Seed Investing: The State of the Union

How the Market Downturn Has Impacted Pre-Seed and Seed

Weekly writing about how technology and people intersect. If you haven’t subscribed, join 50,000+ weekly readers by subscribing here:

Seed Investing: The State of the Union

Earlier this fall I wrote about Daybreak, the new early-stage venture firm I’ve launched. I’m happy to say that Daybreak is now open for business ✅

We have a website, which you can check out here. And we’re actively investing in early-stage startups. We’ve made four investments so far, across a variety of sectors:

Investment #1: B2B Marketplace

Investment #2: Consumer Fintech

Investment #3: Consumer AI Application

Investment #4: B2B E-Commerce Software

At Daybreak, we invest $500K-1M into Pre-Seed and Seed companies. This means we can lead or co-lead at Pre-Seed, and co-lead or invest alongside a lead at Seed. So far we’ve invested alongside firms we admire like Sequoia, Index, and Founders Fund, and last month we made our first lead investment out of Daybreak (the company in stealth mentioned in The Resale Revolution).

The vision for Daybreak is to modernize venture. One way I’d like to do that is by reserving a portion of the fund for members of the Digital Native community. Most of the Limited Partner base will be traditional venture LPs, but it’s important to me to keep a portion for people who have been part of this community. It’s a small step toward democratizing venture, though folks still need to be accredited investors to invest—either $1M in net worth or $200K in income the past two years ($300K with a spouse or partner).

If you’re interested in being an LP in Daybreak, you can fill out this form here:

Of course, please only submit an amount that you can afford. Venture is risky and illiquid; we won’t be returning capital for a while. But my hope is that having members of this community as LPs strengthens our community and plays a small part in broadening access to venture as an asset class, as best we can.

A lot of people might ask, “Is this the right time to launch a Seed fund?”

Daybreak’s launch comes at an interesting moment for Pre-Seed and Seed. On the one hand, we’re seeing massive behavior shifts (the coming-of-age of the digitally-native generation) collide with massive technology shifts (generative AI, most prominently). This shifts create opportunities for entrepreneurs to seize.

But we’re also in a venture downturn, with VC funding drying up. Early-stage investing should be a niche, cottage industry. But over the past few years, we saw it balloon into asset management disguised as venture. This has changed Seed dramatically.

The question is: is Seed still compelling, or is Seed a victim of the downturn and the “industrialization” of venture capital?

Answering that question is the focus of this piece. This week we’ll look at the “State of the Union” for Seed. Then next week we’ll look at how I like to invest at Pre-Seed and Seed, particularly in this market.

The State of the Seed

Investing at Pre-Seed & Seed

Let’s jump in 👇

The State of the Seed

It’s been a rough 18 months for tech. Public tech stocks are down 70-80% as multiples compress. Focus has shifted from growth to profitability. Achieving the latter can have dramatic effects: Udemy, a company with $700M+ in revenue, saw its stock jump +38% in one day after reporting profitable earnings. Netflix was the worst-performing stock in the S&P 500 last year, shedding 75% of its market cap, but it’s up +50% this year after turning in a few highly-profitable quarters. Many SaaS companies have stopped investing heavily in growth and are instead inching their way to cash flow generation.

The downturn in the public markets has extended to privates. Most unicorn companies are probably also down ~80%, even if most haven’t yet raised down rounds. As runway shortens in the coming quarters, we’ll see a slew of layoffs, fire sales, and shut-downs.

Amidst the downturn, venture capital fundraising has dried up. The capital raised in the first nine months of 2023 was only 24.7% the share raised in the first nine months of 2022. It’s a tough time to be in market as a venture fund.

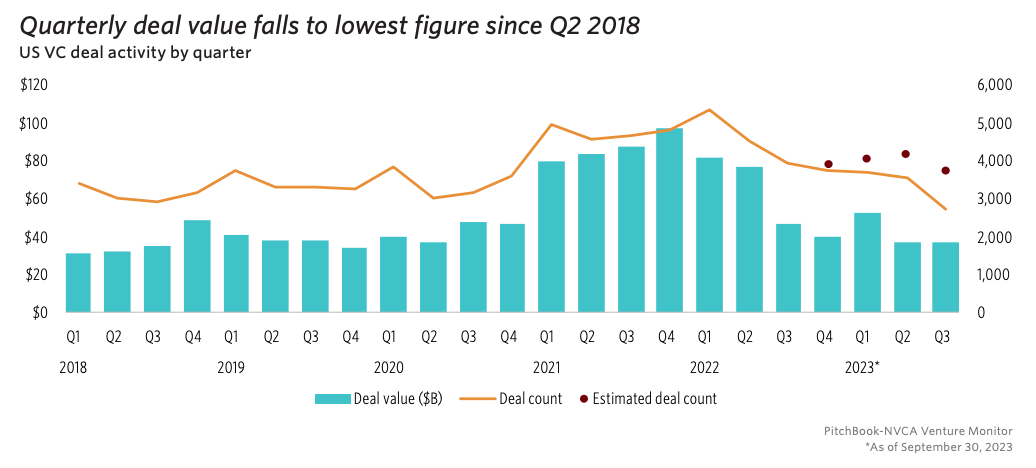

Deal value, meanwhile, is down to 2018 levels, well off 2021 and first-half 2022 highs.

Deal activity—the number of deals happening—is back to 2019 levels. The COVID boom years are over.

Part of the “why now” behind Daybreak is this downturn. Times of volatility are also times of opportunity. I think of a quote from Don Valentine, the founder of Sequoia:

One of our theories is to seek out opportunities where there’s a major change. Major dislocation in the way things are. Wherever there’s turmoil, there's indecision. And wherever there’s indecision, there’s opportunity. So we look for the confusion when the big companies are confused. When the other venture groups are confused. That’s the time to start companies.

The big companies—and the big venture firms—are definitely confused. Rapid changes in technology and human behavior are creating an Innovator’s Dilemma for incumbents. The market correction, meanwhile is creating a talent unlock, with folks underwater on their options, which in turns fuel a boom in startup creation.

Looking back at the Great Recession, venture funding declined overall, but cohorts of iconic companies were born. Companies founded in the five years of 2009, 2010, 2011, 2012, and 2013 include:

These next five years—2024, 2025, 2026, 2027, 2028—may be similarly historic vintages for Seed.

Yet the market correction hasn’t really hit the Seed market.

PitchBook data shows that through the third quarter of 2023, Seed-stage startups had a median pre-money valuation of $12M, up from $11.1M in 2022. That $11.1M figure was itself a record, and 2023 is on track to break that record.

Deal sizes are also inching higher. The median Seed round is $3M this year; the 75th-percentile sits at $5.3M, and the average Seed round (pulled up by frothy mega-Seeds, cutely called “Mango Seeds” in the venture world 🥭) is $4.5M through Q3. For Pre-Seed, the average round is $1.1M and the median round is $0.5M.

Why hasn’t Seed corrected in the same way that late-stage has? For comparison, late-stage deal sizes are down ~30% and valuations are down ~20%:

Seed has seen an influx of multi-stage and late-stage investors moving earlier. When late-stage is unattractive, Seed becomes more compelling by comparison. First, venture investors need to spend their time doing something. And late-stage isn’t really an option right now. But Seed also offers upside with limited downside: if things work, multi-stage firms can lead future rounds and buy up more ownership. If things don’t work, firms don’t lose that much capital.

For a smaller fund like mine, this becomes a point of differentiation with founders: a $1M check doesn’t matter much to a $3B fund, but it matters a lot to me. This manifests in the amount of work a Seed firm will do for a founder compared to a multi-stage firm. All multi-stage firms aren’t the same, of course; many treat Seed with conviction and roll up their sleeves. But this is the broader trend, and many firms do treat Seed this way. Seed is the most “artisanal” of any investment round, yet is being treated by many like financial option value.

While Seed valuations and round sizes haven’t corrected, the number of deals has slumped. We’re at a 12-quarter low in terms of deal activity.

I expect this to turn around soon, largely because of the aforementioned talent unlock. We’re going to see more startups being built as talented people leave overvalued startups. And as I argued in The Mobile Revolution vs. The AI Revolution, AI’s application layer is still immature—we’re a few quarters away from seeing “killer apps” emerge. Both market dislocation and technology shifts will drive more Seed activity.

Another key metric to watch is capital availability—the ratio of capital demand to capital supply. We’re now over 1.5x, a sharp increase from the sub-1.0 levels of the past few years. I expect this ratio to remain high for a while. Venture fundraising isn’t going to pick up any time soon: LPs aren’t getting capital back, and firms already have large coffers to deploy. As early-stage deal flow heats up again, capital demand will outstrip capital supply.

Anecdotally, I’m still seeing most top Seed rounds clustered in the $15-20M valuation range. For AI deals, it’s higher—often by a lot. The challenge with a frothy category is that you’re typically overpaying at entry, and that category might not be as “hot” by the time you exit. You buy high and sell low by comparison. This is why staying disciplined on entry price is crucial, even (or especially) amidst hype cycles.

The next section digs into the math behind why price matters for a Seed fund like Daybreak, and why discipline is so crucial.

Why Seed Valuations Matter

At Daybreak, we aim to keep our weighted-average entry-price low.

Entry valuation, naturally, has a tremendous effect on fund returns. One of my favorite pieces of the boom times was Fred Wilson’s takedown of $100M valuation Seed rounds. The math in that piece is important to understand. Let’s look at a simplified portfolio construction model for a Seed fund to see the importance of valuation.

Let’s say we have a $30M fund that’s able to invest $25M after fees and expenses. So we’ve got $25M to put to work. To keep things simple, let’s assume that we invest $1M into 25 companies, and ignore reserves.

That $1M investment gets us very different ownership at different entry prices:

$1M at a $10M post-money valuation = 10% ownership

$1M at a $20M post-money valuation = 5% ownership

$1M at a $40M post-money valuation = 2.5% ownership

To simplify things, let’s assume that only 3 of those 25 companies are “winners.” The rest are zeros, and we lose our money on them. But those 3 create tremendous value: they turn into $2B, $1B, and $500M outcomes. An AngelList study back in 2021 found that a Seed-stage startup has a 2.5% chance of becoming a unicorn—so about 1 in every 40 companies hits a $1B valuation. Of course, that dataset was from the frothy bull market and has always seemed optimistic to me. Either way, our assumption here is that our Seed fund outperforms the market, with three sizable outcomes among 25 investments.

Let’s look at three valuation scenarios.

In Scenario 1, we make all our investments at $10M post. Our 10% ownership stake is diluted down to 5% at exit, but we still return $175M—a 5.8x fund.

In Scenario 2, we make all our investments at $20M post. We own 5% at entry and 2.5% at exit, returning $87.5M for a 2.9x fund.

In Scenario 3, we paid up for some frothy rounds—$40M post. We only own 1.25% at exit and only deliver a 1.5x fund.

Of course, this math changes dramatically based on how big the winners are. If we get one company to $5B and another two to $1B, we’ve got an 11.7x fund in Scenario 1, a 5.8x fund in Scenario 2, and a 2.9x fund in Scenario 3.

This exercise is vastly oversimplified. For one, fund return numbers are gross, before fees and carry, so they paint a rosier picture than net returns. For another, we’d likely have more than three companies return some capital—the “middle third” of our portfolio might comprise about 20% of returns. But the power law would still apply: a small group of homeruns would carry the fund. Venture is a power law business.

Though imperfect, this exercise gets the point across: ownership in your winners matters. A lot. And ownership is a direct function of entry valuation. Paying nosebleed prices might help you get into hot deals today, but you’ll pay the price down the road.

The power law can be quite powerful when it works. Consider some of the iconic technology companies of the past generation. Investing $1M into Snap’s Seed round would yield a $4.8B stake at IPO, $2.4B with 50% dilution. That’s an 80x return on a $30M fund with just one investment. A $1M LP check in that fund turns into $80M gross.

If Daybreak invests in the Seed round of the next Snap, Airbnb, or DoorDash, we’ll have an incredible fund outcome for our LPs. A $30M fund can turn into a $2B+ fund with a single investment. Hopefully we get two, three, four generational companies in the portfolio. Some of the best venture funds in history are stunning in their success; First Round Fund II, for instance, invested in the Seeds of:

This job isn’t about what can go wrong, but what can go right; it’s a job built on optimism.

My goal with Daybreak is to build a generational venture franchise. Every investment in Daybreak Fund I should be a potential fund-returner many times over, and every entrepreneur we partner with should have the ambition to build an enduring, generational business.

Next week’s Part II will focus on the art of picking—evaluating market, product, business model, founder. We’ll explore how to invest at Seed and Pre-Seed, particularly in this market.

Final Thoughts: It’s Never Too Early

I wouldn’t want to be starting a growth fund right now. The late-stage venture markets are in for a years-long reckoning. They got way ahead of their skis, and the aftershocks will be drawn out and painful.

But I’m thrilled to be starting an early-stage fund. Yes, Seed prices remain stubbornly high. Yes, the “hot potato” dynamic of venture—when an early-stage investor just needed to be sure late-stage capital will come piling in—is over. That’s a good thing; it was short-term greedy, long-term value destructive.

Early-stage investing remains compelling. I chose the name Daybreak because it evokes the very beginning—we’re often the first partner to an entrepreneur. And in my mind, Pre-Seed is an attractive place to invest right now. It can be uncomfortable, sure. Our last lead check was pre-incorporation, and the business didn’t have a name. But the business did have an exceptional founder and a big idea.

This stage is too early for most multi-stage firms—and for many Seed firms—but I think it’s the most exciting stage to partner with founders, and a stage that can deliver generational returns. Note the Pre-Seed / Seed valuations above for the last generation’s iconic technology businesses—most were sub-$10M.

September saw two large commerce IPOs, which I wrote about in The Wild West of E-Commerce. Both Klaviyo and Instacart are now trading in the $7B market cap zip code. And both of their Seed rounds hovered around $7M in valuation. That’s a nice 1,000x multiple for Seed investors.

We’re seeing more and more top founders embrace reasonably-priced rounds—say, a $1.5M to $2M round in that ~$7-10M range. Savvy founders understand that this round construct leaves open the possibility for a larger Seed round after some initial proof-points, encourages the company to stay lean and disciplined while finding product-market fit, and lowers the risk of not being able to raise a Series A after an overly-frothy Seed. Many founders who raised at $20M+ over the last few years are struggling to justify an extension at a lofty price or to attract top talent.

I expect this trend to continue, and the earliest stage is a key focus area for Daybreak. If you’re early in your journey as a founder—no matter how early—reply here or send me a note at rex@daybreakventures.com 📬 I’d love to hear what you’re working on.

And if you want to join us on the LP front, fill out the form here:

Next week in Part II we’ll focus on the art of Pre-Seed and Seed investing—how to actually spot the generational entrepreneurs and companies.

See you next week 👋

Related Digital Native Pieces

Sources & Additional Reading

Pitchbook NVCA Venture Monitor Report — Q3 2023

Investing for Alpha or Beta | Rick Zullo — one of the better pieces on Seed fund management and valuation discipline

Seed Rounds at $100M Post | Fred Wilson — an excellent piece about why investing at sky-high valuations comes back to bite you

Sam Lessin has a great deck on Seed investing full on some spicy hot takes — check it out here

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: