24 Predictions for 2024 (Part I)

From AI Dating to ZIRP, TikTok Shop to Vision Pro

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 55,000+ weekly readers by subscribing here:

24 Predictions for 2024 (Part I)

Hey Everyone,

This is my last piece of 2023—Part I today, Part II next week. After this, it’s a wrap on Year 4 of Digital Native ✅

It’s been a good year, with ~50 long-form pieces totaling ~120,000 words. The best part of writing is building this community of readers, and this community has grown +60% in 2023. Thank you for being part of it.

To close out the year, 24 predictions for what’s ahead in 2024…

1) Dating Disruption: A New App Will Take Off

There’s a new hashtag trending on TikTok: #DatingWrapped2023.

Inspired by Spotify Wrapped, single people are putting together dating recaps for their year, complete with PowerPoint slides, pie charts, and year-over-year comparisons. The trending hashtag has 18.7M views on TikTok, and most Dating Wrappeds are pretty grim.

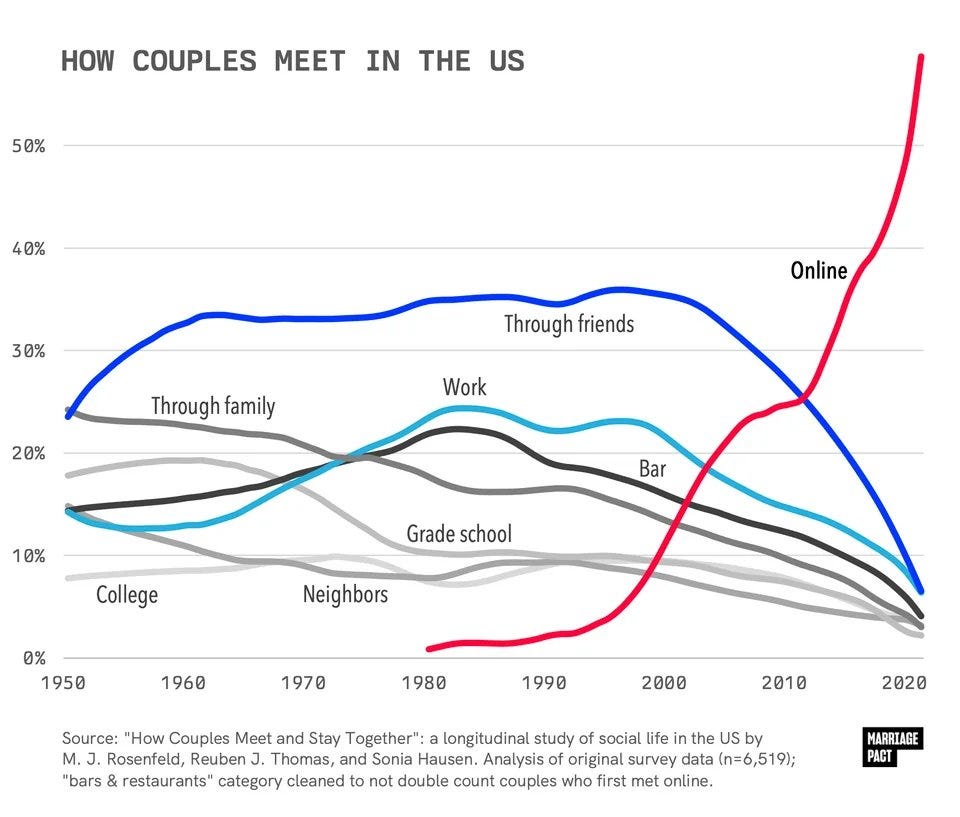

Over the past 20 years, online dating has taken over. This is particularly true over the last decade: you see an inflection in the chart below from mobile adoption, with the rise of apps like Tinder, Bumble, and Hinge. Tinder raked in $1.8B in revenue last year; the app comprises about 60% of Match Group’s revenue. (Match also owns Hinge, OKCupid, and Plenty of Fish.) Match trades at a $9B market cap, while Bumble trades at $2B.

Yet users are fed up with dating.

More than 90% of Gen Zs report feeling frustrated with dating apps, according to a study by Savanta. An October headline in The Guardian reads: “‘It’s quite soul-destroying’: how we fell out of love with dating apps.”

The “swipe” concept that Tinder pioneered hasn’t been innovated in a decade. Dating remains lonely and single-player. That will change. One of my investments this fall is an AI-powered dating app led by a savvy Gen Z team that understands why Tinder has lost the plot. A new enabling technology (LLMs) should hasten along dating disruption, and I expect 2024 will bring the first breakout AI-powered dating app—a dating app that learns about you and refines its matches accordingly.

2) ZIRP No More: Rates Will Stay Flat

Thanks to rising rates, the U.S. government will pay $659B in interest on the national debt this year. That’s about as much as it spends on Medicare or on national defense.

As a good piece in The Atlantic points out, rates haven’t been this high since George W. Bush was president and Taylor Swift was in elementary school. Sheesh. And I don’t expect rates to go down in 2024. The latest central bank projections have rates staying mostly flat for 2024, and falling only slightly in 2025. They’ll end 2025 at about 4%—more than 2x where they ended 2019. Wall Street is expecting rates to potentially stay this high for a decade, using the phrase “higher for longer” in equity research reports.

Today’s rates aren’t the anomaly; the low rates of the last 15 years were. Zero-interest rate policy (ZIRP) was also responsible for the the largest spike in wealth inequality in postwar American history. Federal Reserve data shows that from 2007 to 2019, the wealthiest 1% of Americans saw their net worth swell by 46%, while the bottom half saw only an 8% increase.

ZIRP fueled the boom in venture capital and startup funding over the past decade. With rates showing no signs of falling, venture will remain a tough fundraising environment…

3) 2024 Will Be A Rough Year for Fundraising

In last month’s Seed Investing: The State of the Union, we dug into how 2023 has been a difficult year for VC funding.

The capital raised in the first nine months of 2023 was only 24.7% the share raised in the first nine months of 2022. It’s a tough time to be in market as a venture fund.

This will continue into 2024.

Investors in venture capital funds—Limited Partners—are suffering from what’s known as “the denominator effect.” LPs like Stanford’s endowment or California’s teachers retirement system have exposure to both public markets and private markets. As the public market goes through a downturn, public assets decline in value; consequently, LPs become relatively overexposed to privates. Put simply, they don’t need more venture exposure right now.

4) Smaller Venture Capital Fund Sizes

In 2024, venture funds will get smaller. This isn’t a bad thing. Early-stage investing should be a niche, cottage industry. But over the past few years, we saw it balloon into asset management disguised as venture.

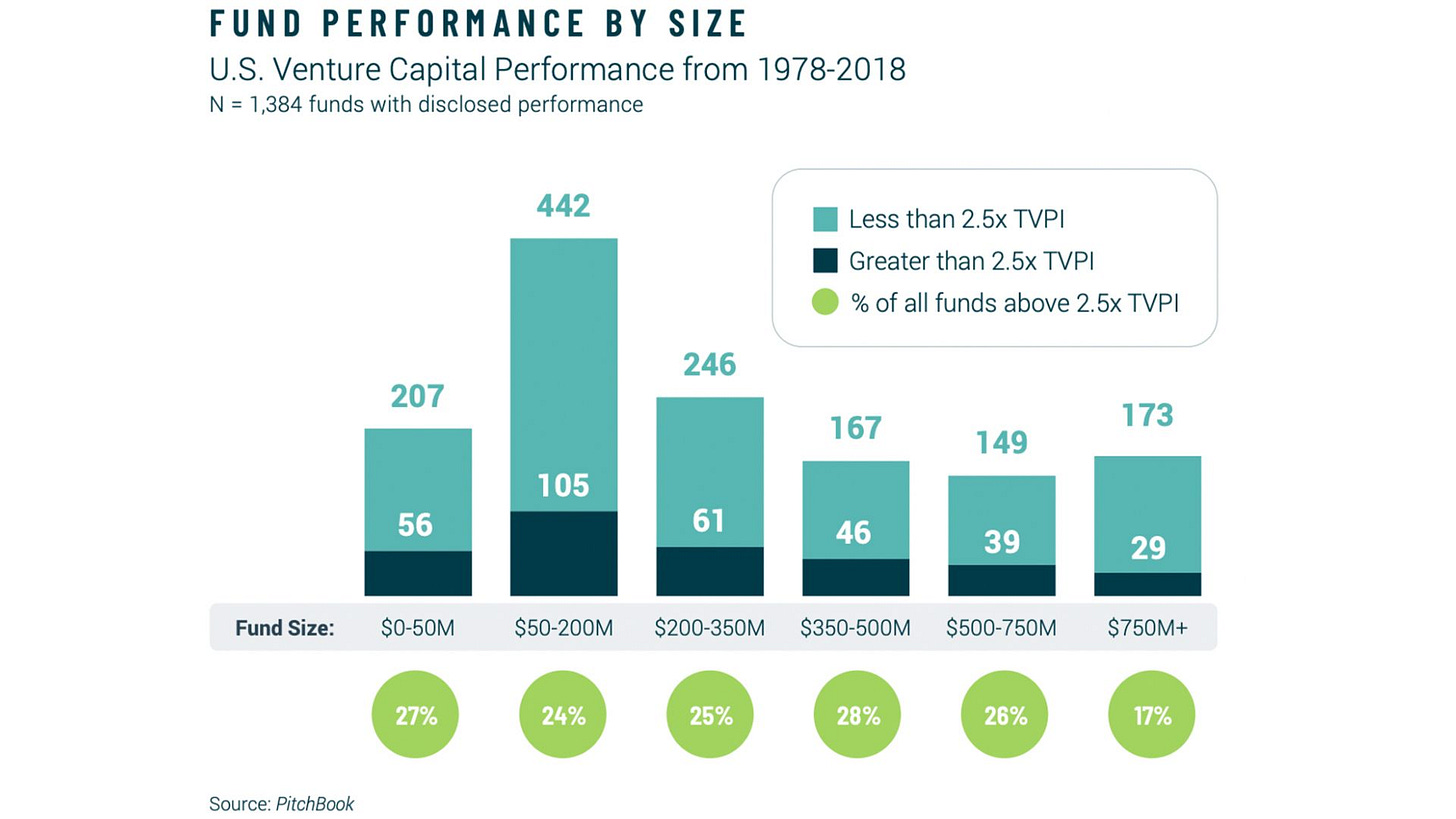

We’ll now see a return to more reasonable fund sizes. A recent study from PitchBook and Sante Ventures showed that venture funds smaller than $350M are 50% more likely to generate a 2.5x return than funds larger than $750M.

Yet in the first three quarters of 2023, 46.8% of U.S. venture dollars went into funds over $500M. In 2022, that figure was 63.6%.

It’s not hard to understand why venture has ballooned as an asset class: (1) ZIRP drove a huge influx of return-hungry capital into PE and VC, and (2) incentives drive larger funds. From the Sante report: “The net present value of management fees alone for a fund at $1,000M exceeds the fees and carry of a fund at $200M, even if it returned 4x.” GPs opt to get rich off of fees.

I expect 2024 will bring smaller fund sizes—not because incentives have changed, but because LP dollars will no longer support mega-funds.

5) A Culling of the Unicorn Herd

In 2021, about two new unicorns ($1B startups) were crowned every single workday. 2022 cut that figure in half, and 2023 is minuscule by comparison:

Of course, most of these companies should never have been valued at $1B+ in the first place. Valuations were completely out of whack compared with historical norms. Take a look at this chart and tell me which years look out of place:

Again, we can blame ZIRP and the influx of capital to private markets. (In 2000, private equity firms managed about 4% of total U.S. corporate equity. By 2021, that number was 20%. Put differently, private equity grew 5x faster than the broader U.S. economy.)

In 2021, it wasn’t uncommon to see startups raising at 50x or even 100x ARR multiples. Most companies will struggle to grow into those valuations. As Elad Gil points out in a good piece, a company that raised at 50X ARR will take 9 years growing 20% a year to just grow into its current valuation (assuming a 10X exit multiple). A company that raised at 100x ARR would take 6-7 years, growing 85% year-over-year, to grow into that last round price. That’s to say nothing of being a 2-3x step-up in valuation for the next fundraise.

Abundant money in the past few years meant that companies that should have shut down years ago were able to stay alive. Now, money is no longer abundant, and 2024 will bring many shutdowns. According to data from The New York Times, 3,200 private VC-backed U.S. companies have gone out of business this year. Startup shutdowns are up +50% year-over-year and up +300% over 2019.

This is only the beginning. Many companies are still surviving on runway from frothy 2020, 2021, and 1H 2022 times. That runway will dry up in 2024, and we’ll see more companies go out of business.

6) 2024 Will Be a Great Year for Pre-Seed & Seed

While growth-stage startups struggle, 2024 will prove to be a great vintage for early-stage—partly as a result of employees leaving their underwater economics to strike out on their own.

More about this phenomenon in November’s State of the Seed report:

7) A Focus on Unit Economics & Profitability

A wave of cheap money in the last decade propped up capital-hungry businesses with questionable economics. Startups like Uber and WeWork burned through billions in venture capital. Some have emerged with light at the end of the tunnel—Uber’s improving metrics are underpinning a $130B market cap, healthily above its last private round of $76B—while others haven’t had such luck:

2024 will bring a renewed focus on unit economics (remember those?) and a continued market focus on profitability. Achieving profitability can have dramatic effects: Udemy, a company with $700M+ in revenue, saw its stock jump +38% in one day after reporting profitable earnings. Netflix was the worst-performing stock in the S&P 500 last year, shedding 75% of its market cap, but it’s up +50% this year after turning in a few highly-profitable quarters. Many SaaS companies have stopped investing heavily in growth and are instead inching their way to cash flow generation.

The companies that raise in 2024 will have strong metrics and solid underlying business models.

8) Temu Ignites Discount Commerce Rivalry

Speaking of unit economics, let’s talk about Temu.

On Tuesday, Apple released its most-downloaded apps of 2023. Temu, the Chinese-owned discount shopping app, topped the list. (The rest of the top five: CapCut, Max, Threads, and TikTok.) Temu is also showing strong engagement times: average daily active users are spending 18 minutes on the app every day, about twice the 10 minutes daily actives spend on Amazon.

Temu’s dominance started late last year. In December 2022, just four months after launching, Temu had more unique visitors than SHEIN and Wish. eMarketer reported that during the holiday shopping season last year, Temu ranked 12th in traffic among U.S. retailers, wedged between CVS (#11) and Walgreens (#12). Temu came in ahead of major retail sites like Nordstrom, Wayfair, and Kohl’s.

Pinduoduo is following the Bytedance playbook of spending aggressively on user acquisition to win the U.S. market. Part of that plan included not one, but two Super Bowl commercials (costing $7M apiece). The strategy seems to have worked: Temu saw a 45% surge in downloads and a 20% uptick in daily active users on the day of the Super Bowl.

Over the summer, installs again picked up meaningfully:

The question for Temu is whether it can make its unit economics work.

Temu is known for selling $4 headphones and $15 hoodies. It’s hard to profit on shipping a bunch of cheap items. But early data has been (surprisingly—to me at least) promising: spend retention on early Temu cohorts shows that shoppers spend ~50% of initial month GMV in their second and third months. For SHEIN, that figure is closer to 20%.

Temu will generate about $15B in revenue this year and Pinduoduo, for its part, just dethroned Alibaba as China’s most-valuable e-commerce giant. In 2024, I expect Pinduoduo to continue to plow money into Temu user acquisition.

We’re also seeing U.S. startups get in on the discount shopping crazy.

Flip took off last month with some heavy incentives for new users—the app gave me $100 to spend (and I haven’t bought anything on it since). YaySay, meanwhile, is gamifying off-price retail—a sort of online TJ Maxx (which is itself a $50B-a-year behemoth growing healthily). The jury is still out on how the economics will work for online discount retailers, but more and more are popping up.

August’s Follow the Money: Categories of Consumer Spend tracked the rise of discounters in the U.S. The top six retailers opening stores in 2022 were all dollar chains and discounters, led by Dollar General, Family Dollar, and Dollar Tree. In 2021, nearly 1 in 3 new chain stores opened in the U.S. was a Dollar General.

In 2024, the battle for the online equivalents will heat up. U.S. challengers to Temu will emerge, both in the startup world and from local incumbents. (I wouldn’t be surprised if Amazon and Google are working on their own competitors as we speak.)

9) TikTok Shop Powers the Rise of Social Commerce

As Temu has exploded in the U.S., another Chinese-powered e-commerce upstart has had a similarly strong year. TikTok Shop is on track to do ~$15B in GMV this year, a ~250% increase year-over-over: in 2021, TikTok Shop raked in $4.4B, and in 2020, TikTok Shop did $600M.

With TikTok, social commerce seems to finally be taking off in the West—years after it began dominating in Asia. TikTok is clearly going all-in on commerce.

The challenge I see TikTok facing: backlash from users. Users are already annoyed by TikTok ramping up ads on the platform (a predictable backlash for any ad-based consumer network). Now users are doubly annoyed by creators shelling product after product after product.

A recent video I saw mocked how common product promotion has become, making fun of influencers hawking “the world’s best vacuum” and “my favorite ever lip gloss.” Comments on the video were interesting to read. Some of the comments I collected:

There’s clearly brewing exhaustion as TikTok Shop ramps up—and Shop is still relatively early days.

If I’m TikTok, I’m paying close attention to this. It’s a fine line between pouring gas on a lucrative new revenue stream, and alienating power users who are on TikTok for passive content consumption, not product discovery. Can TikTok take down YouTube while also going after Amazon and Temu?

I’m more bullish on platforms that allow creators to themselves become small businesses. Flagship, for instance, lets anyone spin up their own boutique storefront, curating their favorite products and taking a cut of sales. Here’s the storefront for the blogger Caroline Moss, a.k.a. Gee Thanks Just Bought It.

I’m biased—Flagship is one of the companies I work with—but I view the ultimate winner here as the solution that gives creators the end-to-end tools to manage their own business as a retailer. Adding commerce as a layer on top of a social or content network works in the near term—it’s the eyeballs are, after all. But long term, it degrades the platform. The more sustainable company is the company that is platform-agnostic for creators; that aligns incentives for shoppers, brands, and creator-retailers; and that turns online creators into the next-generation mom-and-pops that they’re already becoming.

10) Vision Pro Posts Underwhelming Sales

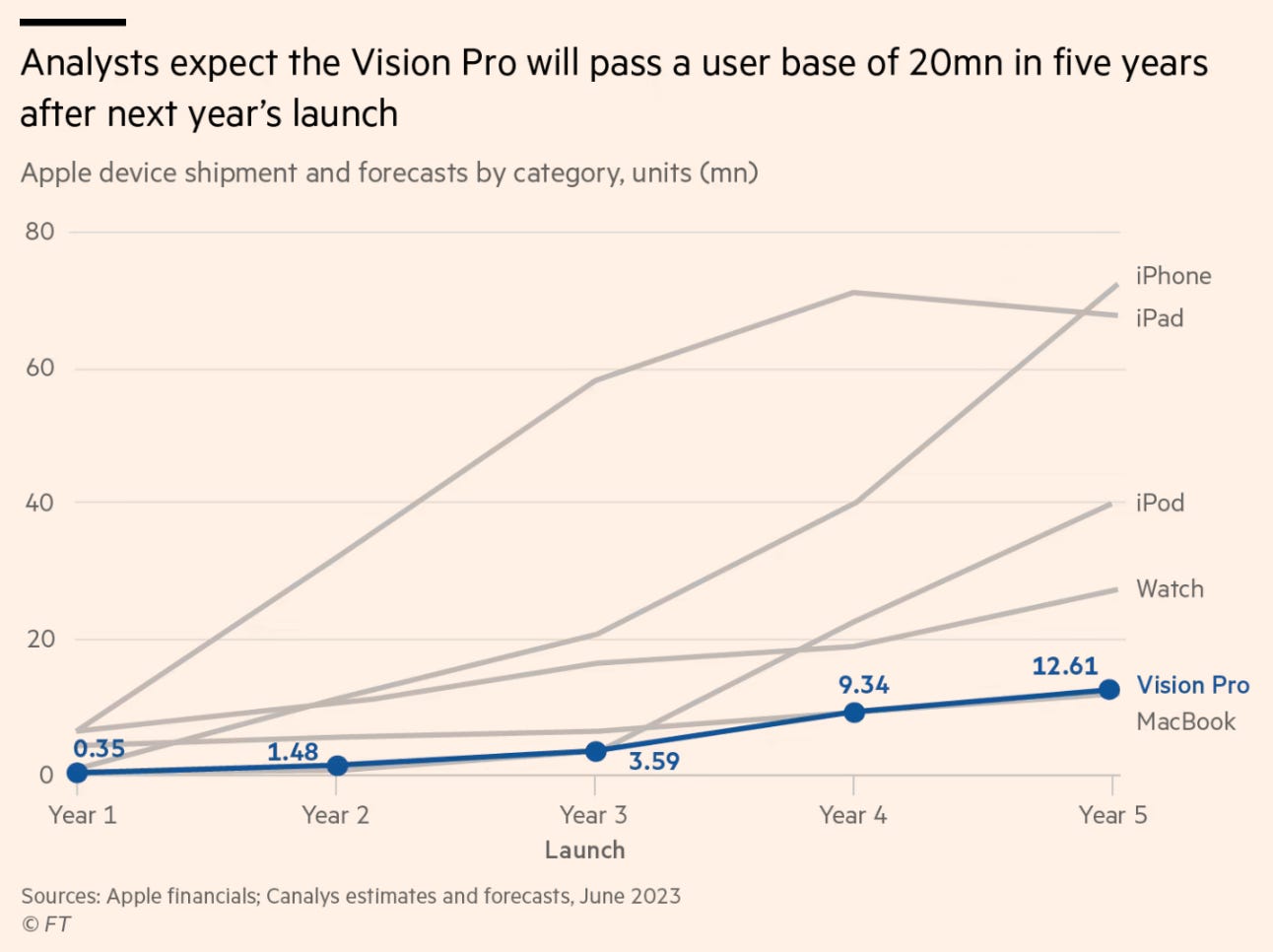

This time next year, we’ll be reading headlines about Apple’s disappointing year of Vision Pro sales. In the run-up to Vision Pro’s launch (likely in spring), the media will proclaim the device as the “next big thing”—then later in the year, the same folks will denounce it as a giant flop.

For some reason—maybe because VR / AR are so hyped—the media will be expecting iPhone-level sales. But Vision Pro will likely sell more like the Macbook or a gaming console.

There’s no reason to expect Vision Pro will fly off the shelves. The device is priced at $3,499—it’s a luxury item. But after a slow 2024 start, sales will increase as Apple drops the price and as killer apps emerge. By 2025 or 2026, the narrative might be quite different.

11) The Year of the Killer Apps

Speaking of killer apps, 2024 will be the year of the application layer. This will be true for Vision Pro—Apple is clearly hoping developers come up with some cool apps before the Vision Pro launch date—and it will be true for AI.

Next year, focus will shift from AI’s infrastructure layer to AI’s application layer. So far, we’ve seen breakout apps build on their own models—Midjourney, for instance, or Character AI. But many foundation models are now available via API, and open source models are improving at a rapid pace. I expect the next breakout applications will build on someone else’s model, instead winning on verticalization (with a resulting data advantage) or by offering a better user experience.

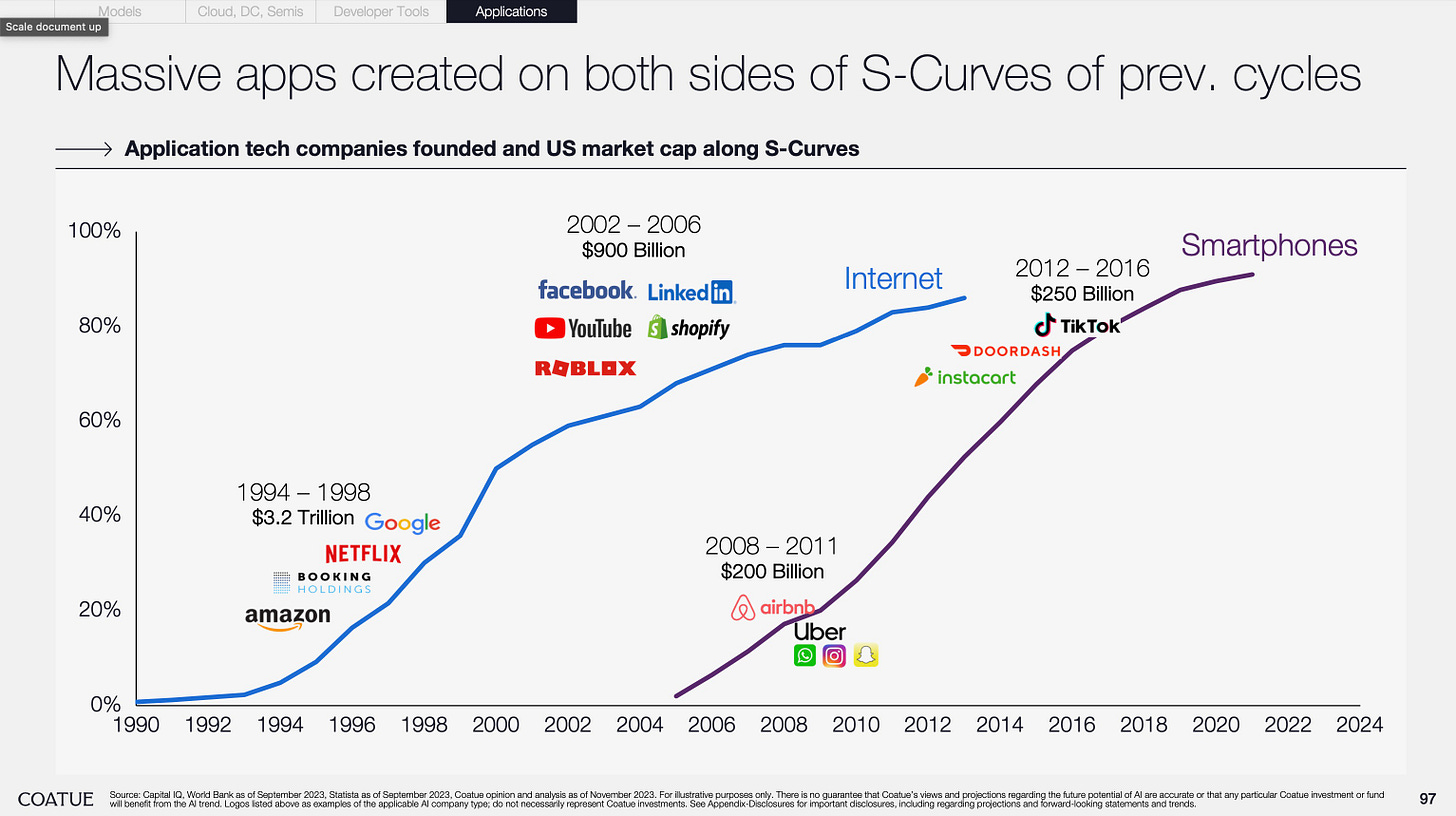

We’ll see a swarm of AI apps emerge, just as we saw mobile apps emerge a decade ago. Interestingly, both internet and mobile applications emerged in two main “clusters.” The chart below shows how 2008-2011 gave us apps like Uber, Instagram, and WhatsApp, while 2012-2016 gave us DoorDash, Instacart, and TikTok.

What will the first wave of AI apps be? Chatbots seem like an early contender, but only time will tell. I expect the application layer to form faster than in past epochs—successive platform shifts have typically halved their penetration time.

Even though it seems like AI is already mainstream (at least in the startup and venture capital echo chamber), we’re still early. While 58% of American adults have heard of ChatGPT, only 18% have used it. I expect we’ll need more vertical-specific, user-friendly LLM applications for the technology to really break through. Many of those applications are being built or dreamt up right now.

September’s piece The Mobile Revolution vs. The AI Revolution argued that it often takes a few quarters, or even years, for killer apps to emerge. The iPhone came out in June 2007; Uber was founded in March 2009.

Here’s a chart of U.S. smartphone ownership after the iPhone came out—I’ve overlaid the foundings of WhatsApp (2009), Uber (2009), Instagram (2010), and Snap (2011).

Where this chart ends—in March 2012—we were still early innings. At that point, smartphone penetration in the U.S. was hovering around 40%.

Here’s a chart that shows continued penetration, alongside the foundings of other major mobile companies: Tinder (2012), Robinhood (2013), TikTok (2015). These apps emerged five, six, and nine years after the iPhone launched, respectively.

2024 will be the beginning of AI’s application layer crystallizing. We’ll start to see generational businesses take shape.

12) Copilot Mania

Alongside the rise of AI, 2023 has given us copilot mania. That will continue in 2024. We’ll see copilots emerge for every conceivable use case.

Teachers will get copilots for homework grading (Class Companion, for instance). Architects will get copilots for building design (SketchPro). Lawyers will get copilots for working on legal briefs (Harvey).

We’ll all get used to using AI in our daily work. AI will reduce barriers, making challenging tasks more accessible to more people. Instead of typing an Excel formula, imagine instead prompting, “Write a formula that removes duplicate names in this column.” Tasks that have historically been enormous time-sucks for knowledge workers—data clean-up, memo writing, monotonous calculations—will become quick and easy.

Many copilots will be commodities, failing to use their data advantage to compound or build a moat. But others will take off. Harvey, for instance, is reportedly already north of $10M ARR, up from ~$1M in April.

Part II Next Week

This week, we covered #1-12. Next week, we’ll cover the last 12 predictions for 2024.

See you then 👋

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: