The Huberman-ization of America

This Decade's Mega-Trend: Health

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 55,000+ weekly readers by subscribing here:

The Huberman-ization of America

In 2020, Andrew Huberman was a little-known Stanford neuroscience professor. Fast forward a few years, and Huberman is a bona fide celebrity and one of the biggest podcasters in the world.

Huberman launched his Huberman Lab podcast in 2021. In episodes often reaching three hours in length, Huberman Lab digs into various health-related subjects. How does ketamine impact the brain? What are the effects of caffeine on our bodies? What’s the science behind hair loss and regrowth?

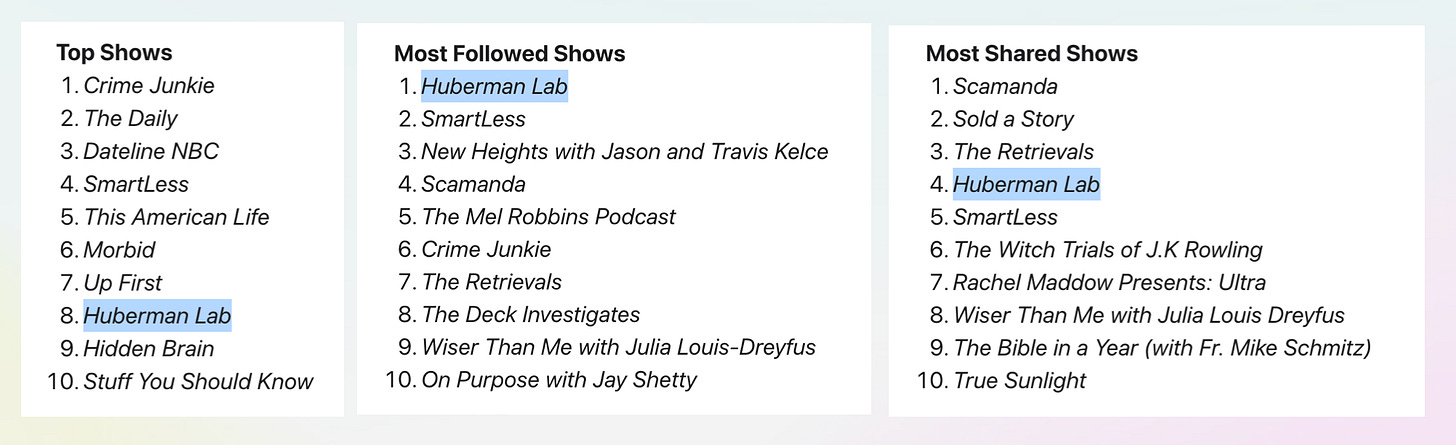

Last year, Huberman Lab was the 3rd most-popular podcast on Spotify. On Apple Podcasts, the podcast is the 7th most-popular, but ranks as the #1 most-followed and #4 most-shared.

Huberman’s episode on alcohol—“What Alcohol Does to Your Body, Brain & Health”—was the single most-shared podcast episode of the year.

Huberman’s ascent has been stunning. His YouTube channel has 4.6M subscribers; his Instagram account has 5.5M followers. He’s our culture’s new-age health guru—though, in my mind, his content has edged closer towards pseudoscience as his fame has grown. (A predictable trend for celebrity physicians.)

Most interestingly, Huberman’s rise is emblematic of a broader mega-shift: society’s growing emphasis on health. My friend Christine calls this “The Huberman-ization of America” and I agree. We care a lot more about our bodies and brains—and consequently, we’re willing to spend a lot more to make sure they’re in good shape.

I’d break this shift into three sub-categories:

Performance

Aesthetic

Health

Each category is seeing a lot of startup action, and I expect “the Huberman effect” to be one of the key tailwinds for spending and innovation in the 2020s.

Let’s take each category in turn.

Performance

Tim Doyle, the founder of Eucalyptus (one of Australia’s largest consumer health startups), told me recently that he sees a distinction between the “consumer-ization of health” and the “health-ization of consumer.”

The former fits more neatly into healthcare; it’s about making outdated, cumbersome healthcare workflows more intuitive and accessible. But that trend is more clinical. It ultimately relies more on B2B2C distribution channels—employers and payers, for instance.

The latter, meanwhile, is about injecting what consumers are now willing to spend more on—their health—into consumer. It’s more likely to be direct-to-consumer, avoiding the red tape (but also potentially the big $$) of the labyrinthine employer/payer systems.

One category of consumer health that’s growing rapidly: performance. We’re seeing a new generation of startups here. Eucalyptus, for instance, has a new product out called Compound. Compound blends diagnostics with coaching and supplements.

There are three steps to Compound. Step 1 involves extensive diagnostics:

(Anecdotally, I’ve seen interest in concepts like DEXA Scans and VO2 Max tests explode online. Google Trends shows a steady increase in searches over the past few years.)

Step 2 is performance optimization based on the results from above:

And Step 3 is personalized treatment and supplements:

Performance is a sub-category that’s more male-dominated. In its own description, Compound markets itself as “health optimization and preventative care to help men unlock barriers to everyday performance.”

Here in the US, Function Health offers a similar product: 100+ lab tests and insights for $499 / year. Function is co-founded by Mark Hyman, a celebrity physician in the vein of Huberman. Web traffic to Function has exploded over the past year, and words like “biomarker” and “lipoprotein” have somehow entered the popular lexicon.

Last fall’s The Hyper-Personalization of Everything argued that technology is powering a shift toward more customized products; we’re all spoiled by things crafted just for us. Performance health is an example. People are showing that they’re willing to pay for tailored insights, recommendations, and supplements.

It’s surprising to me that millions of people still rely on GNC—an outdated, relatively soulless brick-and-mortar retailer. There feels like an opening for a new-age player here, powered by renewed interest in vitamins and supplements.

The Feed, for instance, is an online retailer that’s effectively a fresher, digital-first GNC, populated with its own private-label brands. I also see an opportunity for more household names for whey, creatine, and other supplement brands. “Clean eating” is coming to supplements, and the category enjoys high margins. We’ll see more business creation here as a result.

A final category of performance: luxury gyms. In New York, Equinox dominates; in London, places like Third Space have popped up. Third Space is aptly named: the rise of high-priced gyms is powered by an interest in fitness and performance, yes, but also by the dearth of “third spaces”—churches, community centers, and other locations that offer a sense of belonging outside of the home and workplace. “Performance” culture writ large—including in online networks like Strava, Discord, and Reddit—is partly about community and belonging to a group of health enthusiasts.

Aesthetic

In 24 Predictions for 2024, I wrote about my “selfie thesis.”

The selfie thesis is tangential to another thesis—the idea that all great consumer companies build on one of the Seven Deadly Sins. (See: 2022’s The Seven Deadly Sins of Consumer Technology.) Arguably the most potent sin is Vanity, which isn’t technically one of the “traditional” seven recognized sins, but which is a close sister to Envy.

The rise of mobile phone cameras and social media 15 years ago supercharged Vanity. In tandem, they supercharged any business that makes our selfies look better. If your company helps us snap better selfies—or, even more timely, helps us look better in close-up Zoom meetings—then you have the wind at your back.

Companies building here broadly fit into the “Aesthetic” category of health spending.

An example would be skincare. The global skincare market was about ~$150B last year and is growing 7% annually through 2030. A few years ago, I visited a dermatologist’s office and somehow left $300 poorer, equipped with everything from Tretinoin to spot treatment to a new face wash. The derm convinced me that I needed each product, and many of the products I’m still paying for via subscription.

Startups like GetHarley formalize this, offering telehealth derm consultations and subscriptions to skincare products. GetHarley’s secret sauce is that it tacks on a lucrative e-commerce business to derm practices, with access to thousands of online SKUs. The tailwinds are good: Gen Z is crazy about skincare. An excerpt from NPR:

[Gen Zs] are celebrating birthdays at Sephora, rattling off beauty products' chemical properties, trading samples, and sending each other videos of morning skin care routines, chasing the coveted glowy look. Teen shoppers spent 33% more on cosmetics and 19% more on skin care this year compared with last year.

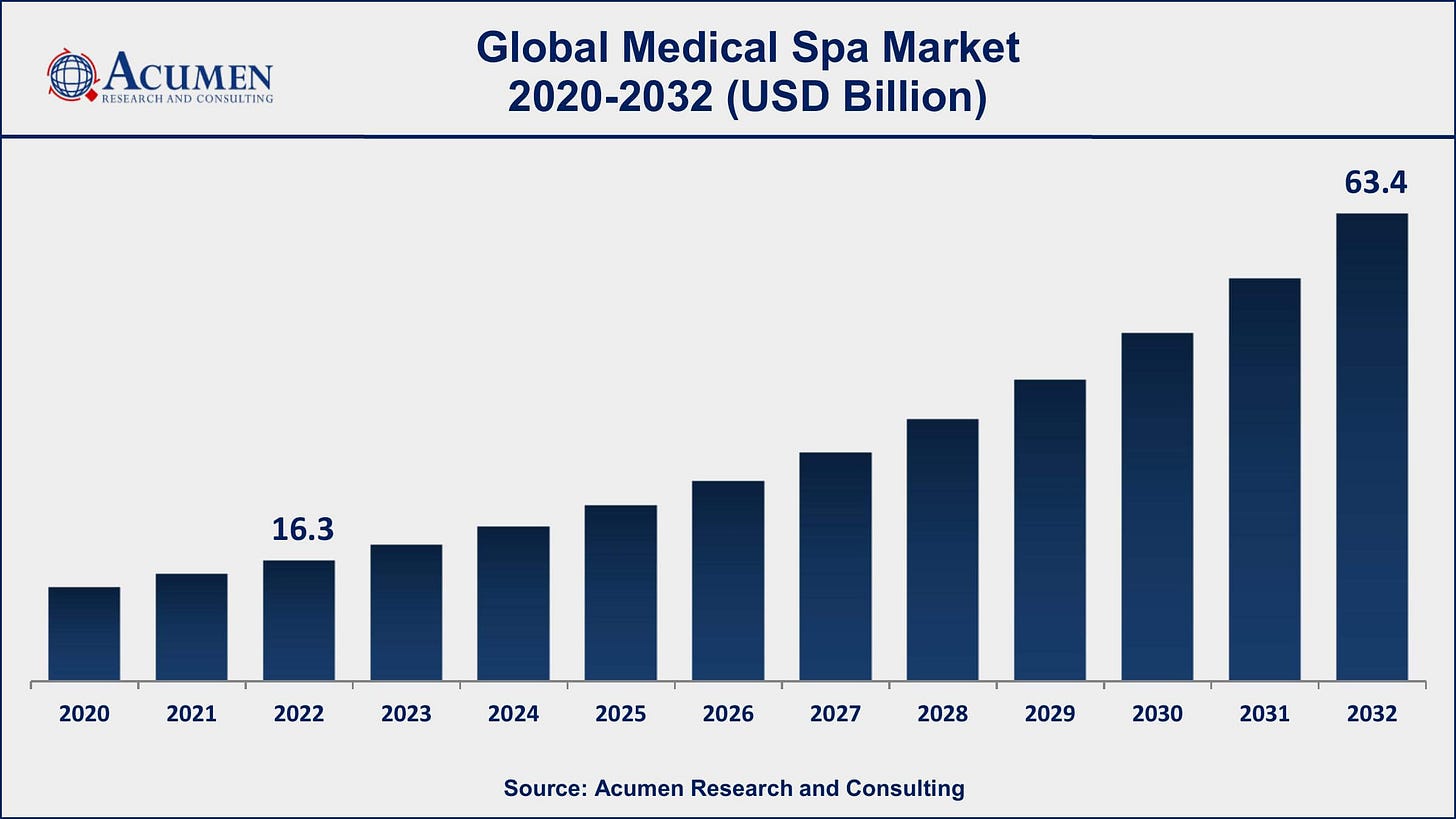

In a related trend, med spas are popping up around the country. Med spas provide nonsurgical aesthetic treatments—think Botox, microdermabrasion, or laser hair removal. There were 8,800 med spa locations in the US last year, making up a $17.5B market. That market is compounding 10% a year. The Bureau of Labor Statistics predicts that employment of estheticians will grow 29% this decade.

Startup plays here include vertical SaaS for med spas like Moxie and “botox at-home” providers like Persimmon. Nurses are tired and overworked; many prefer more lucrative and flexible work administering aesthetic treatments. Consumers, meanwhile, are more willing than ever to pay for such treatments—often indefinitely, meaning high LTVs. Incentives are aligned, and spending is booming.

Of course, health plays a role here too. Part of the reason we pay exorbitant prices for skincare is to, well, maintain healthy skin. But if we’re honest with ourselves, we’re mostly paying for this stuff to look good. And in an increasingly visual world, aesthetic-focused health startups aren’t going anywhere.

Health

Health relates to Performance and Aesthetic, but it’s broader: it’s the category encompassing people who…well, people who want to be healthy. We’re paying more attention to our sleep, to our heart rate, to our blood sugar level. Partly for performance or aesthetics, sure, but partly just to maintain good health.

Consumer hardware products are the foundational layer here. We’ve seen Whoops and Oura Rings and Eight Sleep mattresses on the rise the past few years.

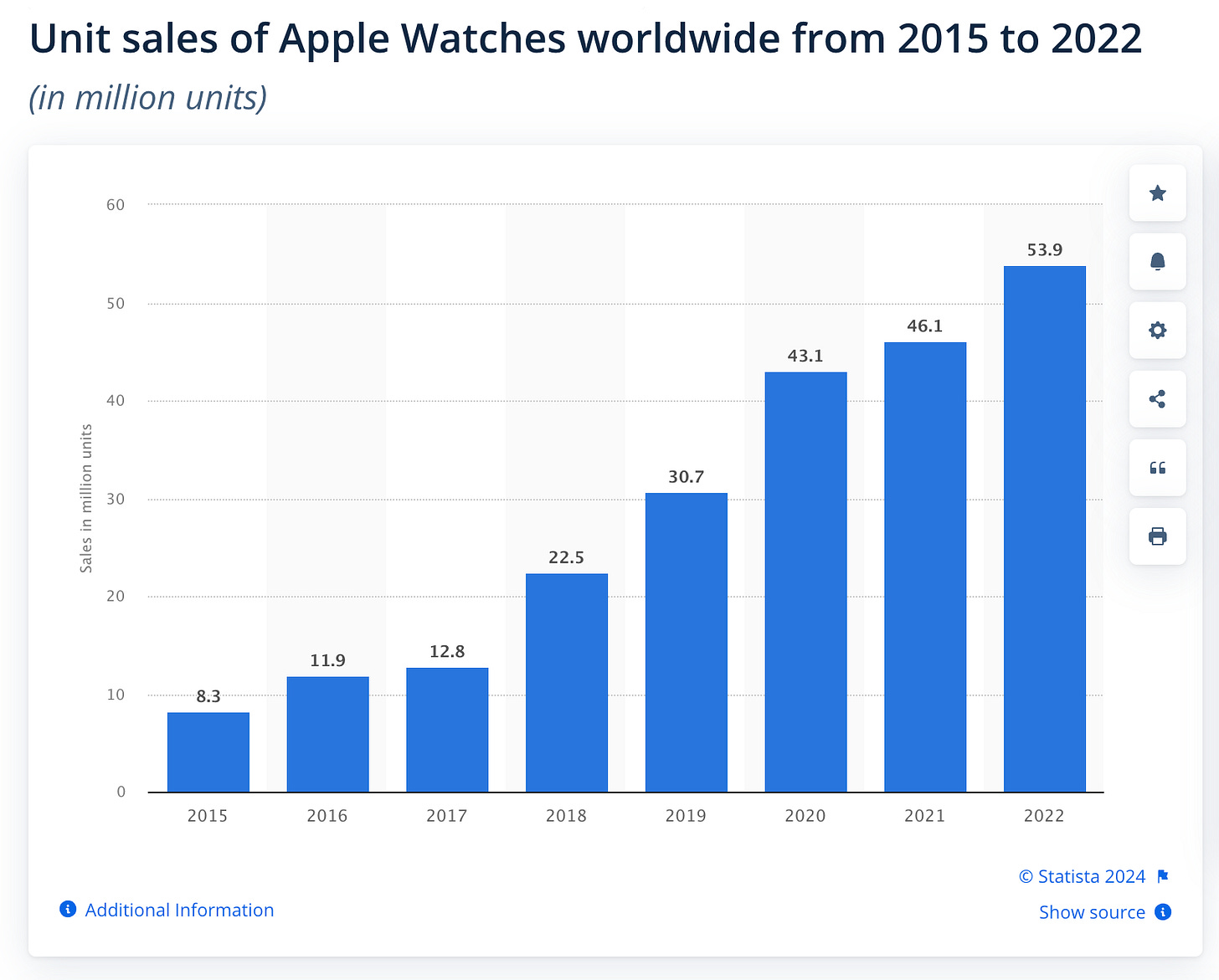

The Apple Watch had a slow start until its killer use case emerged: health. It’s now the leading hardware for personal health, and Apple is building an entire operating system around health, centered around the watch.

People now have more health-related data than ever, and I expect we’ll soon begin to share that data. How long until an app allows you to show your friends how much you slept, how many calories you consumed, what your resting heart rate is? People love tracking their friends on Find My Friends, which has quietly become the social app of the moment. I expect they’ll love to passively observe friends’ health data too.

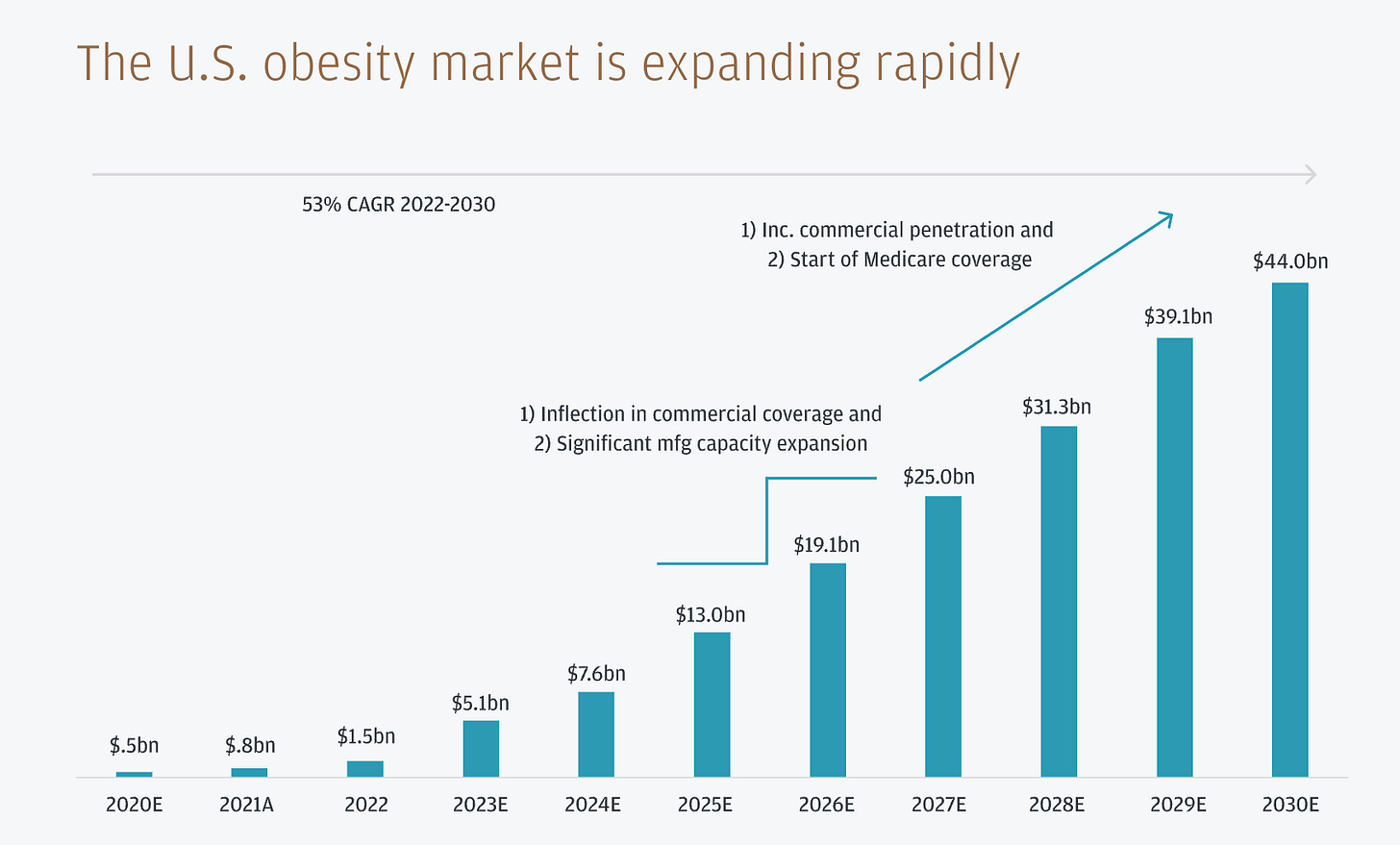

A big tailwind in Health is the rise of GLP-1 agonists like Ozempic and Wegovy. Ozempic is the name of the drug used to treat type 2 diabetes that also has weight loss effects; Wegovy is the name of the drug specifically prescribed for weight management. The Economist estimates that by 2031, the market for GLP-1 drugs will be over $150B. For perspective, that’s on par with the market size for all the drugs used to treat cancer ($185B in 2021).

Here’s a more specific view at obesity specifically, within the United States:

Companies like Nourish and Ro are powering widespread access to GLP-1s. The big winner, of course, is Novo Nordisk, which makes Ozempic and Wegovy. The Danish company briefly overtook LVMH as Europe’s most valuable company last fall, and currently sits at a $411B market cap.

Given that 40% of the world’s population is overweight or obese, there’s a lot of room for growth here. A recent KFF poll found that nearly half of adults (45%) say they would be interested in taking a safe and effective prescription weight loss drug. For perspective, Humira is the bestselling prescription drug of all time and is administered to 300,000 Americans each year (less than 1% of the population).

The market will swell if insurers reimburse the cost, which seems likely:

A 5% reduction in weight can cut an obese person’s medical costs by $2,000 per year

A full transition from obesity to healthy weight saves nearly $30,000 in annual medical costs

Depression rates among obese children are double those of average-weight kids

Of course, GLP-1s are partly aesthetic; weight loss is intimately tied to looks. But GLP-1s are also health-related, helping solving America’s growing obesity epidemic.

The downstream effects of GLP-1s are interesting to contemplate. Snack food companies are already bracing for a hit, and Walmart is reorienting its SKUs across product categories to reflect use of GLP-1 agonists. One interesting ripple effect: it’s estimated that United Airlines would save $80M a year in fuel costs if its customers lost an average of 10 pounds.

Another aftereffect: new studies have found that GLP-1s drive muscle loss, prompting increased demand for drugs and supplements that prevent muscle loss. This ties into Performance above; the rise of GLP-1s could further fuel performance-related products.

Final Thoughts

There are a few groups willing to spend on health: insurers; employers; and consumers. Each group will see increased spend this decade.

Part of rising spend is driven by other tailwinds—our aging population, for instance. But part is driven by people paying more attention to health. Gen Z is eschewing alcohol, with strong interests in ketamine, in MDMA, in psilocybin. (Each substance has a popular episode on Huberman’s podcast.) People are all of a sudden talking about gut health. Everything from sleep-tracking to vitamins to mental health is in vogue.

Companies in the “Health” bucket are most likely to leverage employers and payers. Amazon scooped up One Medical last year for $3.9B. As of its last filings, One Medical didn’t break out its 800,000 paying members into consumer vs. enterprise (the two are annoyingly lumped together in the same line item), but I’d venture a guess that enterprise far outweighs consumer. Nowadays, a One Medical subscription seems a routine benefit for many employees. For scale in healthcare, enterprise usually beats consumer.

“Performance” and “Aesthetic” are currently more powered by consumer spend than B2B. This will be a challenge. Particularly in performance-related products, I expect companies to saturate their markets and then struggle with unit economics. How many people are willing to shell out $500 for diagnostics and coaching? There are too many startups popping up in the space, and most will fail. But some may become enduring health businesses, and I suspect that the ones that survive will ultimately find savvy ways to go B2B2C through employers and payers. That’s the most lucrative and sustainable path in health.

Related Digital Native Pieces

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: