Keeping Up with the Gen Zs

The Defining Characteristics of the New Generation

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 60,000 weekly readers by subscribing here:

Keeping Up with the Gen Zs

It’s been a while since we’ve done a piece on Gen Z.

You’d have to go back to May 2023’s Seismic Waves of Gen Z Behavior to find a piece centered around behavior shifts in the emergent generation. Why do those shifts matter in the first place?

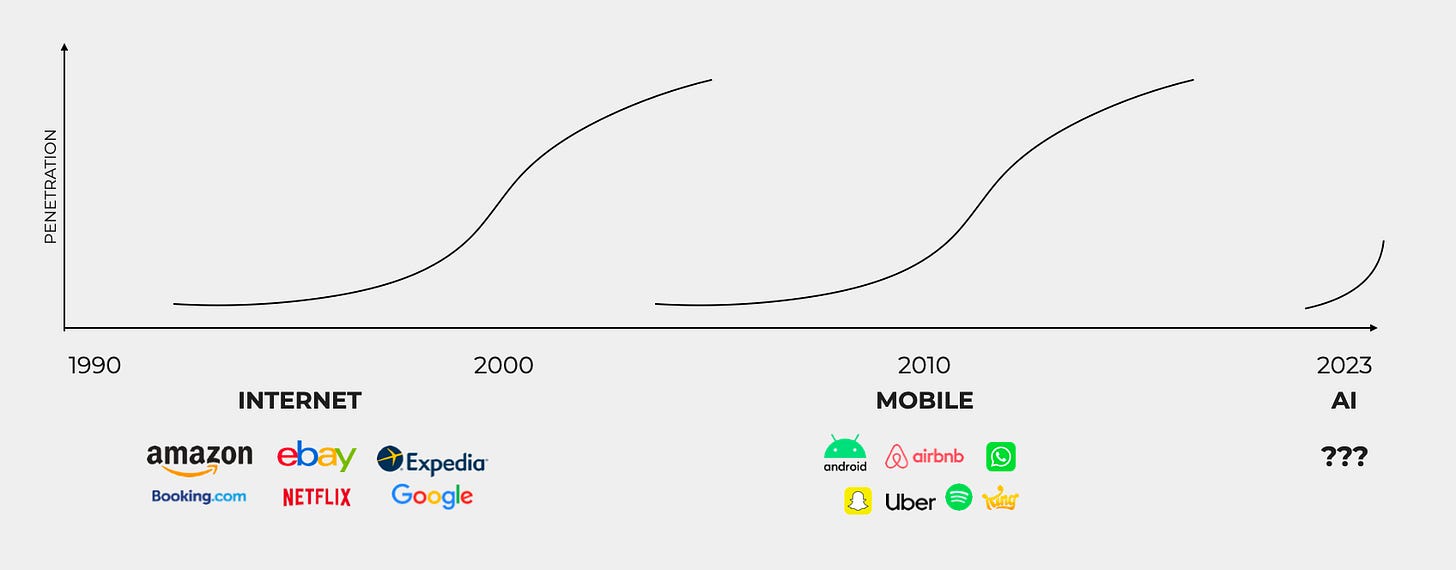

Well, we already know what today’s preeminent technology shift is: generative AI. Last year’s The Mobile Revolution vs. the AI Revolution argued that gen-AI is the most important tech shift since at least Intel’s 1971 development of the microprocessor. We’re about to see a new generation of applications built on this wave; this is why 2023-2027 are such critical vintage years for Pre-Seed and Seed.

But what are today’s preeminent behavior shifts?

To answer that, we have to study young people. Behavior shifts matter because they collide with technology shifts to form the largest startup opportunities.

Three examples from last year’s piece:

Robinhood rode a technology shift (mobile) that intersected with behavior shifts around people becoming more financially educated, motivated, and independent in a post-Great Recession era.

Instagram also rode the rise of mobile, including rapidly-improving smartphone cameras. At the same time, people were learning to live more public lives, build parasocial relationships, and cultivate global communities / social graphs untethered from geographic constraints.

Figma, meanwhile, rode a technology shift in WebGL (released in 2011, WebGL let you render interactive graphics in the browser) alongside the increasing importance of design in a digital world and the expanding definition of “designer”—online, everyone was becoming a designer.

Technology shift + behavior shift = opportunity.

Gen Z is now the world’s largest generation, making up 30% of the globe’s population. And Gen Z is the first digitally-native generation. It’s worth refreshing our understanding of Gen Z, formed around key characteristics and worldviews.

We’ll start by looking at two interrelated phenomena:

The Era of Self-Expression

Everything Is Social

Then we’ll finish by looking at Gen Z shifts in Finance, Health, and Sustainability.

Let’s dive in 👇

The Era of Self-Expression

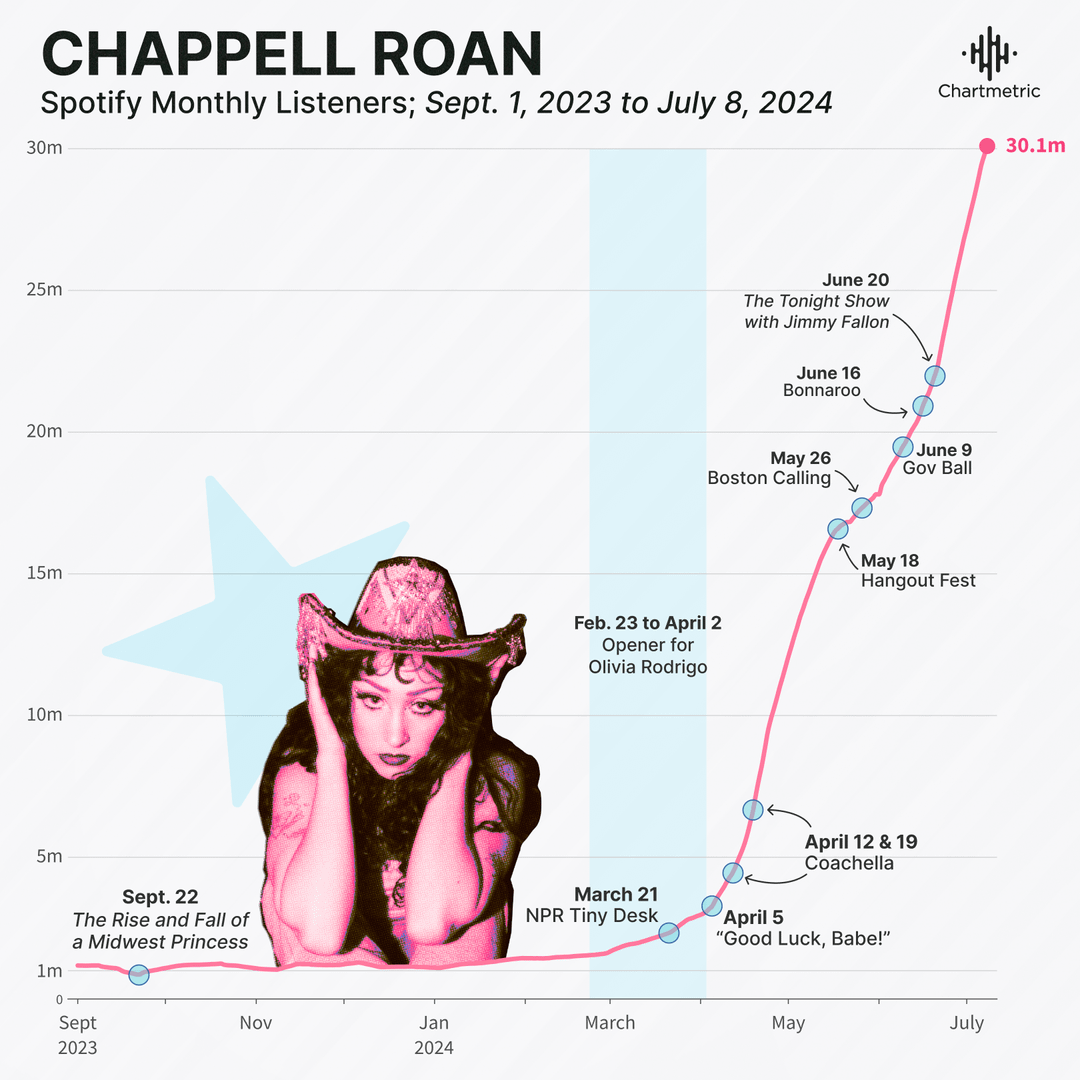

This year’s most fascinating phenomenon to watch: the rise of Chappell Roan.

Chappell Roan—real name Kayleigh Rose Amstutz—is a Missouri-born pop star who was largely unknown until this year. (My claim to fame is having “Pink Pony Club” as my top song of both 2020 and 2021 💅.) But Chappell is an unknown no more; she’s been on a tear in 2024. Check out her past few months of Spotify growth:

🤯

What gives?

In my mind, Chappell’s success comes down to her unapologetic self-expression. She’s Gaga-like in her expressivity and in her mastery of cultivating her community’s self-expression. If you Google Chappell Roan, here’s what comes up:

This is a reference to the drag queen Sasha Colby from RuPaul’s Drag Race. Chappell Roan, like Taylor Swift, knows how to plant seeds for her online fanbase. She also intentionally dictates how her community should engage—for example, by suggesting “themes” for different tour dates to bring the fanbase together. She both expresses herself and pulls self-expression out of her fans.

Chappell Roan is one of the most interesting new celebrities to study because she embodies so much of what the younger generation cares about: authenticity, creativity, internet fluency.

So how do startups build on the cultural shift toward more self-expression?

This cultural shift actually dovetails nicely with the AI revolution. AI is a production revolution, allowing people to make high-fidelity stuff with affordable, intuitive tools. The internet unlocked distribution, which allowed people to express themselves more broadly; now, AI arms them with the tools with which they can express themselves more deeply.

This powers new products. When we all already want to make more stuff, new creative tools have tremendous market pull.

We see this in the new class of creative software.

Take music. Suno is one of the most impressive consumer products I’ve seen in years. With Suno, I can input a text prompt to describe a song I’d like to create. Here I use the prompt:

A sad synth pop song about a long lost lover, set in summertime

Within seconds, Suno produces a full-length song—in this case, it calls my song “Echoes of Summer.”

The track is a surprisingly poignant synth pop song. You can listen to the full song at this link—it’s kind of…great.

I’ve spent hours tinkering on Suno; I recommend doing the same.

Suno explodes open the aperture of who can be a musician. Chappell Roan is blowing up right now because she’s an incredible vocalist, and because she has incredible artistic vision. Not many people will ever reach that level. But technology can allow me to go from someone with zero musical ability (trust me, zero) to someone able to produce a beautiful original song in seconds. That’s pretty remarkable.

Or take examples in video. Two of the most impressive new products, in my mind, are Hedra and Captions.

Hedra’s tagline is, “Imagine worlds, characters, and stories with complete creative control.” Captions bills itself as “Your AI-powered creative studio” and some of the company’s recent drops have been stunning—for instance, check out AI Edit here, which uses AI to analyze your video footage and insert custom graphics, zooms, music, sound effects, transitions, and motion backgrounds—all personalized to your content.

Creative tooling is a massive category.

Canva continues to fly under the radar, but the business actually generates more revenue than Figma, Miro, and Webflow combined. Canva does $2.3B per year in top-line, has 185M monthly users across 190 countries, and has been profitable every year for over seven years (!).

CapCut is overlooked because it’s owned by Bytedance, but it was the 2nd-most-downloaded free iOS app in the world last year—above Instagram, YouTube, and TikTok, and behind only Temu. That’s wild. What’s more, CapCut is a pretty poor product—not too intuitive, difficult to use, limited use cases.

I think we’re going to see an explosion in creative tools. The enabling technology is there with AI (again, give Suno a try to see how far technology has come) and the behavior shifts are in place with a yearning for more self-expression.

Everything is Social

Google’s Jigsaw subsidiary recently surveyed Gen Zs to better understand their online behaviors. The survey wasn’t particularly scientific—it mostly consisted of in-depth interviews with a handful of Gen Zs—but it had a few interesting takeaways. Jigsaw concluded first and foremost that most of young people’s online behavior had a single purpose: “timepass.” In other words, just killing time.

Attention is scarce, and most technology companies are competing for that scarce resource. This reminds me of the infamous Reed Hastings quote about Netflix: “At the end of the day, we’re competing with sleep.”

Even among emergent AI tools, we see this playing out. Do graphic designers use Midjourney? Sure. But from what I’ve heard, the lion’s share of usage comes from people messing around and creating AI-generated images to entertain themselves. They might choose Midjourney over Netflix or TikTok or YouTube. This fact might change long-term, but it might not.

“Timepass” also typically involves something else: socialization. Sharing stuff with friends. Among digital natives, everything is social. We see a steady march toward more social products. Examples from the Daybreak portfolio, across a range of sectors:

Investing: AfterHour, which offers a social hub for trading and financial learning

Dating: Amori, which takes single-player dating and makes it collaborative and social with LLM-powered matchmakers

Mental Health: Marble Health, the focus of the Digital Native piece two weeks ago, centers around group therapy for teens

Shopping: Flagship is commerce infrastructure that powers creator recommendations through boutique storefronts

The “incumbents” for the sectors above—for example, Robinhood, Tinder, Teladoc, Shopify—are far less social. Their products revolve around one person’s usage. The startups above, meanwhile, have social built into their DNA.

Continuing with the commerce example, commerce in the West has traditionally been single-player. For years, startups have been trying to emulate Pinduoduo’s success around group buying in China.

No one has nailed it yet, but we’re starting to see social seep successfully into shopping. TikTok Shop is on a tear, on track to rake in ~$20B in GMV this year (10x year-over-year). Flip has grown popular for more social, discovery-driven shopping—though it seems like user acquisition has been incredibly expensive. And Claim is taking off on college campuses, letting people discover new brands through drops and rewards.

The question for social commerce will be which business models sustain—someone will build a more serendipitous, discovery-driven shopping experience that sticks.

Finance, Health, and Sustainability

Three other major sectors affected by changing generational behaviors:

Finance and Work,

Health, and

Climate and Sustainability.

A quick word on each…

Financial Autonomy

This one’s an interesting paradox.

In some ways, younger people are less autonomous than ever before. In the 1980s, about half of 18-to-34-year-olds lived in a property they owned. Now, about 40% still live with their parents. What’s more, a new Axios survey by The Harris Poll found that 33% of Millennials and 60% of Gen Zs say they rely on their parents for at least some financial support. This reliance isn’t entirely necessary, by respondents’ own admission: 40% of respondents attribute their reliance to “excessive spending on non-essentials.” Oops. Innovations like Buy Now, Pay Later have powered that increased spending. Same for good old-fashioned credit card debt: 1 in 5 Gen Z credit card users are “maxed out.”

Yet in other ways, young people are more autonomous than ever. We’ve seen a surge in retail trading, as the internet (and most recently TikTok) have driven a boom in financial literacy. Robinhood’s mobile-first, zero-commission trading provided both a new interface and a new business model innovation to propel much of this phenomenon. Now, we see newer startups like AfterHour—a Daybreak company—offer the next step: an online hub for financial learning, community, and investing—in some ways, a Bloomberg for Gen Z. (AfterHour is also an example of the socialization of technology products.)

One recent Bank of America study found that 94% of Gen Z and Millennial investors are interested in collecting items like watches, rare cars, and sneakers. This has powered vertical marketplaces like Bezel (used watches) and StockX (sneakers).

We also see the shift toward financial autonomy in the types of work young people gravitate toward: flexible, self-directed work that often means freelancing or self-employment. In 2027, America will shift to a freelance-majority workforce; new business applications, meanwhile, continue to hit record highs, and 55% of Gen Zs already report making money through a side hustle.

Health

We see an outsized emphasis on health and wellness among younger consumers; from a McKinsey survey:

One funny recent news story: summer camps are banning skincare products for Gen Z and Gen Alpha campers, as the products have become distractions from camp activities. A camp letter to one parent wrote, “While nail polish and sheet masks in limited quantities can be a fun activity sprinkled into downtime at camp, we want to avoid ‘playing with skincare and cosmetics’ becoming an activity.”

Skincare-obsessed kids are referred to as “Sephora kids,” and I don’t think it’s a stretch to argue that each successive generation is vainer than the last. This is the result of an increasingly-visual, comparison-fueled online world. Few industries are experiencing more steady growth this decade than skincare.

Of course, Gen Z’s interest in health goes beyond aesthetics. We also see a rise in continuous glucose monitors, in sleep tracking, in dietitian consultations, and so on. It’s cool to care about your health. April’s The Telehealth Tipping Point dug deeper into the “why now” for health and wellness, so we won’t go too deep here. But younger generations are powering the surge. The bottom line is: young people care more and more about taking care of themselves, and they’re willing to spend on that self-care.

Sustainability

A Pew Research report found that 76% of American Gen Zs consider climate change to be “one of their biggest concerns.” No surprise there. The Greta Thunberg generation is at the forefront of climate activism.

One interesting result, though: growing interest in climate-related jobs. Nearly two-thirds of Gen Zs say they want a “green job” within the next five years, according to a LinkedIn study. This stands in contrast to the 1 in 20 Gen Z workers who actually have green skills—measuring carbon emissions, building solar or wind projects, and so on. The mismatch is called the “green skills gap.”

I expect closing the green skills gap will be the focus of both policy and startup innovation in the next decade. It’s easy to imagine online vocational programs or labor marketplaces built to address the problem.

These are just a handful of characteristics we’re seeing emerge in Gen Z. They’re also present in younger Millennials and in Gen Alphas, those born between 2010 and 2024. I’m sure there are many interesting emergent behaviors I’ve missed—let me know what I’ve missed, particularly if you have kids to observe (an advantage I don’t have). Those behaviors can make it into a future piece later this year.

Until next week 👋

Sources & Additional Reading

Two publications I recommend for keeping up with all things Gen Z: Casey Lewis’s After School and The Future Party

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: