Business-in-a-Box 2.0

How AI Supercharges Small Business Creation

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 55,000+ weekly readers by subscribing here:

Business-in-a-Box 2.0

When we think of franchises, we tend to think of McDonald’s and Subway.

McDonald’s operates about 40,000 global restaurants; around 37,000 of those (92.5%) are franchised. Subway trails McDonald’s as the world’s 2nd-largest franchise (though it actually has more US locations), and is 100% franchised. Familiar names round out the top five: KFC (#3), 7-Eleven (#4), Burger King (#5).

But franchises go well beyond fast food.

The first franchise is thought to date back to 1888, when an enterprising woman named Martha Matilda Harper came up with a new way to shampoo. And Harper certainly had the hair to back up her innovation:

Damn.

Harper began to franchise her shampooing methods to other women, eventually offering those women everything from training, to branded products, to advertising, to group insurance. In return, Harper would take a share of their proceeds. At its peak, Harper Salons grew to 500 salons and training schools, lifting hundreds of low-income women from poverty and minting a new breed of entrepreneur.

Fast-forward to modern-day, and haircare remains popular for franchising. Until I got fed up with having a bowl cut, I was a loyal patron of Great Clips. There are 4,400 franchised Great Clips salons in the US and Canada, making Great Clips the world’s largest salon brand.

The International Franchise Association estimates that there are about 792,000 franchise establishments in the US, employing 8.5M people and raking in $825B in annual revenue.

Shoutout to my friend Molly Alter for putting Harper salons on my radar; Molly wrote an excellent recent piece on franchises. She and I have been discussing the concept in depth because we’re seeing the same trend in the Pre-Seed and Seed markets: the return of “business-in-a-box.”

Business-in-a-box was a startup term in vogue a few years back, referring to startups that allow people to…well, to launch businesses. There have been a few major success stories in business-in-a-box (more on those below) and we’re now seeing a new generation of business-in-the-box companies emerge, powered by both technological and cultural shifts. This is one of the foremost trends I’ve been seeing this year in early-stage venture.

On the technology front, generative AI automates workflows, removing the complexities of launching and managing a business. We saw the same thing with software, which digitized cumbersome pen-and-paper tasks. But AI is an order-of-magnitude more efficient at abstracting away the headaches and grunt work of entrepreneurship.

On the cultural front, we’re seeing a shift to more flexible, self-driven work. This is a recurring theme in Digital Native. Gen Z in particular wants to forgo traditional forms of work in favor of more autonomous options. Survey after survey confirms this. A recent Samsung + Morning Consult report found that 50% of Gen Zs aspire to start their own business. Research from ZenBusiness found that 84% of Gen Zs selected entrepreneurship as the most exciting of 12 possible career paths, with 75% saying they want to become entrepreneurs.

We also see a post-COVID effect. Self-employment is currently at its highest share of workers since before the Great Recession.

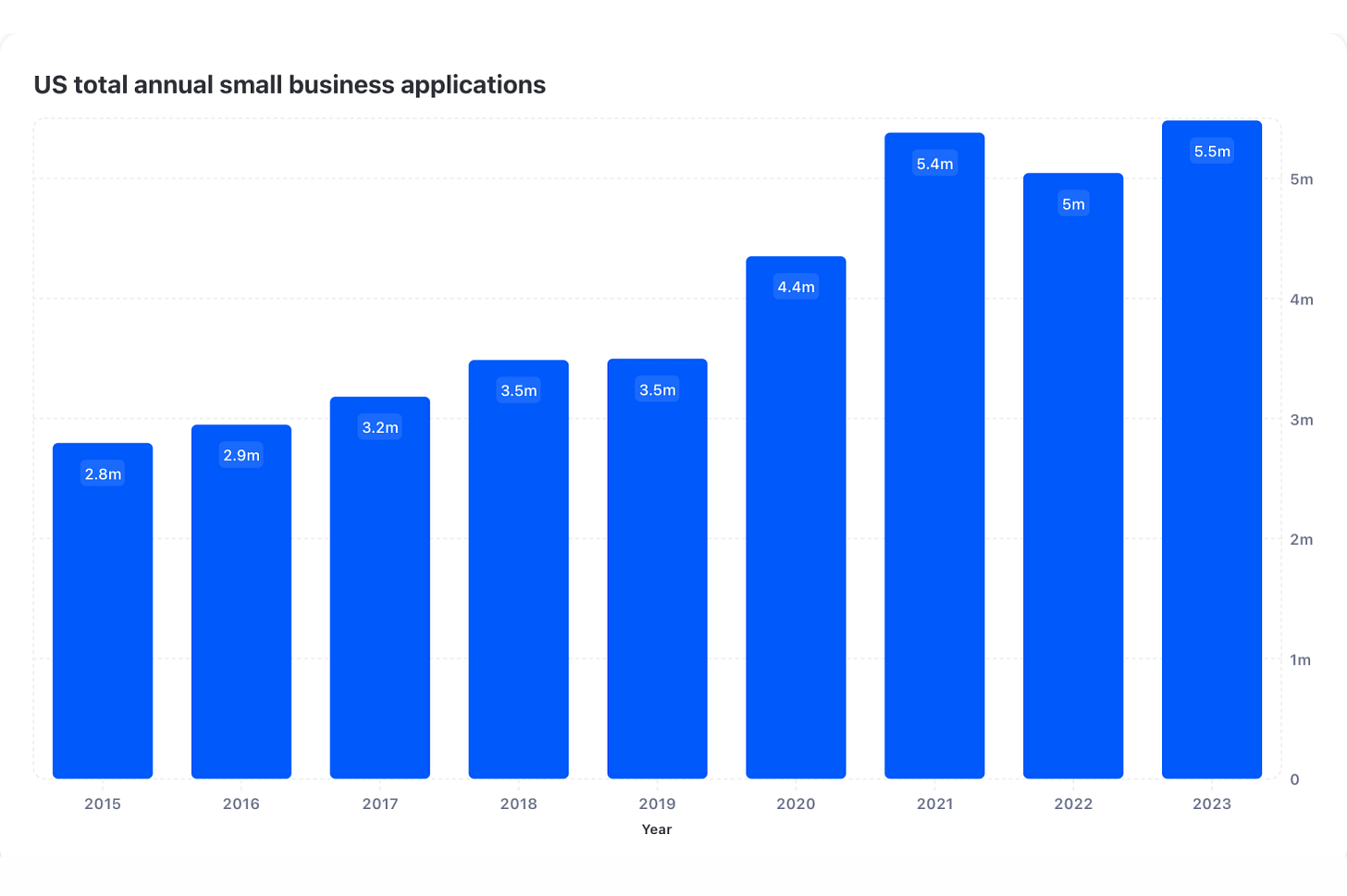

Small business applications are also in record territory, up sharply from pre-COVID levels. Last year, the US saw 5.5M small business apps.

And freelancing—another form of self-directed work—is on the rise. America is set to become a freelance-majority workforce in 2027.

People want to be their own bosses, masters of their own destinies. Young people, in particular, grew up watching parents and grandparents lose jobs during the 2008 financial crisis and again during the pandemic. As a result, a new generation has come of age prioritizing self-reliance.

Software is a lubricant for new business creation. Horizontal products remove complexity: QuickBooks makes accounting easier, and newer players like Found offer holistic business banking for the self-employed; Square makes point-of-sale (and now much more) turnkey; and companies like Gusto help out with HR. The list goes on.

Those examples cut across industries. But vertical SaaS and now vertical AI also play a key role in specific industries.

Vertical SaaS vs. Vertical AI vs. Business-in-a-Box

There’s a lot of overlap between vertical SaaS, vertical AI, and business-in-a-box.

Last month’s Seurat and the Opportunity in Vertical AI argued that vertically-focused companies should follow a familiar playbook:

Identify the most salient pain-point for your customer and solve it.

Use that wedge to win over customers.

Layer in more products over time—cross-sell and up-sell, improving customer lifetime value and becoming more defensible.

The analogy was Seurat’s pointillism: up close, a Seurat work is a single dot of paint; zoom out, and it becomes complex.

Toast’s first product was a cloud-based point-of-sale system for restaurants. It seemed niche. But over time, Toast layered in over a dozen products: inventory management, lending, payroll, marketing, digital ordering, delivery. According to Barron’s, 62% of Toast customers use 4 or more of its 15+ products. Toast now boasts a $9.5B market cap.

I’d argue that business-in-a-box startups differ from vertical SaaS/AI by adding one or both of two additional functionalities: (1) Training, and (2) Discovery.

Overall, I group Business-in-a-Box into three core offerings:

For each offering, let’s take an example of a startup that does it well.

TRAINING

Harper’s franchisees typically weren’t experienced in haircare. So Harper set up training schools to fix that. Similarly, many savvy startups are adding an education component to their suite of products. This is the launch-pad for entrepreneurs.

Elemy runs a course for a Registered Behavior Technician (RBT) training program, helping people become certified to provide in-home applied behavior analysis (ABA) for children with autism.

Training means an upfront cost for the company, sure, but a business can quickly pay that cost back in a matter of weeks—particularly if the product is sticky and produces a nice LTV-to-CAC multiple.

Other startups have used similar approaches. Part of allowing someone to become their own business means equipping them with the skills to get going.

DISCOVERY

Discovery encompasses finding customers—finding people to pay you. Building your book.

An example of a company that facilitates discovery well is Grow Therapy, an under-the-radar but rapidly-growing business. Grow is business-in-a-box for therapists, helping you launch a successful practice.

A key component of Grow is helping therapists find patients. Some therapists might have their own book they can port over, but many don’t. In fast-growing and sought-after professions like “mental health provider,” the discovery component helps a new class of workers get set up quickly.

ADMIN

Admin is the closest component to vertical SaaS and vertical AI. These are the tech tools that remove the day-to-day complexities of a business. To continue with the mental health example, admin is something Headway does well. I’ve seen other mental health startups building on Headway, because Headway does that good a job handling things like invoicing and reimbursement.

A newer startup that’s also a good example here: Moxie, business-in-a-box for medical spas. Last month’s The Huberman-ization of America covered our growing obsession with health and our subsequent willingness to pay for health services. There were 8,800 med spa locations in the US last year, making up a $17.5B market. That market is compounding 10% a year, and the Bureau of Labor Statistics predicts that employment of estheticians will grow 29% this decade.

Moxie offers a variety of features for business owners who launch a med spa:

Find a medical doctor (you need a doctor to order Botox etc—nurses can’t order the product—and that can be tough to find without Moxie’s built-in network)

Secure insurance

Design your menu and pricing

Set up your website and booking link

Manage paid marketing

Design a loyalty program

Naturally, a bigger buyer like Moxie will also get better deals on product, reducing the costs of good sold and increasing margins (and the amount the business owner takes home).

Business-in-a-Box: Act II

Yesterday, there was a funding announcement for Moego—a classic vertical SaaS company that offers scheduling and payments software for pet groomers. If you run a grooming shop, you’re in luck; you can turn to Moego. (Name a more delightful profession; I’ll wait.)

The distinction with business-in-a-box is that a business-in-a-box product would allow anyone to launch their own grooming practice. That company would offer the scheduling and payments software, sure (the “Admin” piece above), but it would also facilitate training or discovery. You might be able to quickly take a course on how to groom a pet, and you might get help in finding customers.

As a result, I view business-in-a-box as an extension—or perhaps a cousin—of vertical SaaS.

There’s a reason that a lot of the examples above are in healthcare. Handling complex insurance coverage and reimbursements is a great way to lock in business owners. A challenge with these companies is disintermediation—will business owners leave once they no longer need you? Maybe the dog groomer doesn’t want to pay for Groomer-in-a-Box software anymore, once she has 30 Fidos to trim every month.

Disintermediation risk is high in categories that require a lot of trust and safety (e.g., childcare) or in categories that tend toward long-term relationships between business and customer (e.g., a housecleaner might stay with a customer for years). If a therapist doesn’t need Headway or Grow to find new customers (after all, a therapist can only take so many patients), what value is the company providing? The answer is a lot, and insurance is a key piece of that. This is one reason health-related services are an early category leader in this space. But any business-in-a-box company should ensure its ongoing value is high enough to drive strong retention.

In America, there are 33M small businesses—99.9% of all businesses. Most are services businesses. And most service industries are a good fit for business-in-a-box. I think of the Richard Scarry books, and how each character’s profession is labeled in the illustrations. Virtually any Richard Scarry profession could now be launched by a tech business that acts as a next-generation franchisor, equipping business owners with the tools to run their operation.

In addition to health-related professions, home services are a natural fit. Molly and her team used NAICS code data to identify contractor segments that have (1) a combination of high absolute employment, and (2) a significant % of the industry sitting in small firms. Painting, wallpapering, and landscaping stood out as the most addressable, with high employment and with ~50% of workers sitting in 0-19 employee businesses.

We’re already seeing startups innovate in services, including in home services.

A century and a half ago, Martha Matilda Harper ran her empire of hair salons. Today, the NYC-based startup GlossGenius allows anyone to launch their own haircare business—and GlossGenius has ridden that concept to a $500M+ valuation. My friends at Forerunner have a great thesis on next-generation franchises, and they’ve backed companies like Fora and Craftwork. Fora lets anyone launch a business as a travel agent; Craftwork does the same in painting.

We saw a prior generation of vertical SaaS giants like ServiceTitan, which offers the software that any plumber or electrician can use to run their business. A natural evolution is a company that allows anyone to start an entrepreneurial journey in that field.

A key question for these companies: how important is discovery?

Different companies have different approaches. Flagship, one of my companies that I’ve written about before (The Future of Creator Commerce), lets anyone with an online following launch their own boutique storefront. In some ways, Flagship is business-in-a-box for small business merchants. Yet most successful Flagship merchants, at least today, have existing audiences they can tap as customers. Discovery is less of an issue; creators bring the shoppers.

Nourish (which I’m also an investor in) sits on the other end of the spectrum. Nourish operates a marketplace where you or I can link up with a dietitian for telehealth consultation, and get it covered by insurance. Nourish actually employs its dietitians, then handles discovery for them; in other words, the company fills their book and ensures that demand is always there.

Both companies are forms of business-in-a-box, but with their own nuances.

A sub-category of business-in-a-box, I’d argue, is the digitally-native job. In November 2022’s The Rise of the Digitally-Native Job, I wrote about the emergence of careers born from an internet platform. Roblox Developer, for instance, or Whop Seller. These types of work also sit upon a technology platform, and in many ways are also the descendant of a franchise model. A distinction I’d make is that digitally-native jobs typically sell a digital product—e.g., a game on Roblox or a sneaker bot on Whop. Business-in-the-box, as defined above, is broader and encompasses these products but also more traditional work—from haircare to mold removal to landscaping to interior design.

Final Thoughts: Enter, AI

The biggest shockwave happening in business-in-a-box startups, of course, is AI. Software made it easier to run your business: instead of filing paperwork for your invoices and taxes, you could use an elegant mobile-first interface; instead of working the phones to fill your schedule, customers could use your booking and payment software.

But AI takes things to a new level. Rather than making work easier like software, AI does work for you. A Flagship merchant might have a 24/7, intelligent chatbot on their store talking to customers—a chatbot trained on specific data from the store and customer preferences. That chatbot replaces customer service support. A Fora travel agent might be able to email an AI agent her invoice and not worry about it again. Companies like Mindy are already making this possible, executing tasks via email.

Phase 1: Handling invoices over the phone and with paperwork

Phase 2: Elegant software to file and organize my invoices

Phase 3: AI agents handling my invoices, like my own personal admin

I like how Molly puts it: “At a certain point, these agents will work together so seamlessly that interacting with the platform feels like working with a seasoned righthand man whom can be trusted to take care of the day-to-day business operations.” At a fraction of the cost, you get a small army of workers helping you build your business.

This makes being a business owner easier. We’re at a cultural moment in which more people want to start a business. At the same time, technology is making that option easier than ever. I expect this combination will lead to an explosion in business creation over the coming years.

Sources & Additional Reading

Related Digital Native Pieces

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week:

![Number of Small Businesses in the US [Updated Dec 2023] Number of Small Businesses in the US [Updated Dec 2023]](https://substackcdn.com/image/fetch/$s_!T9Si!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2F01b57391-54f0-4d04-9e03-001b151b1e22_1760x900.png)