The Telehealth Tipping Point

The Technology + Behavior Shifts Powering Healthcare Startups

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 60,000 weekly readers by subscribing here:

The Telehealth Tipping Point

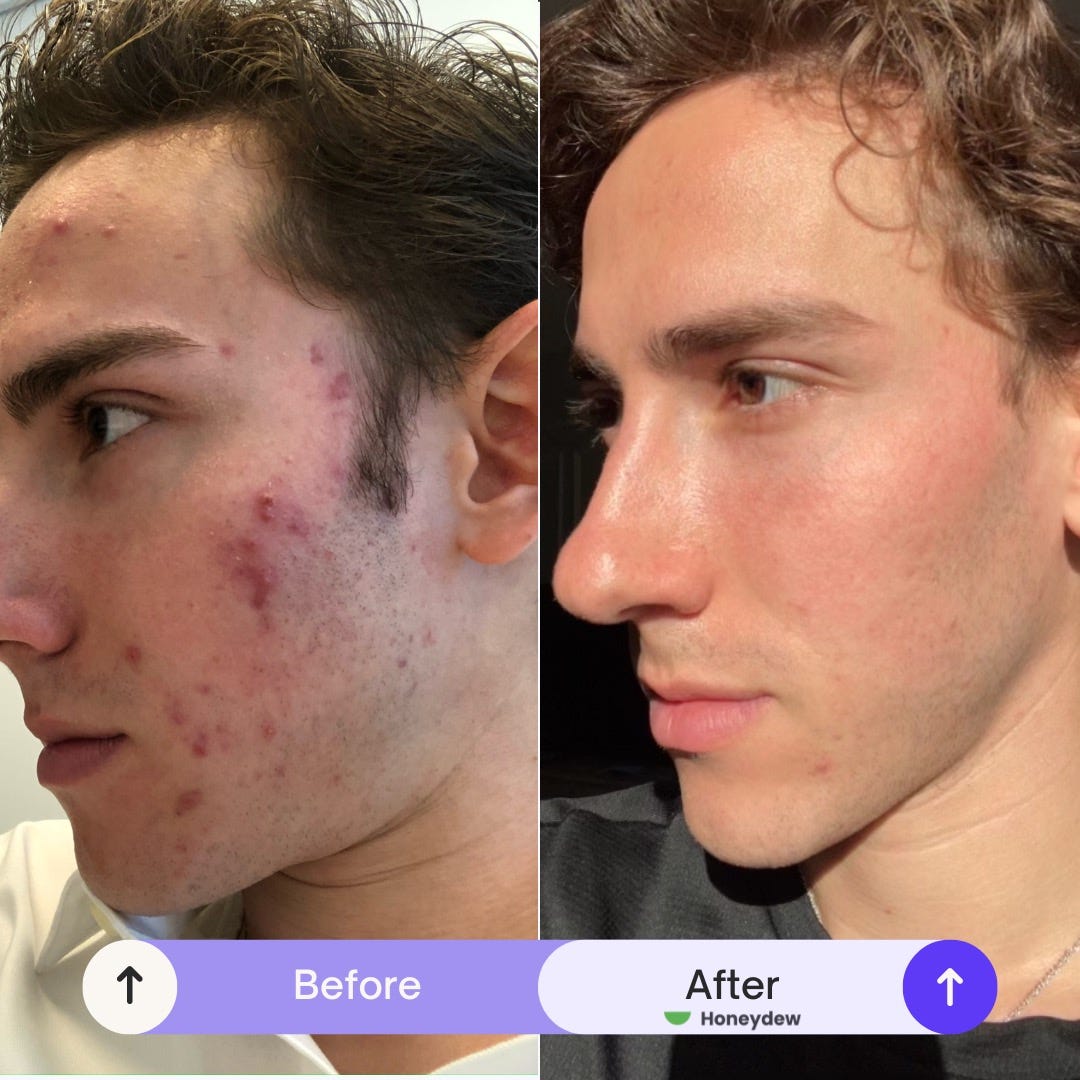

David Futoran suffered from acne for 10 years.

Growing up in a family of physicians, David knew there were good treatment options available. Unfortunately, every time he needed to see a dermatologist he was faced with a four month wait. When he did finally manage to see a derm, over the course of a decade he was trialed through every treatment out there: Clindamycin, Tretinoin, Dapsone, Tazorac, Doxycycline, Duricef, Epiduo—you name it. They’d work, but not for long. It wasn’t until 10 years later that he was prescribed Accutane, and it changed his life.

In David’s words, “It’s hard to explain to someone who hasn’t experienced it, just how life-changing clear skin really is. Skin is the largest organ in our bodies. It connects us to—and protects us from—the outside word. It’s not surprising at all that skin diseases are associated with increased anxiety, depression, and even suicidal ideation. The good news is that we have treatments that work. The bad news is that most people can’t get them.”

Frustrated by a broken system, David set out to build Honeydew, a marketplace through which anyone can link up with a clinician for treatment of chronic skin conditions. I’m lucky to work with David and Honeydew through Daybreak.

Over 100M Americans have a chronic skin condition. Think acne, eczema, or psoriasis. That’s more than 2x the number of Americans with diabetes. But access to care is gated. Nine out of 10 people with a treatable skin disease don’t get treatment. Honeydew aims to broaden access, becoming the all-in-one suite for virtual dermatology care.

David took the patient approach to building infrastructure for dermatology care.

Access to medical-grade skincare treatments isn’t easy. Accutane, for instance, is regulated through an FDA REMS program, with the goal of preventing pregnancy while taking the medication. It’s effective, but it also reduces access to care, disproportionately affecting females and minorities.

David and his team built a dermatology-specialized electronic health record from the ground up, with automated workflows for complex or regulated medications such as Accutane. They’re now operating in 36 states, covering the majority of the US population, and expect to be live in all 50 states by the end of Q2. They’ve built a network of clinicians, dermatologists, and advanced practice providers who can see customers ASAP, prescribe treatments, and offer regular check-ins.

On the customer acquisition side of Honeydew’s marketplace, skincare customers are high intent. Skincare is also both visual and social; we talk about our skin. This lends well to organic acquisition motions and referrals. Customer lifetime values, meanwhile, can be quite high. While treatments like Accutane typically run their course, others are long-term; Dupixent for eczema, for instance, is used indefinitely. Medical-grade treatments offer a wedge into aesthetic care and a broader operating system for skincare. I think back to a few years back when I visited a dermatologist in San Francisco. I left $500 poorer, and still pay for many subscription products like Tretinoin and spot treatment from that visit.

The access problems don’t stop with acne. Only about 1 in 7 Americans with moderate-to-severe eczema, who would greatly benefit from new biologic therapy, gets treatment; for psoriasis, it’s 1 in 8. Access to care has limited quality of care, and technology should (hopefully) expand that access. David shared this text with me about a Honeydew patient who got treated last week on the platform:

Honeydew embodies a larger trend happening in early-stage startups: a telehealth tipping point.

We see the same innovation across healthcare verticals. Grow Therapy, a mental health business frequently covered in Digital Native (and a key example in last month’s Business-in-a-Box 2.0) this week announced its Series C from Sequoia. Nourish, where I’m also an investor, recently announced a large Series A from Index to reinvent access to dietitians. The list goes on.

I've written a fair amount over the past year about health—about obesity, about mental health, about our aging population, about mission-driven companies. This week’s Digital Native goes a layer deeper, examining the status of health in America and unpacking why telehealth is (finally) having its long-overdue moment.

A Health Check-up on America

Why Now?

Vertical Telehealth

Let’s dive in 🩺

A Health Check-up on America

America’s health is…not great.

Our declining health has been a longtime topic on Digital Native, particularly when paired with how much money we spend on healthcare (hint: a lot). But let’s revisit a few charts to further underscore the scale of the problem.

Here’s America’s health expenditure per capita mapped against life expectancy, compared to other countries:

This data is a little old. The US now spends about $13,000 per person per year on healthcare. That’s about double countries like the United Kingdom ($5,500) and Canada ($6,300). Among developed countries, Switzerland is next worst and sits at $8,000, a full United Kingdom below the US. Yet we’re not getting much bang for our buck.

And despite how much we pay, it’s not exactly easy to see a doctor:

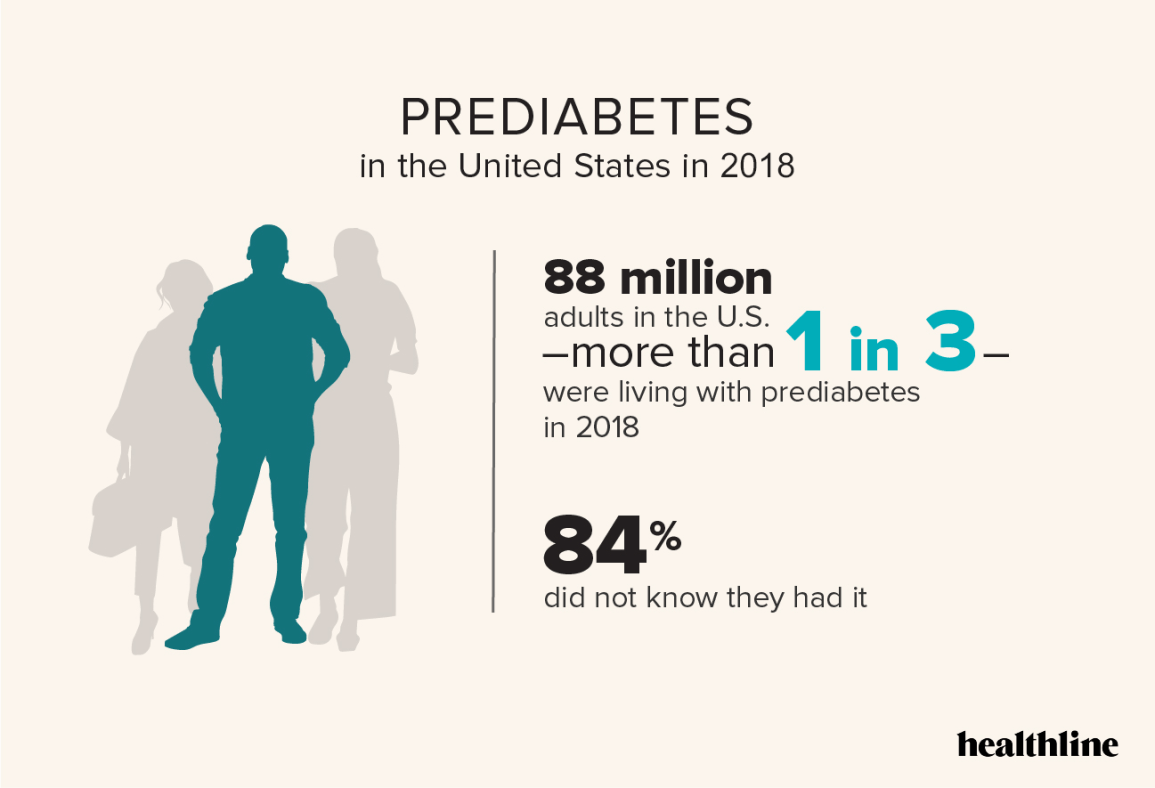

Our problems don’t stop there. Three in five Americans have a chronic condition; two in five Americans have 2+ chronic conditions. About one in five Americans have diabetes—38 million people—and 20% of those people don’t even know it. One in three are living with prediabetes, and 84% don’t know it.

Part of the reason: we’re an obese nation. In 1990, zero states had obesity rates above 20%. In 2018, zero states had obesity rates below 20%. Check out this graphic:

Here’s how we compare to Europe:

Yikes.

Last year’s How Startups Are Combatting America’s Obesity Epidemic went into more detail on the root causes here, but obesity is arguably the crisis of our time. Its competition, perhaps, is our mental health crisis. Over 60% of young adults report “serious loneliness” and over 20M American adults have experienced a major depressive episode. Rates of depression have been steadily ticking up:

Okay, so America’s physical gets a lousy grade. What do we do about it? Thankfully, there are a few factors making now a compelling moment for startup innovation.

Why Now?

The biggest waves often stem from the combination of a technology shift and a behavior shift. We’re seeing that combination right now in health & wellness.

On the technology front, telehealth is making healthcare more accessible and AI is improving both (1) healthcare efficiency, and (2) cost of care. Adoption of each is early innings, and we’ll see significantly more penetration in the coming years.

On the behavior front, COVID gave us a wake-up call to our archaic, lethargic healthcare system. It also supercharged adoption of telehealth (and changed regulations around telehealth to allow for that adoption). A longer-term shift is the consumerization of everything through technology. We’ve been taught to expect elegant user interfaces and convenience is now table-stakes: we order packages on Amazon, meals on DoorDash, cars on Uber. Shouldn’t healthcare be as user-friendly?

A confluence of enabling technologies and new behaviors is powering this moment for healthcare.

Vertical Telehealth

Vertical players have emerged across nearly every facet of healthcare. Honeydew is an example in dermatology, but similar models exist in areas ranging from women’s health to pediatrics to cardiovascular health.

Sample companies:

Many of these platforms underpin full-time work or part-time work for healthcare professionals.

We see a range. Specialties like derm and pediatrics lend themselves to supplemental income for clinicians; dermatologists and pediatricians are using Honeydew and Summer Health, respectively, for part-time work to supplement their income in downtime and on off days. Nourish, meanwhile, actually employs dietitians as full-time employees.

Different players in the med spa space emphasize different models. Moxie’s software largely powers permanent, full-time workers through brick-and-mortar locations. Persimmon or June Skin, in contrast, offer at-home Botox and related treatments (e.g., chemical peels), but largely cater to nurses who want to earn some extra income on the side. (Many nurses only work a few days a week, and want to pack in some lucrative hours on their days off.)

What’s been interesting to watch: how these platforms have begun to underpin large swaths of healthcare professionals. Single Aim did a recent deep-dive into which segments of healthcare have seen the most ‘Business-in-a-Box’ adoption. Their analysis found that therapy leads the way, with 8.7% of all practicing therapists in the US—about 55,000 clinicians—using a technology platform for their businesses.

What all the platforms above have in common, though, across category: they improve access to care through telehealth.

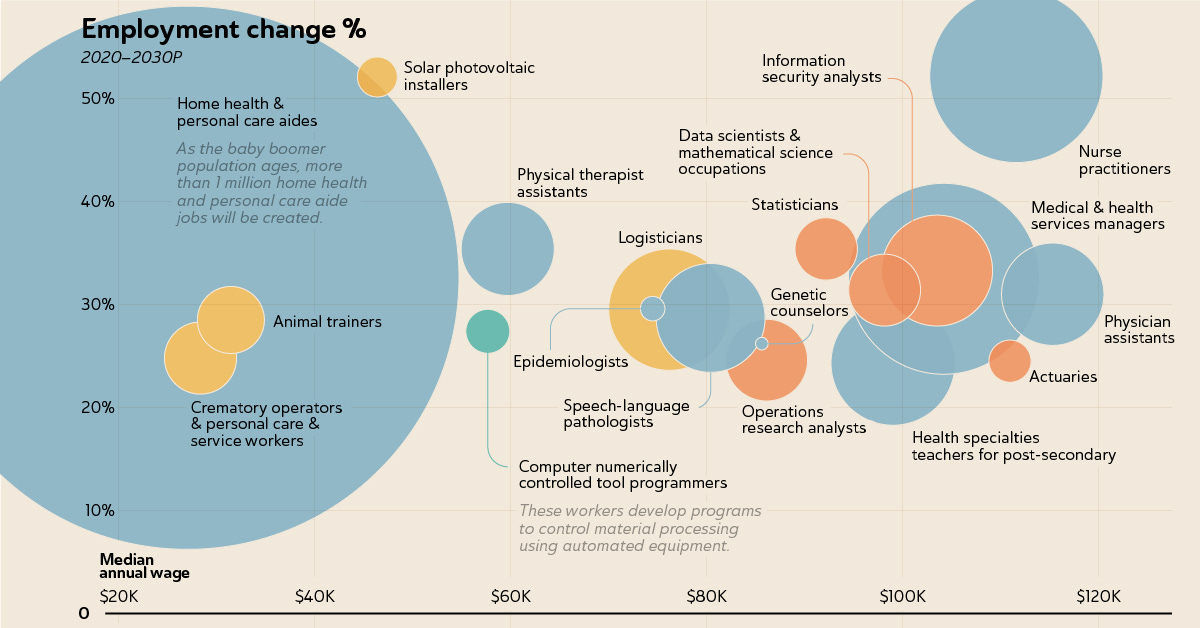

There are still remaining opportunities here. I’d love to find a company underpinning home health for our aging population. January’s Tech’s Blind Spots dug into how older Americans have been underserved by startups. That’s despite arguably the greatest tailwind out there: we’re on track for more than one in five Americans to be a senior citizen by 2040. Half the country is already over 50. This is a global phenomenon, too: people 65 and older will soon outnumber children under 5 for the first time in history. Every day, 10,000 more Americans turn 65, and there are already more Baby Boomers in the U.S. than there are people in the U.K., Israel, and Switzerland combined.

Home health aide is the fastest-growing profession of the 2030s:

We should see more technology platforms allow for (1) match-making between caretakers and care recipients, (2) the software and payments for caretakers to run their businesses. This is one example, but other categories are similarly ripe for the taking.

Final Thoughts: Vertical AI

When it comes to AI, we’ve seen AI bleed horizontally into healthcare. Companies like DeepScribe, Ambience, and Athelas have used an AI medical scribe as a beachhead into becoming an AI operating system for hospitals.

But I also expect we’ll see AI verticalization by specialty. Models can be trained and fine-tuned on specific sets of data. A Honeydew patient, for instance, might soon be able to chat with a specialized AI that can recognize common skin issues and offer advice and treatments. Same for each category above. In healthcare, specialization and expertise (which are of course closely related) rule supreme, and technology products will be no different.

We’re still early days in this telehealth tipping point. Skeptics will point to the few large outcomes for venture-backed healthcare startups. Amazon bought One Medical for $3.9B; Teladoc scooped up Livongo for $18.5B in the frothy market days, but Teladoc now trades under $2.5B; Oscar Health, meanwhile, saw a 94% drop in its market cap after a $7B IPO. The list isn’t too long, and it’s not too encouraging.

But this narrative will shift. People forget that UnitedHealth is a $420B market cap company (Salesforce is the largest SaaS company, with “just” a $290B market cap), or that healthcare comprises 18% of US GDP and is an $8 trillion global industry. Startups are all about timing, and a sea change is coming.

Related Digital Native Pieces

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: