The Five Pillars of Startup Impact

How Startups Can Innovate Our Way Out of America's Crises

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 50,000+ weekly readers by subscribing here:

The Five Pillars of Startup Impact

One statistic that captures the challenges facing America:

Of Americans born in 1940, 92% went on to earn more than their parents; among those born in 1980, just 50% did.

A number of factors contributed to this shift. The New Deal era came to an end in the 70s and Ronald Reagan took office with the promise to pare back government. He cut taxes and deregulated business. In his 1981 inaugural address, Reagan famously declared: “Government is not the solution to our problem. Government is the problem.” Soon enough that sentiment was cross-party, with Bill Clinton echoing Reagan in his 1996 State of the Union: “The era of big government is over.”

Alongside Reagan’s rise, the economist Milton Friedman introduced the notion of “shareholder primacy”—put simply, the idea that “the business of business is business.” In Friedman’s exact words: “The social responsibility of a company is to make profits.” Known as Friedman’s Doctrine, the concept of maximizing shareholder value infiltrated American capitalism. In the 50 years since, it’s had a stranglehold on us.

There’s a good piece by Rogé Karma in The Atlantic this week that digs deeper into how free market economics drove income inequality in America. It’s sobering. What’s most alarming to me is how the American dream has become more difficult to achieve despite massive technological innovation. We have supercomputers in our pockets, the world’s information at our fingertips, and we can get virtually anything delivered to our doorsteps in two days. Yet for many, quality of life is declining.

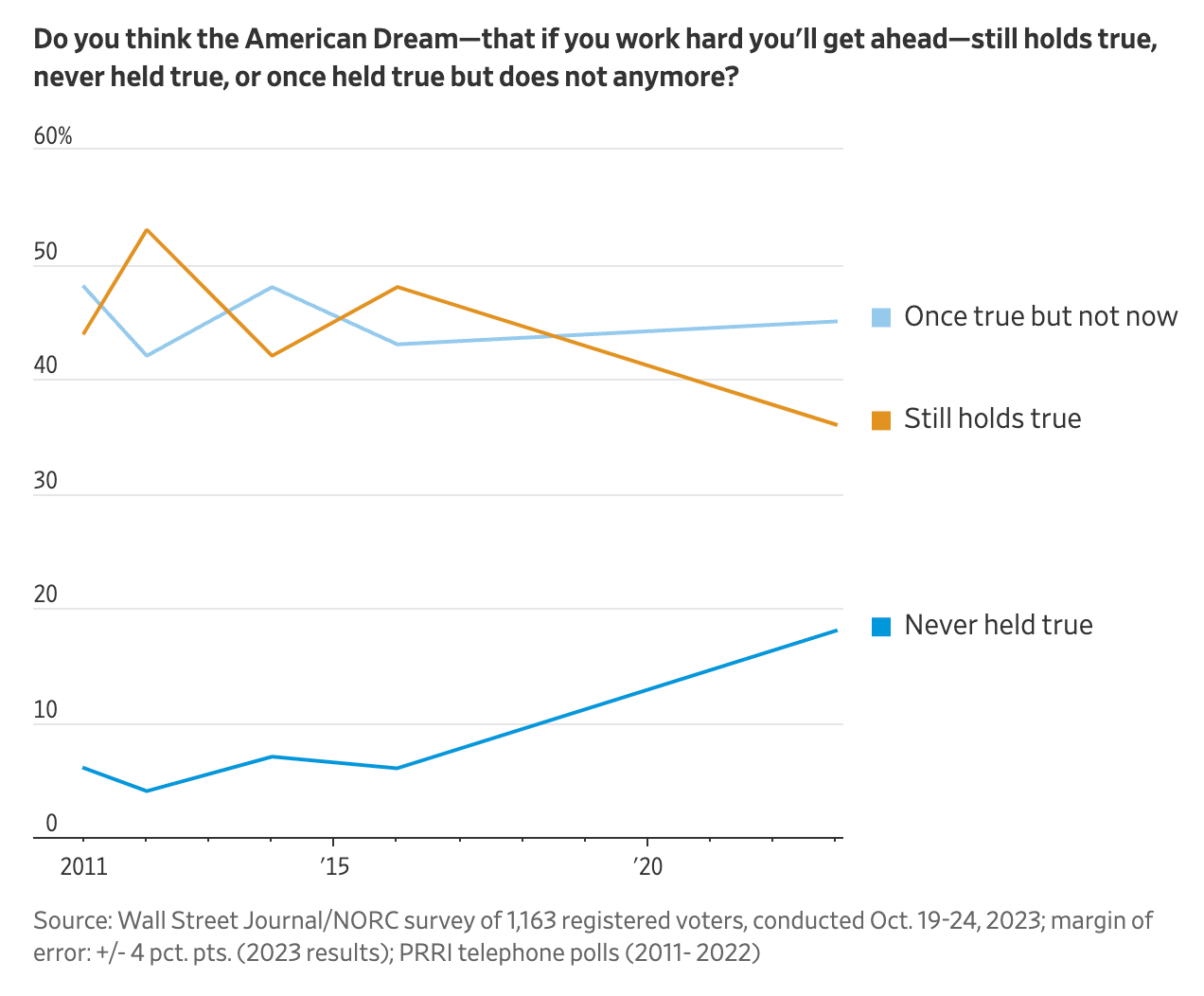

A new WSJ survey found that just 36% of voters believe the American dream—work hard and you’ll get ahead—remains a reality. Ten years ago, that figure was 53%. A growing share believe that it never held true.

Americans are jaded. Among Gen Z, this shows up as nihilism. We see flavors in the quiet quitting phenomenon, the nepo baby backlash, and even the gallows humor of the 💀 replacing the 😂 emoji to connote laughter. (We’re apparently on to 😭, but still.)

In 2018 I read the book Factfulness, which makes the argument that despite what the media tells us, life is actually getting better. The book is rooted in optimism, which I love, and it’s a worthwhile read. But much of the improvement it cites is global in nature—people being lifted from poverty in Asia, Africa, and Latin America. The U.S. isn’t faring as well. A child born today in London or Oslo has a better chance of out-earning than parents than a child born in America.

How does this trickle into the startup ecosystem?

Startups are a lot of work. Many of the best founders and operators I know work constantly; their work is their calling. For people who join startups, it’s a lot easier to put in that work when you believe in the mission. As a result, young talent is flocking to mission-driven startups.

One rule-of-thumb in startups (and life): always follow the talent. And talent is migrating to “impactful” companies. In the words of one early-20s worker I spoke to: “If I’m gonna be a part of capitalism—and I don’t really have a choice—I might as well work for a company that I feel good working for.” Recently, I sat on a plane next to a woman who told me she works for a B2B SaaS company—“You know, making the world better one CRM at a time,” she joked darkly.

People want to work for companies with missions they believe in. The companies that attract the best talent this decade will be those that make life tangibly better for people. At Daybreak, we think about five core pillars of impact:

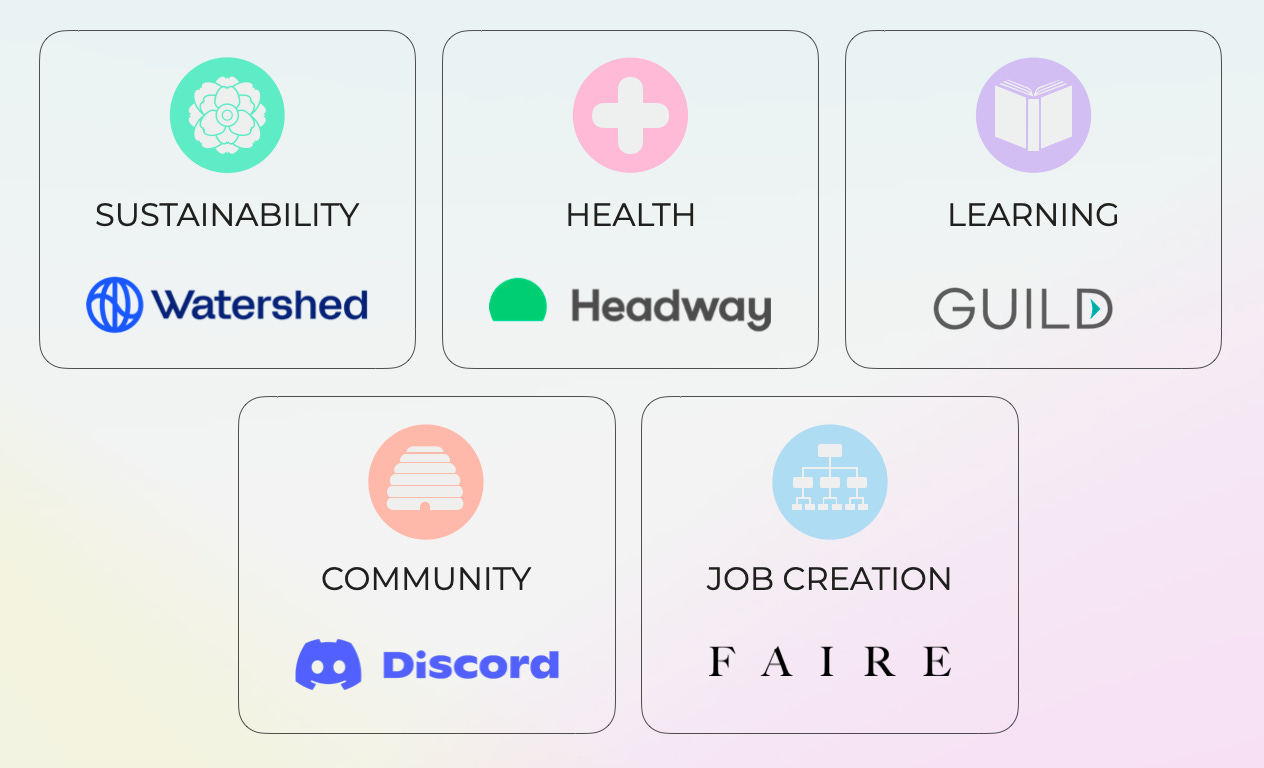

Startups born in the mid- to late-2010s—now growth-stage—innovated in these categories and as a result attracted top 1% talent.

To take an example in each:

Watershed helps enterprises measure, reduce, and report emissions; it’s hard to think of a more pressing mission. Headway makes mental health more accessible through its marketplace and its SaaS tools for therapists, right in the midst of a national mental health crisis. Guild uses a clever business model to reskill workers at customers like Walmart, Taco Bell, and Target: “education as a benefit” which reduces costly worker churn, thereby saving companies money. Discord has 19M living, breathing weekly active servers, each a vibrant community. And Faire acts as the central nervous system for independent retailers and brands, the backbone of small-business commerce.

Each of these companies were founded in the 2015-2019 years. Post-pandemic, workers place an even higher emphasis on joining a mission-driven company. Everywhere you look there are crises—in cost of healthcare, in access to education, in loneliness. More on those later.

We’ve made five investments so far in Daybreak Fund I, one in each pillar:

Sustainability: Platform for secondhand commerce and the circular economy

Health: Marketplace for teen mental health

Learning: Social network and financial tools for financial education and investing

Community: AI application for companionship

Job Creation: Infrastructure for launching a boutique online storefront

This week’s piece offers a look at each of the five pillars, exploring what tectonic shifts create startup opportunities and which businesses I’d love to see built.

Let’s dive in 👇

Sustainability

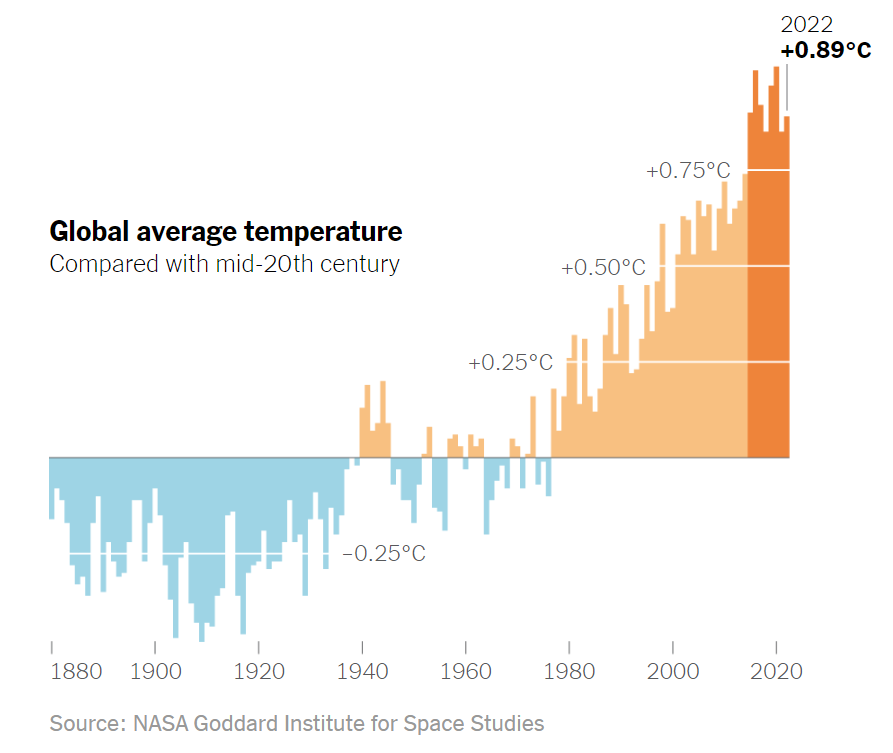

Typically when I share an exponential chart in Digital Native, it’s a good thing. Moore’s Law, for instance, or LLM model size. Up-and-to-the-right.

A less-positive chart is that of annual CO2 emissions:

In the chart below we see that the U.S. is responsible for a large portion of emissions, but that the growth of Asia in the last 50 years has driven most of the increase.

Temperature anomalies are now, well, hardly anomalous. August was the hottest August in recorded history. September was the hottest September in recorded history (and the hottest month period in 174 years of records). October, not to be outdone, was—you guessed it—the hottest October in history. 🤦🏼♂️

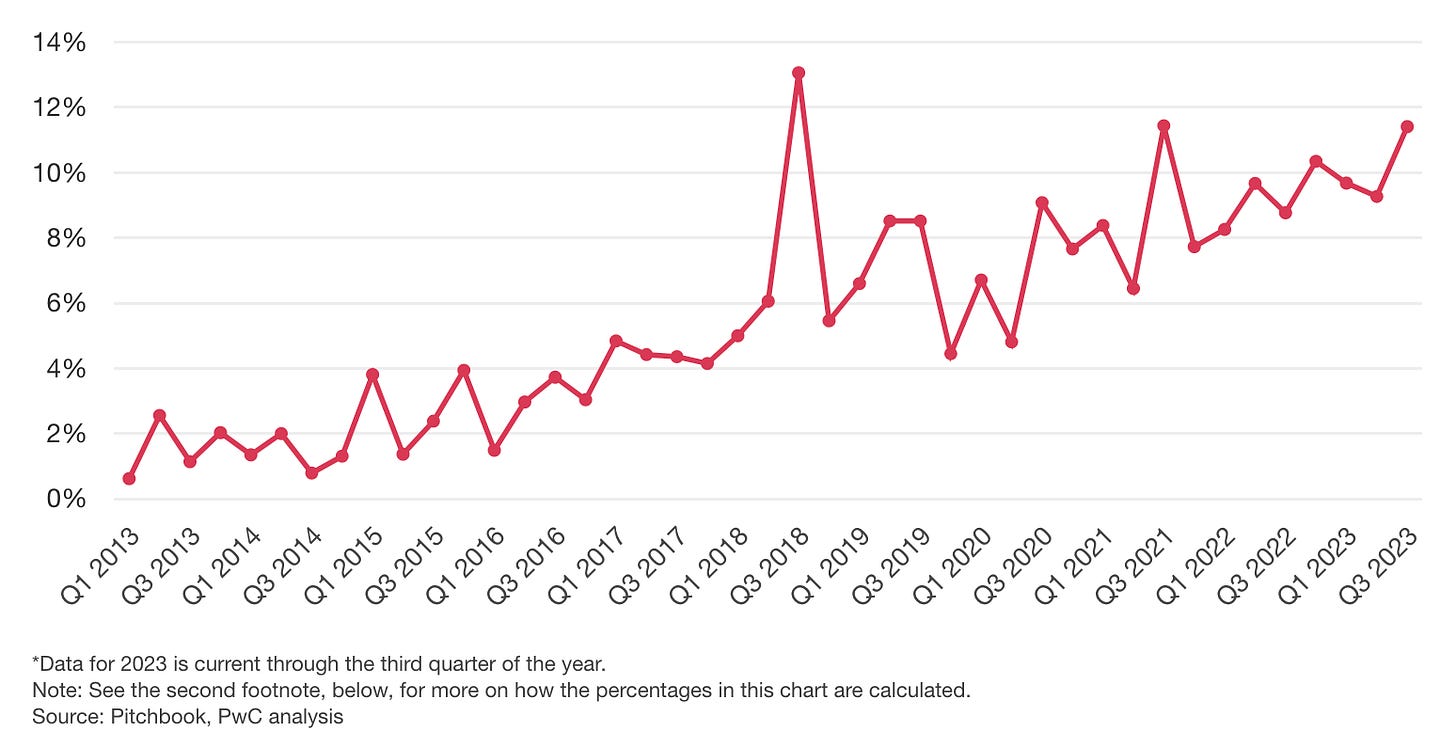

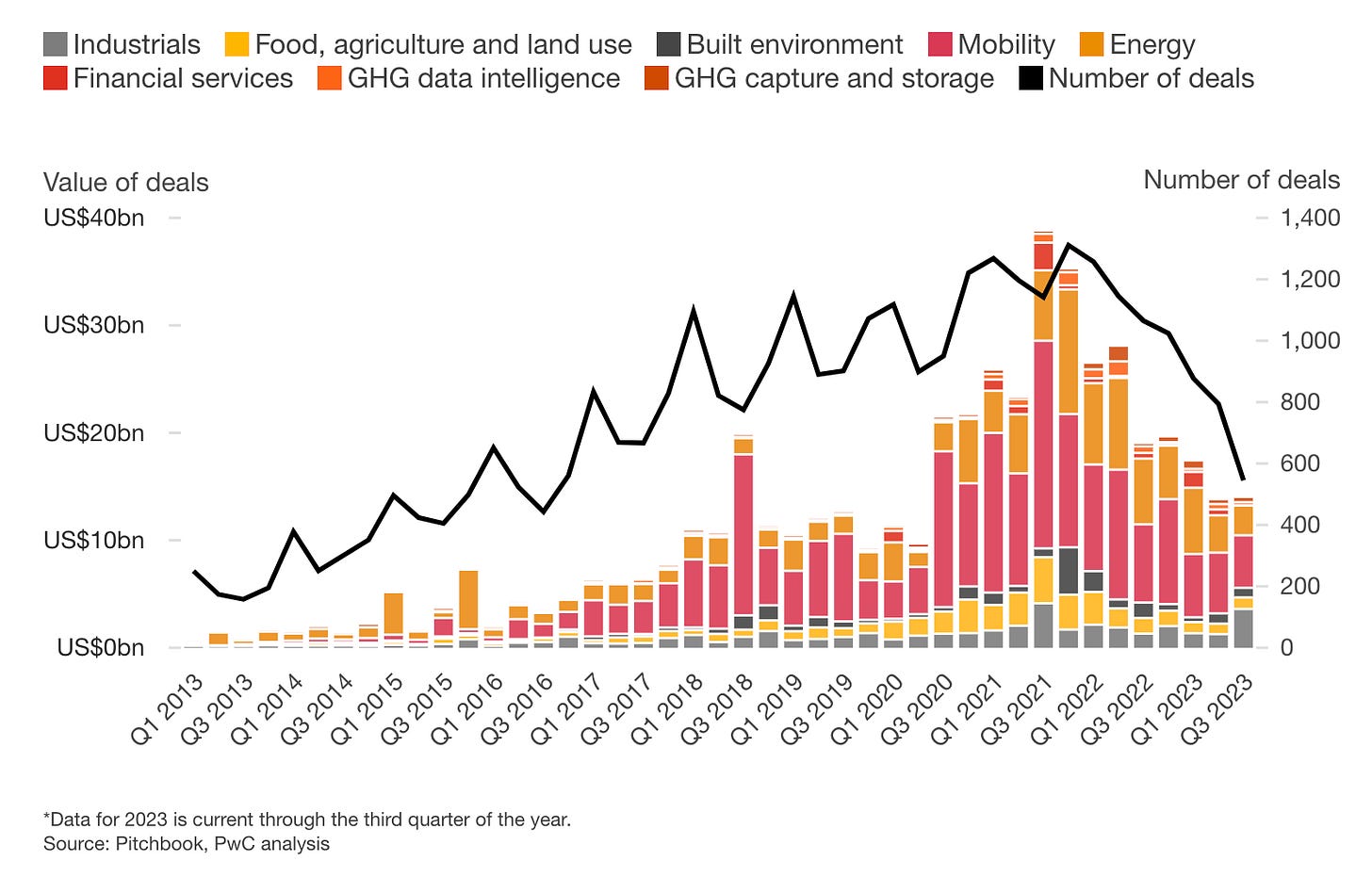

The good news is that venture funding is flowing into climate. Here’s PitchBook data for climate tech funding as a portion of all VC funding—there’s a nice up-and-to-the-right trend-line here. Hopefully we can innovate ourselves out of this mess.

Funding is actually down in 2023, below the torrid pace of 2021 and 2022, but hopefully will pick back up with the broader market.

And venture funding remains somewhat mismatched from the largest contributors to climate change. We get a lot of mobility and energy startups, but not as many in industrials or food & ag.

“Sustainability” is more holistic than “Climate.” We need more core climate tech yes—and I continue to think nuclear will be our deus ex machina—but we also need climate-adjacent innovations. Resale is one example: resale is growing 11x faster than broader retail, and the circularity of secondhand commerce helps lessen fashion’s environmental footprint (10% of global emissions). I wrote about this in last month’s The Resale Revolution.

Another area I’ve been spending time in: excess inventory. Brands overproduce $500B of goods annually. Talk to any brand, and one of their top three hair-on-fire problems is getting rid of excess inventory and making sure it doesn’t go into a landfill.

Ghost is doing interesting things on the B2B side, and consumer-facing companies like YaySay help off-price goods find a new home (sort of like an online TJ Maxx). But we’re only on the cusp of solving the problem, and I think several large businesses will be built to “clean up” brand’s acts and match surplus goods to the right (non-landfill) destinations.

Health

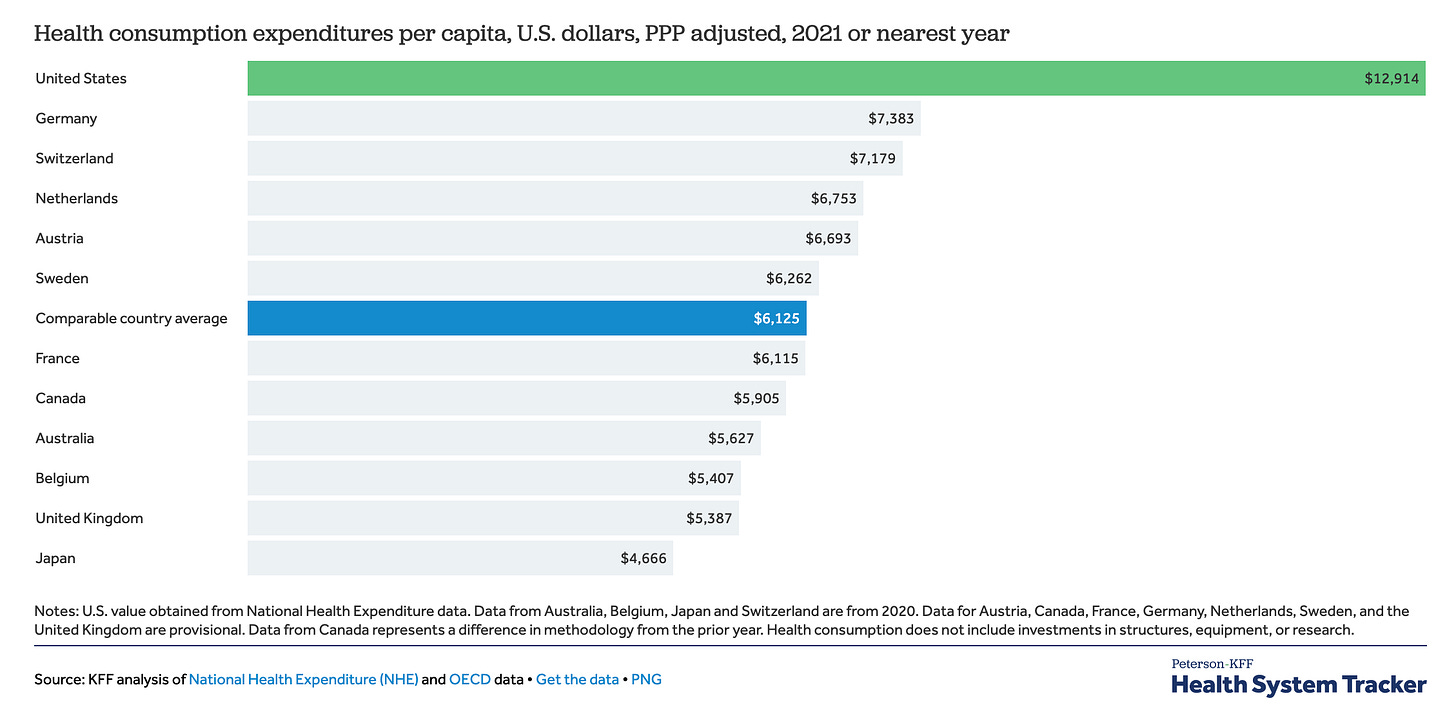

The U.S. spends $12,914 per capita on health consumption expenditures—about double the per capita spend of most wealthy nations.

Healthcare is about 20% of GDP, compared to about 12% for comparable countries.

Yet we’re not getting much for that spend:

When it comes to startup opportunities in healthcare, there are many. I’m broadly interested in the consumerization of health—healthcare products and services becoming more elegant, well-designed, even delightful. We’ve seen this over the past decade with One Medical, Livongo, Ro, and many more. And we’re on the cusp of every aspect of care becoming better. Strong consumer proof-points can then be leveraged into lucrative employer and payor contracts.

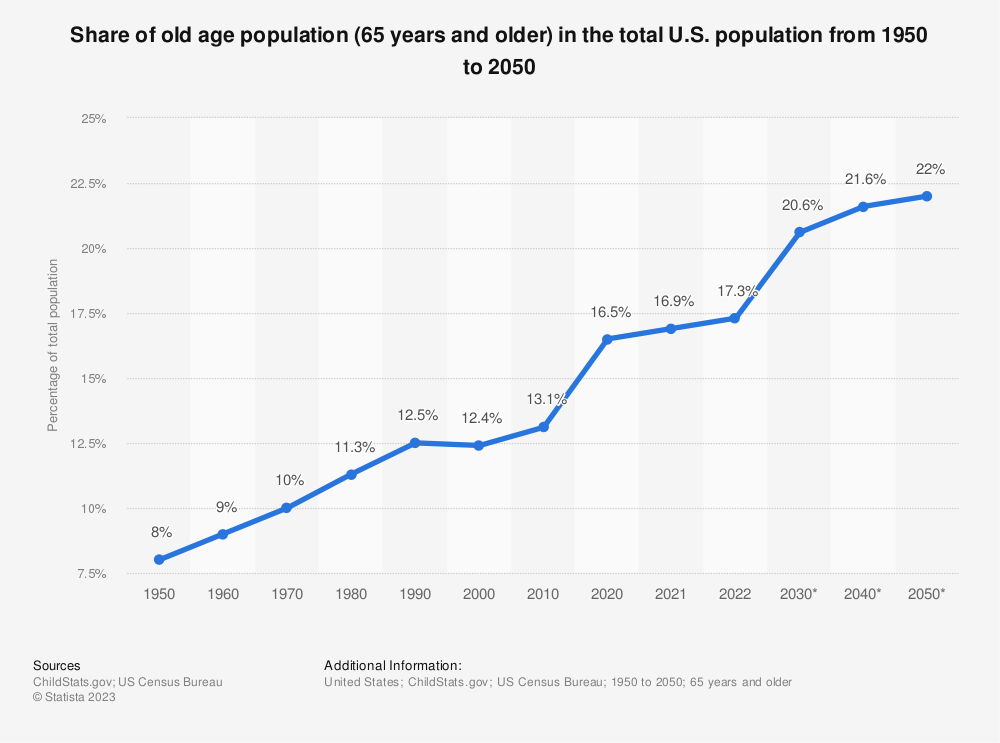

One area that I think a lot about: our aging population. Every day, 10,000 Americans turn 65. How do we care for them?

Looking at the fastest-growing fields for the 2020s decade, we see a sea of healthcare jobs—all the blue circles here. The #1 field is home health and personal care aides—people to care for that aging population.

I’d love to see a number of businesses serve aging Boomers: we need better vertical software for senior homes, sure; we need a way to tether elders to their kids and loved ones (a Brightwheel of the elderly?); we need products to combat the loneliness epidemic among seniors, which ties into Community in the next section.

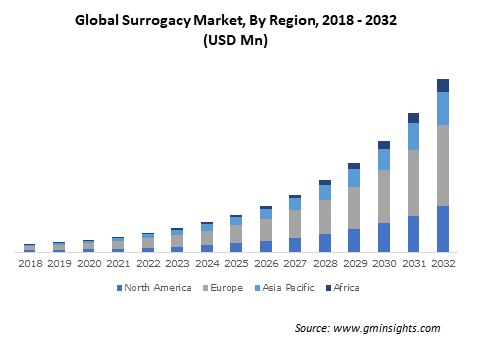

Another space within healthcare that interests me: surrogacy. Surrogacy appeals to me partly because, as a gay man, I’ll likely one day use it; but it also interests me because of its growth and tailwinds. One report from Global Market Insights sizes surrogacy as a $14B market today, swelling to $130B in 2032 (a 25% CAGR). Here’s the chart from the report, unhelpfully without a y-axis:

Surrogacy has everything you wouldn’t want in an investment: a possible one-off transaction, with few repeat transactions; lots of (emotional) humans involved in every step of the process; potential ethical issues and a lingering stigma; multiple and unpredictable decision-makers. And yet, the market is large and ripe for the taking. Someone will figure out a better marketplace + vertical SaaS offering to deliver a 10x product.

One fun healthcare category to end on: longevity. This week, the startup Loyal got a lot of press as it announced that it’s one step closer to FDA approval. The FDA has never approved a longevity drug. Loyal comes with a twist: the startup makes a longevity drug…for your dog.

Loyal’s vision is to first extend our beloved pets’ lives (and Americans spend $140B on their pets each year, +11% year-over-year), before ultimately producing drugs for human longevity.

Learning

ChatGPT is, in many ways, an education company. In some ways, it’s the fastest-growing education product in history—a poll over the summer found that 63% of teachers and 43% of students use ChatGPT. When ChatGPT usage dipped in the summer months, a lot of people pointed to kids being out of school as the reason why.

I’d argue that YouTube has been the most transformative education company of the last 10 years. (TikTok is closing in, though.) ChatGPT is poised to be the most transformative of the next 10. Yes, both products are used for entertainment and various other use cases, but they also make education more accessible and vastly more affordable.

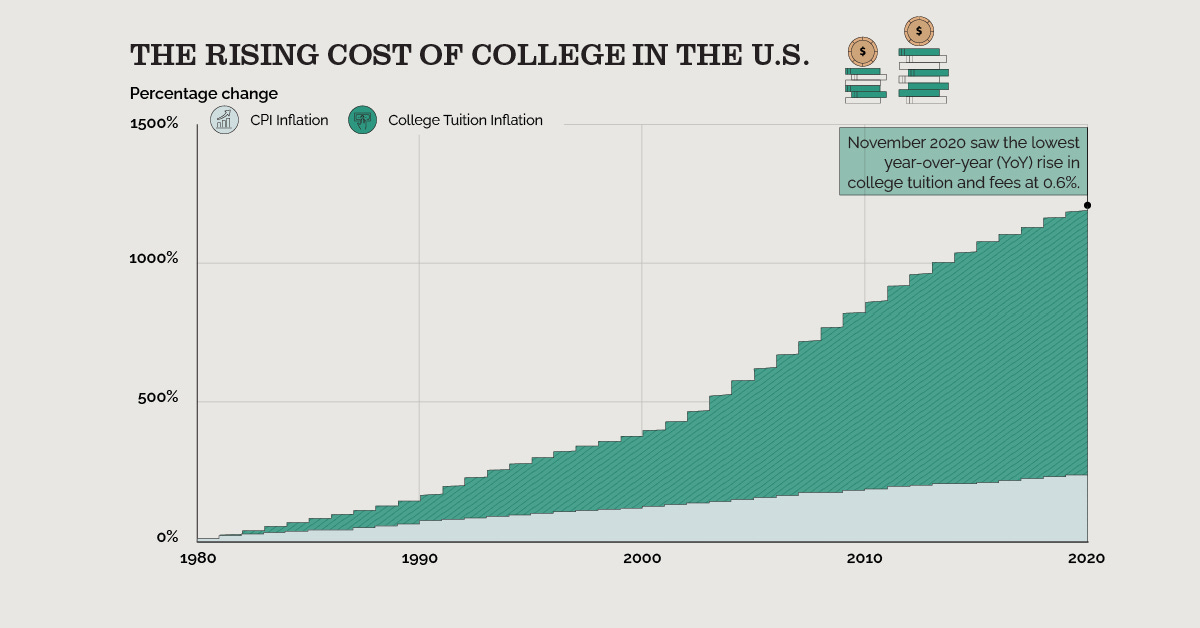

That affordability comes at a critical time, as college becomes financial untenable for many. CNBC reported this week that 1 in 3 Gen Zs can’t afford to go home for the holidays because of student loan payments.

Last spring’s piece From Chalkboards to Chatbots: Our Long-Awaited Education Revolution covered startup innovation in education in depth, but a couple areas continue to interest me.

Workforce Development and Skills-Based Learning

AI Applications for Learning

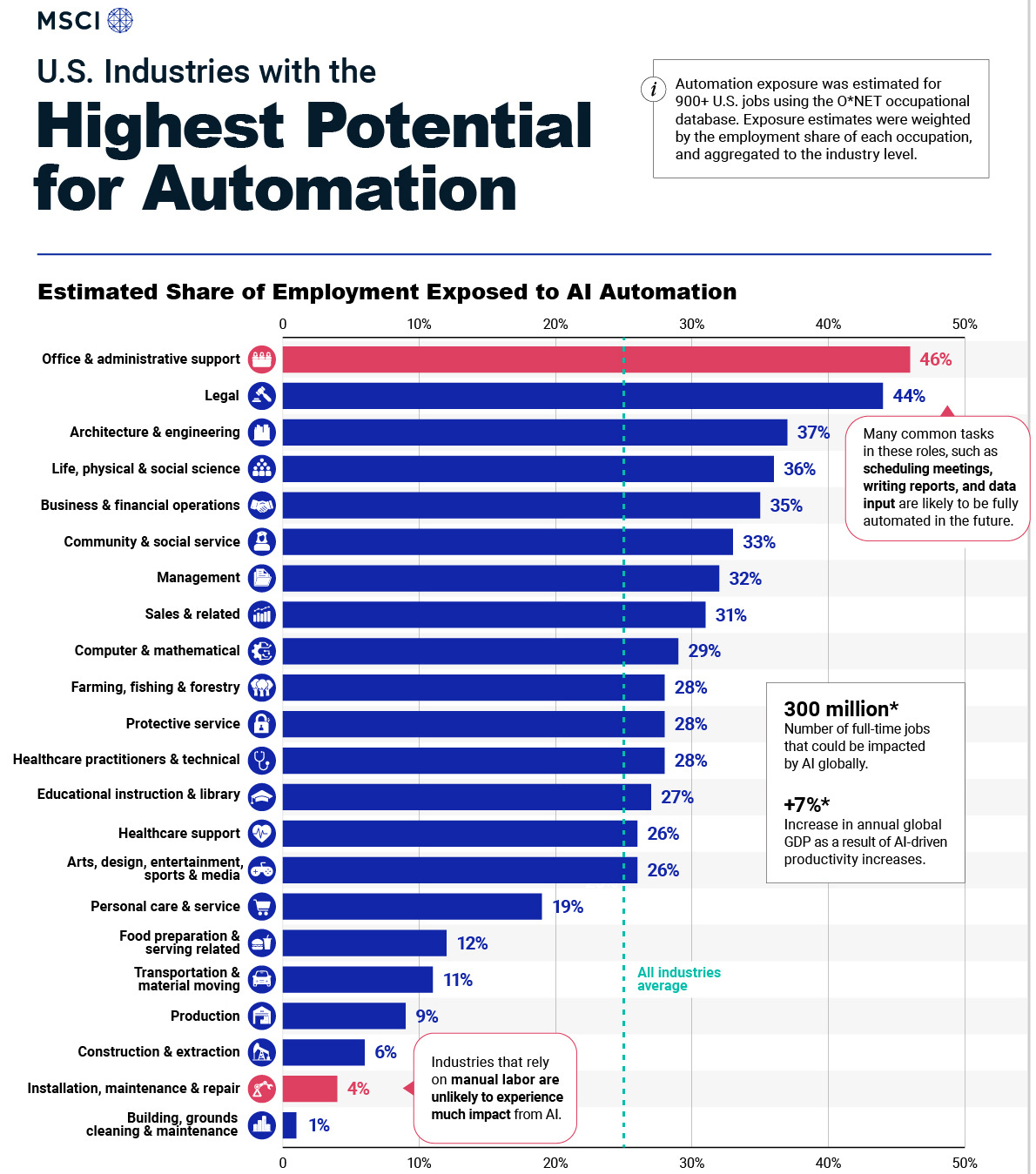

College isn’t the right path for most (hot take 🌶️) and we’ll see a resurgence of vocational programs and enterprise-funded reskilling. An ECMC survey last year found that only 51% of Gen Zs even want to pursue a 4-year college, down from 71% two years ago; 56% would prefer a skills-based education. We’ll see more clever business models like Guild’s to enable this. And reskilling will be especially important in the face of AI automation.

On the AI application front, I’d love to see more tailored use cases for LLMs. Taking on a Chegg, for instance, seems like a no-brainer—Chegg is an $800M revenue business built around homework help, and I’m sure internally the company is scrambling to stay relevant with the pace of AI. Becoming more than just a wrapper on GPT will be tough for a newcomer, but can savvy startups use LLMs to make personalized tutoring affordable and accessible to the masses? I think so.

Community

An interesting headline in the WSJ this week read: People Are Ditching Dating Apps to Find Love on…Duolingo? The article covered a new phenomenon: young people finding love and connection on interest-based platforms: Strava (fitness), Letterboxd (film), Duolingo (language).

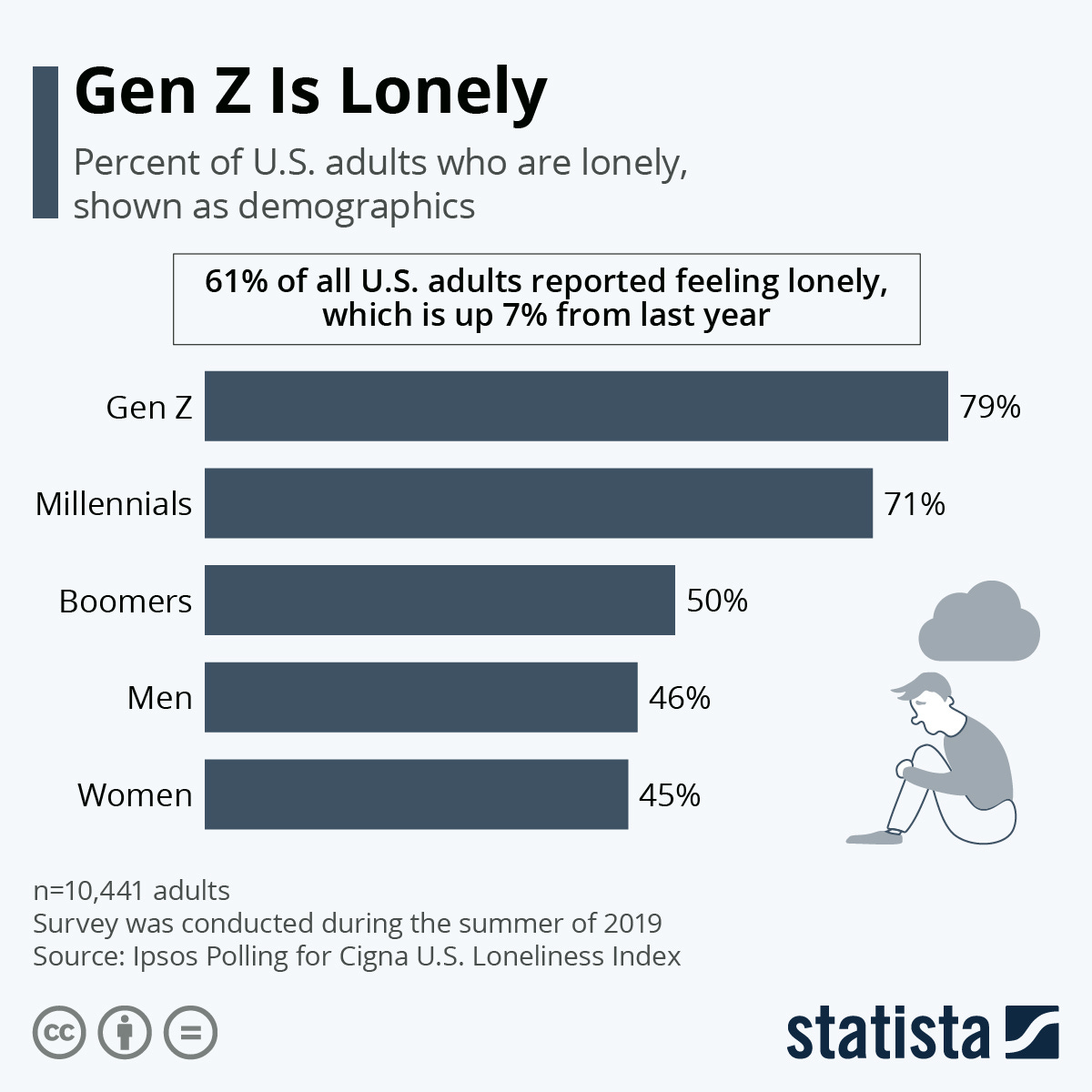

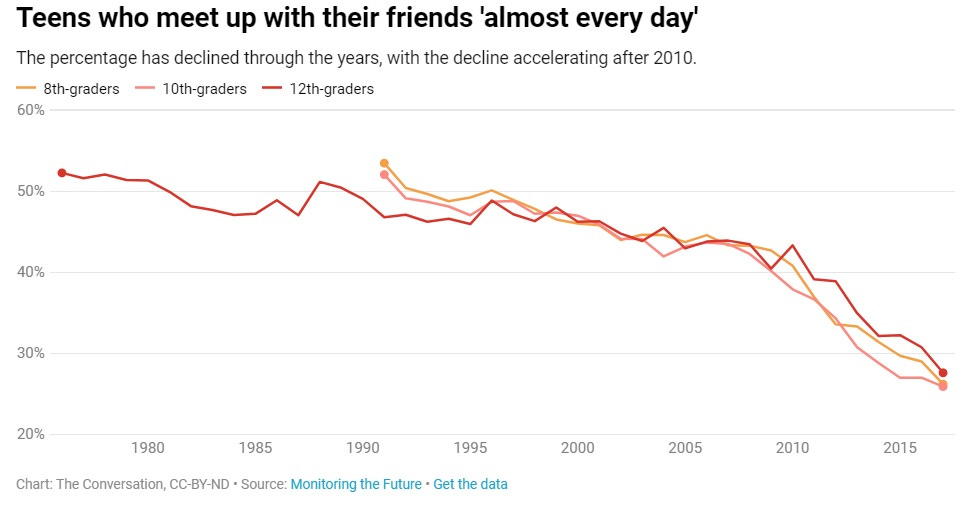

People are lonely; they want more connection. Gen Z in particular is in the midst of a loneliness epidemic.

The internet is both a causal factor—more time online, alone—and a solution, connecting people through newsfeeds and subreddits and FYPs and servers and chatrooms.

America isn’t alone in this. Chinese officials have referred to a “friendship recession” befalling young people. A few years back I wrote about the Chinese app Soul—What China’s Soul Tells Us About the Future of the Social Internet. On Soul, you create a virtual identity with your avatar, then take a personality test inspired by Myers-Briggs. Soul’s algorithm uses your answers to connect you to like-minded people, who you interact with on “Planets,” each built around a shared interest.

Soul has the literal slogan: “May there be no lonely people in the world.”

The app has had success—30 million monthly active users, 80% Chinese Gen Z. I expect we’ll see more interest-focused communities rise in the U.S.

Social is a tough category; it’s incredibly saturated, Big Tech incumbents have powerful network effects, and startups need product velocity to keep user attention. But there are a few opportunities in “Community” I see—

Strava 2.0—more and more people are focused on their health. We wear Oura Rings and we sleep on Eight Sleep mattresses. I think a more holistic health-focused social app for tracking our friends (and flexing our own diets, workouts, and goals, with some good Vanity to boot) would be interesting. Tough to pull off, but not impossible.

Older Americans—returning to the aging population topic, more than one in three seniors (37%) reports feeling a lack of companionship. Is there a way to create social connections between seniors, and between them and their loved ones? Seniors are a tough user to sell into, so maybe the right go-to-market goes through their kids or care providers.

Group therapy and support groups—many conditions are best treated with group therapy, and the unit economics are often more favorable than 1-on-1 therapy. With a decline in community and sense of belonging, this feels like a compelling and much-needed business (especially for the young).

Job Creation

Walmart is the largest private employer in the United States, and the second-largest overall employer after the federal government. Globally, Walmart employs 2.3 million people; in the U.S., it employs 1.6 million (about 1% of America’s total workforce).

Amazon is catching up quickly, with 1.1 million U.S. employees and 1.6 million global employees—already double the 798,000 people employed by Amazon in 2018. (Walmart’s workforce has actually contracted slightly in that time period.) Over the next few years, we’ll likely see Amazon surpass Walmart as America’s largest private employer.

What’s unique about Amazon is that the company provides far more people with a livelihood than the employees captured in its own payroll expense. About 9.5 million sellers earn income on Amazon’s platform.

This gets at a unique property shared by many of the most successful technology companies: they create ecosystems that employ more people than they do themselves. The ecosystem question is one I often ask myself as an investor in startups: if this company is successful—if it really works—can it become a platform for massive job creation?

We see this with Roblox developers, with Etsy merchants, with Cambly tutors, with Whop sellers, with Nourish dietitians. The list goes on.

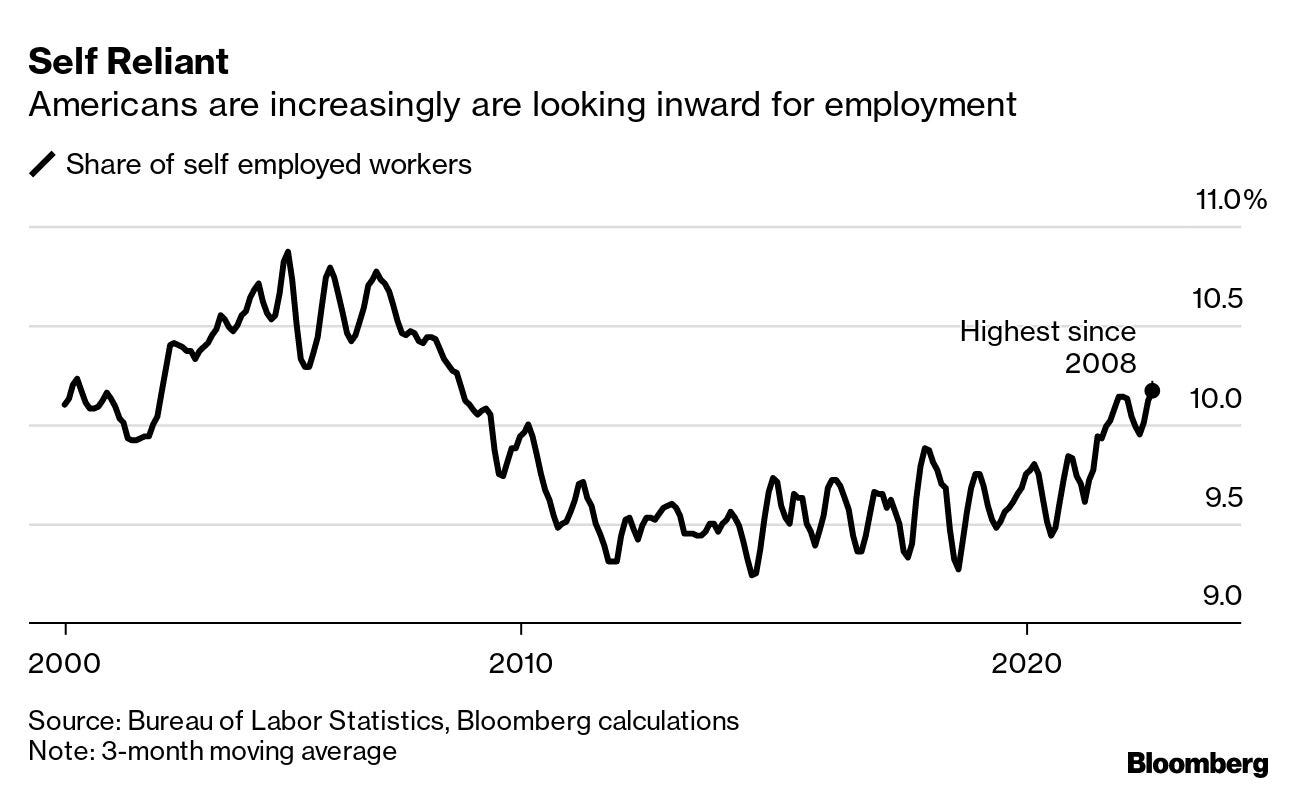

The rise of internet-native work is colliding with the rise of self-directed, autonomous work. More Americans are choosing self-employment; we’re at the highest self-employment rate since the Great Recession.

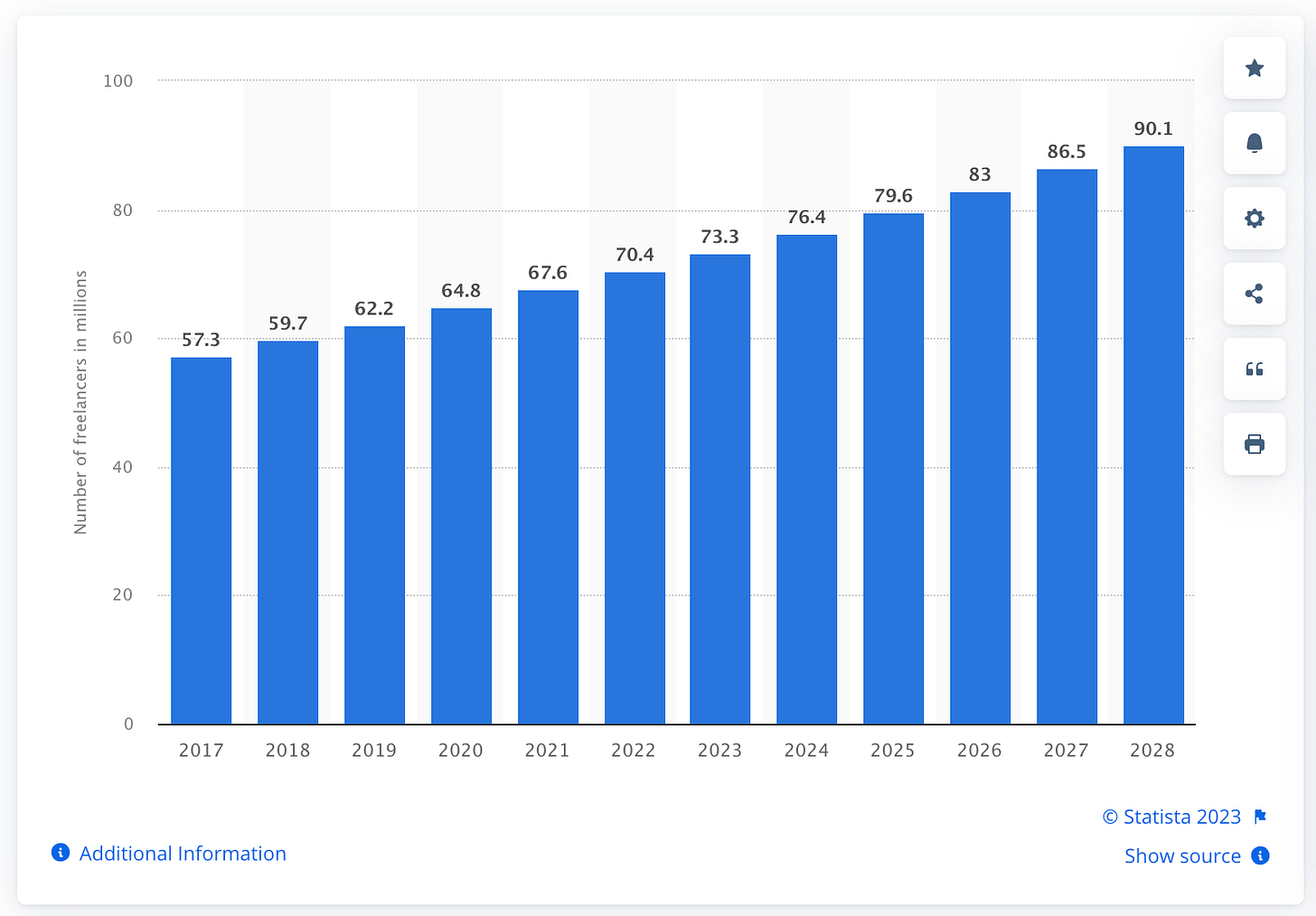

And in 2027, America will become a freelance-majority workforce—fields like design are already overwhelmingly project-based (80% for design).

Let’s look at the chart from above again, but focus on the jobs below the x-axis—the jobs in decline. These workers will need new forms of work, and online work built upon technology platforms is a good place to look.

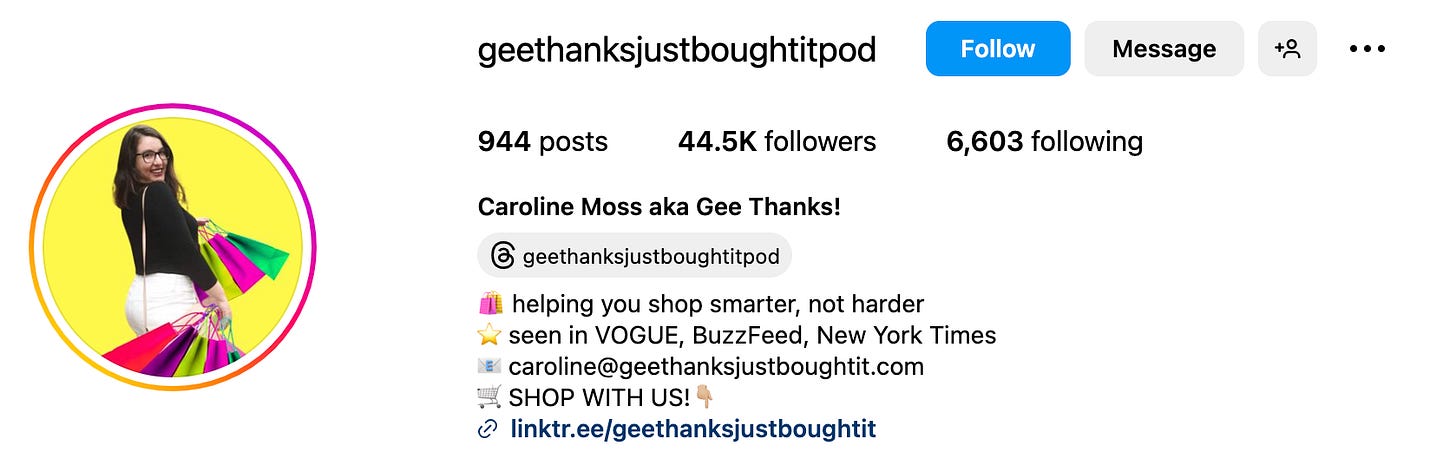

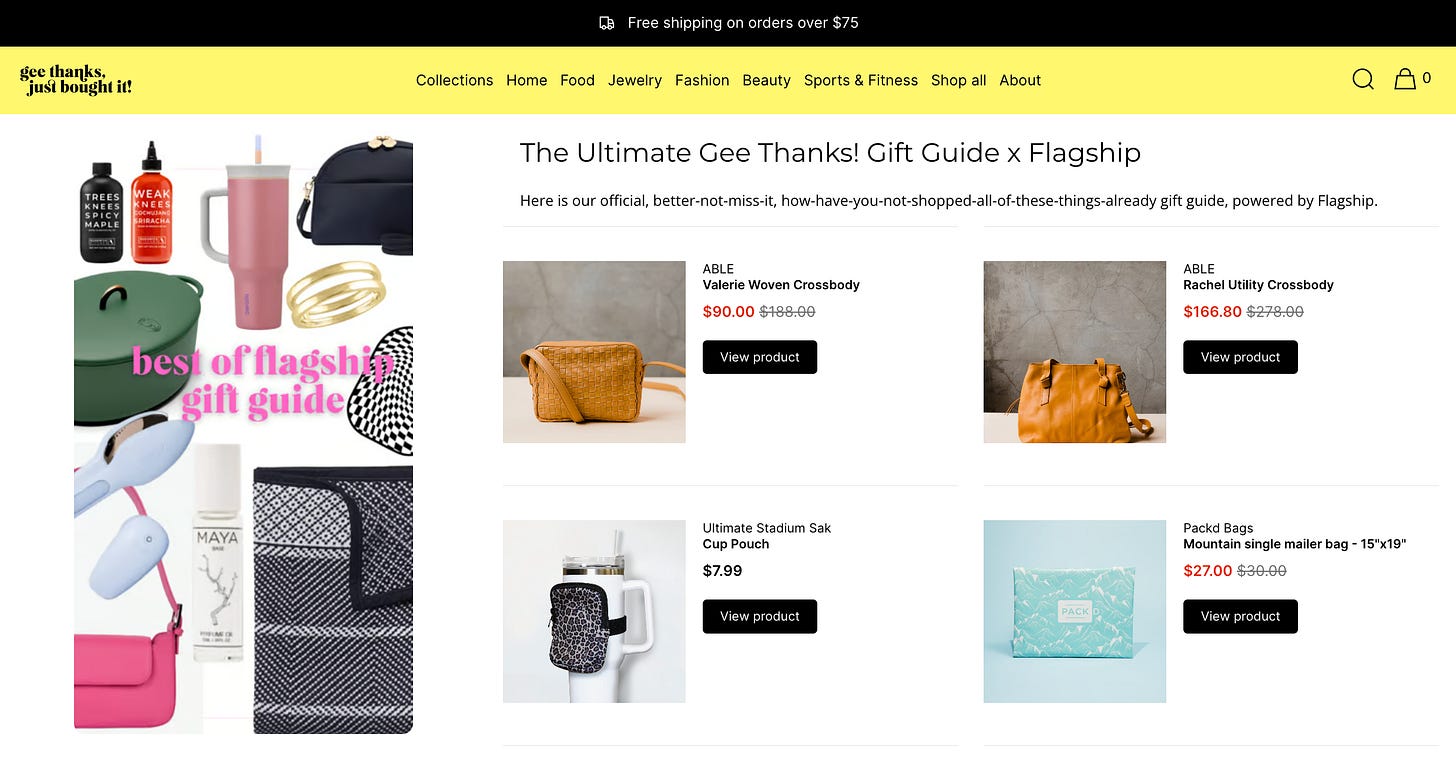

Caroline Moss is better known online as Gee Thanks Just Bought It (love a good Ariana Grande reference), a creator with 44K+ Instagram followers and a popular blog.

Caroline is one of the first merchants on Flagship, where she runs her own storefront. (I wrote about Flagship over the summer in The Future of Creator Commerce.) Caroline’s store fuses content and commerce, letting her community shop her recommendations—and letting Caroline become the next-generation version of the mom-and-pop boutique on Main Street.

That’s an example of how technology companies can underpin new jobs. Giving people a way to earn a living is also a powerful way to drive organic growth; we all like to make money. And becoming the infrastructure for new economies of work is a well-trodden path to becoming a generational technology company.

Final Thoughts

Technology’s impact has been uneven—software, smartphones, and TVs are cheap, but healthcare and education are not. Economic mobility is limited and waning, and the American Dream is slipping from grasp. Young talent wants to work on the most pressing problems (without sacrificing financial upside), meaning mission-driven startups with compelling business models become magnets for talent. The companies that define the next generation of tech will be those that make life tangibly better for all of us.

To close, Midjourney’s interpretation of:

A society in which everyone has equal access to education, healthcare, and housing, where everyone finds companionship, and where everyone has a rewarding and well-paying job.

Apparently utopia means a lot of hot air balloons. See you next week 🎈

Additional Reading

America’s New Deal Economy | The Atlantic

Related Digital Native Pieces

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: