Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 60,000 weekly readers by subscribing here:

AI Is a Services Revolution

One funny thing about Large Language Models: they’re really good at, well…language.

LLMs work by digesting huge amounts of text, synthesizing that text, and then generating an output from the input. Naturally, we need language to power LLMs, and language happens to be the lifeblood of services industries.

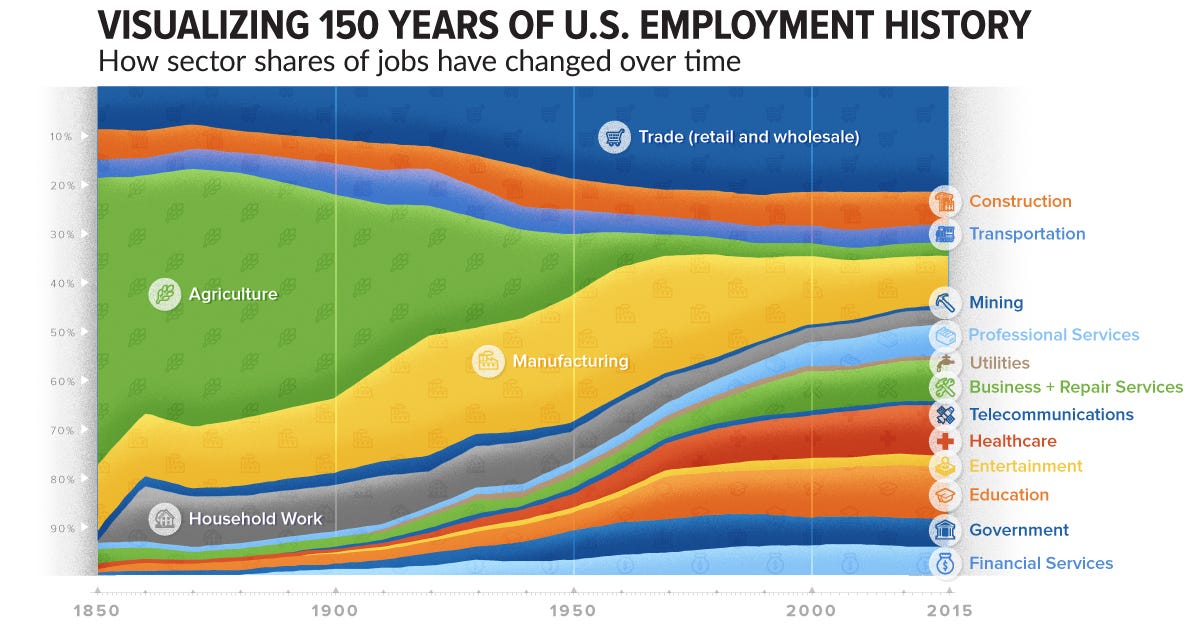

Over time, America’s economy has shifted from an agriculture economy, to a manufacturing economy, to a services economy. Check out the industries that have swelled over the past 50 years:

Healthcare. Education. Financial Services. Business Services. Professional Services.

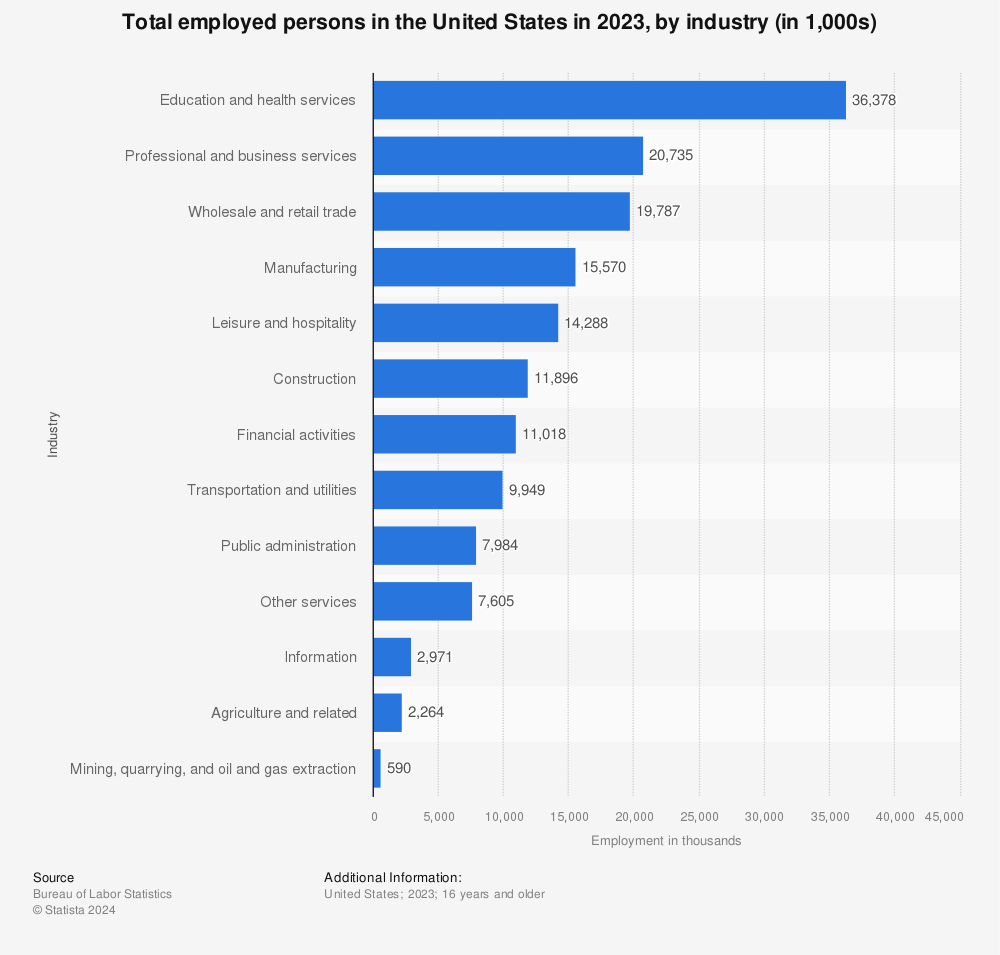

Here’s U.S. employment broken into major categories by Bureau of Labor Statistics data:

Personally, I think the categories here are a little too broad (lumping together Education and Health? come on…) but this gives another window into how services are dominating 21st Century work.

In the 1950s, fewer Americans were working on farms and more were working in factories. In the 2020s, fewer Americans are working in factories, and more of us are sitting in ergonomic desk chairs, hunched over a keyboard. Of course, services also encompass physical labor, but many services industries (particularly the higher-paying) are desk-centric knowledge work.

And it’s this type of work that’s ripe for reinvention by AI.

Spring 2023’s Will AI Come For Our Jobs? looked at the threat of AI automation. That piece cited Goldman’s March 2023 research on which jobs are most exposed to automation. Here’s a chart of the industries that Goldman expects to be most-impacted:

Administrative office work, legal work, and architecture & engineering lead the way. For comparison, here’s the extent of automation Goldman expects across industries:

If you work in maintenance, repair, or construction, you’re pretty safe. If you work in admin or legal, you’re exposure to full replacement is ~40%. Most jobs will be somewhat automated—these are the light-blue bars.

The Industrial Revolution came for farmer’s jobs (and some factory jobs). The AI Revolution is coming for desk workers.

Yet this disruption will take time. From that spring 2023 piece:

I don’t expect many jobs to be replaced in the near future. Historically, organizations are slow to adopt new technology. They’re skittish and they’re bureaucratic. I see AI acting as a companion rather than a replacement, at least for a few years. Most paralegals can probably breathe a sigh of relief in the short-term; in fact, their jobs might become easier, with the benefit of a powerful sidekick to make work faster and less monotonous.

This is playing out. As Benedict Evans recently put it: “The typical enterprise IT sales cycle is longer than the time since Chat GPT3.5 was launched, and Morgan Stanley’s latest CIO survey says that 30% of big company CIOs don’t expect to deploy anything before 2026.” Evans cites a Bain survey on enterprise LLM adoption. Bain’s survey distinguishes between pilots/experiments and deployments, which is a helpful distinction. It turns out that most enterprises are heavy on the former and light on the latter. Lots of trials, not much drastic reinvention:

Enterprises are also learning that LLM capabilities vary across use cases. Based on the chart below, it looks like over time, executives are increasingly impressed by AI-powered sales and software development, while a bit underwhelmed by legal, HR, and operations use cases.

In fact, a meme is emerging that the biggest winners of the AI boom are, ironically, consultants. (The exact kind of services job that’s supposed to be disrupted!) Here’s a headline from April:

This comes from Accenture’s quarterly earnings report, which announced $600M in new bookings for “generative AI work” for clients ($2.4B annualized). For comparison, OpenAI’s annualized revenue was about $3.4B as of June.

BCG, for its part, says it expects 20% of its revenue this year to come from helping big companies figure out a gen-AI strategy.

This trend will continue, and it speaks to how concerned incumbents are about AI. (Rightfully so: The Innovator’s Dilemma was written about moments like this.)

The point is: AI disruption is happening, but slowly. It may seem like the race is over, as we see copilots emerge for every industry under the sun. But it’ll take time for the true winners to emerge, and for metrics to catch up to the hype.

I still think the formula for a compelling AI startup goes something like this:

Pick a large, text-heavy services industry (choose from the charts above!).

Use LLMs to automate workflows and augment workers.

Leverage industry-specific data to fine-tune the model over time, improving the product in tandem. Specialization = your edge.

We’re seeing innovation across various services industries. Some examples…

Law

Harvey is the best-known example here—its product helps with contract analysis, due diligence, litigation, and regulatory compliance—but there are a lot of legal co-pilots that have popped up. Some are broad, and some are more specialized (EvenUp, for instance, focuses on personal injury attorneys).

I like how Pat Grady framed the opportunity in his interview at the Cerebral Valley Summit. It’s not that AI is going to make Kirkland & Ellis accessible to everyone, he argues—nor will AI replace the top law firms. Your Kirklands and Lathams will still exist. Rather, AI will expand access to legal services. Your average person can’t afford to shell out hundreds of bucks an hour for an attorney, but that person will now have access to legal expertise.

Health

Healthcare is very text-centric—ask any doctor about the joys of Electronic Medical Records. Startups have used language as the wedge into owning medical data, and thereby the wedge into disrupting healthcare. The most popular wedge I’ve seen for health AI startups: becoming an AI medical scribe, then expanding from there.

We’ve seen well-funded startups like Freed, Ambience, and Deepscribe build here, using patient conversations as the entry-point to becoming the wall-to-wall operating system for healthcare professionals.

Education

Education was the focus of last week’s piece, How AI Will Change Education.

Education is one of the largest services industries out there. We’ll see AI reinvent both the student side (e.g., homework help) and the teacher side (e.g., lesson planning, grading). ChatGPT is, in many ways, the fastest-growing education product in history, and we’re seeing a new cohort of education-specific AI tools pop up.

Investment Banking

Investment banking is a lucrative and archaic segment of professional services. There’s a new crop of banking co-pilots that automate many of the monotonous parts of the job. There are also broader AI products that touch industries like banking: Hebbia, for instance, can supercharge the due diligence process.

Insurance

We think of insurance as a numbers-centric business, but it’s actually a lot of language. Have you ever read an insurance policy? Buckle up and get your reading glasses. As a result, I think insurance is one of the services industries most ripe for AI workflow automation.

Revisiting Seurat and Vertical AI

February’s piece Seurat and the Opportunity in Vertical AI made the argument for a vertical SaaS / AI playbook. It looks something like this:

Identify the most salient pain-point for your customer and solve it.

Use that wedge to win over customers.

Layer in more products over time—cross-sell and up-sell, improving customer lifetime value and becoming more defensible.

The analogy here was a Seurat painting. Seurat is famous for creating the painting technique known as pointillism. He’s probably most famous for his 1884 work A Sunday on La Grande Jatte—if you’ve seen Ferris Bueller’s Day Off, you’ll remember the painting (it’s still on display in the Art Institute of Chicago today). Up close, a Seurat painting doesn’t resemble much; it’s just a series of dots.

At first glance, vertical SaaS and AI don’t look like much. They often resemble a feature, not a valuable business.

Toast’s first product was a cloud-based point-of-sale system for restaurants. It seemed niche. But over time, Toast layered in over a dozen products: inventory management, lending, payroll, marketing, digital ordering, delivery. According to Barron’s, 62% of Toast customers use 4 or more of its 15+ products.

All of a sudden, zooming out, the company is a one-stop-shop for everything a restaurant needs to operate. It no longer seems niche. Same for a Seurat: zooming out reveals a rich, expansive work.

A vertical SaaS company might start out looking like a feature—a single dot of paint—but over time it becomes a constellation of products with a strong moat. To use another example: Shopify started by letting a merchant build a website with a shopping cart integration. Now, Shopify’s list of products on its website runs 10 pages long (!). The company has also become a platform with its own robust third-party app ecosystem.

We can combine the Seurat playbook with the playbook from earlier—choose a services industry, and identity the most salient pain-point that can be automated with AI. It might be the most mundane workflow, the most time-intensive, the most expensive. Say it’s contract negotiation in law, or lesson planning in education, or entering patient notes in healthcare.

Founders who have direct industry experience have an advantage here. They get what parts of the job are the worst, what parts humans most want automated. After identifying that initial wedge product, founders can execute the rest of the playbook: expand to adjacent products, improve the product with more specialization and better data over time, and so on.

Final Thoughts: The Race Isn’t Won

It might seem like all the AI co-pilots and agents exist. For nearly every industry, there are now dozens of players. Harvey, the best-known startup in the legal AI space, announced yesterday that it’s raised another $100M at a $1.5B valuation. Is this price warranted? Maybe—but Harvey is (very) early days, and this kind of round speaks to the hype right now in AI. It’ll be years before we see whether Harvey is an enduring, defensible, $5B+ business. The race isn’t even close to being over.

We’re still early, and there are still many, many opportunities. The right combination of industry insight + product/engineering chops can catch up and surpass early movers.

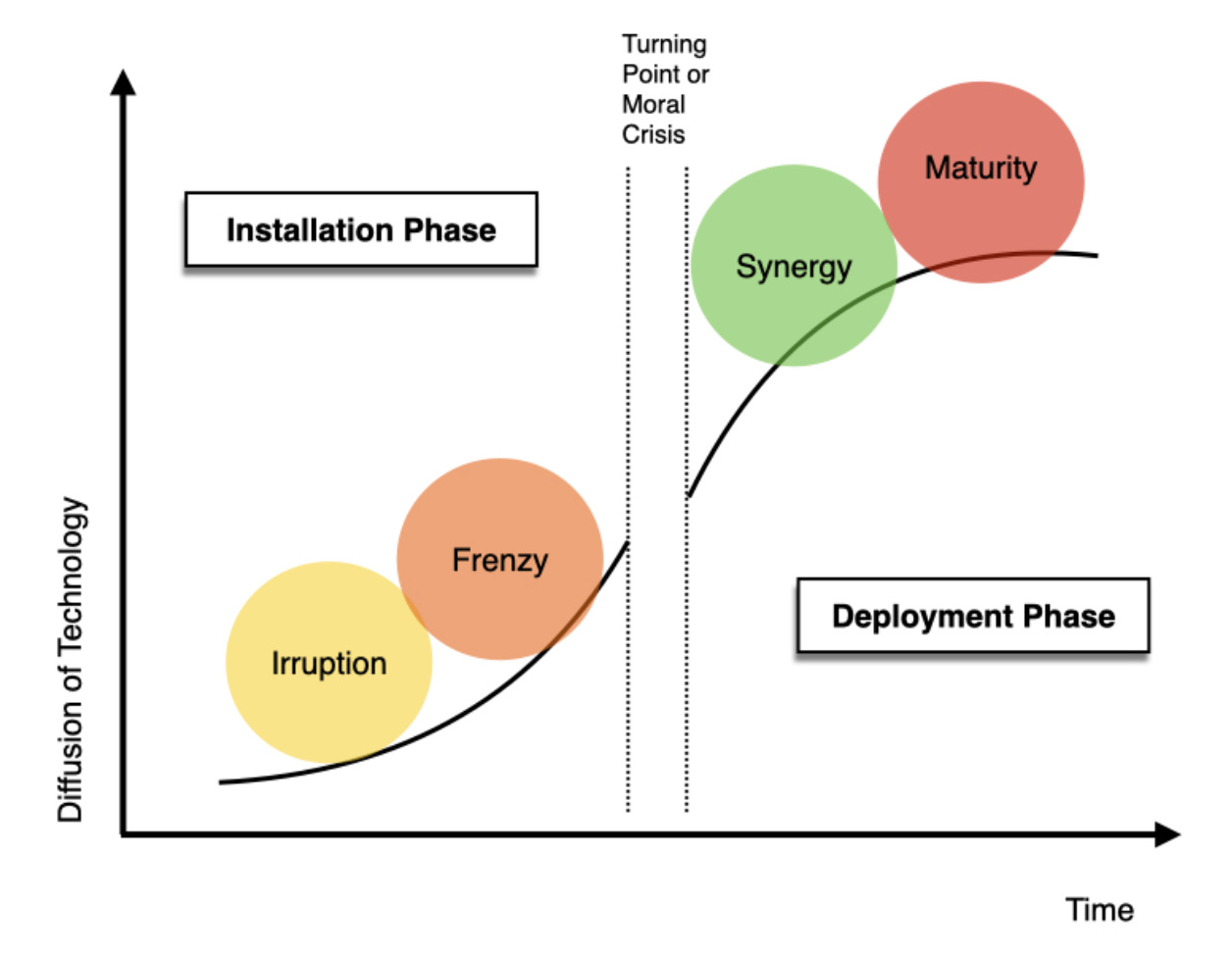

Last year’s The Mobile Revolution and the AI Revolution looked at Carlota Perez’s framework for technology cycles. Historically, technology cycles have lasted about 50 years. The AI cycle probably began in 2017 with the publication of the seminal paper Attention Is All You Need in 2017, which introduced the transformer model (though I think we’ll look back at ChatGPT as the true catalyzing moment).

This means that we’re still in the Irruption Phase:

This is the time when early products emerge and we see fast innovation—but early movers aren’t always the ones that win the race. Look back at the dotcom bubble and how many “sure things” evaporated. Even 5+ years into its existence, Amazon still looked like a distant second to Ebay. Today, Amazon is worth $2T and Ebay is worth $26B, a 74x (!) multiple.

It will be years before we fully grasp how LLMs should best automate workflows and augment workers. The jury’s still out on the right interface. Plus, how much human involvement should there be? (This goes back to The Egg Theory of AI Agents.)

The Industrial Revolution reinvented manufacturing labor, and the AI Revolution will reinvent services labor—the high-paying knowledge work. Every industry that’s language-centric (read: basically every industry under the sun) is ripe for disruption. The race is just beginning.

Related Digital Native Pieces:

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: