The Consumer Renaissance (Part II)

Shopping, Consumer Health, and Patterns of Household Spend

Weekly writing about how technology and people intersect. By day, I’m building Daybreak to partner with early-stage founders. By night, I’m writing Digital Native about market trends and startup opportunities.

If you haven’t subscribed, join 60,000 weekly readers by subscribing here:

The Consumer Renaissance (Part II)

In Part I last week, we dug into how “consumer” has become something of a bad word in venture circles. Broadly, consumer seems out of favor: recent data from Carta showed that just 7.1% of Seed capital raised last year went to consumer startups. That’s less than half the share from 2019 (14.3%).

But last week’s piece also argued that this sentiment is misplaced. We’re only a few years removed from huge consumer tech outcomes—all the IPOs in the chart below happened between 2019 and 2021—and the wins are often bigger in consumer: looking at IPO data since 2010, when consumer companies have gone public, 18.8% have done so at a valuation of more than $10B—over twice the same rate (9.6%) for enterprise companies.

The biggest companies in the world are largely consumer—Apple, Meta, Amazon, Google. Snowflake is the largest enterprise IPO of the last decade, but its market cap is 1/3 the size of Uber’s, 1/2 the size of Airbnb’s, and roughly on par with DoorDash’s. It makes no sense that consumer is being so overlooked and underfunded.

When something is out of favor, that’s usually a good signal that you should pay attention: this is an industry built on being contrarian, not on following the herd. That’s the goal this week—paying attention to consumer technology and what’s next.

Last week we dug into the most obvious place to look for consumer innovation—AI applications—and this week we’ll dig into two more categories: shopping and consumer health. Then we’ll end by seeing what we can learn from household spend patterns. This piece covers #4-6 on the agenda:

Checking in on Consumer SpendConsumer Tech: The Data Doesn’t LieWhat to Watch: AI ApplicationsWhat to Watch: Shopping

What to Watch: Consumer Health

Rule of Thumb: Follow the Spend

Let’s dive in.

What to Watch: Shopping

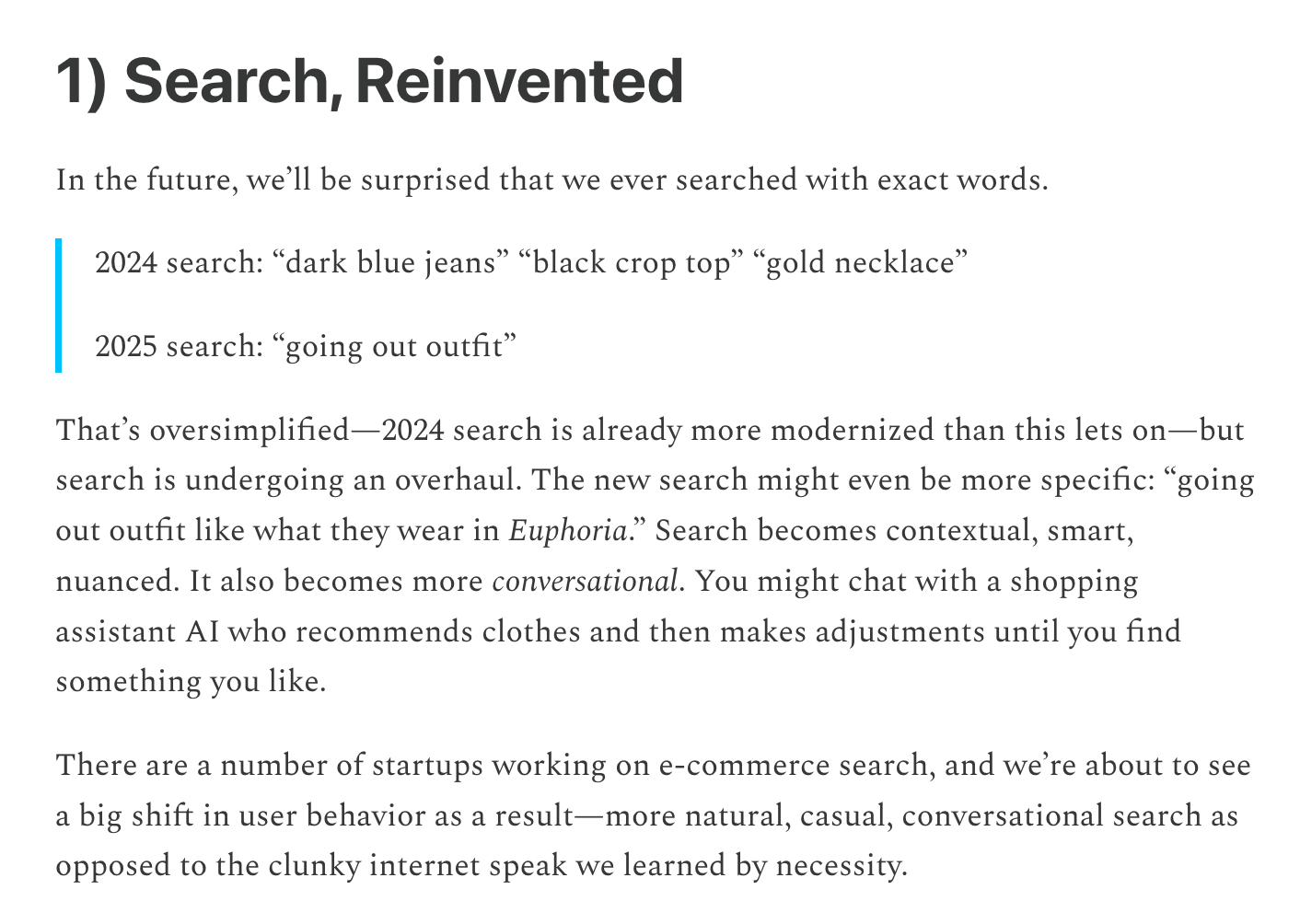

Last month’s 10 Forces Shaping Commerce argued that the $25 trillion (!) retail industry still has a lot of room for innovation. The first “force” mentioned in that piece was AI search; from the piece:

Earlier this week, we at Daybreak backed a talented founder pioneering a new form of AI search for commerce. I think we’ll see a lot of continued innovation here; shopping should be more conversational and natural. That’s the future.

Another area I’m interested in: the intersection of social and shopping.

TikTok Shop continues to be on a tear. AdWeek reported this week that TikTok is now the 9th-largest beauty e-commerce retailer in the U.S., surpassing most major department stores and many beauty specialty retailers—and that’s after only nine months in market.

“Health and Beauty” is TikTok Shop’s best category, but the numbers are impressive across a wide range of categories:

Flagship, a Daybreak company, takes a more agnostic approach to creator commerce than TikTok Shop: creators can launch and manage their own storefronts, without being dependent on a single platform. It’s a more full-stack commerce solution that reinvents the affiliate playbook. (I’ve written about Flagship in the past: The Future of Creator Commerce.)

We also see other companies emerging in social shopping. Claim, for instance, is growing quickly on college campuses by letting users discover new brands, earn cash back, and share rewards with friends. I can get a free acai bowl, then trade it with you for a pint of Ben & Jerry’s. The product injects delight and serendipity into shopping.

A key tailwind powering both Flagship and Claim: the headwinds in customer acquisition. In a post-ATT world, brands are desperate for new, economical channels to get customers. Both Flagship and Claim offer a new channel through their respective discovery-driven commerce business models.

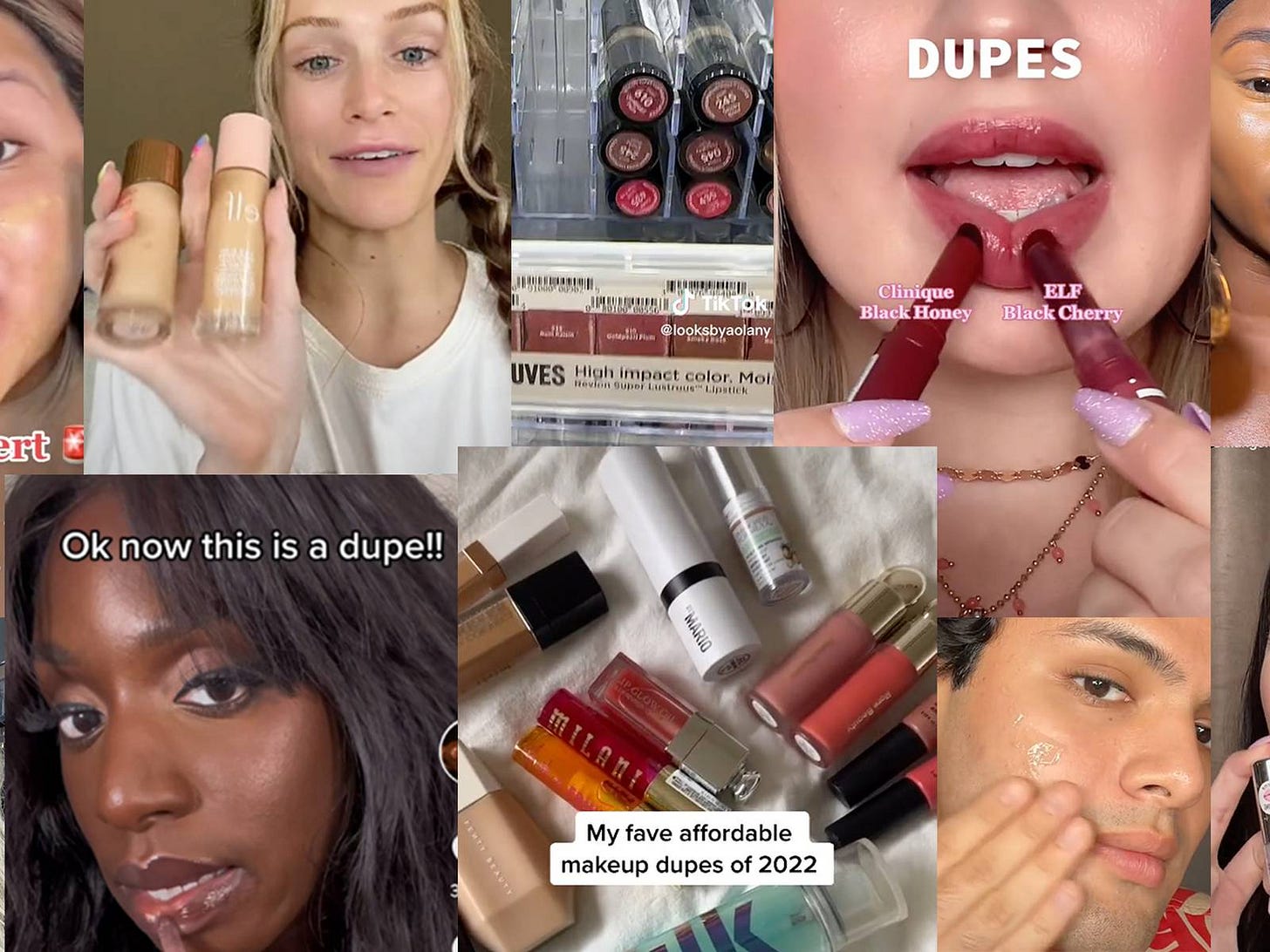

A related form of discovery in shopping comes with Dupe.com. February’s The Future Is a Dupe covered Gen Z’s love for dupe culture. What’s a dupe exactly? Short for “duplicate,” a dupe is basically a cheaper version of a pricey product. In other words, a knock-off.

Prada Thick Frame Sunglasses will run you $385. Dupe bloggers will instead point you to Nasty Gal Factory Bueller II Shades, which look basically the same but will set you back just $20. A Chloe Fay Shoulder Bag costs $1,790. But any dupe-savvy shopper knows you can get the Forever 21 Faux Leather Chain Crossbody—a Chloe Fay dupe—for just $25. And so on; you get the picture.

Dupe.com lets you instantly search any product for cheaper dupes. If you love a fancy chair from Restoration Hardware but are working with a Wayfair budget, Dupe has you covered. It’s a savvy product.

PayPal paid $4B for Honey five years ago, with the goal of letting anyone use a browser extension to automatically find and apply coupon codes at checkout. I think we’re going to see a lot more Honey-like businesses—companies that improve the shopping experience. It should be frictionless to see cheaper versions of products (Dupe) or to see secondhand items (TBD) when we shop.

What to Watch: Consumer Health

McKinsey sizes the wellness industry at $500B in the U.S. and $1.8T globally. “Wellness” is a squishy category, encompassing everything from Botox to skincare to melatonin to weighted blankets—quite the range—but the crux is this: people care more and more about taking care of themselves, and they’re willing to spend on that self-care.

We also see wellness as a uniquely American phenomenon. Bloomberg reports that the average American spends $5,108 on wellness each year. The average European, meanwhile, spends just $1,596.

When I think about consumer products and services, I think of a broad arc bending towards (1) more delight, (2) more convenience, and (3) more affordability. As time goes on, companies reliably pioneer new ways to bolster all three of these key tenets.

This is a good framework for any consumer category, but it works particularly well in healthcare. That’s because healthcare, well, isn’t too enjoyable, isn’t too convenient, and isn’t too affordable. But that’s changing, powered by a combination of technology tailwinds and behavior tailwinds:

On the technology front, telehealth is making healthcare more accessible and AI is improving both (1) healthcare efficiency, and (2) cost of care. Adoption of each is early innings, and we’ll see more penetration in the coming years.

On the behavior front, COVID gave us a wake-up call to our archaic, lethargic healthcare system. It also supercharged adoption of telehealth (and changed regulations around telehealth to allow for that adoption). A longer-term shift is the consumerization of everything through technology. We’ve been taught to expect elegant user interfaces and convenience is now table-stakes: we order packages on Amazon, meals on DoorDash, cars on Uber. Shouldn’t healthcare be as user-friendly?

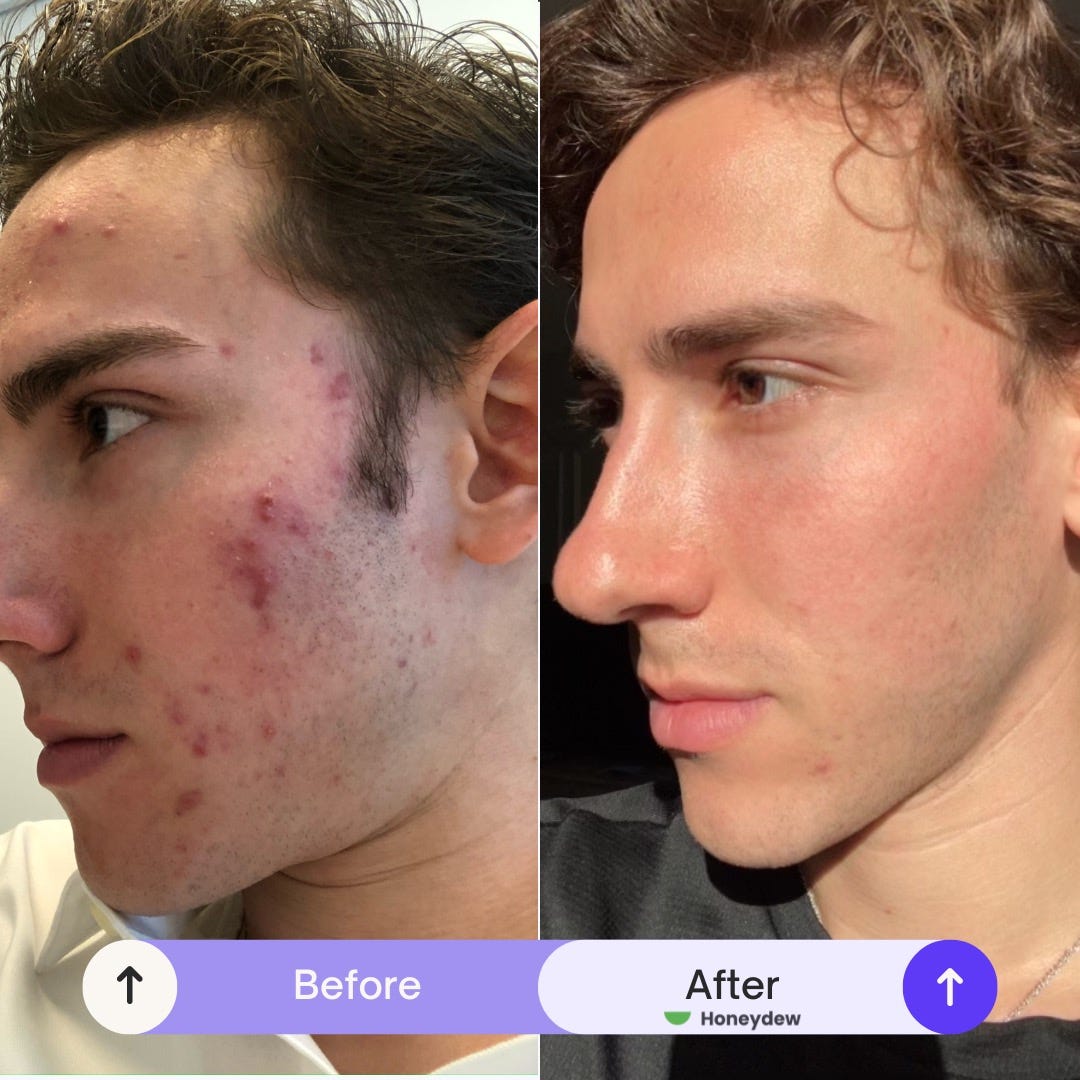

April’s The Telehealth Tipping Point made the argument for a “why now” in consumer health, using our Daybreak portfolio company Honeydew as the example.

Over 100M Americans have a chronic skin condition. Think acne, eczema, or psoriasis. That’s more than 2x the number of Americans with diabetes. But access to care is gated. Nine out of 10 people with a treatable skin disease don’t get treatment. Honeydew solves this with both telehealth and AI, broadening access to care. Dermatological care should become more affordable, more convenient, and more enjoyable.

This same example can extend to any category of health. Some examples from that April piece:

Anecdotally, I’m seeing a lot of Pre-Seed and Seed activity in consumer health. Skeptics will point to the few large outcomes for venture-backed healthcare startups, but startups are all about timing. People forget that UnitedHealth is a $420B market cap company (Salesforce is the largest SaaS company, with “just” a $290B market cap), or that healthcare comprises 18% of US GDP and is an $8 trillion global industry. The time is now, and a sea change is coming.

Rule of Thumb: Follow the Spend

One of the most reliable frameworks for consumer investing is a simple one: follow the money. Cue Jerry Maguire.

What are people spending their money on? What categories comprise a large portion of household spend, and as a result offer large markets for startups to build in?

Here’s how the average U.S. household breaks down its expenditures:

Big startups tend to tap into big segments of consumer spend.

Earlier we talked about three of the biggest consumer IPOs in history, all from the last five years—Airbnb, Uber, and DoorDash. They map nicely to the top three categories of spend:

But you don’t have to be tackling a major slice of the pie to build a big business. We can track more granular patterns of spend and draw conclusions about which areas will support startup success. Three examples:

The average American spends $2-3K per year on travel, and we’re about to surpass pre-COVID travel spend as the experience economy roars back.

Over 7.4M Americans now receive Botox treatment each year, with spend at med spas compounding 14% annually ($19B last year).

And we continue to spend lavishly on our “fur babies”: Americans spend ~$150B per year on their pets (growing 12% year-over-year), and 80% of pet owners say they treat their pets like their own children.

We see fast-growing B2C and B2B2C businesses built on these subcategories of spend:

The biggest category of spend continues to be—and probably always will be—housing. What innovations do we see there?

Bilt has engineered an impressive business by letting consumers turn their rent payments into rewards. They now have a nascent mortgage product too. Less heralded, but also rapidly-growing, is Aven. Aven is a credit card that lets you use your home equity to get really low rates. The team has quietly built a formidable business, one of the rare bright spots in consumer fintech.

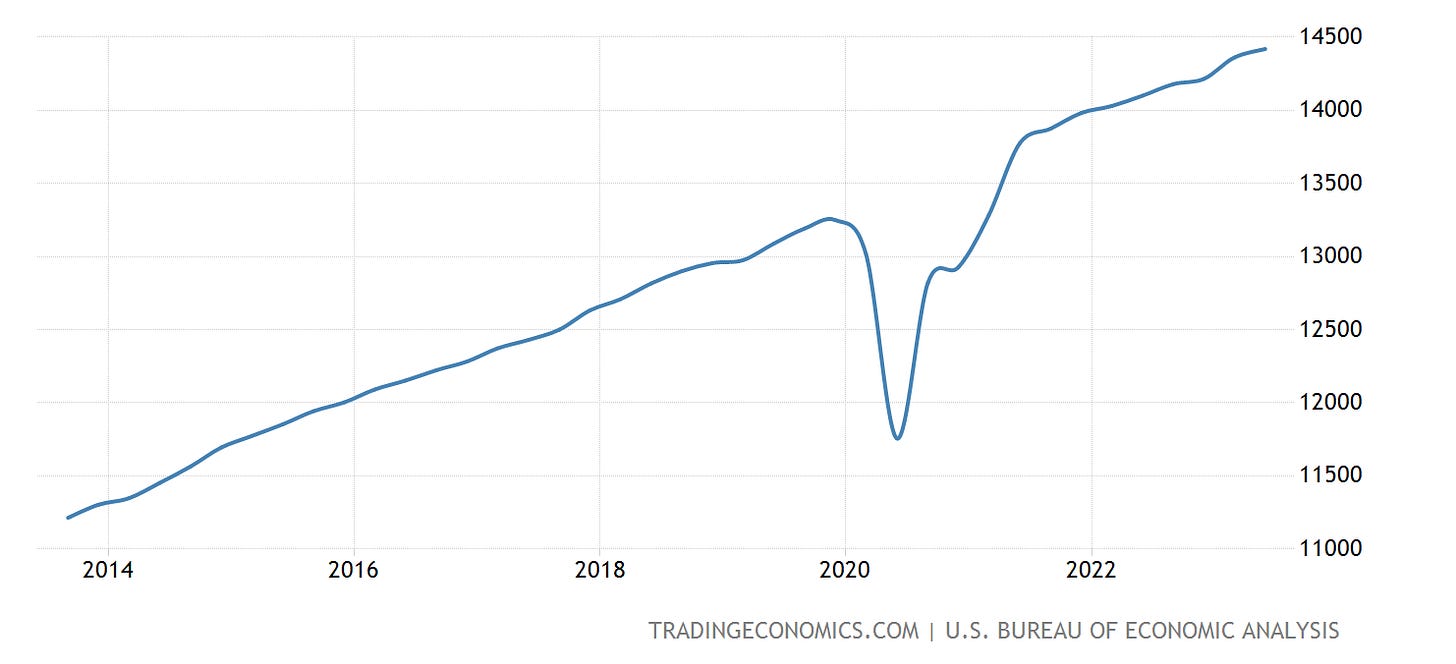

Tracing spend helps trace opportunity. As we covered last week, consumer spend is flying high: after a COVID dip, we’ve continued up-and-to-the-right.

Consumers are spending $15 trillion a quarter in the U.S. New generations are coming of age with new behaviors, and technology is changing rapidly; both dictate how that spend flows.

If consumer has been in the Dark Ages—and I’d argue it never really was—one thing is certain: consumer is now ready for its Renaissance.

Read Part I here:

Thanks for reading! Subscribe here to receive Digital Native in your inbox each week: