The Resale Revolution: Fashionably Sustainable

Aligning Incentives for Brands & Consumers with an End-to-End Platform

Weekly writing about how technology shapes humanity and vice versa. If you haven’t subscribed, join 50,000+ weekly readers by subscribing here:

The Resale Revolution: Fashionably Sustainable

The average American woman owns 103 pieces of clothing. Globally, consumers acquire 80 billion new items annually—a figure that’s up 400% from 20 years ago. In America, we each buy about 68 new garments a year. And most people wear only 20% of their clothes. The rest just….sit there.

I’ve written before about the growth of secondhand, and particularly the growth of resale. There’s a subtle distinction: resale is the portion of secondhand that encompasses reselling items for a profit; secondhand is broader, encompassing thrifting and donations.

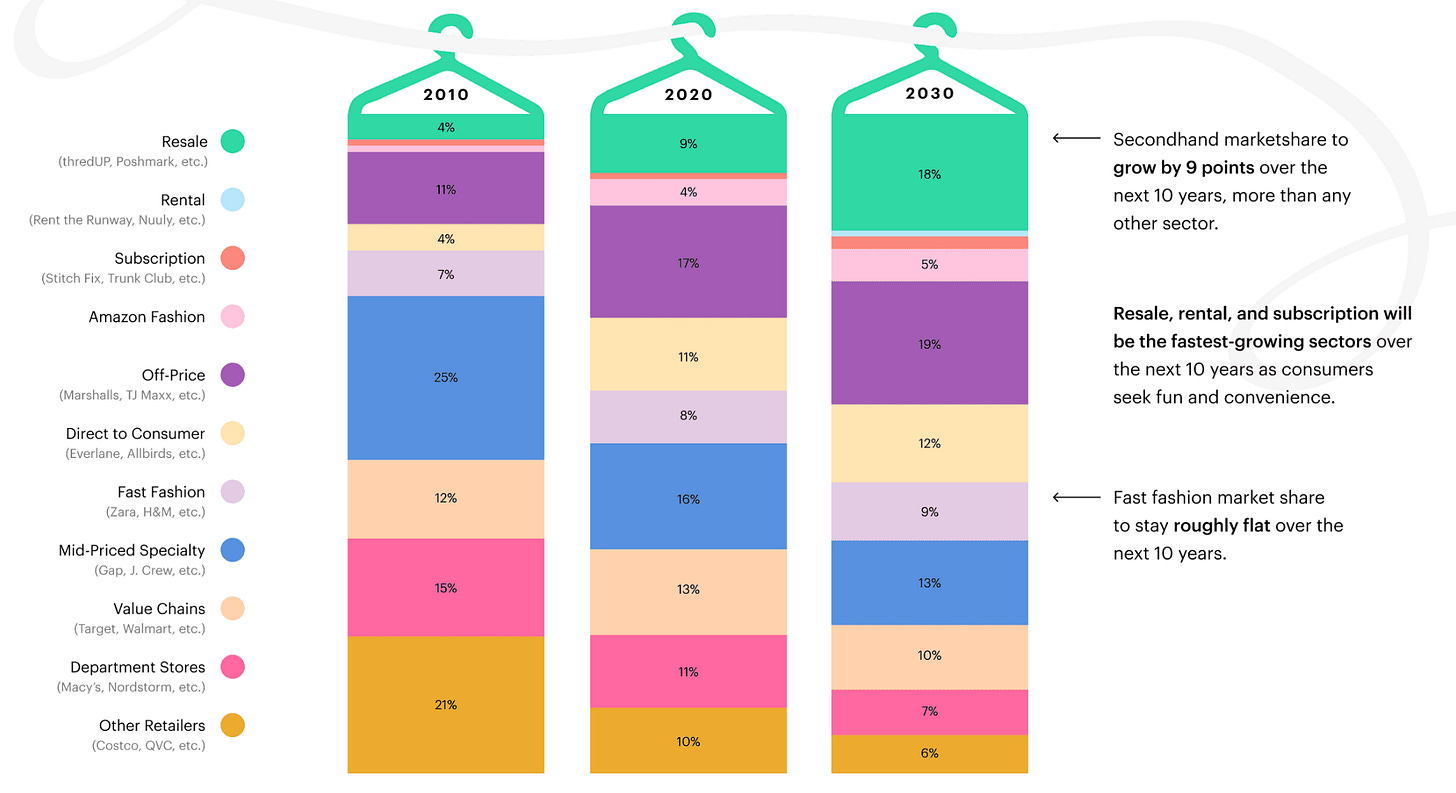

One reason resale has been a frequent topic on Digital Native: its growth. Resale is growing 11x faster than the broader clothing retail sector:

More on the market size and tailwinds below. But what’s most interesting to me is that this growth is happening despite resale remaining largely unsolved by technology. Yes, marketplaces like Poshmark, thredUP, and Depop offer a destination for secondhand commerce; yes, companies like Archive, Recurate, and Reflaunt help brands manage their own resale experience.

But end to end, the resale journey remains broken. There’s no company that solves the brand side and the consumer side—that ties together the lifecycle of a garment from purchase to resale. Most of us have a lot of stuff we’d love to get rid of—even better, stuff we’d love to get paid to get rid of—but selling items remains full of friction, which artificially constrains supply.

At Daybreak, I’m working with a talented entrepreneur building in the resale space. Her goals are two-fold: (1) to help brands benefit from resale without having to deal with any of the logistics or headaches; and (2) to help consumers more easily part with items they want to get rid of (and to get paid for doing so!).

If you’re a brand struggling with how to manage resale, reply to this email and I’ll put you in touch with this entrepreneur 📬

This week’s Digital Native digs into the brand side and consumer side of the equation, examines how AI will help unlock supply, and takes a look at the the broader market opportunity here.

The Brand Side: Resale at Checkout

The Consumer Side: Digital Closets & Latent Supply

Market Opportunity & Tailwinds

Let’s dig in 👇

How Can We Solve Resale?

Resale remains full of friction: most people don’t want to photograph their items, catalog them on a resale site, and swap dozens of messages with potential buyers to land on an agreed-upon price and pick-up date. Friction is the death knell to supply.

I’ve been harping on about this for a while.

For many years, Poshmark ($1.4B market cap) measured time spent as a key KPI. This always puzzled me: Poshmark was optimizing for users spending more time on its app, like it was a normal shopping destination. What the company missed, in my mind, was that its users want to minimize time on the platform—the faster they can offload an item, get paid, and get the hell out of there, the better.

Because most people aren’t willing to catalog items, supply remains constrained. This creates an opportunity to better align incentives between brands and consumers, to unlock latent supply, and to power an end-to-end resale commerce experience.

The Brand Side: Resale at Checkout

I’ve always felt that resale needs to begin at the point of purchase.

From the consumer mindset, a purchase decision takes into account future expected resale value. That’s a natural calculus to make as a shopper. One report found that more than 80% of Gen Zs consider the resale value of apparel before making a purchase.

So…shouldn’t resale appear in checkout?

Let’s digress for a moment and talk about Girl Math.

Girl Math is a popular internet meme that started on TikTok and that captures the convoluted “math” that girls (or just people in general) do just to justify spending. Examples of Girl Math:

If I pay in cash, it was basically free because there’s no proof of spending!

In September, I bought tickets to a concert in March. By the time I go in March, the concert is basically free.

I bought a $500 purse, but I’ll use it every day for a year, so it’s really only $1.37 per day 🤷♂️

You get the picture.

By the way, the internet has turned “Boy Math” into a thing too. One of my favorite examples: “Boy Math is paying $44B for a $25B company and, through business smarts and entrepreneurial know-how, turning it into an $8.8B company.” Internet - 1, Elon Musk - 0.

Even AOC got in on the trend a few weeks back to roast Kevin McCarthy:

Resale at checkout effectively brings Girl Math to the point of sale.

For instance, say I’m shopping and I see a $500 Rag & Bone jacket. What if it says, “Estimated Resale Value: $322”? All of a sudden, that $500 jacket effectively becomes $188. It’s Girl Math, duh.

Resale at checkout reduces friction to consume. This should drive every important brand metric:

⬆️ Average Order Values go up—after all, I might add more items to my cart.

⬆️ Conversion goes up—I’m more likely to check out.

⬇️ Cart Abandonment Rates go down.

⬆️ Repeat Purchase Rates go up.

And so on.

For a brand, this should be a no-brainer. Resale at checkout accomplishes two key tasks: (1) it emphasizes sustainability and the circular economy as core values to the brand; and (2) it drives positive ROI across every metric. Win-win.

If you’re a brand interested in meeting the founder building resale at checkout, reply here or email me at rex@daybreakventures.com 📧

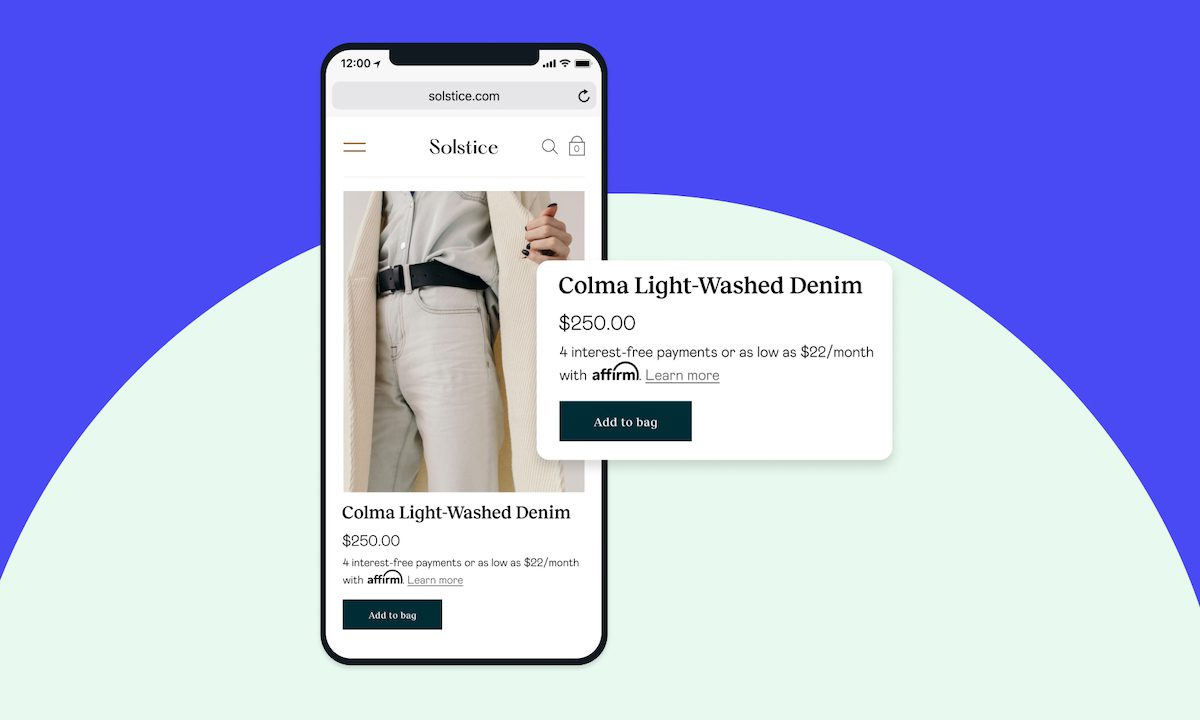

In many ways, we’ve seen this playbook before. Buy Now, Pay Later increases conversions by ~30% on average. (Merchants pay companies like Affirm, Afterpay, and Klarna a percent of merchandise value for products people buy using BNPL.)

BNPL is now tablestakes in online commerce. I expect resale at checkout to soon be tablestakes as well.

The brand side is only one half of the equation, though. The Holy Grail is seamlessly connecting the point of purchase to the moment of resale 🔁

The Consumer Side: Digital Closets & Latent Supply

As alluded to above, the problem on the consumer side of resale is supply. Power resellers might upload their stuff to secondhand marketplaces, but your average person isn’t willing to do that. Even power sellers dread it; as one woman told me, “I know I’ll spend half my Saturday selling three dresses on Poshmark.”

Embedding resale into checkout can automatically generate supply—after all, the company powering that flow now has a record of your closet. Latent supply is unlocked.

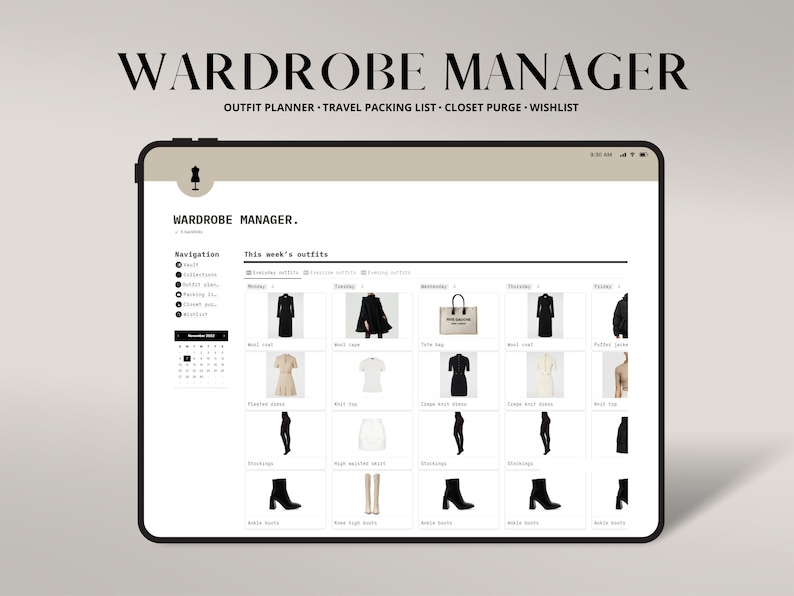

On Etsy, I found this Notion template for organizing your digital closet. (Side note: I still find it fascinating that people sell Notion templates on Etsy.) What if everyone instead had a digital closet pre-populated by stuff we already bought? It could look something like this.

When we’re ready to part ways with a garment, we can list it with one click. The product details are already there (though we might need to send in a quick photo of the item’s current state).

Or, to take things a step further, people could bid on our items. Maybe I wasn’t considering selling my $200 sweater yet, but someone offers me $188 a year into owning it—sure, I might think, I’m open to getting rid of it a little early for that price. Illiquid supply → liquid supply. The key is purchase data flowing through to the resale marketplace.

Large language models should also play a role in removing friction.

The most salient painpoint for resale is the back-and-forth with prospective buyers. Think of Facebook Marketplace, now the second-largest marketplace in the world by number of users (behind Amazon)—many of us exchange dozens of messages to sell a single item. Half the time we get ghosted. It takes a ton of work to complete a sale.

AI should solve this. LLMs can be trained on those back-and-forths, and an AI bot can list items on your behalf, barter for you, and then ask you for final approval on a transaction. You can envision a simple chat interface here.

“Hey Rex, Joe wants to buy your Rag & Bone jacket for $300. What do you think?”

“Good by me—just make sure he pays for shipping.”

“Great, Joe will pay for shipping and we have a box and prepaid label on the way to your house.”

“Cool, I guess I’ll also sell that Abercrombie sweater I bought last fall and the Restoration Hardware coffee table too.”

“Great, I listed those for you and will follow up when I have a buyer.”

This is a unique form of tailored customer service that will make reselling easy. The combination of pulling in purchase data and using AI in the resale experience should meaningfully solve the problems of cataloging items, finding buyers, and completing a sale.

Market Opportunity & Tailwinds

Let’s finish by talking about why this is a big opportunity.

The global market value for secondhand apparel was $177B in 2022 and is expected to nearly double to ~$350B by 2027 (~15% compound annual growth rate):

Americans bought about 1.4B pieces of secondhand apparel in 2022, marking a 40% increase over 2021. By 2030, the secondhand fashion industry will be nearly twice the size of the fast fashion industry, and resale is the fastest-growing category of apparel:

These market sizes are for fashion alone, but other large swaths of commerce are seeing similar growth in resale: furniture and home decor; electronics; jewelry and watches; toys; baby. We all have a ton of stuff we’d love to part ways with—and more and more people are trying to get rid of that stuff.

Growth in resale is powered by Gen Z and Millennial consumers: these two groups account for nearly two-thirds of incremental secondhand spend. In Gen Z closets, 2 in 5 items were bought secondhand.

One strong tailwind: sustainability moving into commerce. Young consumers care about “conscious consumption”—66% of Gen Zs say they’ll pay more for a sustainable product. And fashion, it turns out, is really bad for the environment.

Globally, fashion comprises 10% of carbon emissions—more than maritime shipping and air travel combined. Brands overproduce $500B of goods annually, and at the end of every season about 12% of clothing remains unsold. Much of this unsold product ends up in landfills like the Great Pacific Garbage Patch, which covers 1.6M square kilometers in the Pacific Ocean between Hawaii and California. The garbage patch is growing exponentially, swelling 10x each decade since 1945.

The average American now generates 82 pounds (!) of textile waste each year.

Excess inventory leads to absurd outcomes: in 2017, a Swedish power plant abandoned coal as a source of fuel, instead choosing to burn mountains of discarded clothing from H&M. You can’t make this stuff up.

Secondhand largely negates fashion’s environmental impact; the footprint of a used item is a fraction of the footprint of a new item. This makes sense. As a result, sustainability is a key driver of resale.

But the #1 driver influencing purchasing decisions—always—is value. Consumers care about the environment, but they care more about a good deal. Exhibit A: Gen Z’s professed eco-friendly ethos, and simultaneous penchant for SHEIN hauls.

Young shoppers are thrifty, and secondhand offers goods at lower price-points. This goes hand-in-hand with Gen Z’s love for luxury, which we covered last week. The most popular brands for resale include Coach, Kate Spade, and Lululemon.

Other tailwinds for secondhand include young shoppers’ love for all things vintage, and the desire to more quickly cycle through our clothes (in part powered by social media and our constantly-photographed lives).

Final Thoughts

There’s a big business to be built here. In a market approaching $200B in size, most of the dedicated players are still sub-$1B in revenue. The biggest winners remain the Ebays, Craiglists, and Facebook Marketplaces of the world—antiquated products that haven’t evolved in years.

This creates the opening for a new player. Generational tailwinds are there (sustainable fashion, off-price commerce), alongside a technology unlock (AI). Tying together purchase → resale is the key. I’d love to hear feedback from brands (and consumers!) on this market, its most acute pain-points, and what solutions you’d like to see built.

Sources & Additional Reading

The Environmental Impact of the Fashion Industry | Bloomberg

Data Sources: Statista; WSJ; NYT

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: