance market is worth $1.7T. Globally, insurance is about 7% (!) of GDP. This is a massive market that runs on PDFs and phone calls and siloed information. We should see large AI-native businesses built here, including in New York.

Media

Hollywood gets a lot of the glitz and glamour, but New York is actually a larger hub for media and entertainment. New York is home to SNL and The Tonight Show, Simon & Schuster and The New York Times, SiriusXM and Broadway.

There are some interesting New York companies innovating in media. TollBit, for instance, lets publishers like TIME and The New York Sun monitor, manage, and monetize AI traffic. But media is still pretty nascent overall for AI innovation. I’d argue the most groundbreaking AI x media company (so far) is Sora.

I would love to find more here: how we (1) create, (2) consume, and (3) share content is going to change, and we’ll see startups built in each of those three categories.

Advertising

There’s a reason Mad Men is based in New York: the Big Apple dominates advertising. (The show’s title refers to the so-called “Madison Avenue Men” of the 1950s.)

Over a half-century after the Mad Men, New York has continued to be an epicenter for advertising. Arguably the best acquisition in history was Google’s 2008 acquisition of DoubleClick for $3.1B, which formed the foundation for Google’s domination in digital advertising. People often forget that DoubleClick was a New York company.

Technology is again reinventing advertising with AI. Admittedly, some of the most exciting companies here are out West. AppLovin has been on a tear in the public markets (+80% to $180B market cap in the last year), while Koah Labs is an example of an ad tech startup I find particularly compelling. (Koah injects ads into AI apps. Most apps won’t monetize through subscription, so this is an important pick-and-shovel for app monetization.)

But New York has its fair share of promising players. Profound, for example, has quickly become the leader in Generative Engine Optimization (GEO), letting brands understand how they appear in AI search. You don’t have to squint too hard to see this as a cousin to DoubleClick, two decades later.

Law

We mentioned Mad Men’s New York roots. Another show that’s emblematic of an industry, that also takes place in New York: Suits.

The leading name in AI + law, Harvey (named after the main character in Suits!) is based in San Francisco. Legora, close on Harvey’s heels, is Swedish.

But there are a number of exciting New York legal tech startups, particularly at the earlier stages. Parambil, in our portfolio, is the operating system for mass litigation cases. Crosby, named for the street in Soho, is building an agentic law firm. Draftwise, meanwhile, focuses on contract drafting. The list goes on.

The majority of the world’s largest law firms are HQ’d in New York, and the city is home to over 20% of lawyers at AM Law 200 firms (the most of any city). We’ll see a number of large AI x legal companies built in New York.

Fashion

We could continue with movie and TV examples, but there are too many to count for this category. New York is synonymous with fashion.

This is another category I’d love to find more innovation in. We have one company still in stealth here, but we haven’t seen many breakthroughs yet in AI x fashion. We’re early in the adoption curve for consumer AI, so I expect this will change; next year will further the “unbundling” of ChatGPT.

New York has a higher share of e-commerce deals than San Francisco (see the first chart in this piece), so there’s a good chance that the breakthrough AI shopping app stems from the Big Apple.

Life Sciences & Bio

Boston and New York probably tie for first place in life sciences; on the global scale, Beijing and Shanghai join them. But NYC holds its own, to little fanfare: the city is top in the nation for NIH funding, R&D scientists, and biotech grad students.

We’re seeing innovative companies pop up in the city, like Valthos, which uses AI to identify biological threats and design medical countermeasures in real time. There are a number of recent examples in AI x life sciences, and this industry has the benefit of being at the intersection of not one, but two revolutions: the generative AI revolution is getting a lot of attention, deservedly, but we’re seeing a concurrent revolution take place in biology.

Real Estate

Real estate is another massive category where I haven’t seen much innovation, not for lack of looking. I’d love to see more startup creation here.

On the B2B side, the question is: can the more horizontal finance companies—the Hebbias and Rogos of the world—also extend to real estate, or does the industry warrant its own player?

On the B2C side, the question is: why are we still using StreetEasy and Craigslist to find apartments in 2025?! Maybe AI will finally breathe new life into a stale category.

Healthcare

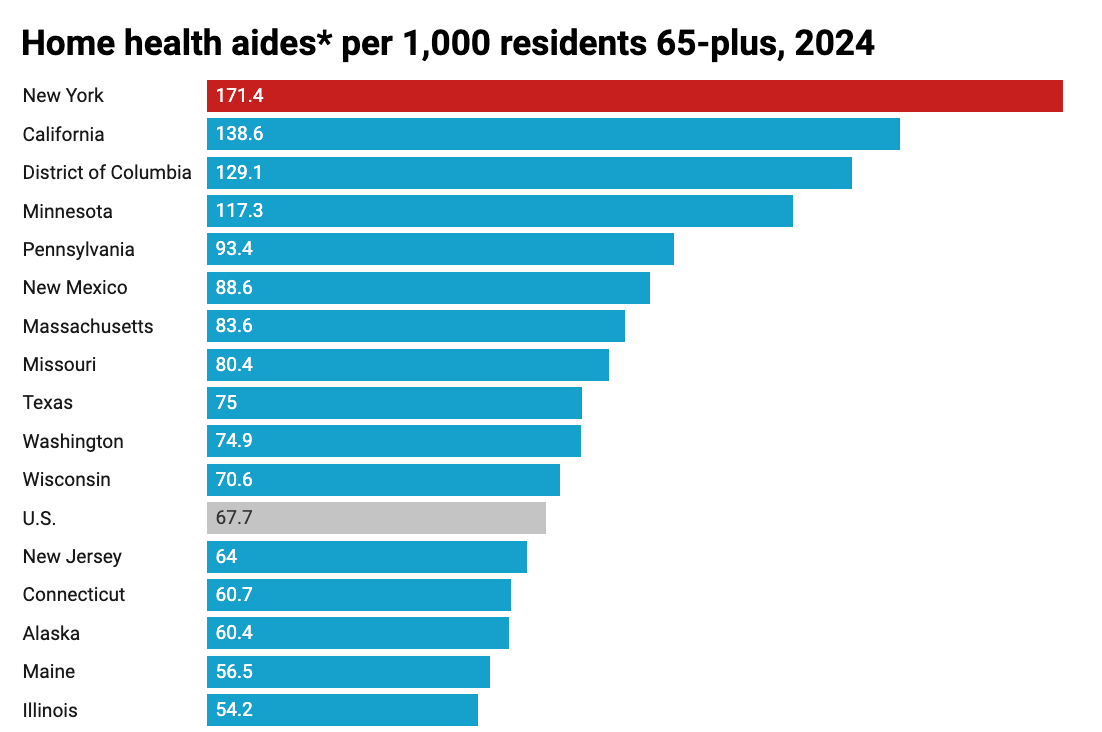

We’ve written at length about the “why now” in healthcare stemming from AI, most recently in September’s Make America Healthy Again. We have five Daybreak companies building in healthcare, all NYC-based. Some operate in spaces where New York is uniquely dominant: Alden, for instance, is building agents to coordinate home-based care. “Home health aide” is the fastest-growing job in America, and NYC leads the country in aides per residents, +153% higher than the national average and +24% higher than 2nd-place California:

This week we have one of our more recent investments coming out of stealth: Sonder Health, which uses AI to streamline the hospital discharge process and direct patients to post-acute care. Today, a patient might be ready to leave a hospital, but then stick around for days in a maze of paperwork and approvals and red tape. Similar to restaurants, hospitals operate on razor-thin margins. A 0.25-0.5 reduction in length of stay would improve hospital margins by >1%.

Sonder’s platform streamlines that admin-heavy discharge process and directs patients to the right place.

Elizabeth and Akash were operators together at NYC-based Ribbon Health before teaming up to build Sonder. (And they’re hiring! If you know someone interested in joining an early-stage healthcare x AI company, email elizabeth@sonderhealth.co 📬)

There’s a lot of healthcare innovation happening in SF too; a few of the major players are based there. But New York has a long history in healthcare, with strong “mafias” stemming from companies like Oscar Health and Flatiron Health. Healthcare may be the biggest prize in applied AI (it’s by far the country’s largest industry), and New York should be at the center of it all.

Final Thoughts

We still measure what percentage of the S&P 500 comes from technology companies. The share is about 34%, in case you’re wondering. But that portion actually doesn’t include companies like Meta or Amazon, which are deemed “tech-related.”

This makes sense: Meta is the world’s biggest media company, Amazon the world’s largest retailer. But this categorization is emblematic of a broader shift: technology has gobbled up every industry, giving less meaning to “tech” as a standalone sector. In the future, won’t everything be “tech-related?”

New York is uniquely suited for “tech-related” companies.

This city thrives on being an industry town. While DC is politics and LA is entertainment and SF is tech, NYC is…a dozen different industries. Being at the epicenter of your industry—where the best talent and customers are—is a huge advantage when building in applied AI.

Of course, no one city will dominate applied AI. San Francisco has plenty of innovation, and you could repeat the exercise above for SF-based companies. But New York is well-positioned. We’re about to see giant industries reinvented by AI, right here at home.

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: