24 Predictions for 2024

From AI Dating to AI Marketplaces, TikTok Shop to Vision Pro

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 55,000+ weekly readers by subscribing here:

24 Predictions for 2024

Hey Everyone,

This is my last piece of 2023. After this, it’s a wrap on Year 4 of Digital Native ✅

It’s been a good year, with ~50 long-form pieces totaling ~120,000 words. The best part of writing is building this community of readers, and this community has grown +60% in 2023. Thank you for being part of it.

To close out the year, 24 predictions for what’s ahead in 2024…

1) Dating Disruption: A New App Will Take Off

There’s a new hashtag trending on TikTok: #DatingWrapped2023.

Inspired by Spotify Wrapped, single people are putting together dating recaps for their year, complete with PowerPoint slides, pie charts, and year-over-year comparisons. The trending hashtag has 18.7M views on TikTok, and most Dating Wrappeds are pretty grim.

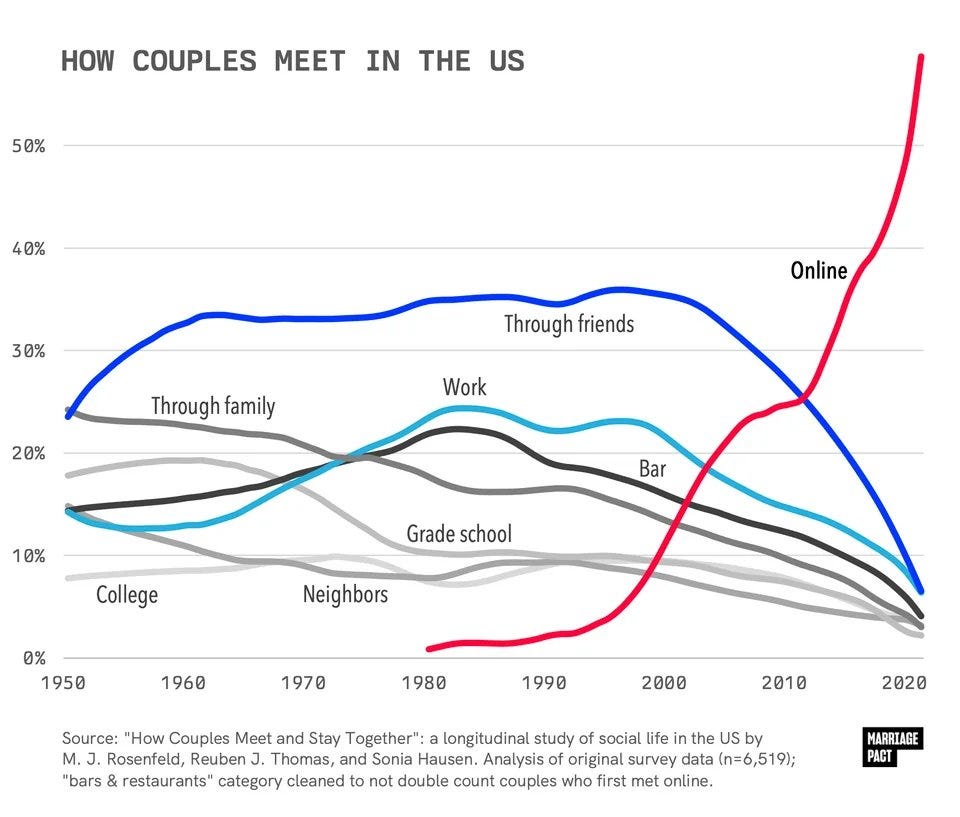

Over the past 20 years, online dating has taken over. This is particularly true over the last decade: you see an inflection in the chart below from mobile adoption, with the rise of apps like Tinder, Bumble, and Hinge. Tinder raked in $1.8B in revenue last year; the app comprises about 60% of Match Group’s revenue. (Match also owns Hinge, OKCupid, and Plenty of Fish.) Match trades at a $9B market cap, while Bumble trades at $2B.

Yet users are fed up with dating.

More than 90% of Gen Zs report feeling frustrated with dating apps, according to a study by Savanta. An October headline in The Guardian reads: “‘It’s quite soul-destroying’: how we fell out of love with dating apps.”

The “swipe” concept that Tinder pioneered hasn’t been innovated in a decade. Dating remains lonely and single-player. That will change. One of my investments this fall is an AI-powered dating app led by a savvy Gen Z team that understands why Tinder has lost the plot. A new enabling technology (LLMs) should hasten along dating disruption, and I expect 2024 will bring the first breakout AI-powered dating app—a dating app that learns about you and refines its matches accordingly.

2) ZIRP No More: Rates Will Stay Flat

Thanks to rising rates, the U.S. government will pay $659B in interest on the national debt this year. That’s about as much as it spends on Medicare or on national defense.

As a good piece in The Atlantic points out, rates haven’t been this high since George W. Bush was president and Taylor Swift was in elementary school. Sheesh. And I don’t expect rates to go down in 2024. The latest central bank projections have rates staying mostly flat for 2024, and falling only slightly in 2025. They’ll end 2025 at about 4%—more than 2x where they ended 2019. Wall Street is expecting rates to potentially stay this high for a decade, using the phrase “higher for longer” in equity research reports.

Today’s rates aren’t the anomaly; the low rates of the last 15 years were. Zero-interest rate policy (ZIRP) was also responsible for the the largest spike in wealth inequality in postwar American history. Federal Reserve data shows that from 2007 to 2019, the wealthiest 1% of Americans saw their net worth swell by 46%, while the bottom half saw only an 8% increase.

ZIRP fueled the boom in venture capital and startup funding over the past decade. With rates showing no signs of falling, venture will remain a tough fundraising environment…

3) 2024 Will Be A Rough Year for Fundraising

In last month’s Seed Investing: The State of the Union, we dug into how 2023 has been a difficult year for VC funding.

The capital raised in the first nine months of 2023 was only 24.7% the share raised in the first nine months of 2022. It’s a tough time to be in market as a venture fund.

This will continue into 2024.

Investors in venture capital funds—Limited Partners—are suffering from what’s known as “the denominator effect.” LPs like Stanford’s endowment or California’s teachers retirement system have exposure to both public markets and private markets. As the public market goes through a downturn, public assets decline in value; consequently, LPs become relatively overexposed to privates. Put simply, they don’t need more venture exposure right now.

4) Smaller Venture Capital Fund Sizes

In 2024, venture funds will get smaller. This isn’t a bad thing. Early-stage investing should be a niche, cottage industry. But over the past few years, we saw it balloon into asset management disguised as venture.

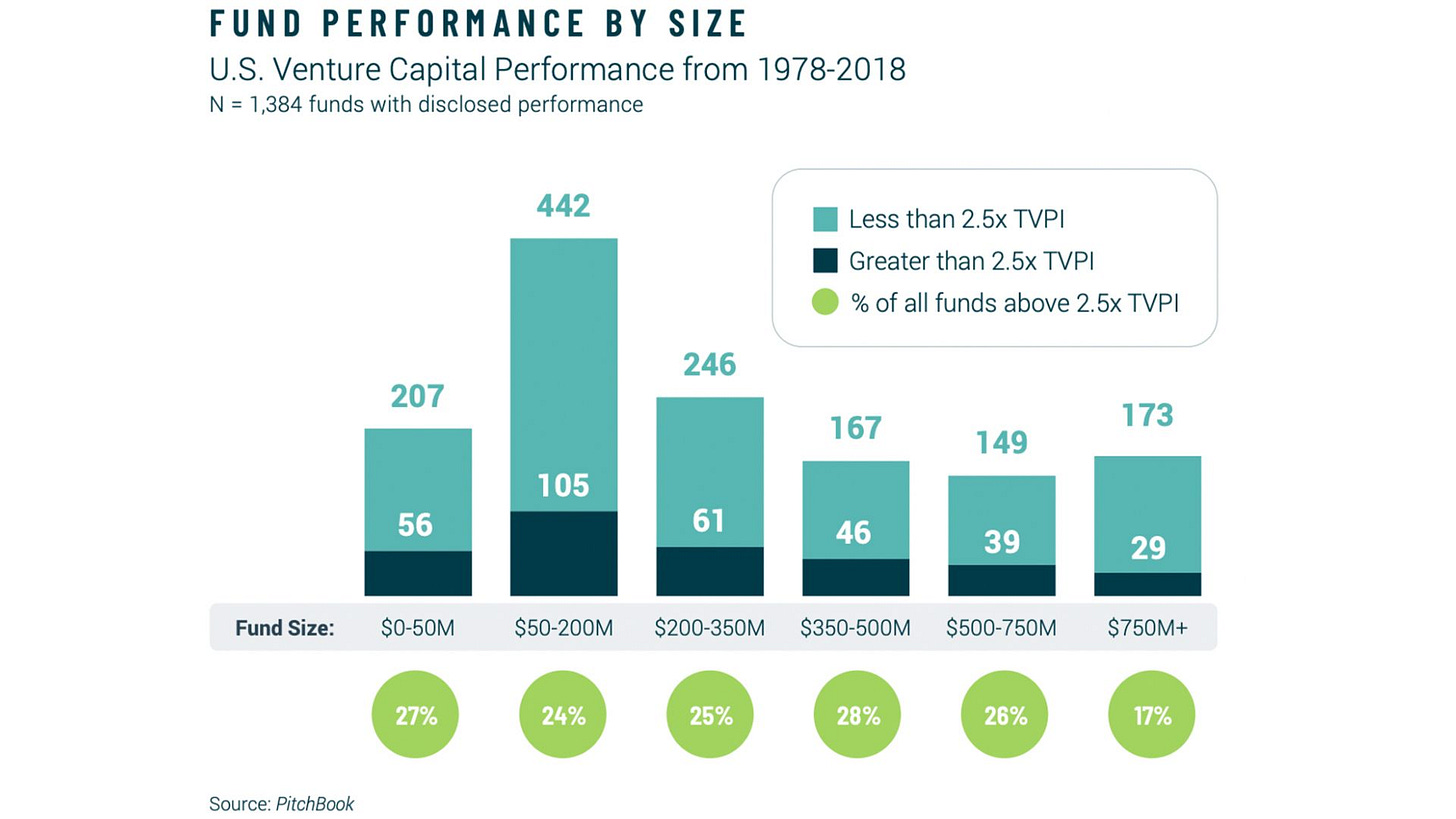

We’ll now see a return to more reasonable fund sizes. A recent study from PitchBook and Sante Ventures showed that venture funds smaller than $350M are 50% more likely to generate a 2.5x return than funds larger than $750M.

Yet in the first three quarters of 2023, 46.8% of U.S. venture dollars went into funds over $500M. In 2022, that figure was 63.6%.

It’s not hard to understand why venture has ballooned as an asset class: (1) ZIRP drove a huge influx of return-hungry capital into PE and VC, and (2) incentives drive larger funds. From the Sante report: “The net present value of management fees alone for a fund at $1,000M exceeds the fees and carry of a fund at $200M, even if it returned 4x.” GPs opt to get rich off of fees.

I expect 2024 will bring smaller fund sizes—not because incentives have changed, but because LP dollars will no longer support mega-funds.

5) A Culling of the Unicorn Herd

In 2021, about two new unicorns ($1B startups) were crowned every single workday. 2022 cut that figure in half, and 2023 is minuscule by comparison:

Of course, most of these companies should never have been valued at $1B+ in the first place. Valuations were completely out of whack compared with historical norms. Take a look at this chart and tell me which years look out of place:

Again, we can blame ZIRP and the influx of capital to private markets. (In 2000, private equity firms managed about 4% of total U.S. corporate equity. By 2021, that number was 20%. Put differently, private equity grew 5x faster than the broader U.S. economy.)

In 2021, it wasn’t uncommon to see startups raising at 50x or even 100x ARR multiples. Most companies will struggle to grow into those valuations. As Elad Gil points out in a good piece, a company that raised at 50X ARR will take 9 years growing 20% a year to just grow into its current valuation (assuming a 10X exit multiple). A company that raised at 100x ARR would take 6-7 years, growing 85% year-over-year, to grow into that last round price. That’s to say nothing of being a 2-3x step-up in valuation for the next fundraise.

Abundant money in the past few years meant that companies that should have shut down years ago were able to stay alive. Now, money is no longer abundant, and 2024 will bring many shutdowns. According to data from The New York Times, 3,200 private VC-backed U.S. companies have gone out of business this year. Startup shutdowns are up +50% year-over-year and up +300% over 2019.

This is only the beginning. Many companies are still surviving on runway from frothy 2020, 2021, and 1H 2022 times. That runway will dry up in 2024, and we’ll see more companies go out of business.

6) 2024 Will Be a Great Year for Pre-Seed & Seed

While growth-stage startups struggle, 2024 will prove to be a great vintage for early-stage—partly as a result of employees leaving their underwater economics to strike out on their own.

More about this phenomenon in November’s State of the Seed report:

7) A Focus on Unit Economics & Profitability

A wave of cheap money in the last decade propped up capital-hungry businesses with questionable economics. Startups like Uber and WeWork burned through billions in venture capital. Some have emerged with light at the end of the tunnel—Uber’s improving metrics are underpinning a $130B market cap, healthily above its last private round of $76B—while others haven’t had such luck:

2024 will bring a renewed focus on unit economics (remember those?) and a continued market focus on profitability. Achieving profitability can have dramatic effects: Udemy, a company with $700M+ in revenue, saw its stock jump +38% in one day after reporting profitable earnings. Netflix was the worst-performing stock in the S&P 500 last year, shedding 75% of its market cap, but it’s up +50% this year after turning in a few highly-profitable quarters. Many SaaS companies have stopped investing heavily in growth and are instead inching their way to cash flow generation.

The companies that raise in 2024 will have strong metrics and solid underlying business models.

8) Temu Ignites Discount Commerce Rivalry

Speaking of unit economics, let’s talk about Temu.

On Tuesday, Apple released its most-downloaded apps of 2023. Temu, the Chinese-owned discount shopping app, topped the list. (The rest of the top five: CapCut, Max, Threads, and TikTok.) Temu is also showing strong engagement times: average daily active users are spending 18 minutes on the app every day, about twice the 10 minutes daily actives spend on Amazon.

Temu’s dominance started late last year. In December 2022, just four months after launching, Temu had more unique visitors than SHEIN and Wish. eMarketer reported that during the holiday shopping season last year, Temu ranked 12th in traffic among U.S. retailers, wedged between CVS (#11) and Walgreens (#12). Temu came in ahead of major retail sites like Nordstrom, Wayfair, and Kohl’s.

Pinduoduo is following the Bytedance playbook of spending aggressively on user acquisition to win the U.S. market. Part of that plan included not one, but two Super Bowl commercials (costing $7M apiece). The strategy seems to have worked: Temu saw a 45% surge in downloads and a 20% uptick in daily active users on the day of the Super Bowl.

Over the summer, installs again picked up meaningfully:

The question for Temu is whether it can make its unit economics work.

Temu is known for selling $4 headphones and $15 hoodies. It’s hard to profit on shipping a bunch of cheap items. But early data has been (surprisingly—to me at least) promising: spend retention on early Temu cohorts shows that shoppers spend ~50% of initial month GMV in their second and third months. For SHEIN, that figure is closer to 20%.

Temu will generate about $15B in revenue this year and Pinduoduo, for its part, just dethroned Alibaba as China’s most-valuable e-commerce giant. In 2024, I expect Pinduoduo to continue to plow money into Temu user acquisition.

We’re also seeing U.S. startups get in on the discount shopping crazy.

Flip took off last month with some heavy incentives for new users—the app gave me $100 to spend (and I haven’t bought anything on it since). YaySay, meanwhile, is gamifying off-price retail—a sort of online TJ Maxx (which is itself a $50B-a-year behemoth growing healthily). The jury is still out on how the economics will work for online discount retailers, but more and more are popping up.

August’s Follow the Money: Categories of Consumer Spend tracked the rise of discounters in the U.S. The top six retailers opening stores in 2022 were all dollar chains and discounters, led by Dollar General, Family Dollar, and Dollar Tree. In 2021, nearly 1 in 3 new chain stores opened in the U.S. was a Dollar General.

In 2024, the battle for the online equivalents will heat up. U.S. challengers to Temu will emerge, both in the startup world and from local incumbents. (I wouldn’t be surprised if Amazon and Google are working on their own competitors as we speak.)

9) TikTok Shop Powers the Rise of Social Commerce

As Temu has exploded in the U.S., another Chinese-powered e-commerce upstart has had a similarly strong year. TikTok Shop is on track to do ~$15B in GMV this year, a ~250% increase year-over-over: in 2021, TikTok Shop raked in $4.4B, and in 2020, TikTok Shop did $600M.

With TikTok, social commerce seems to finally be taking off in the West—years after it began dominating in Asia. TikTok is clearly going all-in on commerce.

The challenge I see TikTok facing: backlash from users. Users are already annoyed by TikTok ramping up ads on the platform (a predictable backlash for any ad-based consumer network). Now users are doubly annoyed by creators shelling product after product after product.

A recent video I saw mocked how common product promotion has become, making fun of influencers hawking “the world’s best vacuum” and “my favorite ever lip gloss.” Comments on the video were interesting to read. Some of the comments I collected:

There’s clearly brewing exhaustion as TikTok Shop ramps up—and Shop is still relatively early days.

If I’m TikTok, I’m paying close attention to this. It’s a fine line between pouring gas on a lucrative new revenue stream, and alienating power users who are on TikTok for passive content consumption, not product discovery. Can TikTok take down YouTube while also going after Amazon and Temu?

I’m more bullish on platforms that allow creators to themselves become small businesses. Flagship, for instance, lets anyone spin up their own boutique storefront, curating their favorite products and taking a cut of sales. Here’s the storefront for the blogger Caroline Moss, a.k.a. Gee Thanks Just Bought It.

I’m biased—Flagship is one of the companies I work with—but I view the ultimate winner here as the solution that gives creators the end-to-end tools to manage their own business as a retailer. Adding commerce as a layer on top of a social or content network works in the near term—it’s the eyeballs are, after all. But long term, it degrades the platform. The more sustainable company is the company that is platform-agnostic for creators; that aligns incentives for shoppers, brands, and creator-retailers; and that turns online creators into the next-generation mom-and-pops that they’re already becoming.

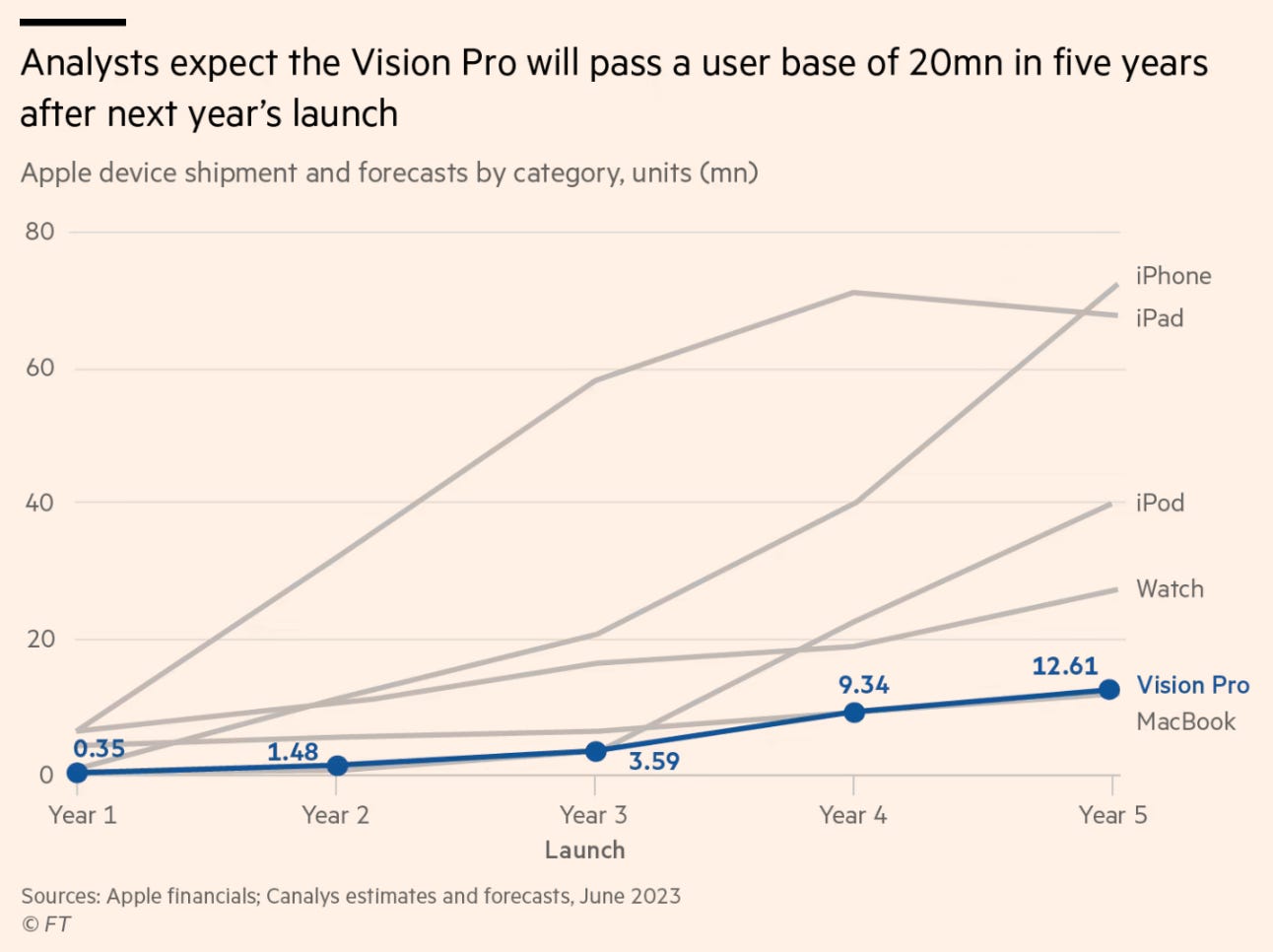

10) Vision Pro Posts Underwhelming Sales

This time next year, we’ll be reading headlines about Apple’s disappointing year of Vision Pro sales. In the run-up to Vision Pro’s launch (likely in spring), the media will proclaim the device as the “next big thing”—then later in the year, the same folks will denounce it as a giant flop.

For some reason—maybe because VR / AR are so hyped—the media will be expecting iPhone-level sales. But Vision Pro will likely sell more like the Macbook or a gaming console.

There’s no reason to expect Vision Pro will fly off the shelves. The device is priced at $3,499—it’s a luxury item. But after a slow 2024 start, sales will increase as Apple drops the price and as killer apps emerge. By 2025 or 2026, the narrative might be quite different.

11) The Year of the Killer Apps

Speaking of killer apps, 2024 will be the year of the application layer. This will be true for Vision Pro—Apple is clearly hoping developers come up with some cool apps before the Vision Pro launch date—and it will be true for AI.

Next year, focus will shift from AI’s infrastructure layer to AI’s application layer. So far, we’ve seen breakout apps build on their own models—Midjourney, for instance, or Character AI. But many foundation models are now available via API, and open source models are improving at a rapid pace. I expect the next breakout applications will build on someone else’s model, instead winning on verticalization (with a resulting data advantage) or by offering a better user experience.

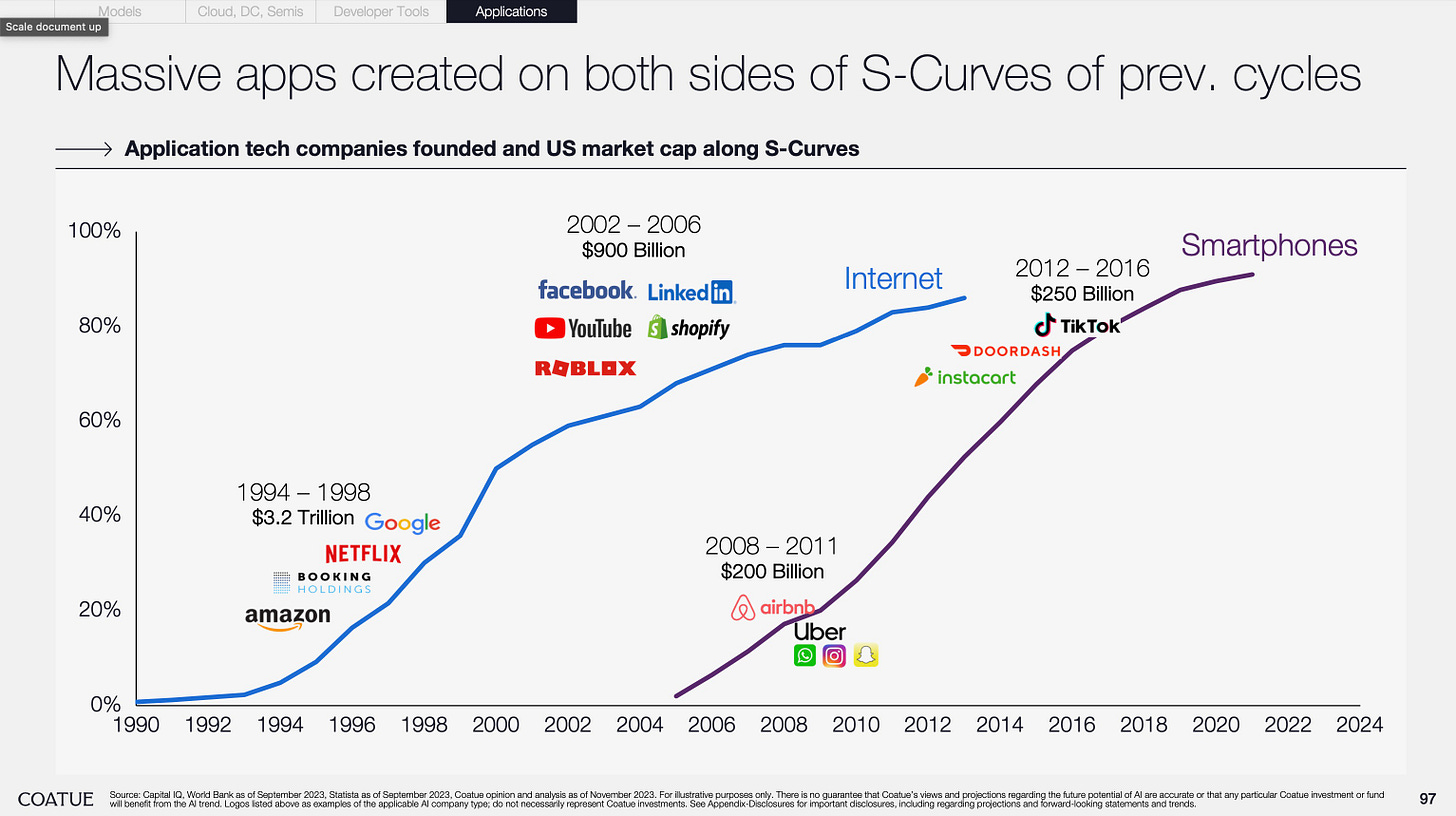

We’ll see a swarm of AI apps emerge, just as we saw mobile apps emerge a decade ago. Interestingly, both internet and mobile applications emerged in two main “clusters.” The chart below shows how 2008-2011 gave us apps like Uber, Instagram, and WhatsApp, while 2012-2016 gave us DoorDash, Instacart, and TikTok.

What will the first wave of AI apps be? Chatbots seem like an early contender, but only time will tell. I expect the application layer to form faster than in past epochs—successive platform shifts have typically halved their penetration time.

Even though it seems like AI is already mainstream (at least in the startup and venture capital echo chamber), we’re still early. While 58% of American adults have heard of ChatGPT, only 18% have used it. I expect we’ll need more vertical-specific, user-friendly LLM applications for the technology to really break through. Many of those applications are being built or dreamt up right now.

September’s piece The Mobile Revolution vs. The AI Revolution argued that it often takes a few quarters, or even years, for killer apps to emerge. The iPhone came out in June 2007; Uber was founded in March 2009.

Here’s a chart of U.S. smartphone ownership after the iPhone came out—I’ve overlaid the foundings of WhatsApp (2009), Uber (2009), Instagram (2010), and Snap (2011).

Where this chart ends—in March 2012—we were still early innings. At that point, smartphone penetration in the U.S. was hovering around 40%.

Here’s a chart that shows continued penetration, alongside the foundings of other major mobile companies: Tinder (2012), Robinhood (2013), TikTok (2015). These apps emerged five, six, and nine years after the iPhone launched, respectively.

2024 will be the beginning of AI’s application layer crystallizing. We’ll start to see generational businesses take shape.

12) Copilot Mania

Alongside the rise of AI, 2023 has given us copilot mania. That will continue in 2024. We’ll see copilots emerge for every conceivable use case.

Teachers will get copilots for homework grading (Class Companion, for instance). Architects will get copilots for building design (SketchPro). Lawyers will get copilots for working on legal briefs (Harvey).

We’ll all get used to using AI in our daily work. AI will reduce barriers, making challenging tasks more accessible to more people. Instead of typing an Excel formula, imagine instead prompting, “Write a formula that removes duplicate names in this column.” Tasks that have historically been enormous time-sucks for knowledge workers—data clean-up, memo writing, monotonous calculations—will become quick and easy.

Many copilots will be commodities, failing to use their data advantage to compound or build a moat. But others will take off. Harvey, for instance, is reportedly already north of $10M ARR, up from ~$1M in April.

13) Decline in College & Return to Trade Professions

From fall 2019 to fall 2021, undergrad programs saw a 6.6% decline in total enrollment. This decline is sharper because of COVID, sure, but it also continues a long-term trend: college enrollment has declined for 11 years straight.

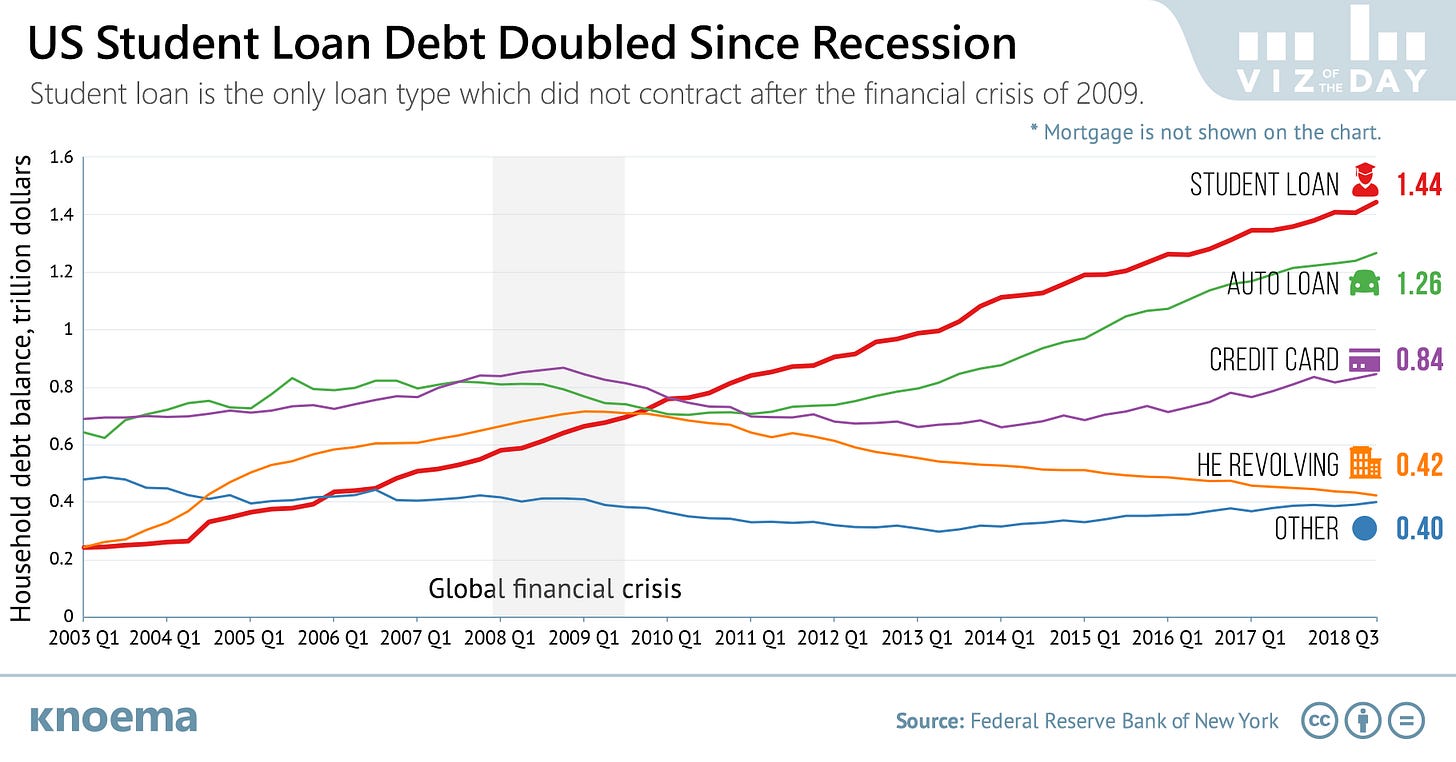

For many people, college is simply unaffordable. Student loan debt has ballooned, doubling to ~$1.5 trillion from 2008 to 2018.

The cost of education is growing 8x faster than real wages. In the 1950s, 30% of household income was enough to pay for college. Today, people need to shell out 80% of their household income. Tuition costs have swelled +1,184% since 1980.

And college is less accessible to the less privileged: children born in the bottom income quartile in the US have just a 9% chance of achieving a college degree by age 25.

College is becoming untenable. And younger people are waking up to that fact. As a result, 2024 will see a continued decline in college enrollment and an uptick in skill-based education—including training for skilled trades.

A January 2022 survey from the ECMC Group found that only 51% of Gen Zs want to pursue a four-year college, down from 71% just two years ago. Meanwhile, 56% believe that a skill-based education makes more sense in today’s world. My view—which may be controversial—is that most people shouldn’t go to college. The return on investment just doesn’t make sense any more. For many, a skill-based program may be a better option.

And interestingly, Gen Z has a uniquely high opinion of skilled trades like plumbers and electricians. A recent survey found that 73% of Gen Zs say they respect skilled trade as a career, putting it second only to medicine (77%); 47% were interested in pursuing a career in a trade. One potential reason: 74% say they believe skilled trade jobs won’t be replaced by AI. Another recent survey found that 52% of university students worry more broadly about AI taking their jobs. From one woman in college: “I’m too disconcerted by the growth of this technology to even look at the positives.”

Here’s the extent of automation Goldman Sachs Research expects across industries:

If you work in maintenance, repair, or construction, you’re pretty safe.

I expect we’ll see more young people pursue trade jobs—a reaction to both AI automation and the younger generation’s more general backlash to technology.

14) We’ll See the First Breakout AI Marketplace

Marketplaces are an elegant business model. At its simplest, the classic two-sided marketplace connects two parties to deliver a product or service. Often, one or both of those parties is a human—Airbnb, for instance, connecting a guest and a host, or Uber connecting a passenger and a driver.

But what happens when one party is an AI?

This may be especially present in services marketplaces, which remain less-developed than product marketplaces. None of the 10 public U.S. marketplaces with $10B+ market caps are in services (you could make an argument for Uber, but that’s about it); none of the 10-largest private marketplaces are either. As Faire’s Dan Hockenmaier puts it, “You can buy a lightbulb in one click on Amazon, but hiring an electrician is still about as hard as it was 100 years ago.”

This is because services are more diverse than products, and thus more difficult to categorize. Services also include humans, leading to a lot of back-and-forth. Anyone who’s tried to hire a plumber on Thumbtack, a furniture-assembler on TaskRabbit, or a housecleaner on Handy understands this: 37 messages later, and you’re still trying to pin down the person who can come on Thursday and do the job for under $100.

AI will first reinvent marketplaces by helping with the matching process; LLMs trained on those 37 messages (multiplied by millions of customers) can get good at delivering the best service-provider quickly. This should unlock innovation in service marketplaces.

But what also interests me is the service marketplace that matches you to AI. I wrote about this back in September’s When AI Begins to Replace Humans.

Essentially, many digital services are vulnerable to automation. Tutoring; web design; translation; animation; website creation. Today on Fiverr, I might search for a logo designer to make a new logo for Daybreak. What if a marketplace instead matched me with an AI that could do the job cheaply and effectively? The demand-side is still a human, but the supply-side becomes AI.

AI is coming to reinvent marketplaces, and I expect that marketplaces selling digital products—Fiverr, Preply, Upwork, Cambly, etc.—are the first to be disrupted.

2024 will bring the first breakout AI-native marketplace.

15) Vanity Continues in Full Force

One long-held investment thesis of mine: “the selfie thesis.”

The selfie thesis is tangential to another thesis—the idea that all great consumer companies build on one of the Seven Deadly Sins. (See: last year’s The Seven Deadly Sins of Consumer Technology.)

Arguably the most potent sin is Vanity, which isn’t technically one of the “traditional” seven recognized sins, but which is a close sister to Envy. The rise of mobile phone cameras and social media 15 years ago supercharged Vanity. And they in tandem supercharged any business that makes our selfies look better.

The selfie thesis means that we care more and more about how we look—first in a selfie, more recently in a close-up TikTok video. Any product that helps us look better in selfies—or just makes us look better, period—is arguably a good investment. In the 2010s this may have been Lightricks, the maker of FaceTune; Curology, a customized skincare startup; or Instagram itself.

The FaceTune-powered, airbrushed perfection of 2010s-era social media has faded. Gen Zs and Millennials now favor “authenticity” (though usually with some air of performance).

FaceTune—which was Apple’s most-popular paid app in 2017 and which in 2018 had 20M times and 500,000 paying users—is down meaningfully in app downloads.

Yet while overly-curated feeds are out, Vanity continues it’s up-and-to-the-right trajectory. Heavy color cosmetics have been replaced by more natural-looking “no-makeup makeup.” But make no mistake, Vanity forges on, undeterred. In 2024, Vanity will reach new heights. What are the new areas to follow?

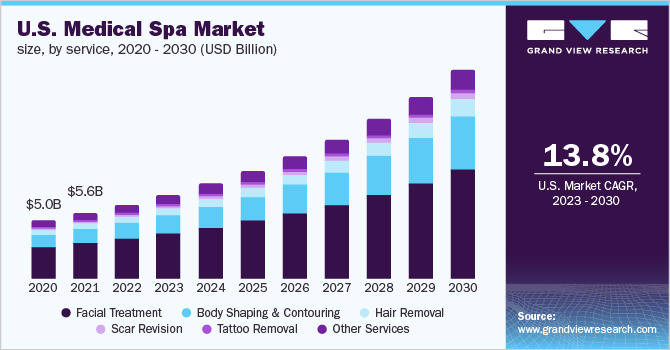

I find the rise of Medspas fascinating. Medspas provide nonsurgical aesthetic treatments—think Botox, microdermabrasion, or laser hair removal. And they’re growing fast.

The U.S. Bureau of Labor Statistics predicts that employment of estheticians is going to grow 29% in the next decade. No surprise there. Startup plays here include vertical SaaS for medspas like Moxie, and we’ll see more picks and shovels emerge.

There’s also no reason that men need to be flying to Turkey to get hair transplants. I expect companies to pop up to make such treatments more cost effective in the U.S. Any cosmetic treatment will become more accessible, more affordable, and—crucially—more acceptable. Stigmas toward plastic surgery and other aesthetic procedures are fading—fast.

Other major categories to watch: sleep, beauty, and skincare. Anti-aging, in particular, is on fire and showing no signs of abating.

Vanity isn’t going anywhere. The selfie thesis will hold strong for 2024 and beyond.

16) Gen Z Mental Health Worsens

By early 2024, there will be more Gen Zs working full-time than Baby Boomers working full time.

And Gen Zs will bring the youth mental health crisis to the workplace. A 2022 survey by Calm—bit of a biased source, but still—found that 58% of Gen Zs feel anxious frequently or all the time. A Deloitte survey of 22,000 people found a similar result: half of Gen Zs reported feeling anxious and stressed almost all the time, compared to only 39% of Millennials. Gallup found that Gen Zs are most stressed up at work:

Derek Thompson had a good recent piece in The Atlantic—“How Anxiety Became Content”—that argued that so much online discourse about anxiety might be contributing to deteriorating mental health. It’s difficult to parse how the destigmatization of mental health is changing reported levels of mental health conditions. On the hand, it’s easier than ever to discuss depression or anxiety; on the other hand, being surrounded by a language of mental health means that everyday challenges may all of a sudden be categorized as a mental health condition.

2024 will bring the mental health crisis to new levels; we’ll reach a breaking point. There will be AI chatbots—Woebot, for instance—that offer mental health support, and there will be a societal debate about whether these chatbots are helping the crisis (more support and companionship) or exacerbating it (replacing offline connections with dystopian online connections).

17) A Gaming Resurgence

Gaming is seeping into broader culture. The 2nd-highest-grossing movie of the year, behind only Barbie, was The Super Mario Bros. Movie. It raked in $1.4B at the global box office.

Meanwhile The Last of Us, an adaptation of a 2013 video game, broke HBO records. The series averaged 30M viewers across episodes, and its Week 2 episode broke a 50-year-old HBO record for largest week-over-week growth in the second week.

As content proliferates, IP becomes more important. We’re going to see a lot more film and TV adaptations of gaming content. Brace yourself.

The size and appeal of gaming is a frequent topic in Digital Native. A piece titled How Gaming Became the New Social Network, Theme Park, and Music Festival is 3.5 years old, and opens with this visual:

Yet as gaming has gone mainstream, the sector has been struggling.

2023 wasn’t kind to gaming. VC funding is down meaningfully. Engagement has shrunk from pandemic highs and iOS privacy changes have battered game publishers. What’s more, people seem to be at concerts and on vacations rather than playing video games (see the Experience Economy section below).

I expect this to reverse course in 2024. Gaming won’t be back to its COVID-era highs, but the sector remains the most attractive segment of media and entertainment. Gaming is a monetization machine, and there are over 3B gamers globally. For many people, gaming conjures the image of a teenage boy isolated in his mom’s basement. The reality is that the average age of a U.S. gamer is 35; that close to half (45%) of gamers are women; and that gaming is deeply social.

AI will enable unique gameplay experiences, and I expect new tools to emerge for game developers to build with AI. Inworld AI, for instance, powers AI non-player characters (NPCs). NPCs will have complex, nuanced personalities that ebb and flow based on gameplay. They’ll begin to feel more and more like real people.

AI will also drop barriers to creation. Building experiences in Roblox is still a pain; not everyone knows Luau. AI will broaden access to game creation, and we’ll soon have infinite games.

VC funding into gaming should tick up for early-stage, and AI + gaming will become a buzzy intersection.

18) Humane Will Be a Massive Flop

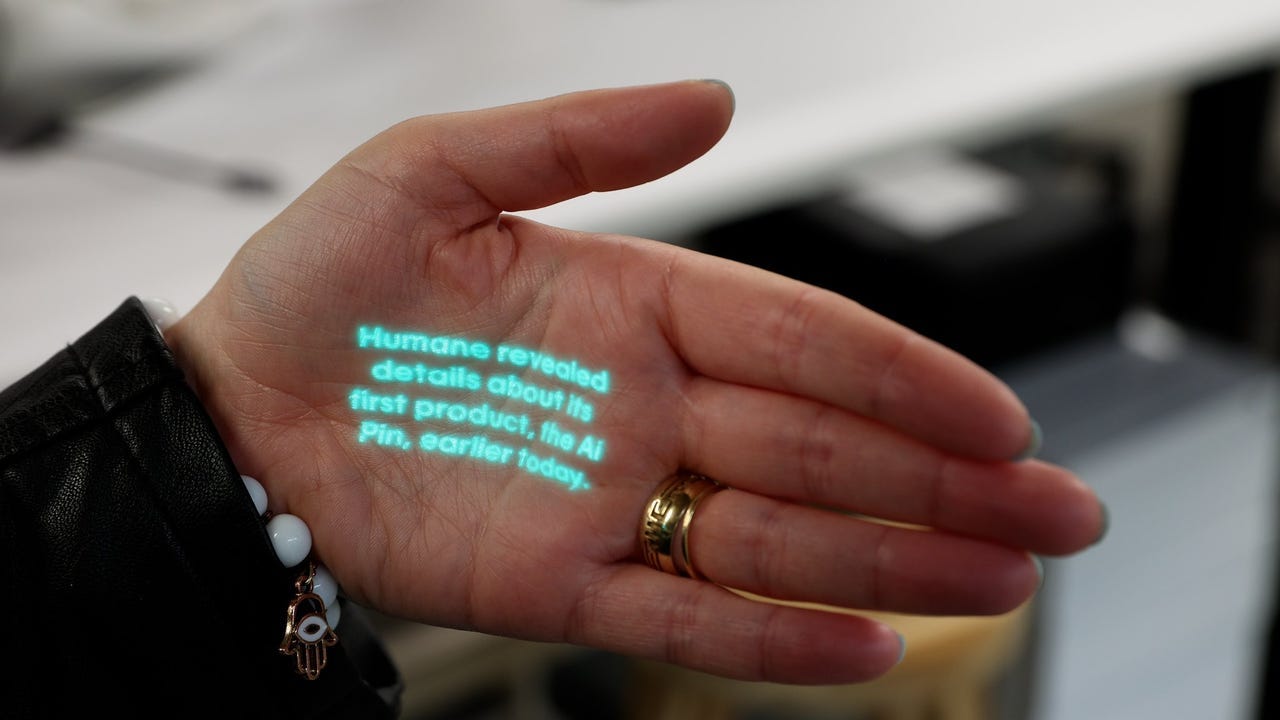

Last month, the tech startup Humane revealed its much-hyped AI Pin. The Pin is a $699 wearable device that comes in two parts: a square device and a battery pack that magnetically attaches to your clothes or other surfaces. Beyond the $699 hardware price tag, Humane comes with a $24 monthly fee.

Humane is led by Imran Chaudhri, best known for creating the user interface and interaction designs for the iPhone. And the device bills itself as a phone replacement: you interact with the device using your voice, and a projector displays things on the palm of your hand.

I think Humane will be a tremendous flop.

The thing is: people like screens. The way we interact with content has been through screens for a long, long time. Films appeared on big screens across the country 100 years ago. Then TVs shrunk down screens into our living rooms. Computers made screens even more portable and accessible, and mobile phones then did the same.

I don’t think Humane’s design is the right one. And beyond the wrong product design, the Pin is orthogonal to today’s culture. Most people don’t want an AI device listening to them. You can imagine a scenario: you’re excited to gossip with your friend, but they’re wearing their Humane Pin. All of a sudden, you’re paranoid and won’t speak freely. I expect Humane—and related hardware plays—will bear the brunt of AI backlash.

Humane’s AI Pin to go more the direction of Google Glass than the iPhone.

19) Experience Economy Roars Back

2023 was the year of Taylor Swift. I think we’ll look back at December 2023 as the month that Swift peaked—Time Person of the Year, an entire episode of The Daily, The Eras Tour movie dropping on streaming services. All within a few weeks. Then again, I thought Swift was peaking during the 1989 era in Summer 2015, and she’s topped that—so we’ll see what she does next.

The Eras Tour is already the highest-grossing tour of all-time—and the tour isn’t even halfway over. Swift played 60 shows in 24 cities in 2023. In 2024, she’ll play another 83 shows (!). The tour will gross well over $2B before all is said and done—over double the next highest-grossing tour in history.

(This chart leaves out Beyoncé’s Renaissance Tour, which is a new entrant into the top 5 tours of all time and was also a mainstay of 2023 culture.)

The Eras Tour and Renaissance Tour embody a broader trend: the resurgence of the “Experience Economy.” Experiences, including music concerts, exploded in 2023, topping record highs from 2022 after pent-up COVID demand.

A new report from StubHub (another somewhat biased source, but still) found that 60% of Gen Zs would skip a major life event—a friend’s wedding, the birth of a new family member—if they could be front row for their favorite artist’s concert. A June report from Experian, meanwhile, found that 63% of Gen Zs and 59% of Millennials said they would prefer spending money on “life experiences,” ranging from concerts to travel, rather than invest in their retirement.

Spending on experiences isn’t anything new. A few years ago I wrote:

Instagram got its start as a literal filtered version of reality. It was a highlight reel—a place to showcase your life with a glossy sheen. And as one of the first mobile-native social apps, Instagram was always with us; social media became 24/7. The app catalyzed the “Experience Economy”—80% of Millennials said they’d rather spend money on experiences than on things. Symbols of status shifted: a Coach bag became an Instagram photo from Coachella.

But Gen Z is taking experiences to even higher heights than Millennials did during the mid-2010s Museum of Ice Cream heyday. (Remember that? 🤳🍦)

I expect 2024 to set new records for experiences. The growth of experiences isn’t going anywhere—it’s partly driven by Gen Z nihilism and the resulting “treat yourself” culture we observe.

In addition to concert-going, travel is surging: as airfares rose faster than inflation, the International Air Transport Association declared earlier this year that they now expect airlines to boast $9.8B in net income this year, more than double the amount initially forecast. Global tourism will hit 95% of pre-pandemic levels in 2023, up from 63% in 2022. Airbnb revenue in the quarter ending June 30th was $2.5B, +18% year-over-year; last-twelve-months revenue in the period ending June 30th was $9.1B, +23% year-over-year.

The Experience Economy, though, is largely dominated by much-loathed incumbents. Ticketmaster is the subject of much ire—particularly after the Taylor Swift ticket debacle—but the company continues to own the market; its parent, Live Nation, is a $20B market cap business. Travel, meanwhile, belongs to the OTAs (online travel agencies): Booking Holdings (which owns Booking.com, Priceline, Kayak, etc.) boasts $20B in revenue and a $109B market cap; Expedia Group (which owns Expedia.com, Hotels.com, VRBO, Orbitz, etc.) boasts $12B in revenue and a $15B market cap.

(To digress for a minute: the reason Booking trades much higher than Expedia is due to margins—Booking has 23% profit margins compared to Expedia’s 7%. How can margins be so different for similar businesses? Expedia competes mainly in America, while Booking dominates Europe. America’s hotel market is dominated by powerful chains like Marriott and Hilton, which have strong bargaining power and resultingly cut down Expedia’s commission. Europe’s hotel market, meanwhile, is fragmented and made up of primarily independent hotels; this gives Booking more power and thus higher commissions.)

Back to the point: dominance by incumbents creates opportunity for disruptors. More experiences + loathed incumbents = more startup opportunities.

We’re beginning to see some innovation in stale, massive categories. Alex Rodriguez and Marc Lore (founder of Jet.com), for instance, are behind a new ticketing startup called Jump that aims to take on Ticketmaster. Safara, meanwhile, is a startup taking on the OTAs.

Whenever I find myself on Booking.com or Expedia.com or Hotels.com, I find myself thinking: this feels like an early-2000s internet experience. Everything is clunky and unfriendly to the end user; we’re forced to wade through pop-up ads and spammy deals. Clearly, there’s an opportunity to innovate. Safara aggregates top hotels into an intuitive, well-designed app—then it gives users 10% cashback on bookings. The idea is to take on the OTA Goliaths with a simple, consumer-friendly app.

AI will clearly offer another opportunity in travel—the travel agent industry was already disrupted by the OTAs, but what happens when someone can say, “Book me a one-week trip to Paris and stay within my $200-a-night budget” and have an AI travel companion seamlessly carry out the booking? We’re already seeing AI trip planners like Tripnotes.ai and Wonderplan.ai promise personalized itineraries; other companies go B2B, like Amelia.ai offering hotels and resorts an AI companion for guests. Soon, everyone will have a copilot for every aspect of their trip.

Swift might go on to set more records in 2024, but I expect we’ll also see more companies ride the wave of Experiences.

20) “Constantly Online” Breaks 50% Barrier

I always like Pew’s annual report on teenagers’ online habits. The survey is helpful for understanding how teens are spending their time online. YouTube continues to reign supreme, far above the pack. TikTok comes in second, and Snap edged out Instagram for third-place.

The data is also helpful for tracking what apps are out of favor: Facebook’s precipitous fall from 71% a decade ago is painful to watch.

One stat from the survey that always stands out to me: the percent of teens who report being online “almost constantly.” This year, 46% of teens (13- to 17-year-olds) reported that they’re online “almost constantly.” This is the same figure as last year, though up roughly double since 2014.

I expect 2024 will be the first year we cross the 50% threshold—and we’ll never look back.

21) How We Search For Things Will Change

During the first few decades of the internet, we were taught to search for things in a certain way. We might type in “blue jeans,” for instance, or “black dress.”

Search is changing rapidly, as search gets smarter and more contextual. Observing younger people browse and shop, we see changes in real time. It’s becoming more common to search something like “going out outfit,” for instance—here are SHEIN’s search results for that query.

In tandem, chatbots are making search more conversational—fewer keywords, more questions.

2024 will accelerate radical changes in search.

22) Distribution Remains King

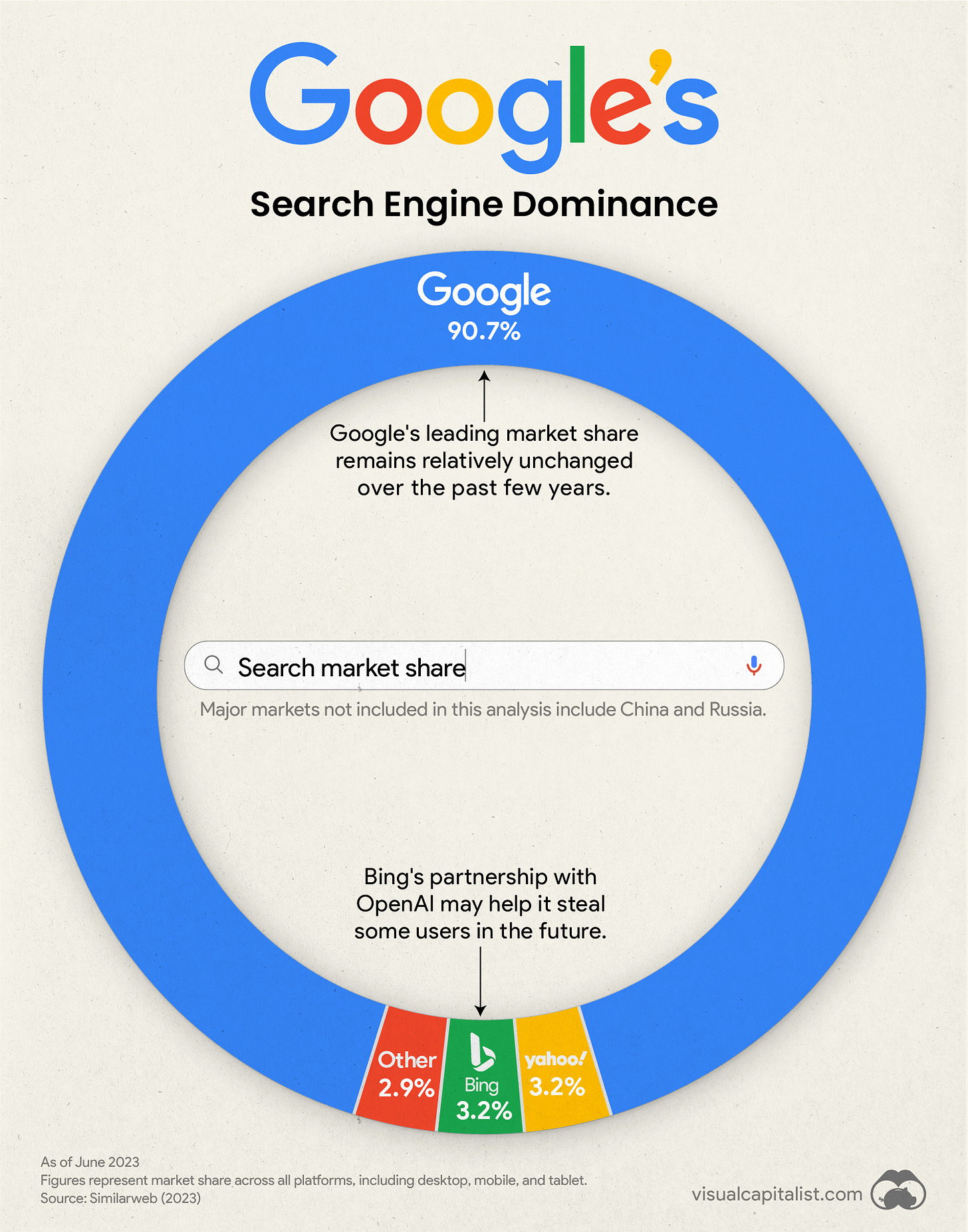

Speaking of search: a year ago, there was talk of Bing taking on Google. After all, Bing had OpenAI on its side. Fast forward to today, and Bing has made hardly a dent. Google (which, of course, is also strong in AI) maintains its stranglehold on search with a 90%+ market share.

This has an important lesson: distribution is everything.

A better product might not win if it doesn’t have strong distribution. In 2024, how does a productivity startup compete with Microsoft Office 365 or Google Workspace, both of which have 1B+ users? How does any AI startup compete with the existing players in its category?

The answer is by being savvy and creative with distribution, which will remain both more difficult and more important heading into 2024. Big Tech has never been bigger, wielding built-in distribution to fend off startups. Incumbents seem all-too-aware that AI is a potential death knell, and they’re moving fast. In 2024, the battle for distribution will heat up.

23) The Rise of AI App Stores

This one builds on last week’s prediction that 2024 will be the year of the application layer. From last week:

Next year, focus will shift from AI’s infrastructure layer to AI’s application layer. So far, we’ve seen breakout apps build on their own models—Midjourney, for instance, or Character AI. But many foundation models are now available via API, and open source models are improving at a rapid pace. I expect the next breakout applications will build on someone else’s model, instead winning on verticalization (with a resulting data advantage) or by offering a better user experience.

We’ll see a swarm of AI apps emerge, just as we saw mobile apps emerge a decade ago.

Interestingly, both internet and mobile applications emerged in two main “clusters.” The chart below shows how 2008-2011 gave us apps like Uber, Instagram, and WhatsApp, while 2012-2016 gave us DoorDash, Instacart, and TikTok.

Even though it seems like AI is already mainstream (at least in the startup and venture capital echo chamber), we’re still early. While 58% of American adults have heard of ChatGPT, only 18% have used it. I expect we’ll need more vertical-specific, user-friendly LLM applications for the technology to really break through. Many of those applications are being built or dreamt up right now. We’re about to see the first “cluster” of apps come into focus in 2024.

More people will access AI apps through some sort of AI app store—just as we learned to try out new mobile apps. Low-code tools will allow people to build their own AI applications, and we’ll all be flooded with apps. Yet despite that, we’ll still end the year with sub-50% ChatGPT penetration and with most people still relatively unaware of the breakthrough AI apps.

24) Black Mirror Becomes Reality

One of Black Mirror’s most moving episodes is “Be Right Back,” which tells the story of a young woman whose husband dies in a car crash. In her grief, the woman signs up for a service that creates a digital version of her dead husband by digesting all of his past online communications and social media profiles. She’s able to message with him, with the AI predicting his likely responses and humor:

Predictably, this goes south: the widow becomes addicted to this AI replica of her late husband and fails to move on in her life. But there are also silver linings: she allows her young daughter to talk with the AI sporadically, as a way to get to know the dad she’ll grow up without.

This fictional plot line is now possible less than a decade after the episode’s 2013 airing. Startups like You Only Virtual allow people to construct facsimiles of their dead relatives to chat to.

Other Black Mirror plot lines are just around the corner. In 2019’s “Rachel, Jack, and Ashley Too,” Miley Cyrus plays a famous pop star who has been digitally cloned into a toy robot for her fans.

The storyline is similar to Meta’s new celebrity AI chatbots that launched in September—you can use Messenger to chat with Kendall Jenner or Tom Brady. The Meta release was met with a muted, confused, and somewhat-disturbed public response. (Sub-prediction for 2024: Meta shuts down this AI initiative.)

Other Black Mirror plots have flavors of other upcoming products. “The Entire History of You” covers a memory implant that records a person’s entire memories—useful for tracing infidelity or crimes. It’s not dissimilar to some of the dystopian elements of the Humane Pin. “Hang the DJ,” meanwhile, covers dating simulation technology that uses an algorithm to find your perfect match—not unlike what LLMs can do for dating, and relevant to our first prediction in this series for a breakout AI dating app in 2024.

The point is: next year, Black Mirror will creep closer to reality. A surprising number of technologies—ones that seemed far-fetched even a few years ago—now seem shockingly close, and 2024 will blur the lines between sci-fi and everyday life.

That’s a wrap. Let me know your own predictions for tech and culture in 2024.

Happy Holidays and see you next year 👋

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week:

![OC] Highest Grossing Music Tours Of All-Time : r/dataisbeautiful OC] Highest Grossing Music Tours Of All-Time : r/dataisbeautiful](https://substackcdn.com/image/fetch/$s_!huJh!,w_1456,c_limit,f_auto,q_auto:good,fl_progressive:steep/https%3A%2F%2Fsubstack-post-media.s3.amazonaws.com%2Fpublic%2Fimages%2Fe5ce95cb-58e8-4083-b2aa-7b66c51de5f2_640x640.jpeg)